You are generating revenue. That capital must execute work.

The standard debate,dividend investing versus index funds,is irrelevant to us.

That discussion is framed for retirees. Not for founders scaling SDR teams, optimizing lead flow, and driving hyper-growth.

Our only focus: Capital Allocation Efficiency.

We require investments that achieve one of two things:

- Maximize Total Return to fund massive expansion and software development.

- Provide Predictable Cash Flow to stabilize recurring operational expenses (OpEx).

This is not a binary choice. It is a strategic allocation problem: When do you prioritize unconstrained growth, and when do you prioritize liquidity?

We utilize both strategies. This hedges market risk and boosts our company resilience.

Here is the pragmatic blueprint for 2026.

Key Takeaways: Pyrsonalize Capital Strategy

- Total Return Dominates: Index funds (VTI, VOO) capture unconstrained growth in tech and innovation. This is how we fund major software updates.

- Dividends Are OpEx Stabilizers: We use high-quality dividend ETFs (SCHD, VIG) for predictable quarterly income. This income offsets recurring costs like CRM subscriptions.

- Taxation is a Liquidity Lever: Selling index units allows strategic tax timing (0% capital gains utilization). Dividends force immediate, less flexible tax events.

- Our Blueprint: Structure your portfolio with a 70% Index Core (Growth) and a 30% Dividend Tilt (Stability). This ensures optimized expansion funding and operational resilience.

Step #1: Define the Objective: Scaling Capital vs. Operational Cash Flow

Index investing is fundamentally passive. Dividend investing, especially when screened for yield, is an active cash flow strategy.

We need to treat them as distinct financial tools designed for distinct business needs. Not as competitors.

- Index Funds: The Scaling Machine. They track the entire market (or a massive benchmark). They minimize fees, maximize diversification, and prioritize Total Return (capital appreciation plus dividends). This vehicle is optimized for maximizing the size of your capital pool over time.

- Dividend Funds: The Liquidity Machine. They screen specifically for companies committed to consistent cash payouts. Their priority is Yield,predictable, current income. This vehicle is engineered for cash flow stability and providing operational liquidity.

Founders must internalize the cost of prioritizing yield: you aggressively sacrifice growth. You miss out on the companies that reinvest profits back into R&D, market share expansion, and innovation (i.e., the growth engines that actually fuel the S&P 500).

Yield is safe. Growth is strategic.

The Capital Allocation Comparison: VTI vs. SCHD

This is not a theoretical exercise. We analyze these vehicles based purely on their utility for a high-growth business model focused on lead generation and scaling SDR teams.

| Feature | Index Funds (VTI/VOO) | Dividend ETFs (SCHD/VIG) |

|---|---|---|

| Primary Goal | Maximum Capital Appreciation (Scaling Capital) | Consistent Cash Flow (Operational Liquidity) |

| Long-Term Performance | Historically Superior Total Return (10+ years). Optimized for wealth building. | Inferior Total Return. Optimized for immediate income stream. |

| Volatility Profile | Higher (Tracks market swings aggressively). | Lower (Acts as a psychological buffer in downturns). |

| Tax Control (The Friction Point) | High. You control precisely when gains are realized and taxed (via selling). | Low. Mandatory quarterly distributions are taxable immediately, regardless of your need for the cash (Tax Drag). |

