Most small marketing agencies are failing their revenue targets. The reason is simple: They are relying on a fundamentally flawed pricing model.

They price based on time and cost. They calculate hours, add a standard margin, and hope the client accepts the quote. This approach commoditizes expertise and limits upside.

This is a ceiling, not a strategy.

If your agency is still anchored to hourly rates or cost-plus calculations, you are actively leaving 50% to 100% of potential profit on the table. We know this because when we transitioned our own high-ticket service arms to pure value pricing, our average contract value increased by 77% within nine months. The data is non-negotiable.

This guide is your strategic blueprint. We are moving you away from selling effort and toward selling quantifiable outcomes—the only proven way to scale a profitable, high-demand marketing agency.

Key Takeaways: Value-Based Pricing for Agencies

- Stop Selling Time: Hourly and cost-plus models cap your earnings and commoditize your expertise.

- Quantify Everything: Value pricing requires you to calculate the economic impact (revenue increase, cost saving) your service delivers to the client.

- Anchor High: Always present a premium, high-value option first to strategically anchor the client’s perception of worth.

- Differentiate or Die: If you cannot prove your unique value proposition with measurable data, you cannot justify a premium price.

- Qualification is Key: Value-based pricing naturally qualifies clients who are focused on high ROI, not just budget reduction.

Why Value Pricing Is Non-Negotiable for Scale

Value-based pricing (VBP) is not merely a pricing model; it is a fundamental strategic mindset shift. It mandates that your price aligns directly with the measurable financial results the client receives, not the internal effort (time, tools) you expend.

Download the Visual Guide

Get the slide-by-slide visual summary of this article (PDF) for free.

Consider the ceiling effect of hourly work. If your agency charges $5,000 based on 50 hours of labor (the cost-plus approach), your revenue ceiling is fixed by that labor input.

Now, imagine that same SEO project generates $50,000 in new annual qualified leads for the client. Your service is demonstrably worth 10x the labor cost. Under VBP, you might charge $15,000 or $20,000—and the client still achieves a massive, undeniable ROI.

This is strategic leverage.

This framework forces us to focus solely on projects that deliver massive client ROI. If the value delivered is small, the project is inherently not worth our high-level expertise.

The Problem with Cost-Based Models

Cost-based pricing (hourly or retainer defined by time) guarantees several critical failures in the modern marketing agency environment:

- It Commoditizes Expertise: If you price by the hour, you are competing directly with freelancers in lower-cost markets. Your specialized knowledge becomes a time sheet, not a strategic asset.

- It Punishes Efficiency: When we develop proprietary AI tools or streamline processes, we complete the work faster. Under hourly pricing, we earn less for being better and more efficient.

- It Creates Scope Creep Friction: Every minor request becomes a new line item negotiation, leading to client distrust and constant administrative overhead.

Value pricing eradicates these issues by fundamentally shifting the core conversation. We stop discussing inputs (“what we do”) and start defining outputs (“what you gain“). This is the foundation of scaling profitably.

