If you run a high-ticket service business or a scaling B2B SaaS company, you understand the core challenge: not all leads are created equal. The vast majority, in fact, are noise.

Focusing valuable sales resources on poorly qualified leads is the fastest route to burnout, stalled revenue, and crippling opportunity costs. This inefficiency is a resource drain that your sharpest competitors are actively eliminating using precise, data-driven scoring systems.

Today’s competitive landscape demands surgical precision in prospect vetting. You simply cannot afford to treat every MQL (Marketing Qualified Lead) as a guaranteed, high-value sales opportunity.

This comprehensive guide details the exact, step-by-step process required to build strategic lead scoring models. These models are designed not just to rank prospects based on activity, but to ensure your sales team spends 90% of their time engaging leads that possess the intent, authority, and budget to close—right now.

Why Generic Scoring Fails High-Ticket Sales

Many organizations attempt lead scoring by relying on vanity metrics—assigning 5 points for an email open or 10 points for a generic whitepaper download. While this baseline approach works for high-volume, low-ACV consumer sales, it is fundamentally flawed for B2B transactions where the Average Contract Value (ACV) is substantial.

High-ticket environments demand rigorous qualification. To justify the time investment of a senior sales professional, qualification must move beyond simple behavioral signals (like clicks) and focus entirely on explicit data points that validate the core fundamentals of a deal: Budget, Authority, Need, and Timing (BANT).

A scoring model based solely on volume and generic engagement inevitably routes low-intent prospects to busy Account Executives. This results in high rejection rates, wasted time, and severely damaged sales pipeline morale.

The strategic goal is clear: move beyond the noise of vanity metrics and focus exclusively on predictive signals that correlate directly with Closed-Won revenue. This requires a fundamental shift in scoring philosophy.

The Mandate for Strategic Scoring

To ensure your scoring system delivers qualified, high-ACV opportunities, the model must incorporate these non-negotiable elements:

- Focus on Explicit Data: Prioritize firmographic fit (company size, industry, revenue) and demographic fit (title, seniority) over generic clicks and content downloads.

- Implement Decay Scoring: Engagement is time-sensitive. Leads must lose points for sustained inactivity (e.g., 5 points deducted every 30 days without interaction) to prevent stale prospects from cluttering the pipeline.

- Validate Contact Quality: Highly score leads where validated, personal contact information is acquired. The willingness of a prospect to share direct, personal data is a strong indicator of trust and serious intent.

