The monthly client report is not a status update. It is a retention tool.

Most agencies fail because they treat reporting as a chore: dumping raw data into a templated dashboard and hitting send. This approach guarantees churn.

High-ticket clients—SaaS founders, sophisticated service owners—do not pay for activity. They pay exclusively for results and demand immediate proof of ROI.

Our reporting system is built differently. We translate complex campaign data into a clear, actionable revenue narrative—a narrative that secures immediate renewals and drives significant upsells.

This article delivers the strategic framework we use. It moves beyond vanity metrics and focuses solely on the levers that increase your client’s bottom line.

What You Will Master: The Revenue-Driven Reporting Framework

- The 3-Part Executive Summary: Translating performance into profit.

- The “Why and What Next” Structure: Eliminating reporting ambiguity and generating next steps.

- Key Templates: The exact metrics required for marketing, sales, and operations reports.

- The Renewal Trigger: How to use historical data to pre-close the next contract during the current monthly review.

Key Takeaways: Reporting as a Retention Strategy

- The ROI Narrative is King: Raw data is noise. Structure your report immediately to highlight the financial return on investment (ROI) and the direct impact on the client’s bottom line.

- Business Outcomes Over Vanity Metrics: Stop reporting Clicks and Impressions (vanity KPIs). Shift focus entirely to Key Results: Revenue Generated, Sales Qualified Leads (SQLs), and optimizing Customer Acquisition Cost (CAC).

- Strategic Commentary is Your Value: Automation handles the data pull efficiently. Your agency’s irreplaceable value is the manual, strategic interpretation, and the clarity of the proposed next steps.

- The Next Step is Mandatory Retention: Every monthly report must conclude with a clear, quantified recommendation for maintaining or increasing the client’s current investment level. Failure to propose the next move is failure to secure the contract.

The Core Problem with Standard Agency Reports

Generic reporting is not just ineffective—it is a significant liability. It actively creates distance between the agency, the client, and the measurable business result.

What defines a standard, value-destroying agency report?

- Page 1: The “Executive Summary” (Vague, often boilerplate filler).

- Pages 2–5: Data dumps focused entirely on vanity metrics (Traffic, Clicks, Impressions).

- Page 6: A list of inputs—tasks completed (the “We worked hard” section).

- Page 7: An ambiguous recommendation to “keep pushing” or “stay the course.”

This outdated approach fails high-ticket clients for one critical reason: It focuses exclusively on inputs, not outcomes.

Your audience is a CEO, a CFO, or a Director of Sales. They do not retain you to write 10 blog posts; they retain you because those 10 blog posts must generate $50,000 in pipeline revenue this quarter.

The monthly report is the single most important touchpoint for retention. It must immediately and clearly answer the core question: “Did my investment pay off this month?”

If the client has to search for the answer—if they have to connect the dots between your activity and their revenue—they are already questioning your value proposition. That is the moment churn begins.

Step #1: Define the Client’s True North (The Revenue Metric)

Before any template is built, you must lock down the single metric that defines success for that specific client. This is not optional—it is the foundational negotiation during the onboarding phase.

If you skipped this critical step, you are currently reporting blind. You are delivering activity reports, not performance reports.

KPI vs. KPR (Key Performance Results)

We must immediately halt the tracking of vanity metrics. They feel good internally, but they never move the client’s needle. The distinction between activity and outcome is crucial:

- Key Performance Indicator (KPI): A measure of activity or effort (e.g., clicks, impressions, time on page).

- Key Performance Result (KPR): A measure of revenue impact or measurable business outcome.

“Do not report on impressions. Report on the Cost Per Qualified Lead (CPQL) and the subsequent conversion rate to a closed deal. Everything else is noise.”

The KPR is the anchor of the entire client relationship. It must be specific and tied directly to the client’s P&L:

- For a SaaS Client: Monthly Recurring Revenue (MRR) attributed directly to agency campaigns, or Customer Lifetime Value (CLV) increase.

