You landed the high-ticket client. The annual retainer looked massive. But when the month closes, your net profit margin is sitting at 12%. That is a loss cycle.

That is not sustainable growth. That is the curse of competency: great delivery that costs too much to execute. We see it constantly.

In 2025, scaling an agency is not about landing more deals. It is about understanding the precise financial mechanics of every single service line you offer—down to the minute.

We built our entire lead generation and client acquisition system specifically to target clients who respect value-based pricing. This is the only way we maintain industry-leading margins (30%+ Net Profit, consistently).

You need to know the numbers that actually drive profitability. Hint: It is never just the total revenue figure.

You are about to learn the three critical agency margins—the metrics that separate million-dollar agencies from those stuck in the churn cycle. More importantly, you will learn the strategic levers we use to push those margins past the 30% mark.

Key Takeaways: The Margin Mandate

- Delivery Margin is the Core Metric: Stop obsessing over Net Profit per project. Focus on achieving a 70%+ Delivery Margin at the project level.

- Cost vs. Price: True profitability is driven by lowering the Average Cost Per Hour (ACPH) and increasing the Average Billable Rate (ABR).

- Benchmark for Scale: A healthy agency requires a minimum 25% Net Profit Margin (EBITDA) to fund aggressive growth and internal R&D.

- Process Efficiency: Margin improvement is inherently linked to process standardization. Inefficient delivery kills profit.

The Three Non-Negotiable Agency Margins for Scale

Most agency owners make a critical mistake: they only track Net Profit. That metric shows the final result, but it provides zero diagnostic value.

Download the Visual Guide

Get the slide-by-slide visual summary of this article (PDF) for free.

You cannot scale what you cannot diagnose. To strategically manage profitability and unlock exponential growth, you must segment your costs. We track three distinct, non-negotiable margins: Gross, Delivery, and Net.

#1 Agency Gross Margin (AGI)

The Gross Margin measures how much revenue remains after paying for external costs directly required for service delivery. We call these Pass-Through Costs.

These are funds that flow in and immediately flow out to a third party. Examples include media/ad spend, white-label services, specialized contractor fees, or necessary software licenses (e.g., stock imagery).

The remaining revenue, which is the money your agency actually keeps, is the Agency Gross Income (AGI).

Formula:

Gross Margin % = ((Total Revenue - Pass-Through Costs) / Total Revenue) x 100

Example:

If you bill a client $100,000 but $30,000 is earmarked for media spend and external tools, your AGI is $70,000.

Your Gross Margin is 70%.

Strategic Benchmark: We mandate 50% or higher.

If your Gross Margin dips below 50%, you are too reliant on external vendors. You are sacrificing internal margin before your team even starts work. A low Gross Margin is a critical warning sign that your pricing model fundamentally fails to cover necessary third-party costs.

#2 Delivery Profit Margin: The Core Lever

This is the most critical metric in your agency. This is the figure you must obsessively track.

The Delivery Margin isolates the efficiency and utilization of your internal team. It shows the profit generated from your AGI after accounting for internal labor costs.

Delivery Costs are the Fully Loaded Costs (FLC) of your employees—salaries, benefits, and payroll taxes—for the time spent directly on client work.

We call this the core lever because it is the margin you can most directly control through rigorous process optimization, efficient resource allocation, and utilization management.

Formula:

Delivery Margin % = ((AGI - Delivery Costs) / AGI) x 100

The Strategic Distinction: Project vs. P&L Tracking

Tracking Delivery Margin is mandatory at two distinct levels:

- Agency P&L Level: The overall margin for the entire business. Our target is 55%+.

- Per-Project/Per-Client Level: The specific margin generated by individual deliverables. Our target is 70%+.

Why the 15-point buffer? The 70% project target is non-negotiable because it accounts for the realities of agency operations: inevitable scope creep, utilization gaps across the team, and shared labor costs that are difficult to allocate perfectly. Hitting 70% on the project level guarantees you have the necessary buffer to cover fixed overhead and still drive a powerful Net Profit.

#3 Net Profit Margin: The Big Picture

The Net Profit Margin represents your true, final bottom line.

It is the percentage of total revenue remaining after all three categories of expenses are covered: Pass-Through Costs, Delivery Costs, and Overhead Costs (G&A: rent, administrative salaries, software subscriptions, sales, and marketing).