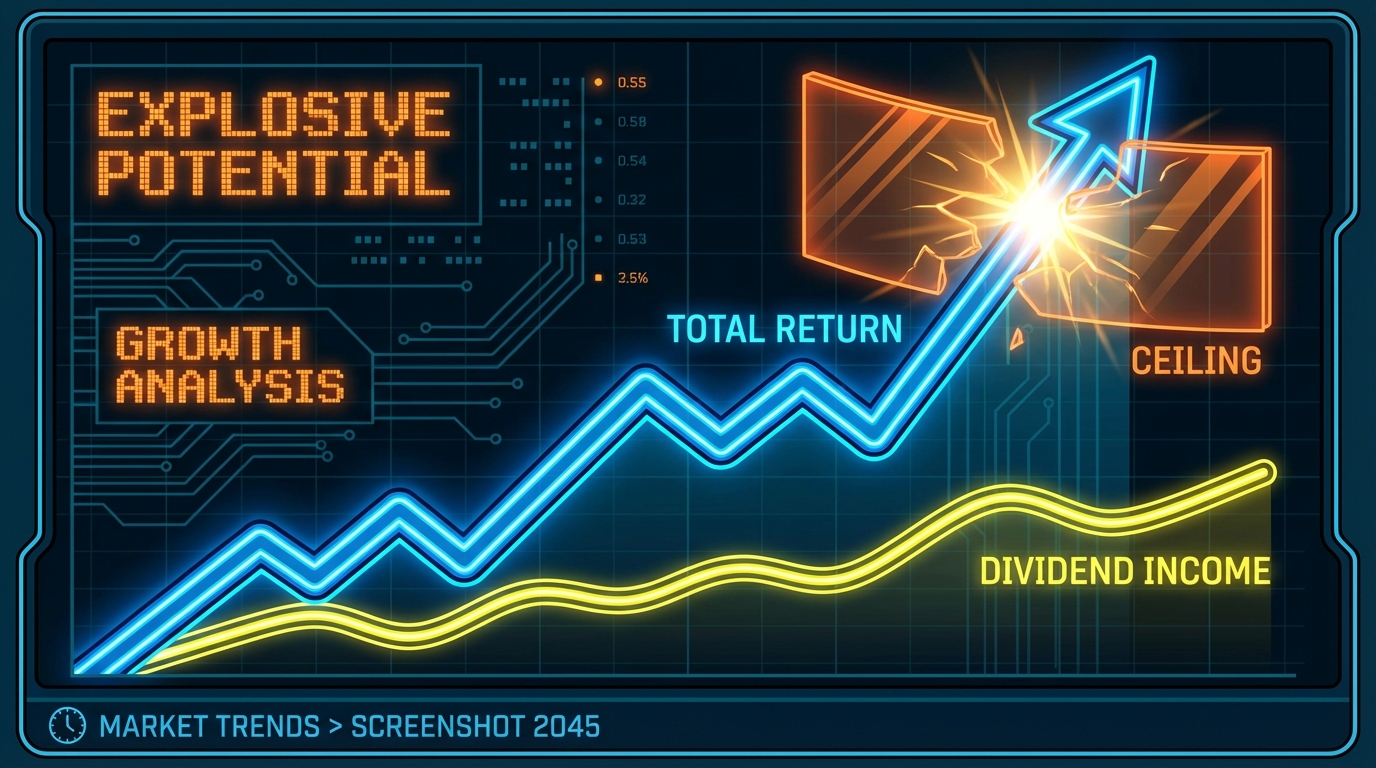

Step #2: Why Total Return is Mandatory for Scaling

If your objective is massive scaling, you need massive capital appreciation. Period. We cannot afford to leave growth on the table when building high-velocity systems.

Index funds are the undisputed champion of the accumulation phase.

We leverage them for one reason: they capture the entire economic engine efficiently.

- The Tech Multiplier: Index funds inherently hold high-leverage sectors (Technology, Communication Services). These sectors pay minimal dividends but drive exponential price appreciation. Removing them caps your potential growth,guaranteed.

- Compounding Efficiency: Low expense ratios are non-negotiable. Immediate reinvestment of capital gains means compounding works harder and faster. Every single basis point matters when you are planning for long-term revenue growth.

This capital is your future war chest. It is designed to fund your eventual exit or provide the immense funding needed for strategic expansion.

Think rapid market penetration. (See our 4-Week Velocity Model for how we execute this.)

We operate on a core principle:

We don’t chase yield when we are building the business. We chase maximum, tax-efficient capital growth. Yield is a distribution strategy; it is not a growth strategy.

