Key Takeaways: The High-Margin AI Agency Model

- Reject Integration: Stop selling basic workflow templates immediately. Shift to the high-value AI-as-a-Productized-Service (AAPS) model.

- Verticalize Deeply: Niching is non-negotiable for 2026 success. Focus on regulated or complex data niches (e.g., specialized financial analysis, regulatory compliance).

- Operationalize Quality: Implement strict SOPs for LLM monitoring and Automated Output Quality Control (QC). This is how you eliminate client churn risk.

- Price on ROI: Charge $5k–$15k monthly retainers. Pricing must be based on guaranteed revenue impact or risk mitigation,never on hours spent.

The 2026 Market Reality: Why One-Off Builds Fail

- Complexity: Proprietary logic, custom data handling, and multi-step models built for scale.

- Reliability: Systems designed for enterprise uptime, not hobby projects held together by duct tape and webhooks.

- Measurable Revenue Impact: Solutions that directly increase sales (our focus) or decrease massive overhead.

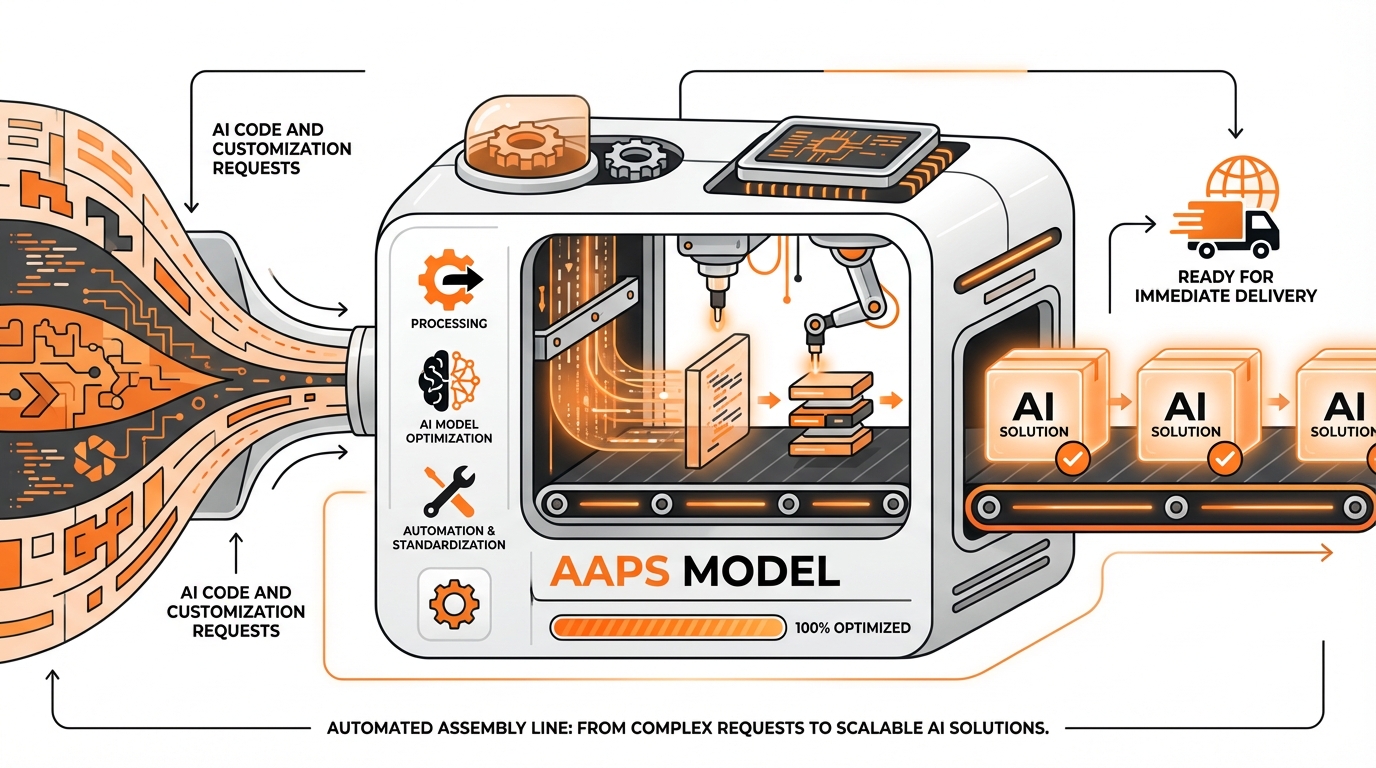

Step #1: Shift to AI-as-a-Productized-Service (AAPS)