This margin is not useful for day-to-day operational decisions. Instead, use it to assess the overall financial health, valuation, and market attractiveness of the agency.

Formula:

Net Profit Margin % = (Net Profit / Total Revenue) x 100

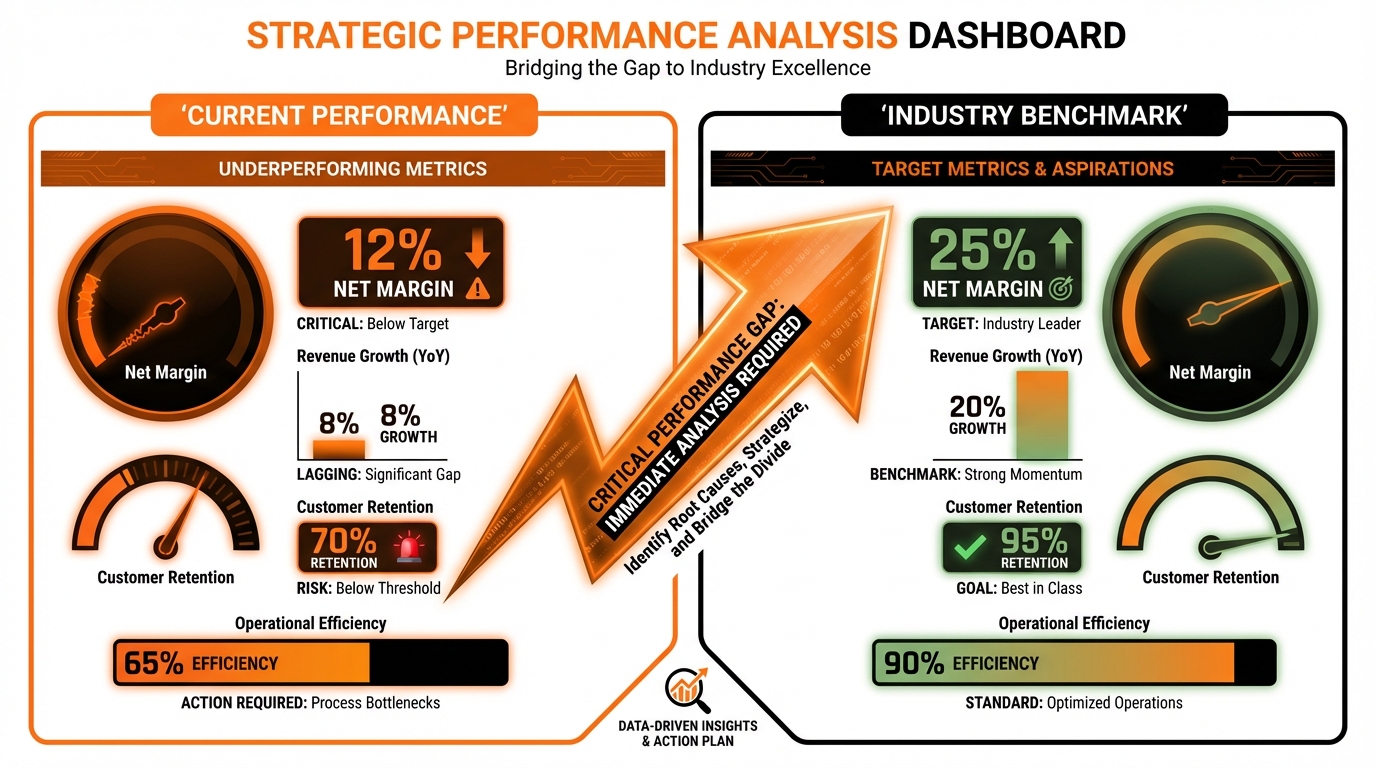

Strategic Benchmark: The industry average hovers around 10–15%. We consider this unacceptable.

To fuel aggressive, scalable growth—the kind that allows you to invest heavily in proprietary technology, AI tools, and rapid service line expansion—you must target a non-negotiable 25% Net Profit Margin (EBITDA) or higher.

Step #1: Calculate Your True Internal Labor Cost

You cannot effectively manage your Delivery Margin if you do not know the true cost of an hour of your team’s time. Most agencies guess; we measure.

