The landscape for financial advisors is not what it was five years ago. We are operating in 2025, and the old methods of lead generation-cold calling, generic direct mail, and mass seminars-are inefficient, costly, and fundamentally damage your brand authority.

Your prospects, particularly high-net-worth individuals and C-suite executives, demand precision and personalization. They will not respond to generic outreach. They require a trust-based acquisition model.

Our team has analyzed the highest-performing financial advisory firms across the United States. We determined that sustained, scalable growth hinges on three core principles: extreme niche focus, proprietary content systems, and hyper-personalized digital outreach.

You are about to learn the definitive 2025 blueprint for generating qualified, high-intent leads without resorting to buying expensive, low-quality lists.

Key Highlights: The 2025 Financial Advisor Mandate

- Niche Focus is Non-Negotiable: Generalist advisors cannot scale efficiently in 2025. You must specialize in a high-value niche (e.g., tech founders, retiring physicians, specific corporate executives).

- AI-Powered Prospecting: Leverage AI tools to bypass gatekeepers and acquire verified personal contact data for high-intent, targeted outreach.

- Trust Over Transaction: Every touchpoint must be educational and value-driven. Your goal is to establish authority before attempting a sale.

- The Content Gating Rule: Use proprietary research reports and tools as mandatory lead magnets to capture high-quality contact information.

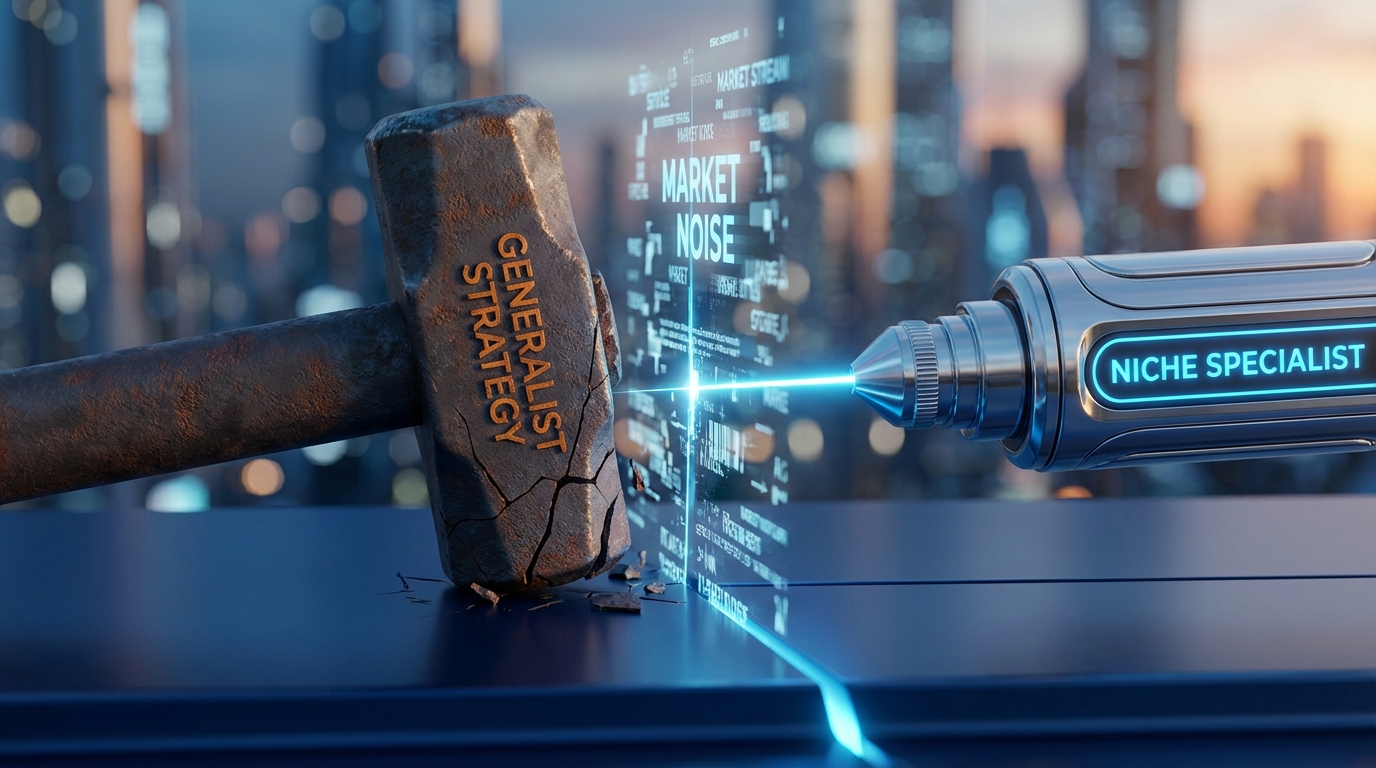

The Foundational Shift: Why Generalists Fail in 2025

If your value proposition is simply “I help people manage money,” you have already lost. The market is saturated with that message. High-ticket clients are seeking specialists who understand their unique, complex financial pain points.