- For High-Ticket Services: The number of booked sales calls with a defined minimum deal size (e.g., deals over $10k).

- For E-commerce: Return on Ad Spend (ROAS) or incremental profit margin generated by the channel.

Every element of our report structure must flow backward, starting and ending with this singular KPR.

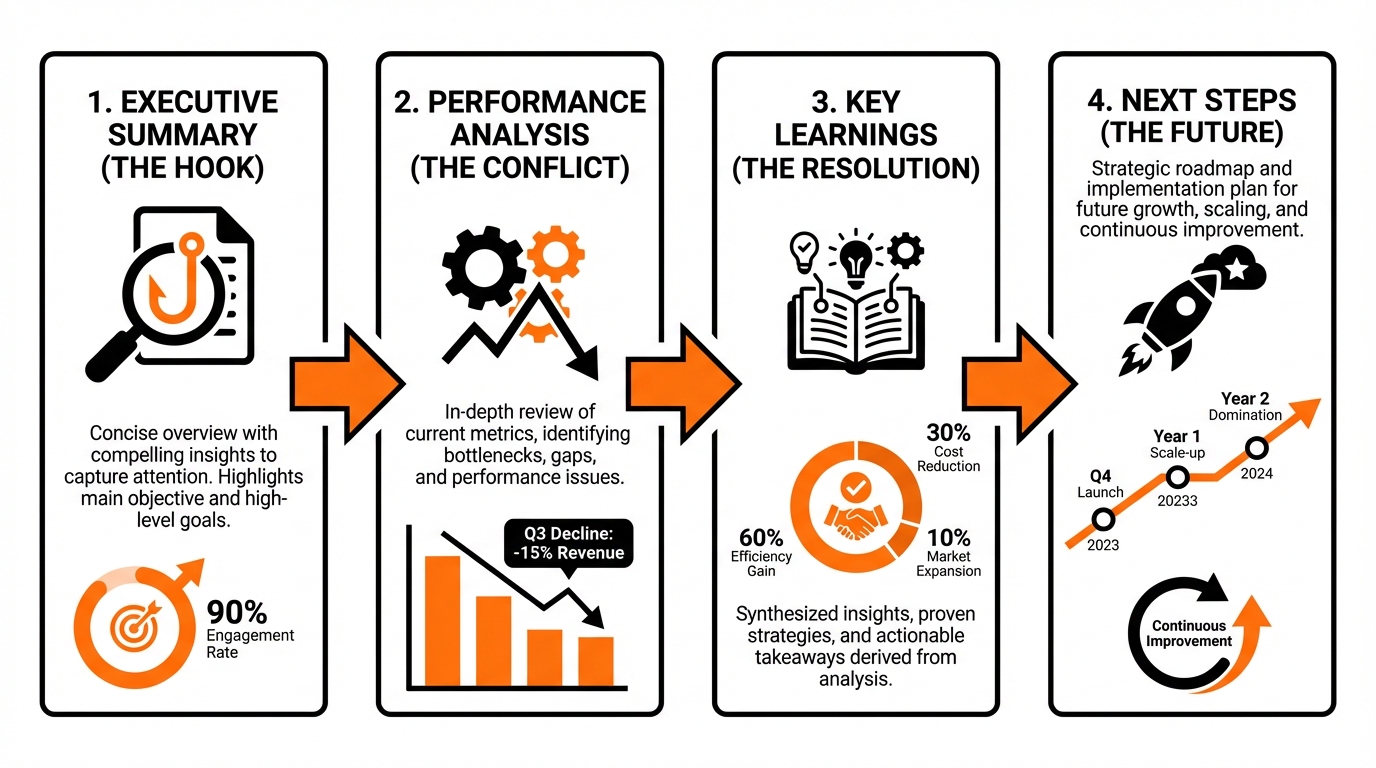

Step #2: Structure the Report for Narrative Control (The 4-Part Framework)

Defining the True North metric (Step #1) tells you what to report. Structuring the report controls how the client perceives that performance. If you fail here, the client will interpret the data for themselves—and they will likely interpret it negatively.

