You are focused on scaling revenue. You build optimized lead generation systems.

But true financial security,passive wealth,requires strategic capital deployment *outside* of your primary business engine.

Real estate remains the proven asset class. The problem? Traditional entry points are resource sinks.

Broker fees and massive down payments destroy capital velocity. That model is inefficient. It is obsolete.

Real estate crowdfunding eliminates this friction. It provides institutional access immediately. Busy founders and sales leaders can deploy capital passively (and strategically).

We have observed a critical failure point: Beginners chase high minimums. They waste weeks researching platforms requiring $25,000,when the only goal is validating the strategy with $1,000.

This is the strategic blueprint for capital validation. We focus only on platforms that maximize non-accredited diversification. We treat this initial investment like an automated, long-term revenue stream generator.

Key Takeaways: Your $1,000 Strategy

- Capital Efficiency: Use sub-$100 minimums (e.g., Groundfloor) to diversify the full $1,000 immediately. Maximize distribution of risk.

- Debt/Equity Split: Debt (Groundfloor) drives short-term velocity and cash flow. Equity (Fundrise) is for long-term compounding and appreciation. Structure your portfolio accordingly.

- Operational Friction: Prioritize 1099-INT platforms. Avoid K-1 complexity initially to minimize administrative overhead.

- Holding Period Mandate: Commit to a 5-year minimum. Treat this capital as illiquid to avoid penalties and maximize compounding effects.

The Strategic Filter: Defining High-Leverage Entry Points

Your initial $1,000 is validation capital. It must be deployed where friction is zero.

We ignore platforms that gate access behind accreditation or high minimums. Those requirements kill capital velocity. They prevent scalable passive income generation for the strategic beginner.

Our mandate is clear: Maximize diversification. Prove the concept immediately. Use the smallest possible entry cost.

Equity vs. Debt: The Velocity Decision

This is the core strategic choice. It dictates your time horizon and return structure. Do you need immediate cash flow, or are you prioritizing long-term asset appreciation? We treat these two models differently.

1. Equity-Based Crowdfunding (The Compounding Engine)

- Mechanism: Fractional ownership of pooled real estate assets (eREITs).

- Return Structure: Cash flow (dividends) plus capital gains upon asset sale.

- Timeline: Long-term commitment (typically 5–10 years). High potential for compounding returns.

- Strategic Goal: Build the long-term, passive foundation.

- Example: Fundrise. Your $1,000 immediately buys a slice of a massive, professionally managed portfolio.

2. Debt-Based Crowdfunding (The Cash Flow Accelerator)

- Mechanism: Funding short-term, secured loans to vetted property developers (i.e., fix-and-flips).

- Return Structure: Fixed interest payments. Predictable income streams (8%–12% typical).

- Timeline: Short-term velocity (6–18 months). Low volatility.

- Strategic Goal: Generate immediate reinvestment capital. Prove the model fast.

- Example: Groundfloor. Your $1,000 is instantly diversified across multiple notes, generating monthly returns.

Our proven strategy utilizes both systems. Debt proves the concept and generates capital velocity. Equity builds the long-term, compounding foundation. You need both running simultaneously.

The $1,000 Platform Playbook: Velocity Assets (2025)

We selected these platforms specifically because they bypass accreditation hurdles. They are optimized for the strategic, non-accredited investor seeking immediate deployment.

| Platform | Minimum Investment | Accreditation Required? | Investment Type | Holding Period (Avg.) | Ideal for $1,000 |

|---|---|---|---|---|---|

| Fundrise | $10 (Starter) / $1,000 (Core) | No | Equity (Diversified REITs) | 5+ Years | Anchor portfolio for passive, compounded growth. |

| Groundfloor | $100 (Flywheel) / $10 (Loans) | No | Debt (Short-term real estate loans) | 6–18 Months | Cash flow velocity engine. |

| DiversyFund | $500 | No | Equity (Growth REIT) | 5+ Years | High-growth equity allocation. |

| Arrived | $100 | No | Equity (Fractional Rentals) | 5–15 Years | Fractional rental income stream diversification. |

Strategic Deep Dive: The Highest-Leverage Entry Points

For strategic deployment, you must segment your capital goals. We use these two platforms to achieve two distinct, critical outcomes: long-term compounding and immediate cash velocity.