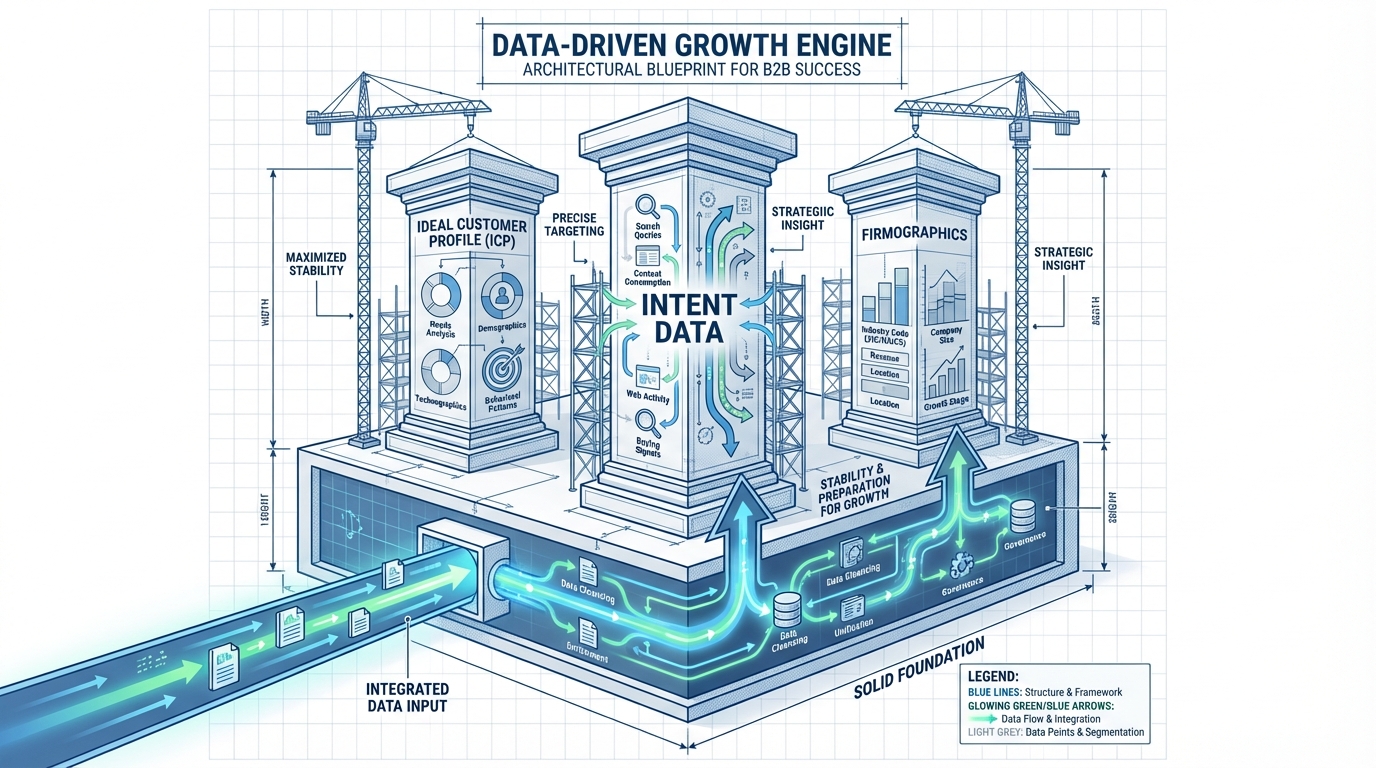

Phase I: Building the Foundation (The ICP and Data)

Before you assign a single point, you must establish the criteria that actually define a valuable prospect. This phase requires rigorous data analysis and complete alignment between marketing, sales, and executive leadership on what constitutes a ‘good’ customer.

Step #1: Define Your ICP with Surgical Precision

The Ideal Customer Profile (ICP) is not merely a description of who buys from you. It is a detailed rubric of the characteristics that make a customer profitable, easy to onboard, and likely to achieve long-term success with your solution.

We break the ICP down into two critical data types for effective scoring:

- Explicit Data (The Fit): This is the factual, declared information that defines whether the lead can buy your high-ticket solution.

- Implicit Data (The Intent): This is the behavioral data that defines whether the lead wants to buy, and how soon.

For high-ticket B2B, Explicit Data must carry the heaviest weight. A perfectly engaged lead from a company with 5 employees will almost never convert to an enterprise deal, no matter how many whitepapers they download. Fit must precede intent.

Mandatory Explicit Scoring Criteria:

- ✅ Company Size (Employee Count or Revenue Band)

- ✅ Industry Vertical (Must align with your core competency and regulatory knowledge)

- ✅ Geographic Location (Critical for service delivery or compliance requirements)

- ✅ Job Title/Role (Must be a decision-maker or influential buyer, e.g., VP of Sales, CTO)

If you are struggling to acquire this level of granular, accurate data, it means your current lead generation system is too passive. For high-ticket B2B, you must utilize tools that actively validate these explicit points, often by finding the specific decision-maker’s roles and contact information, ensuring you target the right buyer at the right company.

Step #2: Calculate Your Conversion Baseline (The 2025 Metric)

Your entire scoring model is useless if it is not benchmarked against actual performance. Before creating a point system, you need a clear, objective metric for success: the Lead-to-Customer Conversion Rate (LCR).

Formula: (Total Closed-Won Deals / Total Qualified Leads) * 100

This LCR is your overall starting point—your average conversion rate. Now, you must segment this metric by attribute to identify which characteristics actually predict success.

Review your CRM data from the last 12 months. Ask the following questions, segmenting the LCR by each attribute:

- What was the LCR for leads who were VPs of Marketing? (e.g., 8%)

- What was the LCR for leads who attended the annual conference? (e.g., 15%)

- What was the LCR for leads who work in the Financial Services industry? (e.g., 22%)

Any attribute (explicit or implicit) that shows a conversion rate significantly higher than your overall LCR baseline must be assigned a higher point value in your model. This is the only way to ensure your scoring is truly data-driven, not based on internal assumptions or gut feeling.