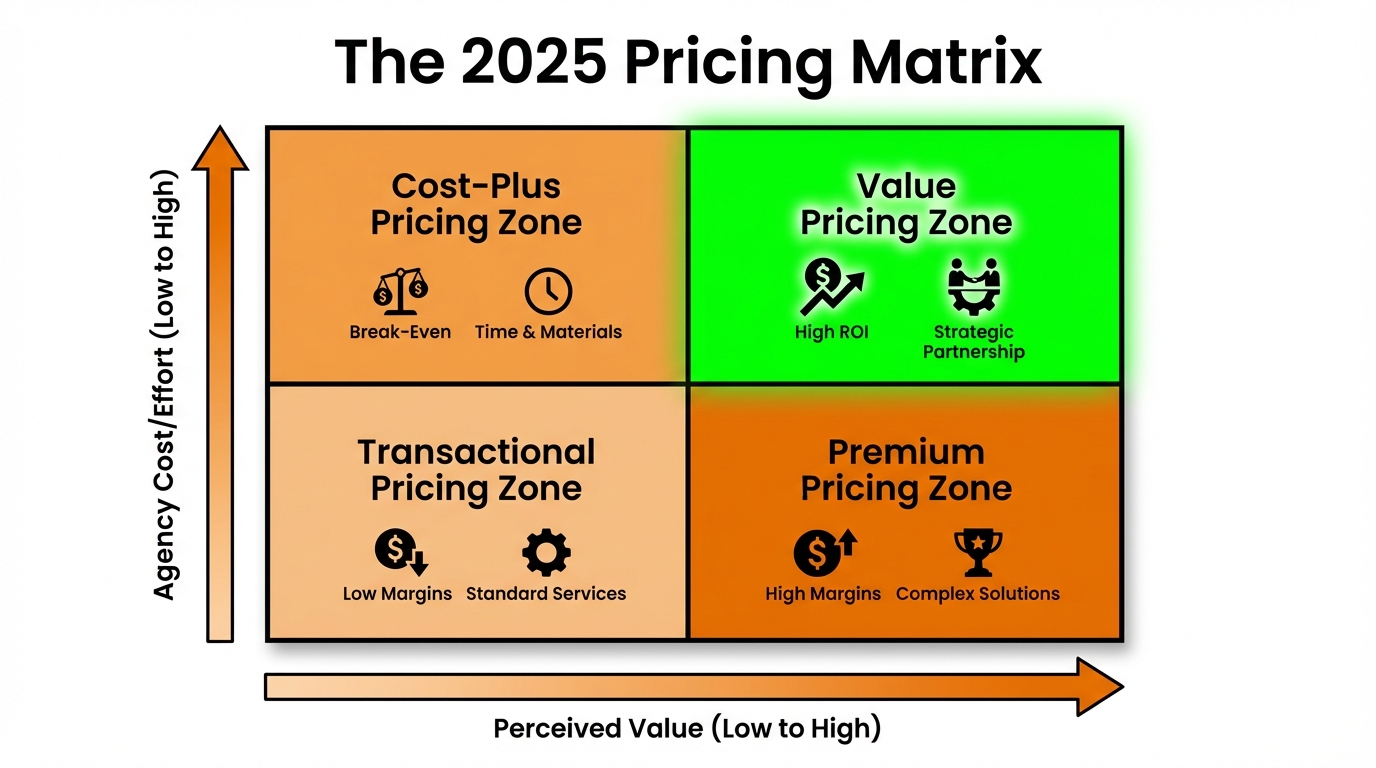

Cost vs. Value: The 2025 Pricing Matrix

To truly scale, you must abandon archaic pricing structures. Moving past the limiting ceiling of hourly work requires a clear understanding of the three primary pricing philosophies. This strategic comparison illustrates why VBP is the only model built for exponential agency growth:

| Pricing Model | Basis for Price Setting | Agency Profit Potential | Strategic Focus |

|---|---|---|---|

| Cost-Plus (Hourly) | Internal costs (labor, overhead) + fixed margin. | Low. Capped by time input. | Efficiency and cost control. |

| Competitor-Based | Average market rate for similar services. | Moderate. Creates a race to the bottom unless highly differentiated. | Market positioning and volume. |

| Value-Based (VBP) | Client’s perceived and actual economic gain (ROI, savings). | High. Uncapped by time; tied to client success. | Measurable outcomes and strategic partnership. |

The matrix confirms the reality: Cost-plus models prioritize efficiency (internal focus); Value-Based Pricing prioritizes economic impact (client focus). If your goal is uncapped profit margins and sustainable, scalable growth, VBP is not an option—it is the prerequisite for operating in the high-ticket service space.

Step-by-Step: Implementing Value-Based Pricing in Your Agency

Transitioning to VBP requires operational discipline and excellent client communication. You need to gather specific data points before you ever issue a quote.

Step #1: Identify and Quantify Client Outcomes

You cannot charge based on value if you do not know the client’s current financial metrics. This step is about diagnosis and data collection. We use our AI lead generation software to find the critical decision-makers and their financial pain points immediately.

Ask these questions in your discovery calls:

- What is the Lifetime Value (LTV) of an average customer?

- What is the current conversion rate from lead to customer?

- How much does a single point of inefficiency (e.g., slow website, poor reporting) cost them annually in lost revenue or wasted labor?

- What is the absolute maximum they would pay if they were guaranteed to hit their revenue target?

For a small agency, focus on the most direct lever you control:

If you run PPC, you are not selling clicks. You are selling qualified leads that generate X revenue. If you manage social media, you are selling brand trust that reduces sales cycle time by Y days.

Action Point: Before the proposal, force the client to state the financial outcome they expect. If they cannot quantify their need, they are not qualified for high-ticket services.