Integration Agency vs. AAPS Agency: Defining Your Ceiling

| Feature | Integration Agency (The Old Model) | AAPS Agency (The 2026 Model) |

|---|---|---|

| Core Offering | One-off workflow builds (e.g., Make.com template setup). | Managed, proprietary system (e.g., AI Lead Engine, Compliance Bot). |

| Pricing Model | Project-based ($1k–$5k). High churn. | High-value monthly retainer ($5k–$15k). Recurring revenue. |

| IP Ownership | Client owns the workflow; agency provides setup hours. | Agency owns the core system/IP; client subscribes to the output only. |

| Scalability | Low; requires continuous, bespoke development and custom support. | High; systems are cloned, centrally maintained, and instantly deployable across multiple clients. |

Step #2: Verticalize Your High-Value Niche

Focus on Complexity and Liability

-

Regulatory AI (The Compliance Niche):

- Target: Mid-sized financial services, healthcare, or legal firms.

- The System: AI that monitors dynamic global regulations (e.g., GDPR, EU AI Act) and automatically flags internal documents or communications for compliance risk.

- The Value: They aren’t buying automation. They are buying guaranteed risk mitigation. This justifies $10k+ monthly retainers instantly.

-

Specialized Sales Intelligence (Our Core Focus):

- Target: B2B SaaS companies selling complex, high-ACV platforms.

- The System: AI deployment focused on lead generation: analyzing prospect intent data, synthesizing hyper-personalized value propositions, and isolating exact decision-makers (Founders, SDRs, VPs). (Need help finding those clients’ personal emails? Start Your Free Trial.)

- The Value: Direct, traceable impact on pipeline and revenue. You charge a retainer plus a percentage of the new pipeline generated.