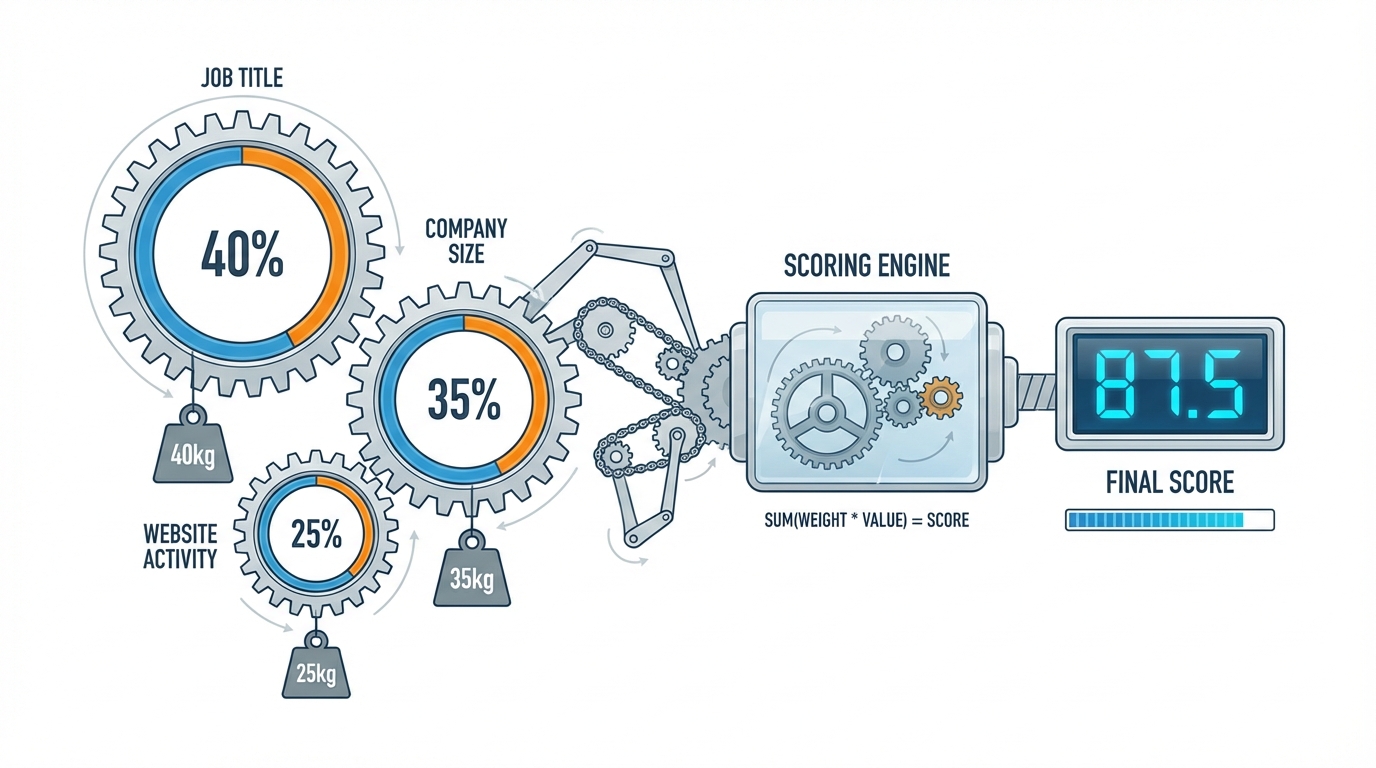

Phase II: Designing the Scoring Model (The Weighting Strategy)

Phase I established the data foundation and identified the predictive metrics (Steps #1 and #2). Phase II is the critical implementation stage: translating those insights into an actionable, weighted scoring model. This model must objectively prioritize leads by assigning points based on their proven correlation to high customer lifetime value (CLV) and conversion rates.

Step #3: Establish Explicit Criteria Weighting (Firmographics and Demographics)

In high-ticket B2B sales, explicit data—which defines the foundational ICP fit—must dominate the scoring. This information is static, reliable, and highly predictive. We recommend that a lead score at least 60% of the total possible points based purely on profile fit, before any engagement is measured.

For illustration, we use a simple 100-point maximum model, but the weighting ratios apply universally. The goal is to allocate the majority of points to the attributes (like company size and job role) that demonstrated the highest conversion correlation in your Step #2 analysis.