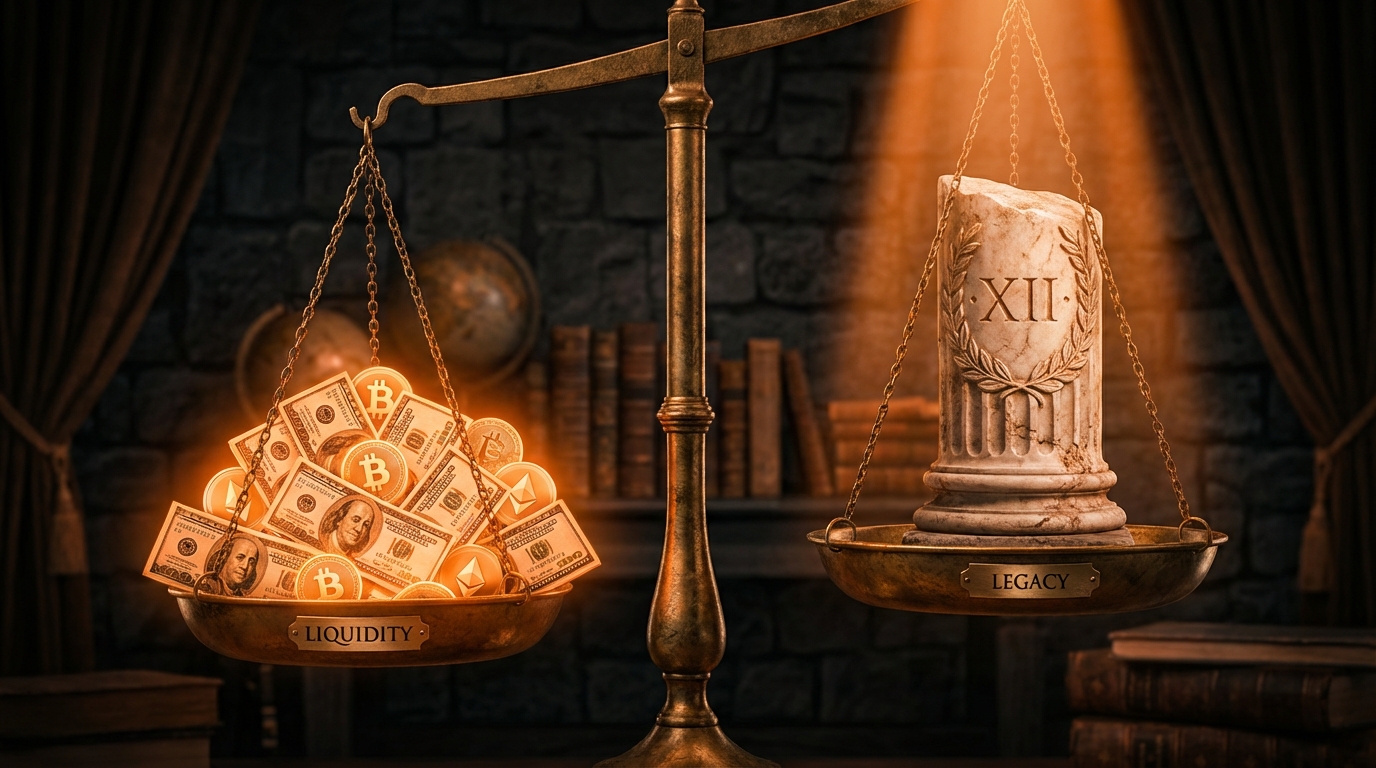

Step #3: Allocating Capital: Liquidity vs. Legacy

Investment allocation is not philosophical. It is a functional requirement rooted in your business timeline.

We treat capital as having two distinct roles: Legacy Capital (long-term growth) and Liquid Capital (short-term stability).