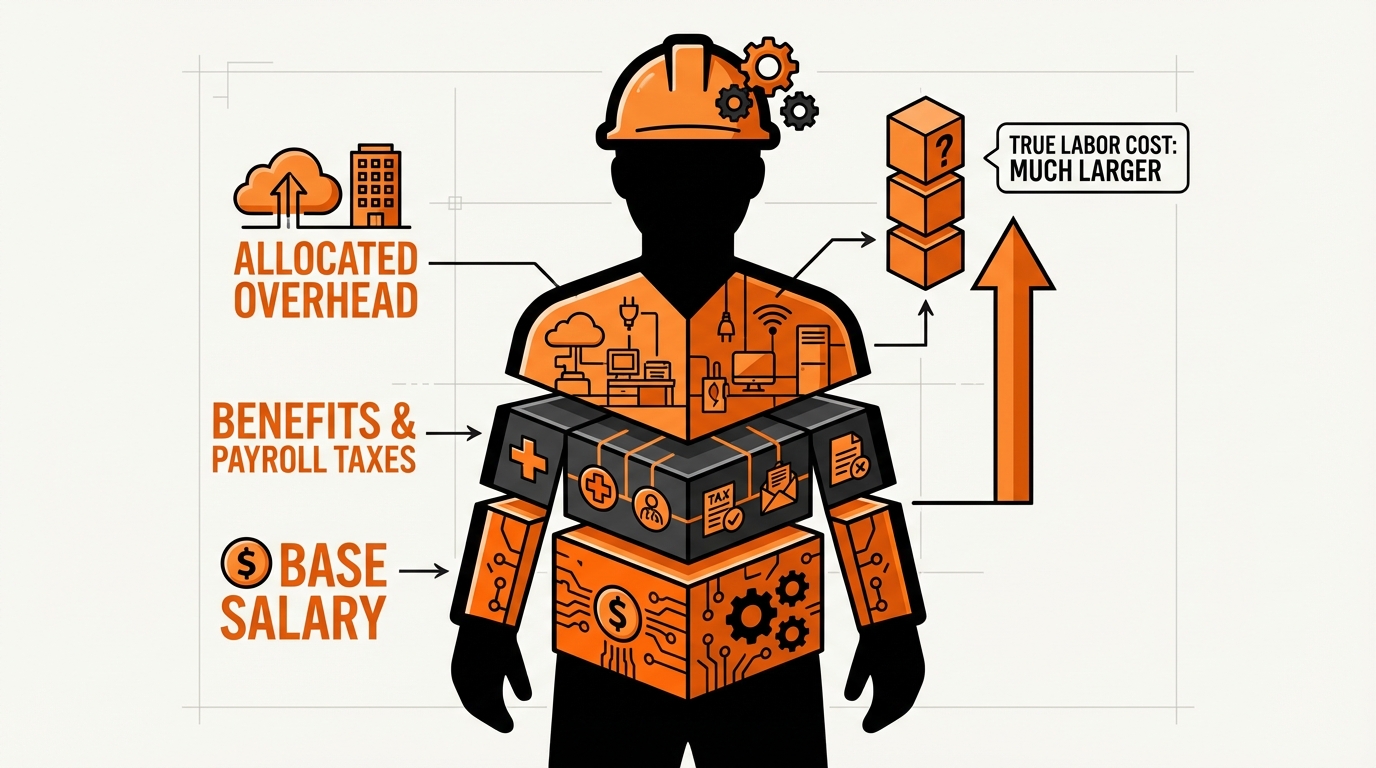

To establish a precise baseline, we focus on the Fully Loaded Cost (FLC) for every employee.

Determining Fully Loaded Cost (FLC)

The FLC represents the total annual expense the agency incurs for that specific employee. This is not just their salary; it’s the true cost of their existence on your payroll, which is critical for accurate diagnosis.

We define FLC by summing four critical components:

- Annual Salary (Base Pay)

- Benefits & Employer Taxes (Health insurance, 401k match, FICA, etc.)

- Software & Tools Allocation (SaaS licenses, specialized tools)

- Training & Development (Certifications, internal coaching time)

FLC = Annual Salary + Benefits + Taxes/Insurance + Training/Software Per Employee

Once the FLC is established, the next step is determining the Average Cost Per Hour (ACPH). This metric translates the annual expense into an hourly rate, providing the baseline cost of production.

We use 2,080 working hours per year (40 hours x 52 weeks) as the standard capacity baseline for a full-time employee:

ACPH = FLC / 2,080 Hours

Example: Calculating ACPH

A Senior Strategist has an FLC of $135,200.