A strategic report is not a data dump; it’s a narrative tool. Like any successful presentation, you must state the result first, explain the data second, and propose the next action third. This framework shifts the conversation from defense (justifying last month’s spend) to offense (securing next month’s investment).

Use this four-part framework to control the narrative, minimize client anxiety, and anchor the discussion in strategic growth:

- The Executive Summary (The Verdict): Immediate ROI and goal status.

- Performance Deep Dive (The Evidence): Connecting activity to measurable results.

- Analysis & Context (The Expert Take): The “Why” behind the numbers.

- Next Steps & Investment (The Strategic Pivot): The quantified plan for future growth.

1. The Executive Summary: Immediate ROI Proof

This is the most critical section—it is the only part 80% of executives will read. It must be concise, quantitative, and directly address the client’s True North metric.

If the client reads nothing else, they must understand their ROI and the status of the relationship after reading this section.

Required Components:

- The Headline Result: State the Key Performance Result (KPR) directly. Example: “Campaign X generated 14 SQLs, contributing $42,000 in verifiable pipeline value this month.”

- Goal Status: Did we hit the monthly target? Use simple, unmistakable color-coded indicators (Green/Yellow/Red) to signal health immediately.

- Key Challenge: Identify the biggest bottleneck right now. (e.g., “Lead volume is high, but the qualification rate dropped 5% due to form friction on mobile.”)

- Key Recommendation: The single, most important, actionable item for the next 30 days.

2. Performance Deep Dive: Connecting Activity to Result

This section is where you present the actual data, but never as raw numbers. Your job is to present chains of causality. We show the client that our activity is not busywork—it is strategic leverage.

Show exactly how the activity (e.g., increased ad spend, new landing page deployment, A/B testing) directly led to the result highlighted in the Executive Summary.

The Core Rule of Reporting: Never present a metric without a comparison point. Always compare MoM (Month-over-Month), YoY (Year-over-Year), or against the established goal. Contextualized data prevents questions; raw data invites scrutiny.

3. Analysis & Context: The Expert Take

This is the section where you earn your retainer and justify your agency’s expertise. Automation tools pull data; your team provides the why.

Do not just report performance drops. Analyze and explain the cause, demonstrating that you are monitoring the entire ecosystem, not just the dashboard:

- Market Context: Was the change seasonal? Did a competitor launch a major campaign?

- Internal Factors: Was there a technical issue (e.g., tracking script error, site downtime)?

- Strategic Implications: What did we learn from the data that changes our underlying assumptions about the target audience or channel?

Use this section to prove proactive monitoring. If you can explain why the numbers moved, the client sees you as a partner, not just a vendor.

4. Next Steps & Investment: The Strategic Pivot

The report must always end with a forward-looking strategy. If you deliver strong results, the client is primed to invest more. If results were soft, they need confidence in the revised plan. Never leave the meeting without a quantified next step.

Structure the next steps into two distinct categories:

A. Immediate Fixes (Optimization): These are the tactical steps we are committing to implement in the next 7-14 days to address identified bottlenecks and capitalize on immediate opportunities.

B. Strategic Expansion (Investment/Upsell): This is the quantified recommendation for scaling impact. We justify the next phase of work—whether it’s increasing ad budget, launching a new channel, or investing in deeper strategic analysis.

This section is crucial for proactive revenue generation. We often use it to introduce necessary scaling costs. For instance, if the client is scaling fast, we discuss the need for specialized tracking tools or increased retainer fees to match the complexity of the growth. This makes future conversations about agency setup fees and retainer adjustments much smoother, as the need has already been quantified and justified by performance.