A. Index Funds: The Legacy Capital Strategy (Exit & Acquisition)

Index funds are the mechanism for Legacy Capital. This capital is untouchable; it is designed to maximize net worth over a 10+ year horizon. It funds the future: specifically, your exit strategy.

If you are building toward a major acquisition,or using accrued value to launch new, high-leverage digital assets,the index base must be maximized.

We leverage this growth to fund new revenue streams. This ensures high-leverage projects (like the 2026 Blueprint for Automated Affiliate Funnels) are seeded by appreciated capital, not volatile operational cash flow. This protects your core lead generation engine.

B. Dividend Funds: The Operational Cash Flow Strategy (Stability)

Dividend funds serve the Operational Cash Flow Strategy. The goal here is liquidity and predictability.

They provide income specifically to stabilize current fixed costs. Operational volatility is guaranteed in early-stage lead generation systems; quarterly dividend payments become a crucial stability mechanism.

They act as a hedge against inevitable revenue dips, ensuring your systems remain funded.

Strategic Use Cases for Dividend Income:

- SDR Team Bonuses: Funding quarterly performance bonuses or minor operational upgrades without dipping into core business revenue.

- Software Subscriptions: Reliably covering high-cost, recurring SaaS licenses (e.g., AI lead generation platforms, advanced CRM systems).

- Psychological Hedging: During deep market corrections, the continued flow of cash prevents panic selling or rash business decisions. Cash flow is king, even when the market is bleeding.

This allows us to maintain a high-velocity sales structure without sacrificing long-term growth potential.