1. Fundrise: The Anchor Portfolio (Automated Growth)

Fundrise is how we secure long-term, passive appreciation. You deploy capital into managed funds (eREITs) holding diverse assets across the US.

This is not active management. This is capital compounding without daily friction.

- The $1,000 Mandate: Deploy the full $1,000 to bypass the basic Starter Tier. This unlocks the Core Portfolio,giving you immediate access to more sophisticated, diversified funds.

- The Strategic Advantage: True passivity. The assets are professionally managed. We pay the fee to eliminate management time, which is the most critical resource for high-level founders and sales teams.

- The Cost Analysis: A standard 1% annual fee. This is the operational cost of reducing friction and maximizing time freedom.

2. Groundfloor: The Velocity Capital Generator

Groundfloor is our engine for capital velocity. It focuses exclusively on short-term real estate debt.

Understand this: We are not holding long-term equity here. We are cycling capital to generate predictable, fixed returns that fuel subsequent investments.

- The $1,000 Deployment Strategy: Maximize diversification immediately. Split your capital across 10 to 20 individual loans (notes start as low as $10).

- The Alternative: Utilize the automated Flywheel product for hands-off, fixed-interest deployment.

- The Actionable Cycle: Loans mature rapidly (typically 6 to 18 months). You receive principal plus interest. You immediately redeploy that capital. This rapid cycling proves the system works,just like structuring a high-speed lead generation sequence.

- The Result: Predictable, fixed returns. This cash flow proves the model and allows for quick scaling or reinvestment into long-term assets.