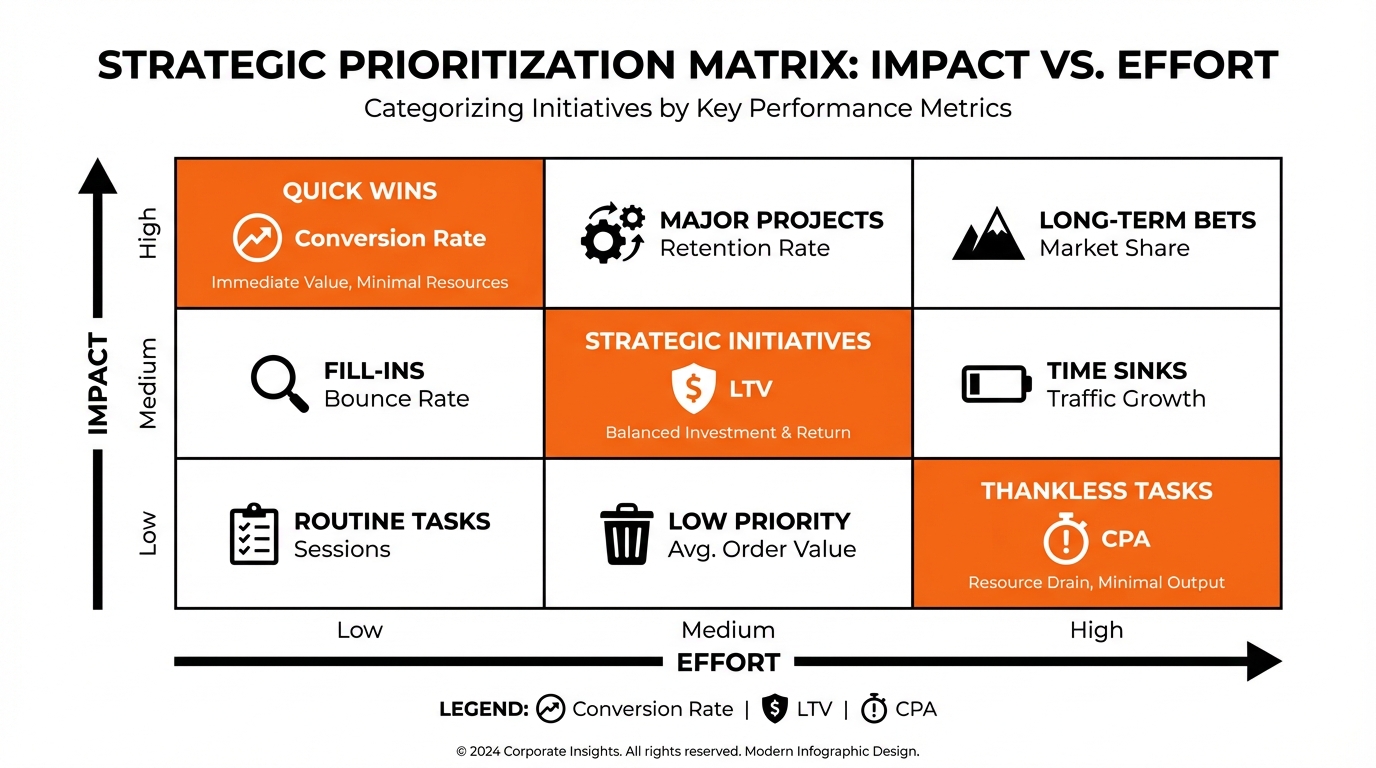

Step #3: The Essential Metrics Matrix

The structure controls the message. The metrics *are* the message. If the goal of the report is to drive alignment—and secure the renewal—we must rigorously eliminate data points that do not directly map to the client’s financial goals (the True North Metric established in Step #1).

Stop reporting vanity metrics. They distract the client, dilute the core message, and force the conversation back to low-level activity. Your reporting should prove investment value, not just effort.