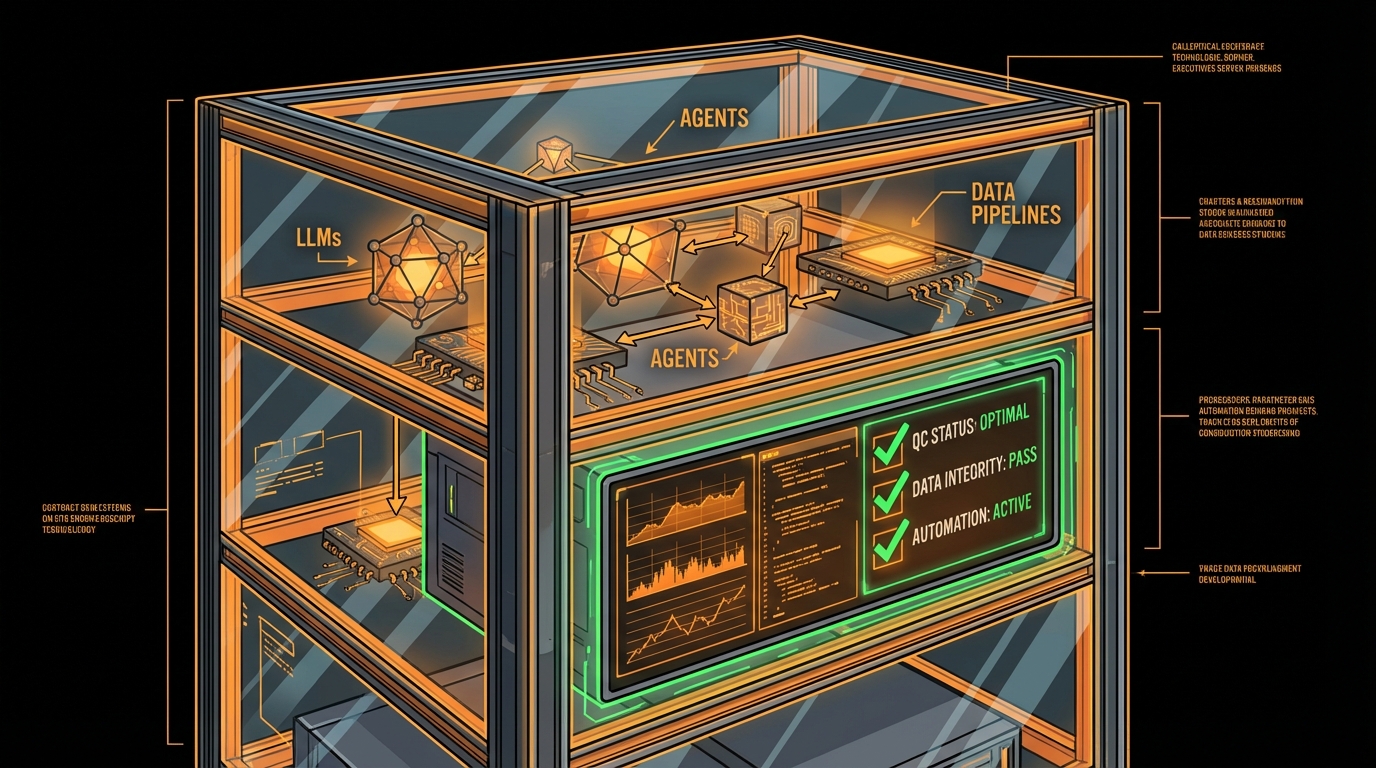

Step #3: The Advanced Tech Stack and Automated QC

Your 2026 AI Tool Stack

- Lead Generation & Outreach: Proprietary systems are mandatory for scale. Your tools must handle personalized, multi-channel outreach without hitting spam filters. You need surgical data enrichment: finding clients’ personal emails and direct contact details is non-negotiable. (Want to see our stack? Start Your Free Trial Here).

- LLM Orchestration: LangChain or specialized frameworks are mandatory. We do not accept simple, one-off API calls. Complex, multi-step reasoning agents require robust orchestration.

- Data Storage: Vector databases (Pinecone, Weaviate) are essential. Why? Retrieval-Augmented Generation (RAG) grounds outputs in client-specific, proprietary data. This eliminates hallucinations and guarantees accuracy.

- Monitoring and Maintenance: This is the secret to premium retainers. We use dedicated platforms to track token usage, latency, and,most critically,output drift. If you aren’t monitoring, you are losing money.

Implementing Quality Control (QC)

Establish Quantifiable Success MetricsLeverage Secondary LLMs for ValidationImplement Automated Alerting and PausingStep #4: Value-Based Client Acquisition (The Conversion Engine)