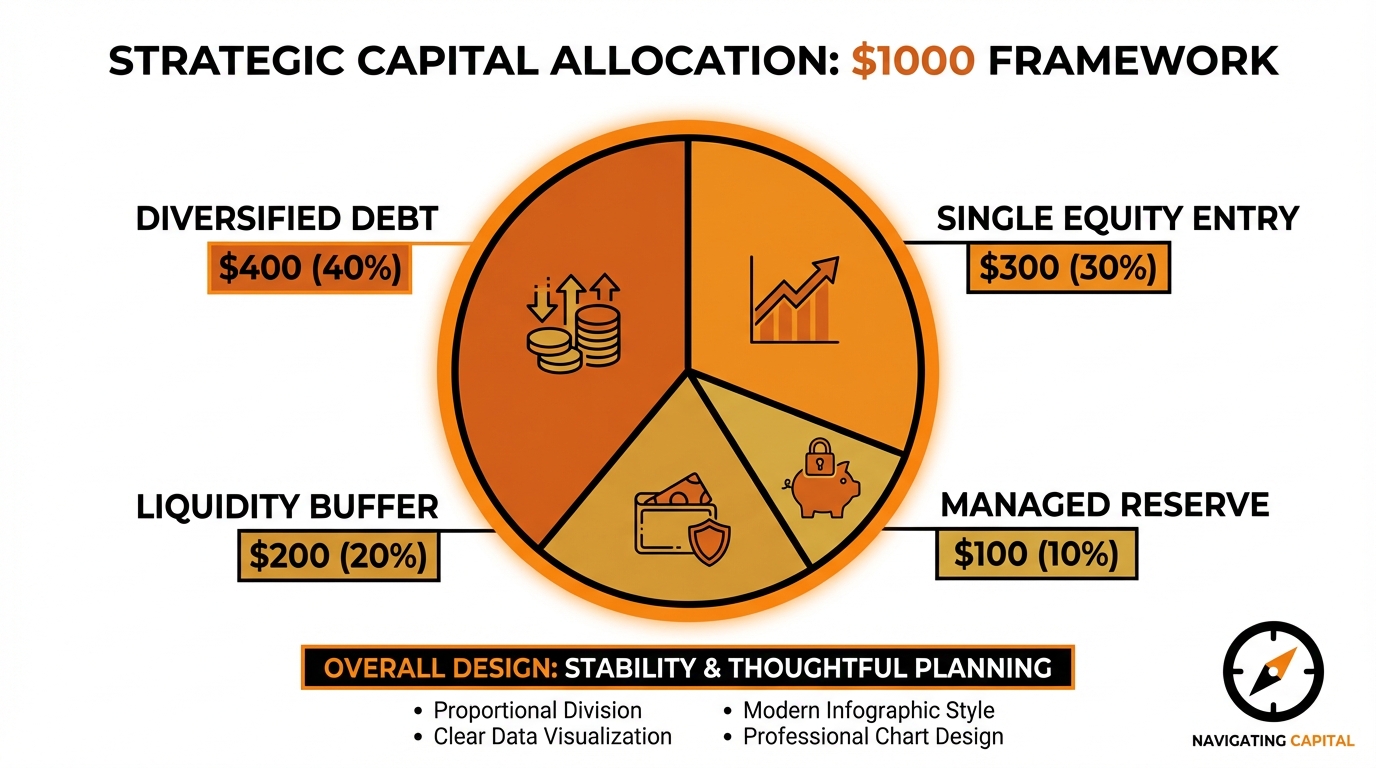

The $1,000 Deployment: Strategic Allocation Frameworks

Forget treating this capital as a savings account. We deploy capital to generate measurable returns. This is a targeted deployment strategy built for velocity and scale.

Strategy #1: The Dual-System Split (50/50 Velocity/Equity)

This is the optimum starting point. It minimizes single-asset risk while optimizing for dual goals: immediate liquidity (debt) and long-term appreciation (equity). We use dual-system strategies across all our revenue funnels for redundancy.

- Allocation: $500 into Fundrise Core Portfolio, $500 into Groundfloor Flywheel or 10+ individual loans.

- The Advantage: Mitigation of illiquidity risk. Debt returns provide short-term cash flow; equity provides long-term growth. The crucial step: Cash flow from Groundfloor is immediately reinvested into Fundrise. This creates a self-sustaining, automated compounding loop.

- Strategic Alignment: This mirrors our core philosophy for lead generation: building multiple, automated revenue streams to mitigate single-point failure. (See: The 2026 Blueprint for Automated Affiliate Funnels).

Strategy #2: The Pure Growth Mandate (7+ Year Lock-In)

This mandate is simple: Maximum exposure, minimum withdrawal. It is strictly reserved for capital you will not require for the next seven years. We prioritize long timelines for exponential growth.

- Allocation: $1,000 into Fundrise (Core Portfolio).

- The Win Condition: Maximum exposure to institutional-grade assets immediately. Low management fees amplify net returns. This strategy optimizes the compounding curve over a decade,we call this the ‘Set and Forget’ system.

Strategy #3: The Capital Velocity Test (Proving the Model)

This is the system validation step. The goal is proving the cash flow model quickly and generating realized returns within 12–18 months. Speed is the metric here.

- Allocation: $1,000 into Groundfloor (diversified across 20 loans).

- Why It Works: It tests the entire system end-to-end. You generate realized, measurable returns (typically 8%–12%). The capital plus profit is returned in under 18 months, validating the investment thesis without the illiquidity lock-up of equity. This is a rapid feedback loop.