We prioritize metrics based on their direct proximity to revenue and pipeline generation. The Essential Metrics Matrix below outlines the strategic shift required for B2B and high-ticket service agencies. This is how we move the conversation from “activity” to “investment.”

| Metric Category | Low-Value Metric (Avoid or Minimize) | High-Value Metric (Focus Area) | Why the Shift Matters |

|---|---|---|---|

| Awareness/Traffic | Total Impressions, Page Views, Social Follower Count | Qualified Sessions (Target ICP visits), Time on Page (Conversion Assets), Audience Demographics Match | Impressions are cheap and easy to inflate. Intentional engagement by the Ideal Customer Profile (ICP) proves audience quality, which directly impacts lead quality down funnel. |

| Lead Generation | Total Form Submissions, Clicks to Landing Page, Email Open Rate | Marketing Qualified Leads (MQLs), Cost Per Qualified Lead (CPQL), Conversion Rate (Session to MQL) | We must prove the leads are truly ready for sales engagement, not just filling out forms. CPQL directly measures the efficiency of marketing spend toward actionable results. |

| Conversion/Sales | Conversion Rate (Lead to MQL), Number of Meetings Booked | Sales Qualified Leads (SQLs), Pipeline Value Generated, Customer Acquisition Cost (CAC) | SQLs and Pipeline Value are the language of finance and the CEO. This proves direct, measurable revenue contribution and validates your strategic efforts. |

| Efficiency/ROI | Total Spend, Click-Through Rate (CTR), Bounce Rate | Return on Ad Spend (ROAS), Lead-to-Customer Velocity, Lifetime Value (LTV) Projection | High-ticket clients need to see long-term profitability and scaling potential. Focus on velocity and LTV to position the agency as a growth partner, not a cost center. |

Step #4: Automate Data, Manualize Insight (Avoiding the Generic Trap)

If the metrics are the message (Step #3), the delivery mechanism must be flawless. Scaling an agency in the current landscape makes manual data extraction mandatory for elimination. Pulling numbers from 12 separate platforms is not just inefficient; it guarantees human error and wastes the most expensive resource: senior strategist time.

We must use robust tools to automate the data collection and visualization layers. This is non-negotiable. Automation handles the plumbing, freeing our experts to focus solely on the high-value activity: the analysis and strategic recommendation.

The Automation Trap: Why AI Summaries Fail

Many agencies make a critical error: they automate the entire report, including the executive summary, often using basic AI prompts. This is a shortcut to mediocrity.

Automated summaries are inherently generic. They rely on vague, non-committal phrases like, “Performance was generally positive with room for improvement.” This statement is useless. Our clients are paying for strategic judgment and clear direction, not ambiguity.

To avoid the generic trap and deliver tangible value, our reporting process must operate across three distinct layers:

- Data Layer (100% Automated): Connect all necessary sources (GA4, CRM, Ad Platforms). Ensure accurate Strategic GA4 ROI Tracking for High-Ticket Leads is in place.

- Visualization Layer (Automated/Templated): Display the validated KPRs clearly using consistent dashboards (Looker Studio, Power BI, etc.) with strict MoM/YoY comparisons.

- Insight Layer (100% Manual & Strategic): A senior team member writes the Executive Summary, the Contextual Analysis, and the Next Steps. This is the strategic leverage point.

The client needs absolute certainty that an expert reviewed their file and applied strategic judgment. They are paying for expertise and actionable direction, not for automated data processing.

Step #5: Leveraging the Report for Trust and Scaling

Once the data is automated and the insights are manualized (Step #4), the final output—the monthly report—becomes the cornerstone of client retention and scaling. This report must be delivered proactively, never reactively.

Proactive Delivery is Mandatory

Never just email the PDF and wait. Proactive delivery means scheduling a mandatory 30-minute review call. Crucially, the client must receive the completed report 24 hours prior. This call is not for reading slides aloud; it is for strategic decision-making.

We structure the 30-minute review call with ruthless efficiency:

- Reviewing the Executive Summary: 5 Minutes. (What happened.)