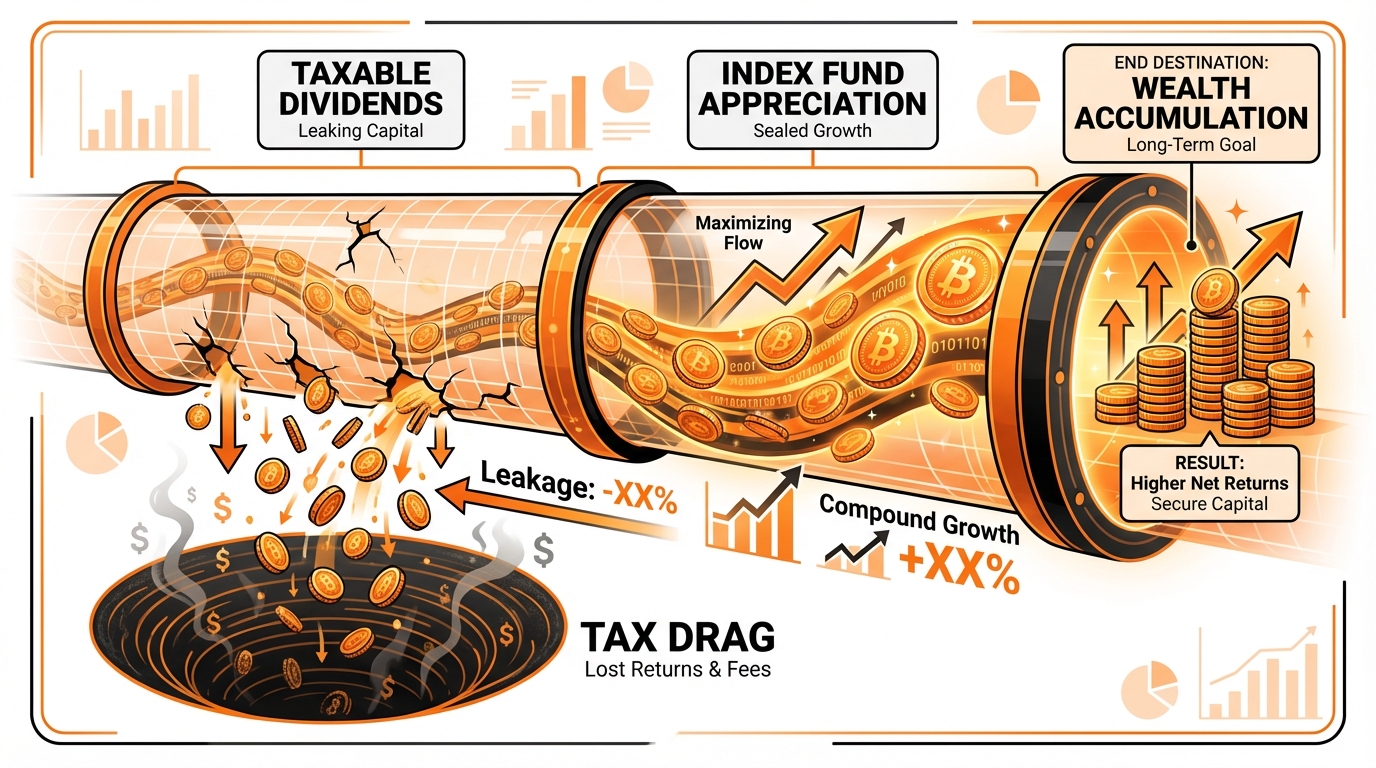

Step #4: The Tax Efficiency Mandate

Tax minimization is not optional. It is a core component of your revenue preservation strategy,a mandate we enforce rigorously.

When comparing investment vehicles in a standard taxable brokerage account, index funds offer superior efficiency. The reason is simple: Control.

The Index Advantage: Surgical Control

Index funds operate on a Total Return strategy. You generate income only when you choose to sell shares.

This surgical approach is how we minimize tax drag and maximize compounding:

- You Control the Trigger: Realized capital gains only occur when you initiate the sale.

- You Control the Timing: If your business revenue dips (a lower income year), you can strategically realize gains at a significantly reduced (or even 0%) federal capital gains rate.

Your capital compounds tax-deferred until the moment you decide to liquidate. This is strategic delay.

The Dividend Drag: Mandatory Tax Leakage

Dividend funds, even high-quality ETFs, create immediate taxable events. They distribute cash quarterly,a mandatory payout.

This distribution is taxed immediately, regardless of whether you need the income or immediately reinvest it (DRIP).

This forces two significant inefficiencies:

- Forced Taxation: You pay tax on income you might have preferred to keep compounding inside the fund. This immediately slows growth.

- Administrative Overhead: While most are Qualified Dividends (taxed favorably), tracking non-qualified distributions (like certain REITs or MLPs) adds complexity. Your finance team wastes cycles tracking potential ordinary income tax rates.

If your priority is optimizing your Legacy Capital for maximum, long-term growth in a taxable environment, the Total Return strategy is mathematically superior. We prioritize tax deferral over forced income every time.