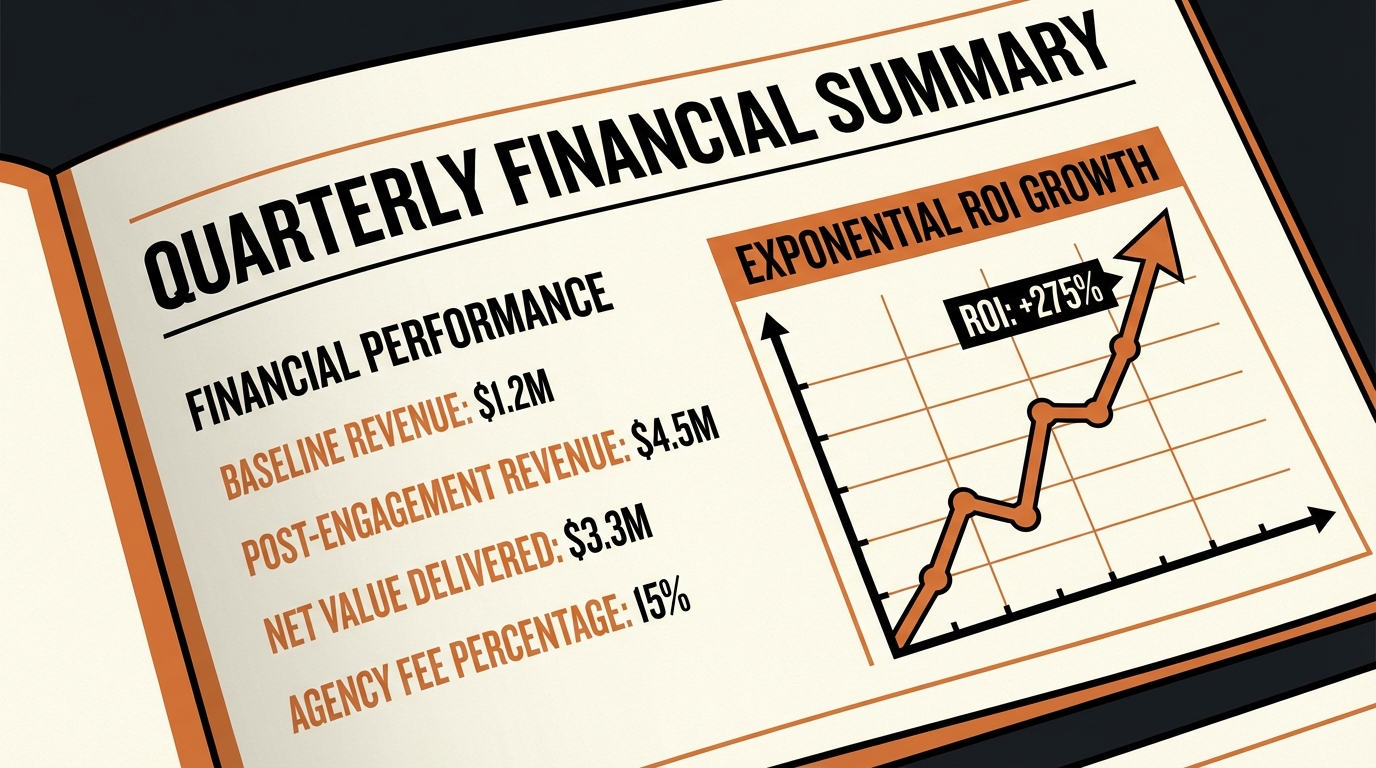

Step #2: Calculate the Differentiated Economic Value (DEW)

This is where you determine your price ceiling. The DEW is the total financial benefit the client receives from your solution, minus the cost of their next best alternative.

We use a simple formula:

Client Benefit – Next Best Alternative Cost = DEW

Example: You are an SEO agency. The client wants to increase organic traffic by 10,000 visitors per month, resulting in 200 new qualified leads. Their average lead LTV is $500.

- Total Annual Value Delivered: 200 leads/month * 12 months * $500 LTV = $1,200,000.

- Next Best Alternative (PPC): To get 200 leads, they would spend $10,000/month on PPC, totaling $120,000 annually.

- DEW: $1,200,000 (Total Value) – $120,000 (PPC Cost) = $1,080,000.

The client’s economic benefit is over $1 million. Charging $50,000 for your annual SEO retainer is a bargain for them. You capture a small fraction of the value created.