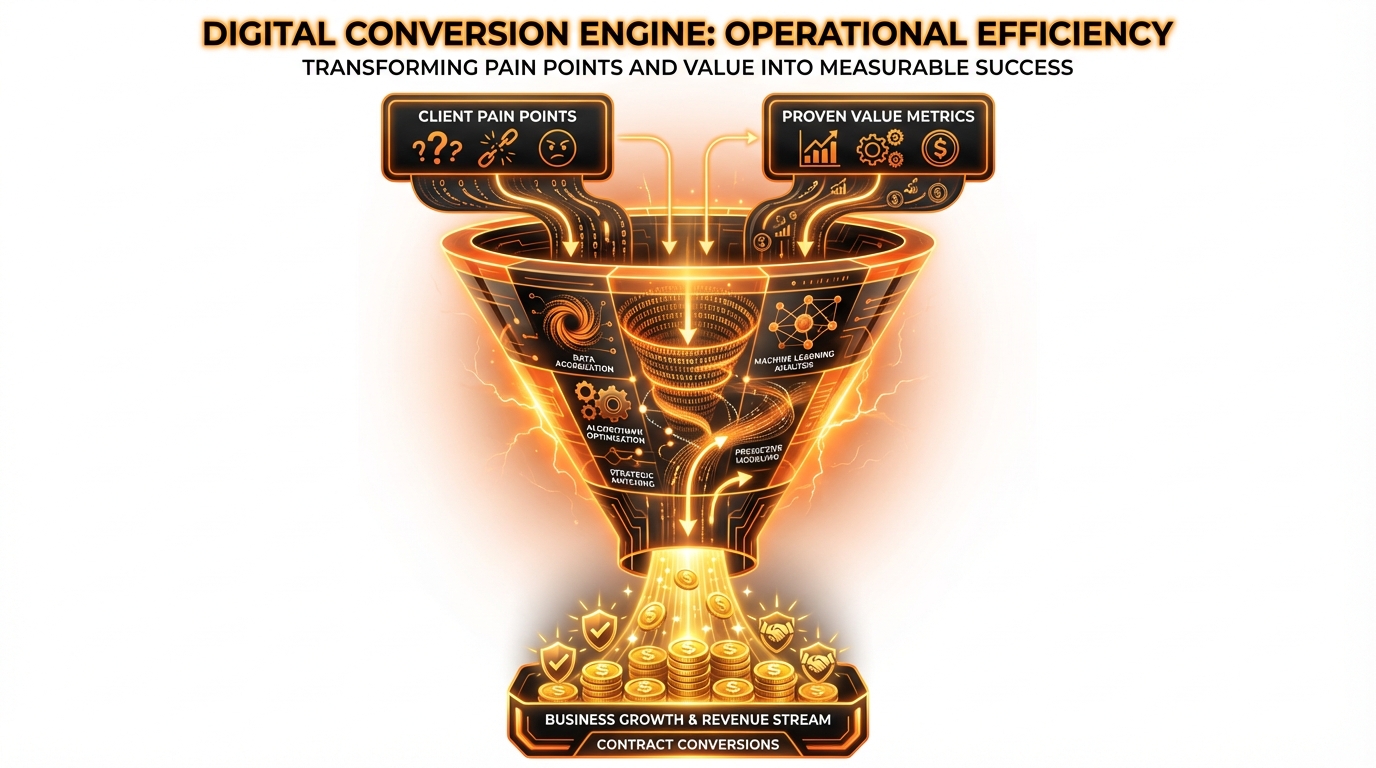

The High-Leverage Outreach Strategy

- #1. Identify AI Pain Points: Target ICPs struggling with expensive, manual labor. Look for clear signs of operational drag: high churn, poor compliance records, or slow content velocity.

- #2. Deliver Hyper-Personalized Proof (Upfront Value): Do not ask for a meeting immediately. Send a small, free deliverable generated by your AAPS system first. Show, don’t tell.

- Example: If you target regulatory firms, send a sample analysis of their internal policies, benchmarked against the latest AI Act draft. Highlight three immediate compliance gaps. This is instant, undeniable value.

- #3. Strategic Authority Positioning: High-ticket clients operate on LinkedIn and specialized forums. We utilize sophisticated engagement strategies to position ourselves as the authority *before* the outreach even begins. This builds immediate, necessary trust. (Learn how we convert prospects using Strategic LinkedIn Commenting for B2B Lead Conversion).

“The fastest way to close a $15k retainer is to show the prospect $50k worth of value in the first 10 minutes of the call.”

Mastering the High-Value Negotiation

What is the cost of hiring and training a full-time employee (FTE)?What is the risk of a compliance fine?Step By Step Guide To Selling Premium Domains To End UsersStep #5: Operational Maturity and Scaling Infrastructure

Hiring Specialized Roles

- The AI Prompt Engineer (PTE): This is your highest-leverage hire. They are the gatekeepers of output quality. Their KPIs are simple: Optimize RAG performance, manage primary LLM interactions, and maintain a 95%+ QC threshold. Pay them based strictly on system reliability.

- The AI Maintenance Technician: Infrastructure stability is a full-time job. This role handles monitoring alerts, manages API key rotations (a huge security risk if ignored), and executes minor integration tweaks. They stop small failures from destroying client trust.

- The Vertical Strategist: An absolute necessity for niche authority. This Subject Matter Expert (SME),e.g., a former Compliance VP for finance,guides the PTEs on context, compliance, and industry requirements. They ensure AI output is authoritative, not generic filler.