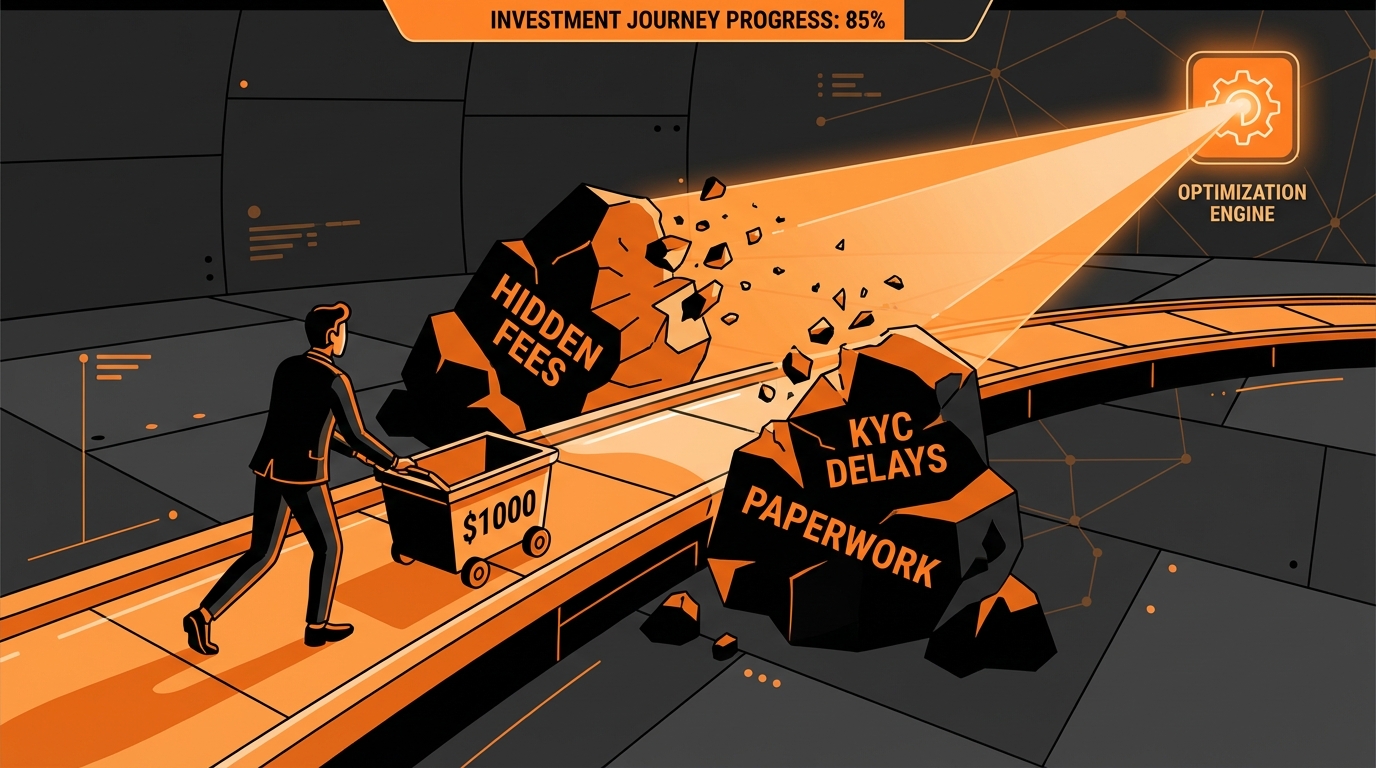

Operational Friction: The Administrative Overhead You Must Eliminate

You cannot scale if you ignore administrative friction. A strategic deployment demands pre-emptive accounting for overhead and legal structure.

1. The Illiquidity Trap: This Is Not a Savings Account

Do not confuse real estate crowdfunding with stock trading. These assets require maturity.

- Expected Hold Time: Expect 5–7 years for most equity funds. This is a long-term capital lock-up.

- Early Exit Costs: Early redemption fees (1–3%) are standard. This is not emergency capital. Treat it as inaccessible until the defined maturity date.

- Your Mandate: Define the five-year goal for this $1,000 before you click “invest.”

2. Tax Optimization: K-1 vs. 1099 (The Efficiency Metric)

This is the single biggest administrative differentiator between platforms. It dictates your tax season workload.