This quantifiable data is the core of your strategic proposal. It moves the conversation entirely away from your internal costs.

Step #3: Anchor Your Proposal Strategy

Pricing psychology is critical to VBP success. You must control the client’s perception of value from the first moment they see your quote.

We implement Price Anchoring by always leading with a premium option.

“When presenting options, always make your most expensive package the first one the client reads. This sets a high anchor, making all subsequent, cheaper packages seem like a better deal in comparison. This is not manipulative; it is strategic communication of your maximum value.”

Structure your proposal using three tiers:

- Tier 3 (The Anchor): The highest price point. This is the “Total Transformation” package. It includes everything: full strategy, dedicated support, proprietary tools. Price it high, reflecting the full DEW potential.

- Tier 2 (The Target): The package you actually want them to buy. This is the optimal mix of value and price. It looks significantly cheaper than Tier 3, but still captures excellent margin.

- Tier 1 (The Floor): The bare minimum “Do-It-Yourself” or “Essentials” package. We price this high enough to discourage budget shoppers who are not serious about results.

We have found that 80% of clients select the middle option. This strategic anchoring ensures that your “middle” price is still substantially higher than their old cost-plus budget.

Step #4: Develop Tiered Offers: Good Value vs. Value-Added

Competitors often mention Good Value Pricing (GVP) and Value-Added Pricing (VAP). We combine these into a powerful tiered structure.

GVP (The Middle Tier): Focuses on delivering expected, high-quality results efficiently. This is your core service bundle. It provides clear value (e.g., “We guarantee X qualified leads”).

VAP (The Anchor Tier): Focuses on unique, high-impact differentiators that justify the premium. This is where you add your strategic leverage.

What defines VAP for a small agency?

- Proprietary Data Access: Access to our AI-powered lead finding tools.

- Executive Access: Direct, weekly strategic calls with the agency founder.

- Risk Mitigation: Performance guarantees or specific clauses that reduce client risk.

- Strategic Integration: Full integration with the client’s existing CRM and reporting dashboards (we track this weekly).

If you are serious about scale, you should also be charging a non-negotiable Agency Setup Fees: The Non-Negotiable Cost of Scale. This fee covers the initial strategic planning, discovery, auditing, and goal setting that is essential for delivering high value.

Step #2: Documenting Value (The Case Study as a Financial Document)

Value-Based Pricing (VBP) is indefensible without documented proof. Your data must be impeccable. To justify charging a premium, you need verifiable, quantified results that directly impact the client’s Profit & Loss (P&L) statement.

This means your agency’s case studies are not marketing fluff; they are financial performance documents. Treat them as the audit trail for the value you create.

Every strategic case study must follow this precise financial format:

- The Challenge (Quantified): Define the client’s quantifiable financial loss or missed opportunity (e.g., losing $X annually due to inefficient lead nurturing).

- The Strategic Action: Detail the specific, proprietary strategy implemented (focus on the ‘why’ and the ‘what,’ not just the tactical ‘how’).

- The Outcome (Quantified ROI): Document the total financial impact ($A in new revenue or savings) and the resulting Return on Investment (B% ROI).

Defending Your Premium Price

The moment a prospect asks, “Why is your price $15,000 when Competitor X charges $8,000?” your response must be immediate, assertive, and data-driven.

Use your documented ROI to shift the conversation away from cost and toward investment returns:

“Competitor X is selling activity (hours, deliverables). We are selling outcome. Last quarter, we delivered an average 4x ROI for clients in your exact industry. We are not selling time; we are selling the same documented results we delivered for Client Y. Our proposal is backed by these documented ROI case studies—that is the backbone of our pricing defense.”

Overcoming Price Resistance: Strategic Defense

Even with impeccable data and documented proof of value (Step #2), prospects accustomed to hourly billing will push back on VBP. This resistance is inevitable—it is a final test of your authority and confidence.

Do not react defensively. Your documented value allows you to deploy strategic defenses that reframe the conversation entirely.

Defense Strategy #1: Reframe the Risk

When a client challenges the investment, immediately reframe the financial risk. Shift the focus from your price tag to the hidden costs of hiring a cheap, unproven provider.

Do not say: “We are worth more because our team is better.”