$135,200 / 2,080 hours = $65.00 ACPH.

This $65.00 is the minimum hourly cost you incur just by having them on staff. This is the floor for your delivery expense on any given project.

The Strategic Application of ACPH

ACPH is a powerful diagnostic tool that immediately reveals where your delivery costs are inflated and processes are broken.

- Resource Misallocation: If a junior employee (ACPH $30) is spending 10 hours on a task a senior employee (ACPH $65) should have handled in 3 hours, your process is inefficient. You are paying $300 for a task that should have cost $195.

- High-Cost Overhead: If you have high-ACPH employees (like senior leadership or specialized strategists) routinely performing low-value administrative work, your Delivery Margin immediately suffers. You are wasting expertise and money.

Managing ACPH effectively requires standardized execution. This is why we focus heavily on SOP Blueprint: Scale Your Agency Revenue in 2025. Standardized processes ensure that only the necessary labor hours—ideally drawn from the lowest ACPH resource capable of maintaining quality—are allocated to a specific task. This is how you protect and maximize your Delivery Margin.

Step #2: Identify Your Current Profitability Benchmarks

With the Fully Loaded Cost (FLC) established, Step #1 defined the true financial foundation of your delivery team. Step #2 requires a sharp comparison.

Before we optimize—before we adjust pricing or resource allocation—we must define the benchmarks used by elite agencies. The top 3% of firms operate with margins that buffer them against market shifts, fund aggressive R&D, and secure superior talent. We use these targets as our baseline.

| Margin Metric | Strategic Target (P&L) | Actionable Insight |

|---|---|---|

| Gross Margin % (AGI / Total Revenue) | 50% + | Indicates reliance on external costs (subcontractors, media spend). Low GM requires renegotiating vendor prices or aggressively reducing pass-through expenses. |

| Delivery Margin % (Project Level) | 70% + | Measures internal efficiency against FLC. This is the primary target for operational optimization (SOP adherence, resource allocation, scoping accuracy). |

| Delivery Margin % (Agency P&L) | 55% + | The overall health of your delivery model after factoring in inevitable utilization gaps and non-billable training time. |

| Overhead Costs % (of AGI) | 20% – 30% | Measures fixed expenses (rent, software licenses, administrative salaries). If this percentage is high, your scaling model is inefficient or executive costs are bloated. |

| Net Profit Margin % (EBITDA) | 25% + | The final bottom line. Achieving this target is essential for funding aggressive, non-debt-based growth and building cash reserves. |

This table is not just data; it is your monthly operational diagnostic tool. We monitor the relationship between these metrics to pinpoint bottlenecks.

For example: If your Project Delivery Margin hits 70%, but your Net Profit is stuck at 15%, the operational problem is not efficiency on the floor. The issue is bloated, non-billable overhead. You must pinpoint the choke point before implementing any solution.