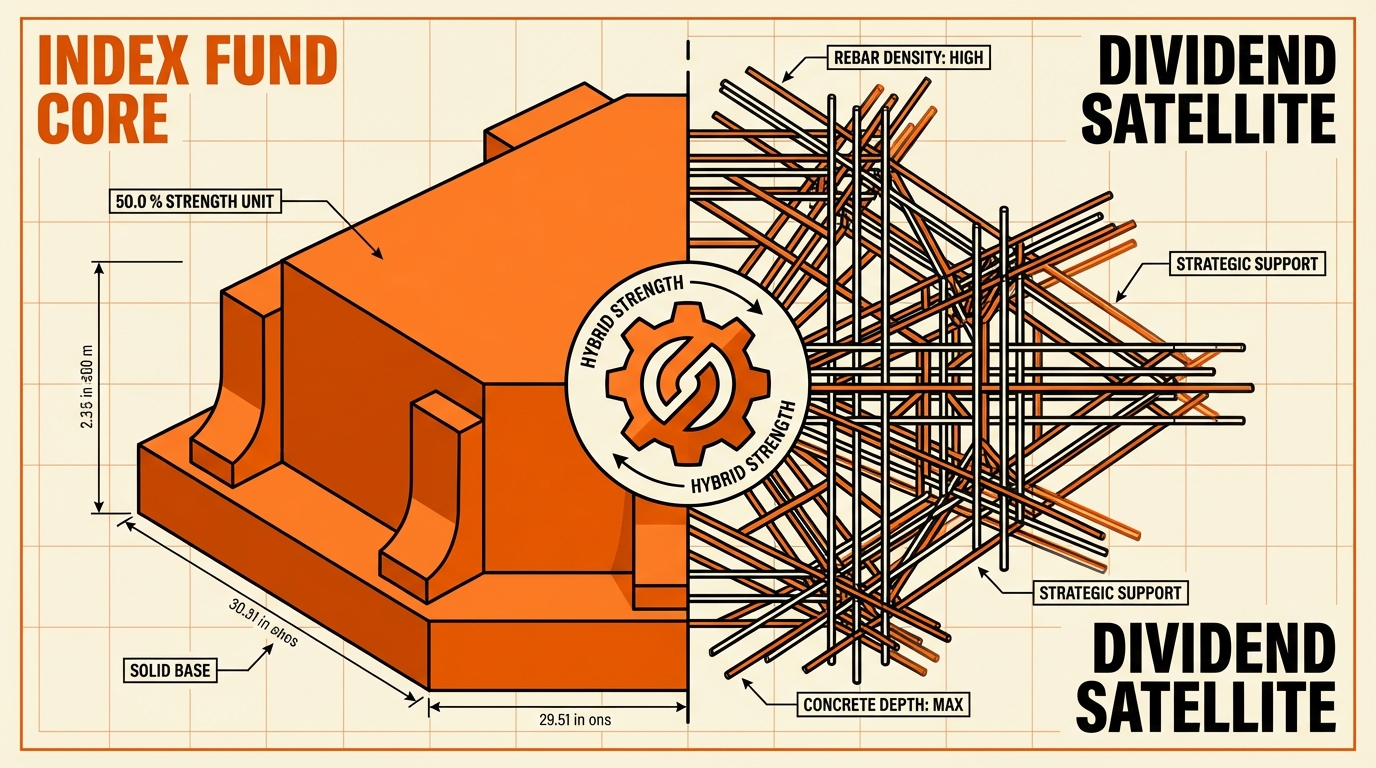

Step #5: Building the Strategic Hybrid Portfolio

We do not recommend an absolute binary choice between index funds and dividend stocks. The strategic mandate is blending these two approaches.

You must leverage tax-advantaged accounts (IRAs, HSAs) to maximize the unique benefits of each asset class. This is how you optimize your post-tax revenue preservation.

Blueprint 1: The AI-Focused Growth Strategy (70/30)

This blueprint is engineered for founders focused on aggressive scaling. You need maximum growth capital to fund high-leverage projects,specifically, those detailed in our 2025 AI Passive Income Blueprint.

- 70% Core (Growth): Total Market Index Funds (VTI, VXUS). Maximize exposure to unconstrained growth. Place this in a standard taxable account for maximum liquidation flexibility and surgical tax control (per Step #4).

- 30% Tilt (Income Shield): Dividend Growth ETFs (VIG, DGRO). Focus strictly on the growth rate of the dividend, not the current yield. Place this in a Roth IRA or HSA, where distributions are fully tax-free upon withdrawal.

Result: Maximum growth potential combined with a stable, fully tax-sheltered income stream. This shields future personal wealth from unnecessary tax drag.

Blueprint 2: The Liquidity-Focused Strategy (60/40)

This structure is for founders requiring higher operational liquidity or those approaching a significant exit event. The goal here is aggressive de-risking and cash flow stabilization.

- 60% Core (Stability): S&P 500 Index Funds (VOO). Maintain exposure to large-cap stability and reliable appreciation.

- 40% Tilt (Cash Flow): High-Yield, High-Quality Dividend Funds (SCHD). Prioritize consistent, quarterly cash flow. Use this income stream for quarterly business expenses or immediate reinvestment into safer assets.