- Discussing Strategic Implications: 10 Minutes. (Why it matters.)

- Aligning on Next Steps and Investment: 15 Minutes. (Where we go next.)

This strict time allocation ensures the client arrives prepared and forces the conversation toward strategic growth, not just time-wasting data validation. We treat the report review as a consultation, not a status update.

Using Reports to Identify Systemic Failure

The report is more than a scorecard; it is a critical diagnostic tool. If our reports consistently show high traffic volume but failing SQL (Sales Qualified Lead) conversion rates, the failure is not in the reporting—it is rooted in the client’s systemic lead generation process.

When data points to systemic failure, the “Next Steps” section must immediately transition from performance updates to a project proposal. For example, consistently poor lead quality requires us to propose fixing the front-end qualification process, positioning our agency as the necessary solution provider.

Identifying bottlenecks early directly prevents churn. We document these issues rigorously because accountability is enforced by the data itself. Agencies lose clients by making fundamental errors that surface repeatedly in reports. Use the monthly data to enforce accountability and avoid common pitfalls like these: 12 Strategic Errors Costing You Revenue in Lead Generation.

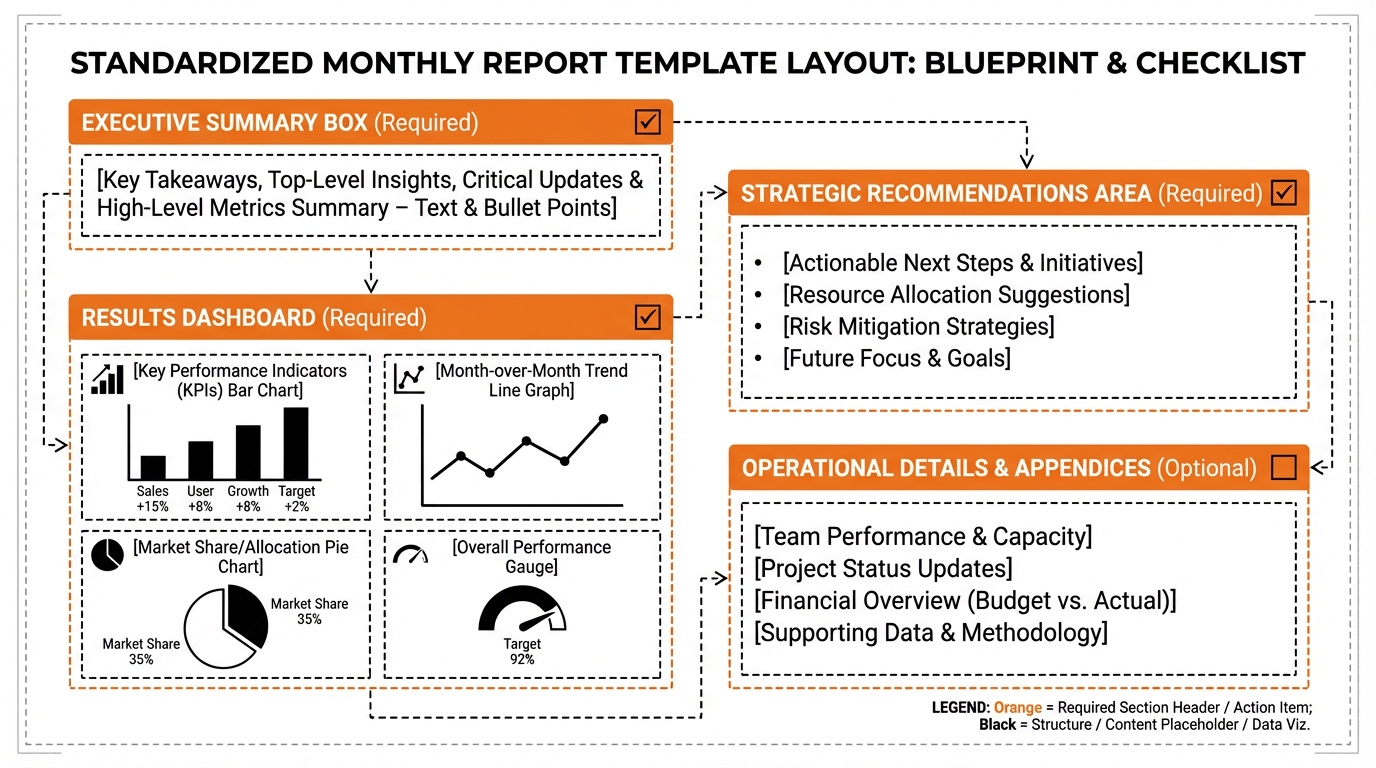

The Template Blueprint: Essential Sections Checklist

We do not leave success to chance. A standardized, high-impact template is mandatory. It ensures consistency across all clients and forces your team to focus only on metrics that drive revenue. Your monthly report must include these non-negotiable sections, structured for maximum executive impact:

- Cover Page: Client Name, Reporting Period, Agency Logo. Keep it clean, professional, and branded.

- Executive Summary (The 1-Minute Read): This is the most crucial page. It must deliver KPR results, current Goal Status (green, yellow, or red), and the Single Top Recommendation for next month. If the client reads nothing else, they read this.

- Financial Snapshot: The ROI section. Compare Agency Investment (cost) against the Generated Pipeline Value and the current Customer Acquisition Cost (CAC). This proves we are an investment center, not a cost center. (Mandatory for high-ticket, performance-based contracts).

- Channel Performance Breakdown: Segment performance by channel (e.g., SEO, Paid Media, Email Marketing). The focus must remain on lead quality metrics like Cost Per Qualified Lead (CPQL) and Sales Qualified Lead (SQL) volume.