Step #3: Leverage Average Billable Rate (ABR) for Pricing

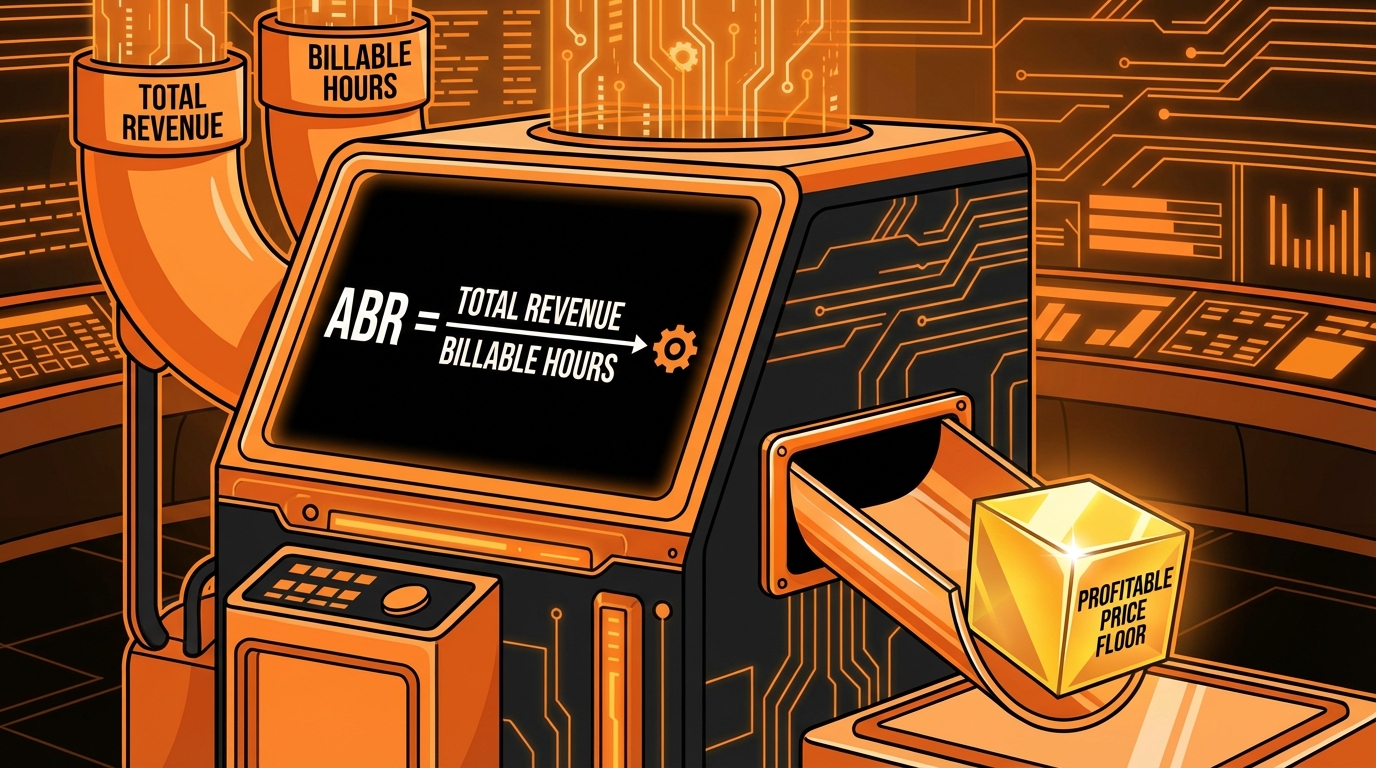

With your cost foundation (FLC and ACPH) established, Step #3 introduces the crucial output metric: the Average Billable Rate (ABR). This is the second critical lever we use to control profitability.

ABR measures the effective hourly rate you are actually earning from a project—regardless of whether the contract is structured as hourly, fixed-fee, or a monthly retainer. It cuts through pricing complexity to define true earned income.

ABR = Agency Gross Income (AGI) / Total Delivery Hours

Why ABR Is The Growth Engine

If you operate on fixed-fee or value-based contracts—which we highly recommend, as they reward efficiency—ABR becomes your primary growth engine. This metric separates elite agencies from the rest of the market.

The only way to increase ABR without raising the client price is to aggressively reduce the delivery time required to achieve the promised result. This is why we champion systems like Value-Based Pricing: The Small Agency Growth Blueprint; it directly rewards operational excellence.

Consider this example:

| Scenario | Client Fee | Delivery Hours | Calculated ABR |

|---|---|---|---|

| Initial Project | $10,000 | 100 hours | $100.00 |

| Optimized Project | $10,000 | 50 hours | $200.00 |

By implementing better processes and reducing delivery time by 50%, the ABR doubles. Your client pays the same fixed price, but your Delivery Margin expands exponentially.

The ABR Target Formula: Removing Pricing Guesswork

To ensure you hit the elite profitability benchmarks (e.g., a 70% Delivery Margin), you must strategically set your pricing based on your team’s Agency Cost Per Hour (ACPH).

This formula reverses the margin calculation, forcing your pricing to meet your cost and margin requirements:

Target ABR = ACPH / (1 - Target Delivery Margin %)

Practical Application:

If your blended ACPH (cost) for a project team is $50, and you want to achieve a 70% margin (0.7):

- Target ABR = $50 / (1 – 0.7)

- Target ABR = $50 / 0.3

- Target ABR = $166.67

You must ensure your fixed-fee retainer or project scope translates to an effective hourly rate of $166.67 or higher. This calculation removes all guesswork from your pricing strategy, guaranteeing the desired margin before work even begins.