Example Weighting Table (High-Ticket SaaS)

| Criteria Category | Attribute | Points Assigned | Justification |

|---|---|---|---|

| Company Size (Explicit) | 1,000+ Employees | +25 | Meets ICP requirement for enterprise licensing. |

| 500-999 Employees | +15 | Mid-market fit, lower ACV potential. | |

| Job Role (Explicit) | C-Level (CEO, CTO, CFO) | +30 | Ultimate Authority (Highest conversion correlation). |

| VP/Director Level | +20 | High influence, but not final economic buyer. | |

| Industry (Explicit) | Targeted Vertical (e.g., FinTech) | +10 | Strongest LCR performance historically. |

| Total Explicit Potential | 65 Points |

The SQL Profile Threshold: A lead scoring 65 points in this model is a near-perfect profile fit. They are automatically designated as a Sales Qualified Lead (SQL) profile, irrespective of their current behavioral engagement. These leads must be routed directly to a sales development representative (SDR) for immediate, personalized outreach.

Step #4: Map and Weight Behavioral Signals (Intent and Recency)

Implicit data measures the lead’s current activity level and urgency, effectively validating the timing component of qualification. Since we allocated 65 points to explicit fit, the remaining 35 points in our 100-point model must be weighted based on demonstrated intent.

Points are assigned based on proximity to purchase. Actions that signal direct buying intent (e.g., pricing page views, requesting a technical spec sheet) receive maximum weight.

Tiers of Behavioral Scoring (Maximum 35 Points):

- High Intent (15-20 Points): Direct signals of buying readiness (e.g., Demo Request, Pricing Page Visit, Trial Sign-up).

- Mid Intent (5-10 Points): Signals of deep research or serious consideration (e.g., ROI calculator use, viewing competitor comparison pages).

- Low Intent (1-5 Points): Signals of general interest or educational consumption (e.g., blog post views, generic e-book downloads).

If your team uses gated content, ensure content addressing implementation, ROI, or competitive comparisons scores significantly higher than introductory material. A prospect researching “How to implement X solution” is far more valuable than one reading “What is X solution?”

The Critical Role of Recency

Behavioral signals are only useful if they are timely. An action taken yesterday is exponentially more valuable than the same action taken six months ago. The scoring model must reflect the current temperature of the lead, not their historical data.

Implementation Rule (Recency Decay): To ensure accuracy, implement strict decay rules. For high-intent actions (e.g., a recent product trial sign-up), the points should decay by 50% after 7 days, and be removed entirely after 30 days if no further engagement occurs. This prevents stale, high-scoring leads from clogging the sales pipeline.

Step #5: Implement Mandatory Negative Scoring (Disqualification Metrics)

A sophisticated scoring system must not only reward positive fit but also penalize negative indicators. Most organizations fail here, focusing only on adding points and allowing poorly fit leads to linger in the pipeline.

Negative scoring ensures that low-fit or low-quality leads are automatically deprioritized and routed to a long-term nurture sequence—saving valuable sales capacity.

You must define explicit negative criteria, often based on clear disqualifiers identified in your ICP definition:

| Negative Criteria | Points Deducted | Action |

|---|---|---|

| Competitor Company/Industry | -100 | Immediate Disqualification (DQ) |

| Using generic email address (e.g., Gmail, Yahoo) | -15 | Indicates lack of professional intent or data quality issue. |

| Unsubscribed from any email list | -50 | Clear signal of disinterest. Move to DQ or deep nurture. |

| Job Title: Student, Intern, Retired | -100 | Zero authority or budget. Immediate DQ. |

| Inactivity Decay (30 days without engagement) | -5 | Prevents stale leads from cluttering the high-score list. |

The Disqualification Threshold: Define a hard floor (e.g., 0 points or below). When a lead hits this negative score threshold, they are immediately removed from the active sales queue and flagged as Disqualified (DQ). This process is non-negotiable for maximizing sales efficiency and minimizing rep burnout.