You sacrifice peak growth here. But you gain superior stability and a larger, more reliable cash payout.

This is a critical psychological safety net during market uncertainty,it keeps your focus locked on organic lead generation, not market volatility.

Step #6: Execute with Precision (Final Mandates)

Financial strategy is not an independent pursuit. It is a support function. It must serve your core business,your lead generation and conversion systems.

Do not overcomplicate the execution phase. We are optimizing for speed and post-tax revenue retention. Follow these three final mandates:

Mandate 1: Structure by Tax Code.

Tax drag kills compounding efficiency. We structure our assets based on the tax code,this is mandatory optimization for founders.

- Growth Assets (Index Funds): Must leverage tax-deferred containers (401k, Traditional IRA). This maximizes compounding velocity without immediate tax liability.

- Income Assets (Dividend Funds): Must utilize tax-free accounts (Roth IRA). You eliminate the immediate tax burden on distributions. This boosts your effective income yield immediately, providing cleaner cash flow.

Mandate 2: Benchmark Total Return.

Ignore the seductive, high-yield vanity metric. A 6% dividend yield is irrelevant if the underlying capital value dropped 15%,that is a net loss of 9%.

We only track one metric for performance: Total Return.

That figure,capital appreciation plus dividends,is the only measure of your actual ROI. Everything else is market noise designed to distract you.

Mandate 3: Stay Consistent.

Behavioral drift is the single greatest threat to your long-term performance. You wouldn’t panic-switch AI lead generation software every quarter based on a competitor’s press release.

Treat your investment portfolio the same way. Consistency is the compound multiplier.

- Choose a Blueprint (70/30, 50/50, etc.).

- Execute systematically (automate contributions).

- Review only every 12 months (minimum).

- Do not let quarterly market noise disrupt your strategic allocation.

Frequently Asked Questions

Is dividend investing safer than index fund investing?

Safety is relative. We are focused on systemic risk mitigation. Index funds are fundamentally safer due to massive diversification. You own 500+ companies (or more). The failure of a single stock is negligible.

Dividend stocks often feel safer. They are usually mature, stable companies that exhibit lower volatility during downturns. But this stability comes with a critical risk: Sector concentration. If that specific sector underperforms, your portfolio suffers significant losses. Index funds mitigate this risk; dividend strategies compound it.

Should I reinvest my dividends or take them as cash?

This depends entirely on your operational phase:

- Accumulation Phase (Growth): Reinvest immediately. This is non-negotiable for maximizing compounding efficiency. Your total return accelerates faster this way.

- Distribution Phase (Income/Operations): Take the cash. If you require the capital for business operational expenses or personal income, cash flow is the priority.

Crucial Mandate: If the assets are held in a taxable brokerage account, you owe tax on the dividend distribution the moment it is paid. Even if you immediately reinvest it. Tax drag is real and must be managed.

What is the “Total Return” approach and why do experts favor it?

The Total Return approach is pragmatic. It measures the complete performance: capital appreciation (price growth) PLUS income (dividends). We favor it because it is strategically superior for tax efficiency and flexibility.

You control the income generation. Instead of relying on mandatory, tax-inefficient dividend payouts, you sell units only when you need cash. This allows you to harvest gains strategically, controlling the timing and amount of realized capital gains. This minimizes unnecessary tax drag,a core mandate for post-tax revenue retention.

Ready to take the next step?

Stop relying on generic outbound strategies. Use AI to find your clients’ personal emails and scale your outreach now.

Start Your Free TrialReferences

- Dividend ETFs vs. S&P 500: Where Should You Invest? – Investopedia

- Investing in mutual funds/ index funds vs dividend funds when young?

- Index Fund Investing vs Dividend Investing: What You Must Know

- 5 Reasons Dividend Investors Choose Funds Over Stocks

- Why (& When) to Consider Dividend Stocks in Your Portfolio