Step #4: Optimize Utilization (The Third Profit Lever)

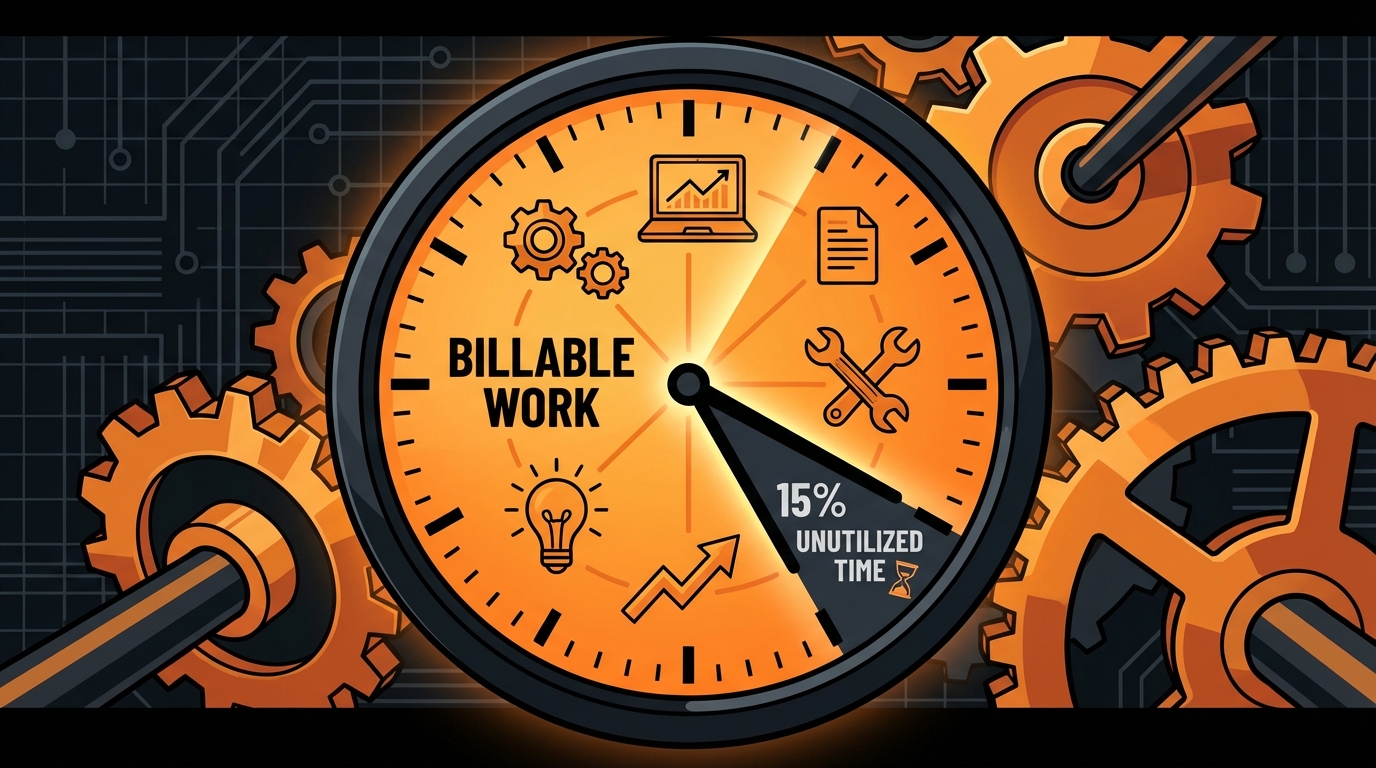

We have established your costs (FLC/ACPH) and defined your pricing floor (ABR). Now, we introduce the final, critical lever for maximizing margins: **Utilization.**

Utilization is often misunderstood. It is not about forcing 100% billability. It is about ensuring every paid hour is efficiently directed toward generating revenue or supporting the business infrastructure.

Employee Utilization Rate: Capacity Efficiency

Employee Utilization measures the percentage of total paid capacity (Total Capacity Hours) dedicated to *any* client-facing work, whether directly billable or necessary delivery support.

Utilization Rate = (Delivery Hours / Total Capacity Hours)

For core delivery roles, we target **85–90% utilization.** This buffer (10–15%) is essential. It covers necessary overhead: internal training, professional development, administrative tasks, and crucial downtime.

If your rate falls too low (e.g., below 75%), you are carrying excess capacity. This signals an immediate need to secure more high-ticket clients or strategically reduce headcount. Low utilization is often the trigger for a major headcount review. This is often the signal that it is time to review The Strategic Checklist: When to Hire Your First Agency Employee.