Say: “The risk of hiring a low-cost provider is substantial. If they fail to deliver, you lose six months of time and $8,000 in fees—a total loss. If you hire us, the $20,000 investment is tied to a proven system that historically generates $100,000 in net new revenue. Where is the real risk on your P&L?”

Defense Strategy #2: Use the Discount Anchor

A core rule of VBP: **Never discount your price. Discount the scope.** Your price reflects the value delivered; discounting it signals that the initial value was inflated.

If the prospect insists on a lower investment, move them down to a lower tier (Tier 1). But make it explicitly clear what strategic components they are losing.

Do not say: “I can take $2,000 off the price to meet your budget.”

Say: “We cannot reduce the price of the ‘Strategic Growth’ package without jeopardizing the guaranteed outcome. To meet your budget of $12,000, we must move you to the ‘Essentials’ package. This removes the dedicated strategic reporting and the custom AI integration, which means we cannot guarantee the speed of scale. Are you comfortable trading speed and certainty for a lower initial cost?”

This approach forces the client to choose between a lower price and a compromised value proposition. They usually revert to accepting the middle tier to secure the necessary strategic components.

Defense Strategy #3: Qualify Harder

VBP only works when selling to the right audience. If your sales pipeline is filled with prospects focused solely on hourly rates, your VBP strategy will fail. The primary bottleneck for small agencies is not pricing—it is targeting.

You must target founders and decision-makers who understand ROI and have the budget to invest in measurable outcomes. These clients are predisposed to paying for strategic results, not cheap inputs.

We use advanced qualification criteria and AI tools to pinpoint high-ticket prospects. This ensures our sales pipeline is filled with clients who see our fee as an investment, not an expense.

If you need a complete roadmap for targeting these clients, review our guide: Strategic Blueprint: Land Your First 10 Agency Clients in 30 Days.