Debt Platforms (e.g., Groundfloor): You receive a 1099-INT. This is simple interest income. Minimal friction. High administrative velocity.

Equity Platforms (e.g., Fundrise, DiversyFund): You receive a K-1. This is a partnership tax form. It is complex. It often arrives late (disrupting your filing timeline). It requires detailed filing.

We prioritize administrative efficiency across all our systems,from lead generation conversion to investment portfolio management. If you are optimizing for velocity, the 1099 structure is superior for your initial foray. (If you want to understand how we apply this efficiency mandate to high-growth services, review The 2026 Blueprint for a Technical Writing Business.)

3. The Fee Structure Mandate: Cap Your Overhead

Fees must be 100% transparent. If the platform obfuscates costs, you exit immediately.

- The Target Ceiling: Total annual fees must not exceed 1.5% of Assets Under Management (AUM).

- The Red Flags: Avoid high transaction fees. Specifically, watch for hidden “disposition fees” that materialize only upon asset sale,they erode your final net return.

Final Action: Systemizing Your $1,000 Capital Deployment

That first $1,000 is not just capital. It is your pilot program for passive wealth generation.

We approach this deployment with the same strategic rigor we use to build our AI lead generation systems. The goal is simple: High efficiency, low friction, and clear, measurable outcomes.

If you cannot measure it, you cannot scale it. That applies equally to revenue and financial returns.

Before you commit, confirm these three critical variables:

- Strategy Alignment: Choose the debt/equity split that precisely aligns with your required timeline (short-term cash flow vs. long-term appreciation).

- Friction Elimination: Verify the platform’s administrative overhead and fees. (We only implement systems that minimize drag on performance.)

- Exit Strategy: Understand the illiquidity period. You must be prepared for the typical 5–7 year hold time before deployment.

You have defined the target. You have minimized the friction points. Now, you set the investment system and allow compounding to drive the results.

Stop trading time for money. Start building scalable financial systems today. This is how strategic capital deployment ensures long-term financial resilience,just like automation ensures scalable lead generation.

Frequently Asked Questions

Is real estate crowdfunding safer than the stock market?

No. It is structurally different,and strategically superior for portfolio stabilization.

The public market offers daily liquidity and high volatility. Crowdfunding lacks that daily liquidity, but it also strips out the daily noise and emotional trading risk.

It carries unique risks:

- Project failure.

- Extended illiquidity (you cannot sell instantly).

We mandate it as a crucial diversification lever. It stabilizes overall portfolio risk by moving capital into a less correlated asset class.

Do I have to be an accredited investor?

Absolutely not. The barriers to entry have been systematically lowered.

The platforms we recommend leverage Regulation A+ offerings (Reg A+). This specific regulation allows non-accredited investors,the majority of beginners,to participate with low minimums. Focus on the strategy, not the paperwork.

What is the minimum amount I should invest?

Some platforms allow $10. We mandate $1,000.

Investing $10 is a hobby; $1,000 is a pilot program. Strategic deployment requires critical mass. This minimum ensures two key factors:

- Access to crucial, diversified Core Funds on equity platforms (e.g., Fundrise).

- Sufficient capital to properly diversify across multiple debt notes (e.g., Groundfloor), avoiding single-asset risk.

This is a non-negotiable step for measurable risk management.

How often are returns paid out?

Payout frequency depends entirely on your chosen vehicle: Debt vs. Equity.

- Debt Investments (e.g., Groundfloor): Typically pay upon loan maturity (6–18 months). Some specialized products offer monthly interest payments.

- Equity Funds (e.g., Fundrise): Usually pay quarterly dividends. Crucially, many high-growth funds automatically reinvest cash flow to maximize long-term appreciation. We prioritize reinvestment for compound growth.

Stop Wasting Time. Start Automating.

You systematized your capital. Now systematize your revenue engine.

Stop manually searching for client emails. Start automating your lead generation process today.

Start Your Free Trial