Step 1: Define Your Irreproachable Niche

We see countless advisors wasting budget targeting “retirees” or “small business owners.” These segments are too broad. You need to identify a cohort that shares a specific, identifiable financial event or challenge.

Example of High-Value Niches:

- Executives receiving Restricted Stock Units (RSUs) at pre-IPO tech firms.

- Physicians specializing in specific, high-earning surgical fields navigating practice management and tax laws.

- Second-generation family business owners planning intergenerational wealth transfer.

When you specialize, your marketing spend becomes exponentially more effective. Your content speaks directly to their fears and goals. Your expertise is unquestionable within that micro-segment.

Step 2: Optimize Your Digital Authority Platform

Your website is not a brochure. It is a lead capture machine and an authority validator. If a prospect finds you through networking or referral, the first thing they do is a 5-second test on your website. Does it immediately validate your niche authority?

Mandatory Website Elements for High-Ticket Lead Conversion:

- Clear Niche Messaging: The headline must state exactly who you serve and the specific problem you solve (e.g., “Tax-Efficient RSU Management for Bay Area Tech Executives”).

- Proprietary Research: Host original white papers, calculators, or reports relevant only to your niche. This is your high-value gated content.

- Social Proof that Matters: Feature testimonials that reference specific, complex scenarios you resolved, not generic praise.

- Clear CTAs: Offer a non-committal, high-value initial consultation (e.g., “15-Minute RSU Analysis Session”).

The 2025 Acquisition Blueprint: High-Intent Digital Sourcing

The single biggest shift in modern lead generation is moving away from generic advertising and toward highly targeted, manual outreach facilitated by smart technology. We are talking about finding the exact individual who needs your service right now, and delivering a personalized message directly to their inbox.

Step 3: Leveraging AI for Direct Prospect Identification

Gatekeepers, generic info@ emails, and outdated CRMs are the enemies of efficiency. Our strategy bypasses them entirely.

You must use AI lead generation software (like ours) to scour professional networks and databases to find the verified, private contact information of your ideal client persona.

How This Works in Practice:

- You define your niche (e.g., “VPs of Product at Series B FinTech companies in Texas”).

- The AI tool finds 1,000 specific individuals matching that criteria.

- The tool extracts their validated, personal email addresses (not generic corporate addresses).

- You now have a list of 1,000 highly qualified prospects ready for personalized outreach.

This is the difference between sending 10,000 mass emails with a 0.1% conversion rate and sending 1,000 hyper-targeted emails with a 5-10% positive response rate. LinkedIn Lead Generation: The 2025 Trust Blueprint details how to structure the initial identification process effectively.

Step 4: The Hyper-Personalized Outreach Sequence

Once you have the direct contact information, the outreach must be impeccable. This is where most advisors fail, defaulting to a sales pitch.

We recommend the 3-Part Value Sequence:

A. The Research-Backed Hook (Email 1)

Your first email cannot ask for a meeting. It must reference something specific and relevant to the prospect’s situation or company.

- Bad Hook: “I saw you work in finance and wanted to offer my services.”

- Good Hook: “I noticed your company, [Company Name], recently closed its Series B. We’ve published a proprietary report on tax implications for early employees post-Series B liquidation events. Would you find a quick PDF useful?”

You are leading with value, demonstrating domain expertise, and asking a low-friction question.

B. The Diagnostic Offer (Email 2)

If they interact with the content, follow up with a highly specific, high-value offer.

- “Based on the data in that report, most VPs in your position overlook the Section 83(b) filing deadline. I can provide a free, 10-minute diagnostic review of your vesting schedule to ensure compliance. No sales pitch, just clarity.”

C. The Trust Builder (Optional Video)

For the highest-value prospects who haven’t responded, deploy a personalized video message. Seeing your face, hearing your tone, and knowing the video was made specifically for them creates immediate, high-level trust that generic text cannot replicate. Learn more about this crucial technique here: generating leads through personalized video messages.

Trust-Based Conversion Systems: Content and Referrals

While digital outreach drives immediate pipeline, sustainable growth relies on systems that passively generate qualified leads based on perceived authority.

Step 5: Gated Content as a Mandatory Lead Filter

Your content must act as a filter, allowing only high-intent prospects to exchange their valuable contact information for your expertise. Free, ungated blog posts build SEO authority, but gated content builds pipeline.

What makes a piece of content worth an email address?

- Specificity: It addresses a niche problem that costs the client money or time if ignored.

- Actionability: It provides a clear framework or checklist they can use immediately.

- Proprietary Data: It includes research, benchmarks, or calculators that cannot be found elsewhere.

We advise creating High-Intent Lead Magnets specifically designed to capture data from high-net-worth individuals, such as detailed tax guides or complex scenario planning tools. This ensures the leads you capture are already qualified by their demonstrated interest in sophisticated financial topics.

Step 6: Optimizing the Professional Referral Engine

Referrals remain the gold standard, but relying on passive word-of-mouth is a fatal flaw. You must build an active, professional referral network composed of complementary service providers.