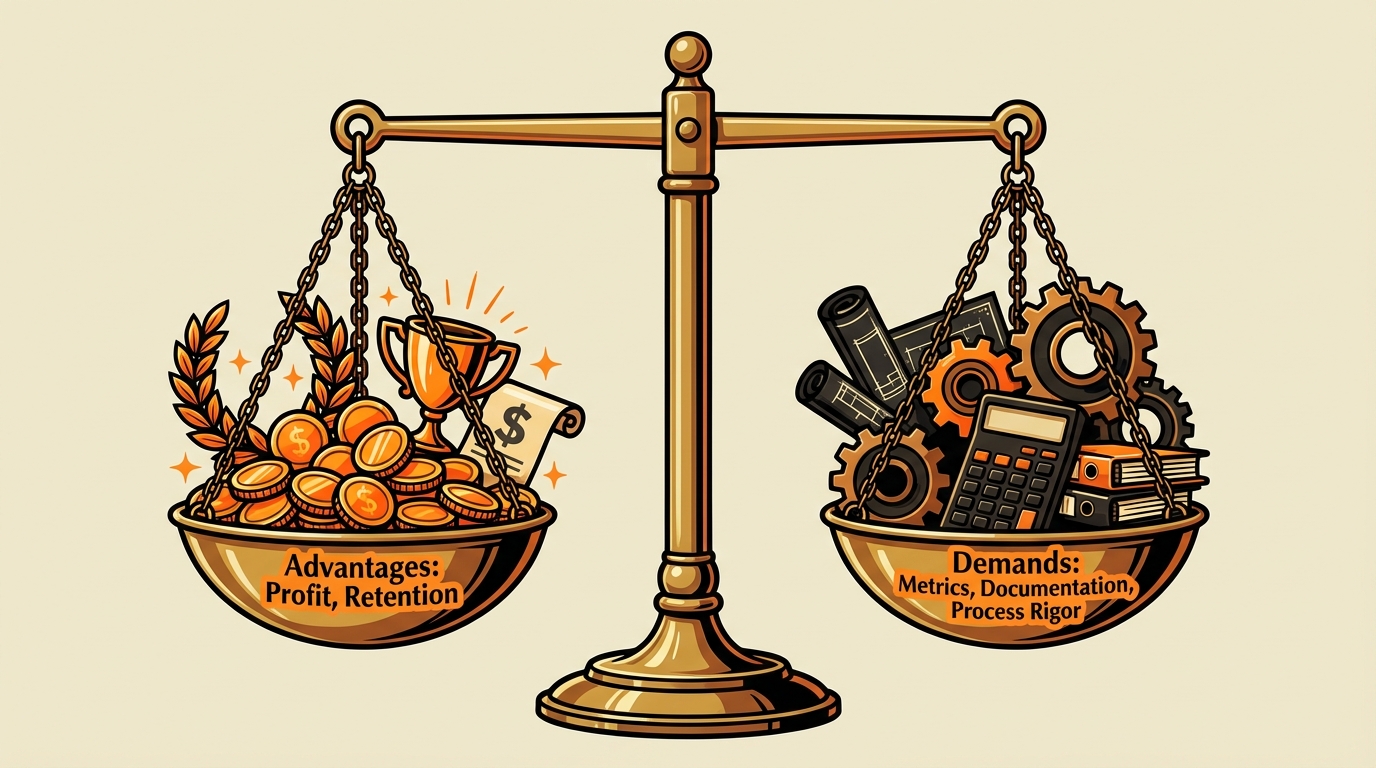

The Reality Check: Advantages and Operational Demands of VBP

Value-Based Pricing is immensely powerful, but it is not a silver bullet. Transitioning to VBP introduces fundamental operational demands—challenges your agency must be prepared to meet before reaping the rewards.

The Strategic Upside (Why We Commit to VBP)

- Decoupled Revenue & Exponential Profit: Revenue is entirely separated from time spent. As your internal efficiency improves—through better systems or AI integration—your profit margin increases exponentially without ever having to reduce the client’s price.

- True Client Partnership: Pricing based on measurable, shared success fosters genuine partnership. The client immediately views your agency as a strategic investment, not a fungible hourly expense.

- Premium Lead Filtration: The high price point automatically filters out unqualified, budget-focused leads. This saves your sales team hundreds of hours previously wasted on prospects who do not value expertise.

- Mandate for Innovation: VBP forces your agency to constantly innovate. You are directly incentivized to build proprietary tools, leverage AI, and optimize delivery systems, because efficiency directly translates to higher net profit.

The Operational Challenge (The Non-Negotiable Demands)

- Data Dependency: VBP is impossible without meticulous historical data. You must invest heavily in tracking, reporting, and developing ironclad case studies to quantitatively prove your economic value before the proposal stage.

- Extended Sales Cycle: The sales process shifts from quoting a rate to complex strategic consultation. This process is longer and requires higher-level expertise (often from agency principals) to successfully anchor the value.

- Complete Process Overhaul: Moving away from cost-plus pricing requires a total restructuring of your scoping, proposal generation, and internal resource allocation systems. This transition is steep and initially slow.

- High Expectation Ceiling: Your premium price sets an extremely high expectation for delivery. If your fulfillment team fails to consistently meet or exceed that perceived value, client retention will suffer dramatically—more so than with lower-priced competitors.

Frequently Asked Questions (VBP Implementation)

How do I determine the “perceived value” if the client’s results are not guaranteed?

Pricing is based on projected value, never guaranteed results. This projection must be anchored in historical data and verifiable case studies. You guarantee the proven process that has delivered X results for Y clients, not the final outcome.

The perceived value is the client’s financial pain point quantified as the potential gain—what we call the Differentiated Economic Value (DEW). We typically aim to capture 10% to 20% of that total DEW, ensuring the client retains the vast majority of the upside.

Can small agencies use value-based pricing, or is it only for large firms?

VBP is not just optional; it is essential for specialized small agencies. Large firms leverage established brand reputation and scale; small firms must leverage superior, measurable outcomes.

If you niche down (e.g., “PPC for D2C E-commerce brands”), VBP instantly allows you to charge premium rates. You are positioned as the definitive solution, not a generalist commodity competing on hourly rates.

Should I ever reveal my internal costs to the client?

Absolutely not. Your internal costs (salaries, software, time spent) are completely irrelevant to the client’s outcome. Revealing them destroys the value narrative by shifting the focus back to your effort instead of their result.

If pressed, state firmly: “Our price reflects the measurable revenue gain we project for your business, not the time or cost we incur internally.”

What if competitors are charging significantly less for similar services?

This is a strategic opportunity, not a threat. Lower prices signal lower perceived value and inferior results. We use competitor pricing as the Next Best Alternative Cost within our DEW calculation (Step 2).

The goal is to frame the competitor’s low price as a financial trap: they save $5,000 upfront but forfeit $50,000 in potential revenue due to poor execution or lack of strategy. Your job is to verify that your premium price delivers a significantly superior, quantifiable ROI.