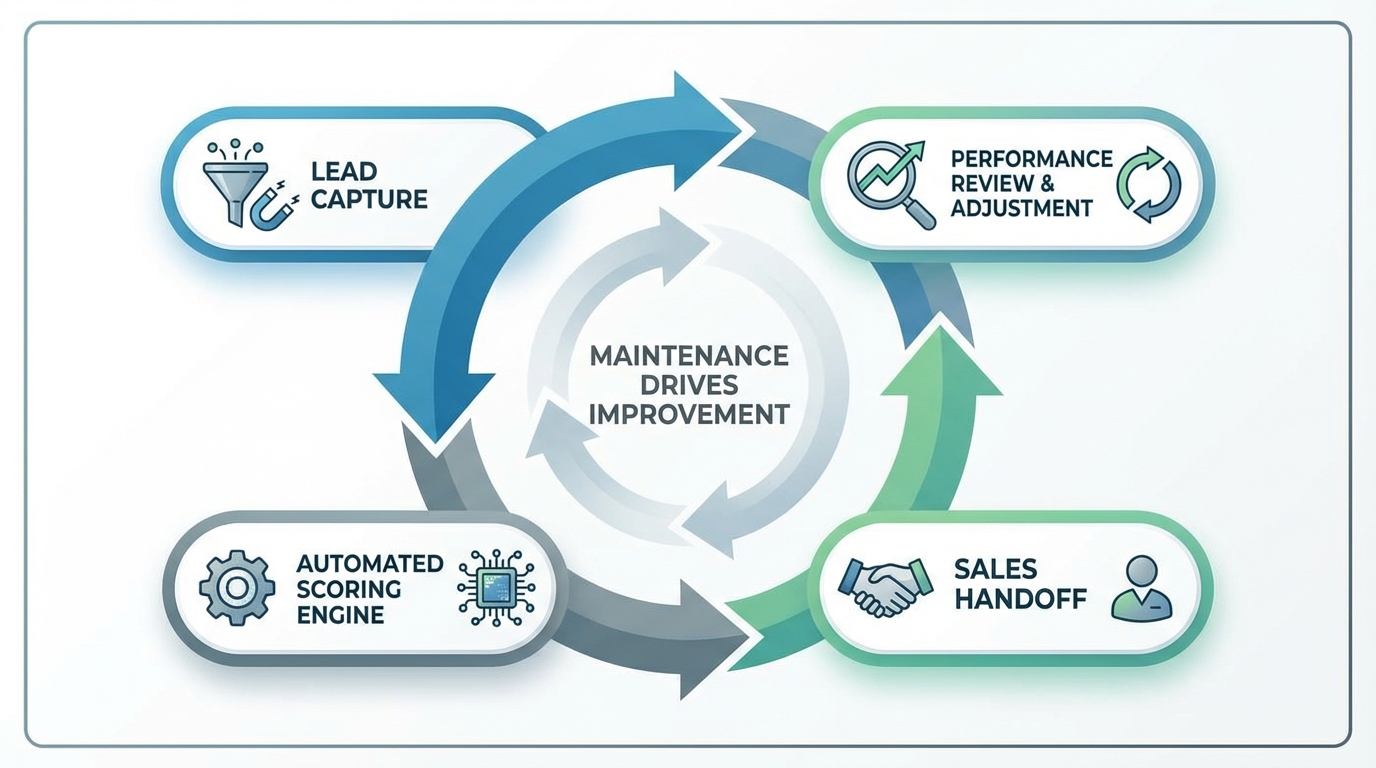

Phase III: Execution and Maintenance (Automation and Review)

A lead scoring model is not static; it is a living, breathing asset. Phase III focuses on operationalizing the scoring logic through automation and ensuring its long-term predictive accuracy through rigorous maintenance.

For high-ticket B2B, this demands seamless, two-way integration between your Marketing Automation Platform (MAP) and your CRM (e.g., HubSpot, Marketo, Salesforce). While the core scoring logic resides in the MAP, the immediate status, priority queue, and routing must be instantly visible and actionable within the sales team’s CRM pipeline.

Step #6: Set the MQL Threshold and Handoff Protocol

This step defines the critical moment of transition, establishing the clear, objective score that converts a Marketing Qualified Lead (MQL) into a Sales Qualified Lead (SQL) ready for outreach.

If your maximum possible score is 100, where does the handoff occur? We typically recommend setting the MQL threshold aggressively, usually between 60% and 75% of the total score, based on historical conversion data.

Handoff Example

- MQL Threshold (70 Points): The lead has demonstrated strong profile fit (e.g., +45 Explicit points derived from firmographics) AND high intent behavior (e.g., +25 Implicit points, such as visiting the pricing page twice in 48 hours).

- SQL Status: Once the lead hits 70 points, they are automatically flagged as “Hot” and routed to the appropriate Sales Development Rep (SDR) based on territory or industry vertical.