- Key Assets Performance: Identify the specific assets—landing pages, lead magnets, or content clusters—that contributed most directly to the Key Performance Results (KPRs).

- Strategic Analysis (The Context): This is the written narrative. We provide context for the numbers: Why did performance shift? What strategic insights did we gain? What opportunities or threats did we identify? This section justifies the agency fee.

- Action Plan & Investment Roadmap: A detailed, bulleted list of next month’s priorities (Tasks 1-5). Crucially, include any required budget adjustments, scope changes, or client deliverables needed to execute the plan.

- Appendix: Use this section for supporting data—raw traffic volume, granular keyword ranking reports, or other detailed metrics the client requested but which are not core Key Performance Results. Keep the main report clean.

This template is rigid by design. It forces strategic thinking and ensures every report delivers tangible value, not just data volume.

Strategic Reporting FAQs: Addressing Common Objections

- What is the ideal length for a high-ticket client report?

- The ideal report is highly concise. The Executive Summary must be readable in under 60 seconds. The comprehensive report—including deep dives and appendices—should never exceed 8 pages. High-ticket clients pay for results, not volume; they demand brevity and actionable clarity above all else.

- Should we include negative results in the monthly report?

- Absolutely. Transparency builds long-term authority. If a campaign underperformed, report it immediately. However, never report failure without the solution: report the immediate diagnosis and the corrective action you have already deployed. This proves proactive strategy and minimizes client panic.

- How often should we send performance reports?

- The required standard for high-ticket accounts is monthly. We mandate a brief, automated weekly snapshot focused exclusively on velocity metrics (e.g., Lead Volume Pacing). This prevents surprises. The strategic, narrative-driven report—where our analysis is delivered—must remain monthly.

- Is it better to use Google Looker Studio (GDS) or a custom PDF/Presentation?

- Both are essential, but they serve distinct functions. Live dashboards (like Looker Studio or Tableau) handle raw data access and real-time transparency. The custom PDF/Presentation (or HTML document) delivers the narrative and strategic analysis. High-ticket clients hire us for our interpretation. Never rely solely on an automated dashboard; the strategic analysis document is the product we sell.