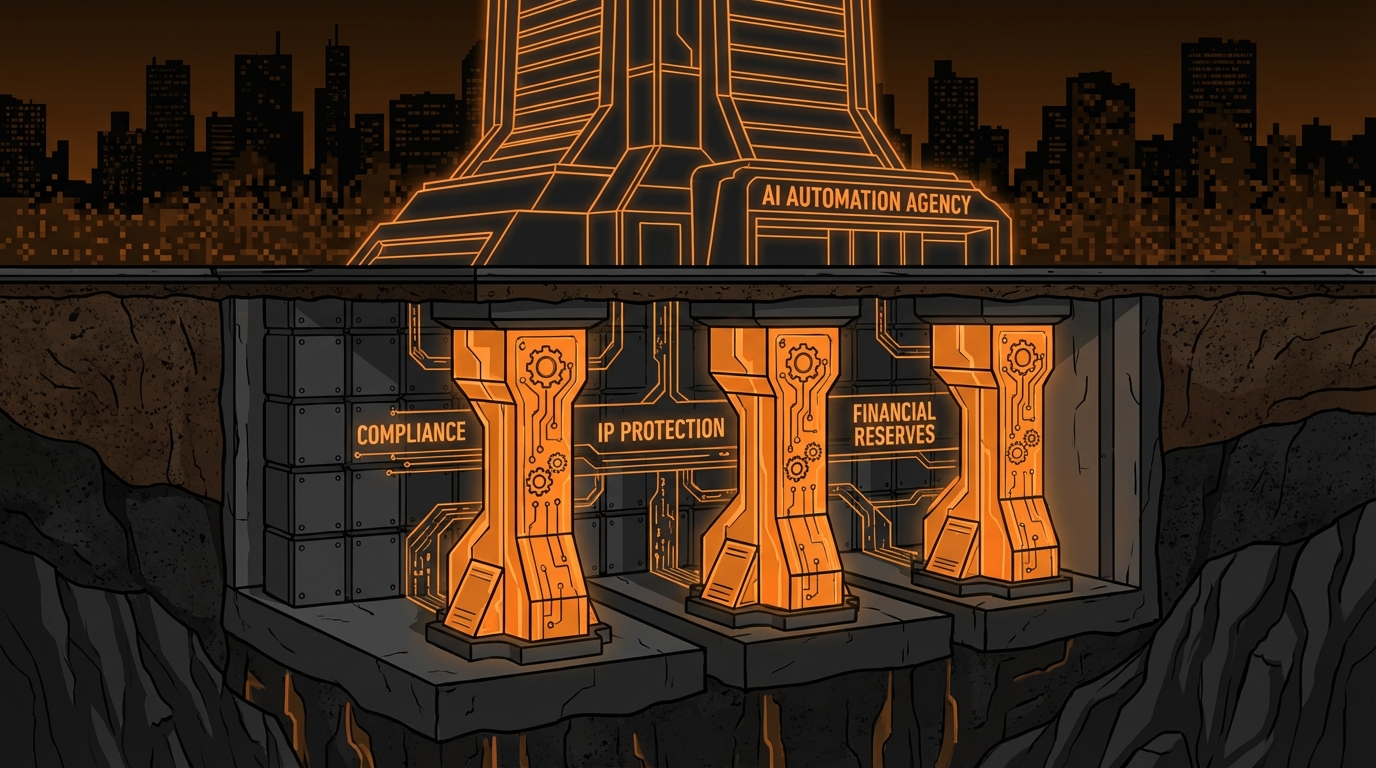

Step #6: The Legal and Financial Foundation (Future-Proofing)

Financial Modeling: COGS vs. Retainer

- LLM API Usage: Token cost is volatile, especially with specialized models.

- Automation Subscriptions: Tools like Make, specialized lead generation software, and data enrichment platforms.

- Cloud Infrastructure: Hosting RAG implementations, vector databases, and client data processing pipelines.

The 80% Gross Margin Rule

Frequently Asked Questions

Q: How quickly can I realistically scale my agency to $20k MRR?

Days 1–30:Days 30–60:Days 60–90:Q: What is the most profitable niche for AI automation in 2026?

Specialized FinTech:Regulated Healthcare:Complex B2B SaaS Onboarding:Q: What are the absolute must-have tools for a modern AI automation agency?

Client Acquisition:Workflow Orchestration:Impact Tracking:Q: How do we practically ensure compliance with the EU AI Act when deploying client systems?

Classification:Documentation:Human-in-the-Loop (HITL):How do I find my first AAPS client in a complex niche?

Step #1: The Zero-Cost Blueprint

Data Aggregation:Targeting:Step #2: Quantify the Cure

Step #3: The Price Point Shift

Crucial Rule:What is the biggest mistake new AI automation agencies make in 2026?