Delivery Utilization Rate: The Profit Driver

This is the truly strategic metric. Delivery Utilization measures the ratio of *purely billable hours* against the team’s *total client delivery hours.*

It exposes internal friction. If your team logs 40 hours on a client project, but 15 of those hours are spent fixing scope creep issues, managing internal conflicts, or correcting process errors, your effective delivery utilization is dangerously low.

High delivery utilization directly correlates with high project profitability and reduced waste.

How do we maximize this driver?

- Tight Scoping: Define project requirements precisely during the sales process. Ambiguity is a profit killer.

- Process Automation: Implement tools to minimize manual administrative time and repetitive tasks.

- Resource Management: Optimize for ACPH. Ensure the right person (the optimal cost center) is assigned the right task to prevent unnecessary complexity.

Step #5: Control Overhead Costs Ruthlessly

High Delivery Margin is meaningless if bloated overhead consumes it. Overhead must be treated as a fixed, predictable cost—not a constantly expanding leech on your Agency Gross Income (AGI). This is the final choke point for net profit.

The Target: We measure overhead as a percentage of AGI. Your benchmark must be 20% to 30% of AGI. If you exceed 30%, your business model is fundamentally inefficient and unsustainable at scale.

Overhead bloat indicates inefficiency in fixed costs. We break down the three most common culprits requiring immediate audit:

- Software Bloat: Are you paying for 15 specialized tools when five integrated solutions would suffice? Audit every subscription quarterly. Eliminate redundant or underutilized SaaS products immediately.

- Facilities Costs: High office rent in 2025 is often an unnecessary expense for modern digital agencies. If you maintain expensive physical space, ensure it demonstrably contributes to talent retention or client service quality.

- Administrative Over-Staffing: Are you staffing non-revenue generating roles before maximizing automation? Use AI and specialized operating systems for administrative tasks (HR, invoicing, reporting) before hiring another FTE.

Every dollar wasted on overhead directly subtracts from your 25%+ Net Profit goal. Treat these fixed expenses with the same unforgiving rigor we apply to optimizing client acquisition budgets.

Frequently Asked Questions

What is the difference between Gross Margin and Delivery Margin?

Gross Margin (based on AGI) is calculated by factoring out external, pass-through costs (like media spend or specialized vendor fees). It measures revenue efficiency before internal labor is considered. Delivery Margin is the crucial operational metric. It takes the Gross Income (AGI) and then subtracts all internal labor costs (Delivery Costs). This difference defines the health and efficiency of your core service delivery model.

Why should I aim for 70% Delivery Margin on projects if the agency target is 55%?

The 70% target is your strategic buffer. Scope creep, unexpected delays, and resource misallocation are inevitable realities in project work. Aiming for 70%+ at the project level creates a necessary financial cushion. This cushion ensures that even when specific projects underperform, the overall agency P&L still hits the required 55%+ target. This 55% minimum is essential to maintain a healthy 25% Net Profit after all fixed overhead is covered.

Is it better to increase ABR or decrease ACPH?

You must pursue both simultaneously. This is the definition of maximizing the spread:

- Decrease ACPH: Lower your base cost directly through efficiency, robust SOP implementation, and strategic delegation to lower-cost resources.

- Increase ABR: Increase the revenue generated per hour through value-based pricing, superior positioning, and faster delivery.

The most scalable agencies achieve high ABR by maintaining ruthlessly low ACPH, thus maximizing the profit spread between cost and price.

How do I calculate the Fully Loaded Cost (FLC) for a contractor?

Contractors present a key nuance. If they are specialized vendors (e.g., specific software licensing or external media buyers), treat them as a **Pass-Through Cost**. If they act as temporary staff executing core agency functions (e.g., a fractional copywriter), treat them as a **Delivery Cost**.

The traditional Fully Loaded Cost (FLC) calculation (salary + taxes + benefits) is reserved strictly for W-2 employees. Contractor costs are simpler: use their fixed or hourly rate directly, plus any related management or onboarding time incurred by your internal team.

References

- Calculating Agency Margins & Profitability: A Beginner’s Guide – Scoro

- Agency Profitability: How To Calculate, Track & Maximize

- Calculate Agency Profitability: Key Insights for Marketers – Parakeeto

- A Complete Guide to Calculating Agency Margins – DashClicks

- The Advertising Agency Profitability Field Guide – AskCody