The Core Referral Network:

- CPAs and Tax Specialists: They see complex financial situations first. Establish a reciprocal relationship where you handle investment/wealth management, and they handle the tax optimization.

- Estate Planning Attorneys: Clients consulting on wills, trusts, and legacy planning are high-net-worth by definition.

- Executive Recruiters: They place high-earning individuals who often need immediate advice upon starting a new role (e.g., managing new compensation packages).

- Commercial Real Estate Brokers: Business owners buying property often need capital planning and liquidity advice.

The Reciprocity Mandate: Do not just ask for referrals. You must actively send them business first. Schedule monthly check-ins with your top five referral partners to discuss specific client profiles and identify opportunities for mutual value exchange. This is not casual networking; it is a structured, revenue-generating partnership.

Step 7: Hosting High-Value Educational Workshops (The Anti-Seminar)

Dinner seminars are often seen as high-pressure sales environments. We are pivoting to high-value, educational workshops that focus purely on instruction, not selling.

Blueprint for a 2025 Workshop:

- Topic Focus: Must be narrow and timely (e.g., “Navigating the 2026 AMT Changes for Tech Stock Options”).

- Venue: Choose a professional, non-sales environment (e.g., a high-end corporate meeting space or university lecture hall).

- Mandatory Pre-Registration: Require detailed qualification questions during registration (e.g., “What is your primary financial challenge today?” or “What is your current AUM?”). This filters out low-value attendees.

- Follow-Up: The only CTA should be an offer for a free, 10-minute follow-up call to discuss their specific situation, based on the content of the workshop.

The Follow-Up Mandate: Nurturing and Conversion

Lead generation is wasted effort without a robust, personalized follow-up system. Financial advisors often generate leads but fail at nurturing them because they lack segmentation and consistency.

Step 8: Implement Dynamic Lead Segmentation

Not all leads are created equal. You must segment leads immediately based on their intent, asset level, and stage in the buyer journey.

Critical Segmentation Categories:

- A-Leads (High-Intent): Downloaded a high-value guide, attended a workshop, or were referred by a CPA. They require immediate, personalized outreach.

- B-Leads (Medium-Intent): Signed up for a general newsletter or followed you on LinkedIn. They require consistent, educational nurturing via email sequence.

- C-Leads (Cold/Future): Prospects identified via AI sourcing but not yet engaged. They receive the 3-Part Value Sequence (Step 4).

Segmenting allows you to deploy the right content at the right time. Sending a generalized market update to an A-Lead who needs complex tax advice is a critical mistake.

Step 9: Automated Personalization at Scale

We know that personalization boosts revenue by 10% to 15%. But how do you personalize outreach to hundreds of leads without manually writing every email?

This is where automation tools become mandatory. Use a CRM or marketing automation platform to create nurture sequences that dynamically pull data points (like the prospect’s company name, job title, or the specific lead magnet they downloaded) into the body of the email.

Example Automated Sequence Goal: Keep your firm top-of-mind for 12 months until the prospect is ready to convert.

- Week 1: Deliver requested content + follow-up with a related resource.

- Month 2: Share a case study about a client with a similar profile.

- Month 4: Invite them to the next niche-specific webinar.

- Month 8: Offer a free annual financial checklist or planning tool.

This system ensures persistence without being pushy. You are consistently delivering value, proving your expertise, and remaining available when the prospect’s financial timeline aligns with your service offering.

The Pyrsonalize Advantage: Why Manual Sourcing Wins

Many advisors rely on buying generic leads or running expensive, broad PPC campaigns. This approach is inefficient because you are paying for noise.

Our methodology focuses on generating qualified, high-intent leads by targeting individuals who meet the rigorous criteria of your niche before outreach begins. We are not interested in volume; we are interested in conversion rate.

By leveraging AI to find direct contact information, you eliminate the friction points of traditional marketing. You move from waiting for leads to come to you, to proactively engaging the exact clients you want to serve.

This strategic shift-from mass marketing to precision targeting-is the single most important action you can take to scale your financial advisory practice in 2025.

Frequently Asked Questions

- How often should a financial advisor post content to maintain authority?

-

Quality trumps quantity, especially in high-trust industries like finance. We recommend one deeply researched, niche-specific piece of content (blog post or white paper) every two weeks. This content should be repurposed across all social channels (LinkedIn, email, etc.) to maximize reach. Consistency is more important than daily posting.

- Is it worth buying leads from third-party services like SmartAsset or Investopedia?

-

Lead generation services can provide volume, but the quality is often low because the leads are sold multiple times. You are essentially competing against dozens of other advisors. We advise investing those marketing dollars into systems that generate proprietary, exclusive leads (like AI sourcing and gated content) where you are the only one in the conversation. Focus on quality over quantity; a smaller number of exclusive leads yields a far higher ROI.

- What is the ideal conversion rate for financial advisor leads?

-

If you are generating high-quality, pre-qualified leads (A-Leads), your goal conversion rate from initial meeting to client should be between 15% and 25%. If your conversion rate is below 10%, your lead qualification process is flawed, or your initial pitch is not sufficiently personalized to their pain points.