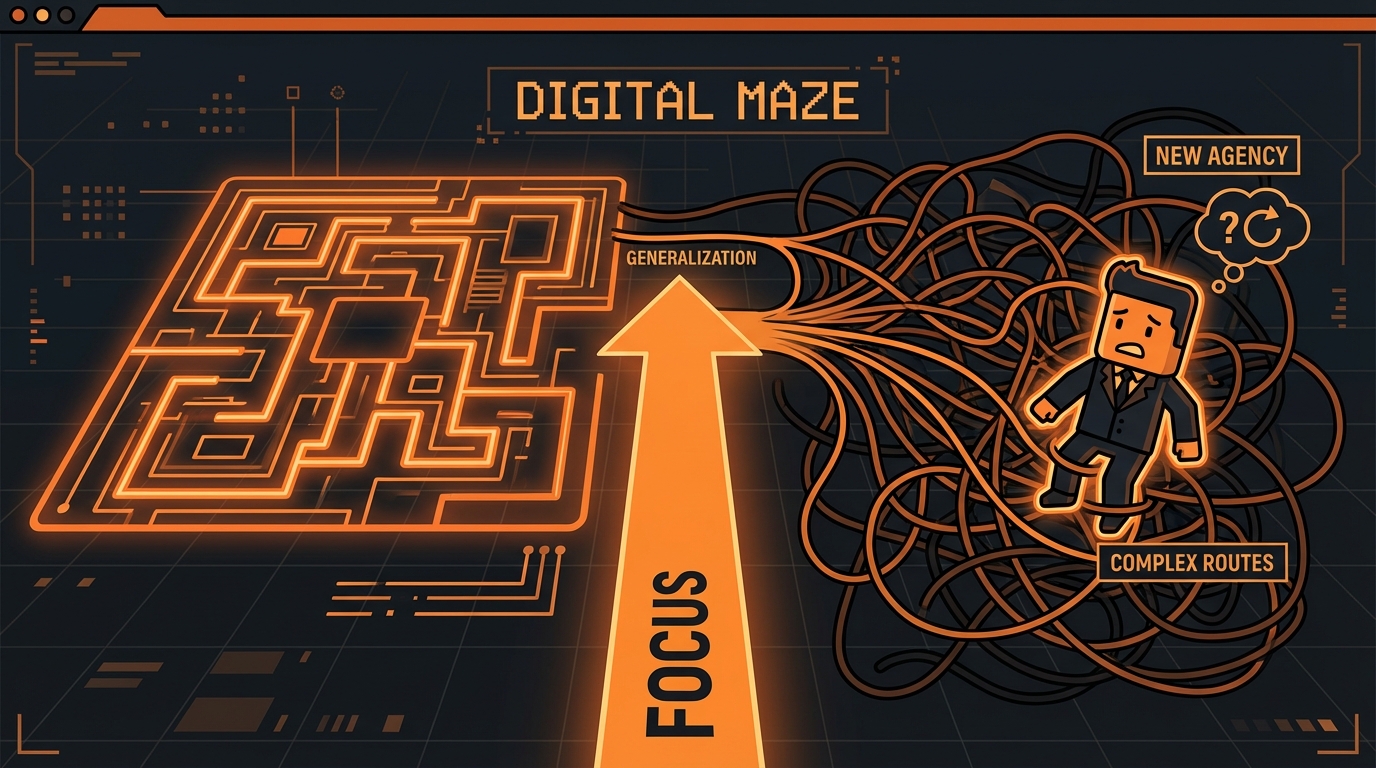

The single biggest failure point is generalization.

New founders become ‘AI tourists.’ They chase every shiny new tool, every trending automation concept. They try to serve SaaS, e-commerce, and finance all at once.

This strategy guarantees you two things:

- Weak expertise (A mile wide, an inch deep).

- Low client trust (and thus, low retainers).

You gain zero leverage selling general AI capabilities. Authority is not built on breadth; it is built on deep vertical focus. If you are selling AI solutions, you must demonstrate measurable, niche-specific results.

Commit. Lock down one complex niche. Your mandate is to become the undisputed expert in solving that niche’s specific, high-dollar problems using automation and LLMs.

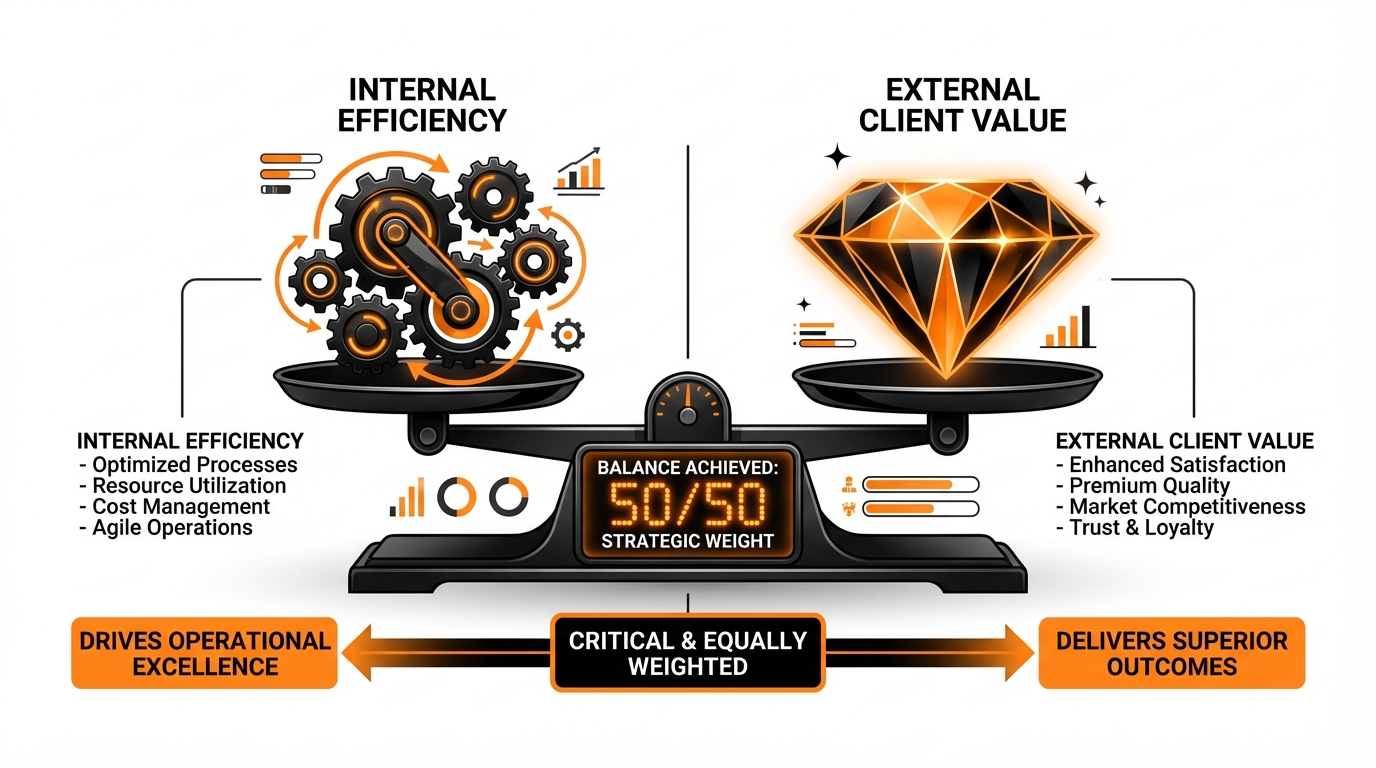

Should I focus on internal business automation or external client-facing AI?

The choice is simple: Revenue generation always wins the budget war.

You must focus exclusively on external, client-facing AI solutions. This is non-negotiable for founders aiming for high-ticket retainers.

We target systems that directly impact our client’s revenue and acquisition pipeline. Systems like:

- AI Lead Generation (finding high-intent prospects and contact data).

- Automated Content Delivery and Personalization.

- High-volume Customer Voice Agents (handling tier-1 support and qualification).

Why this focus? Because these systems are measurable. You can tie your fee directly to value delivered, justifying true Value-Based Pricing.

The mistake is chasing internal efficiency projects (e.g., optimizing HR workflows or internal data management).

These are categorized by the CFO as cost centers. Cost centers are inherently harder to sell at premium prices,you cannot justify a $10k/month retainer simply by saving the client 5 hours of administrative time per week.

Focus on cash flow, not clock management.

Ready to Implement High-Value AI?

The fastest path to revenue is finding the right client contact. Start finding high-value personal emails for your B2B prospecting right now. Start Your Free Trial.

Click Here