CRITICAL SERVICE LEVEL AGREEMENT (SLA): The mandatory SLA between Sales and Marketing must require that all newly flagged SQLs are contacted within 4 hours. If a lead has invested the time to accumulate 70+ points, they are actively looking for a solution, and speed is paramount to capture their attention before a competitor does.

Step #7: Continuous Model Calibration (The Quarterly Audit)

The predictive power of your scoring model decays rapidly if left unchecked. Your market dynamics shift, your product evolves, and your Ideal Customer Profile (ICP) is a moving target. Failing to maintain the system ensures score accuracy will plummet within two quarters, resulting in wasted sales resources and lost opportunities.

You must conduct a formalized, Quarterly Lead Scoring Audit. This audit focuses on two key areas to create an essential feedback loop:

- Closed-Lost Analysis: Review the 50 highest-scoring leads that ultimately failed to convert (Closed-Lost). What attributes did they share? If 80% of your high-scoring losses were in Industry X, you must reduce the point value for Industry X to prevent similar leads from prematurely reaching SQL status.

- Closed-Won Analysis: Review the 50 lowest-scoring leads that converted into high Annual Contract Value (ACV) deals. Why did they score low? If they all shared the attribute “Downloaded PDF Guide B,” then Guide B is a higher-intent signal than you previously thought, and its point value must be increased immediately.

This systematic feedback loop ensures your model remains predictive and aligned with current market reality. Predictive accuracy—the correlation between high scores and successful conversions—should be your primary metric for the scoring system’s health.

Advanced Lead Qualification Frameworks (Beyond Automated Scoring)

A sophisticated lead scoring system effectively moves prospects from Marketing Qualified (MQL) to Sales Qualified (SQL). However, the crucial final step—turning an SQL into a viable Sales Opportunity—requires rigorous, human-led qualification.

While the scoring model validates explicit criteria (e.g., job title, company size), sales representatives need strategic frameworks to validate implicit criteria, uncover true pain, and assess the organizational readiness for change during the discovery call. These frameworks ensure the human element of qualification is as structured and data-driven as your automated scoring system.

1. MEDDIC: The Gold Standard for Complex Enterprise Sales

MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) is the definitive framework for high-ticket, complex B2B sales cycles. It mandates that the sales professional gathers deep, strategic information about the organizational structure, purchasing mechanics, and quantifiable financial impact of the solution.

If a sales rep cannot confidently answer all six components below, the lead is not yet fully qualified, regardless of the initial automated score:

- Metrics: What is the quantifiable ROI the client expects? (e.g., “We need to reduce lead acquisition costs by 20% within 12 months.”)

- Economic Buyer: Who ultimately controls and signs the budget? (This is often the CFO, COO, or CEO, not just the technical VP.)

- Decision Criteria: What are the non-negotiable technical or functional requirements? (e.g., “Must integrate natively with Salesforce,” “Must be ISO 27001 compliant.”)

- Decision Process: How exactly will the purchase be approved, and what are the steps? (e.g., “Procurement review, legal sign-off, board approval in Q3.”)

- Identify Pain: What is the core, urgent business problem, and what are the immediate consequences of not solving it? (Focus on the strategic impact.)

- Champion: Who inside the organization is actively invested in your success and is selling your solution internally?

2. GPCTBA/C&I: The Consultative Qualification Model

Developed for consultative selling environments, GPCTBA/C&I (Goals, Plans, Challenges, Timeline, Budget, Authority / Consequences & Implications) is ideal when the buyer is aware of a problem but may not yet know the exact solution they need. It focuses on understanding the client’s strategic vision before positioning a specific solution.

- Goals: What are the organization’s 3-5 year strategic objectives?

- Plans: What internal projects or initiatives are currently underway to achieve those goals?

- Challenges: What internal or external obstacles are actively blocking those plans? (This identifies the entry point for your solution.)

- Timeline: When must the challenge be resolved to meet the Goal? (This establishes urgency.)

- Budget & Authority (BA): Similar to BANT, confirming the resources allocated and the power structure for approval.

- Consequences & Implications (C&I): The crucial step—what are the negative business impacts (financial, personnel, market share) if they fail to resolve the challenge? (This justifies the investment and creates urgency.)

Using one of these advanced frameworks consistently ensures that sales teams prevent wasting time pursuing ‘happy ears’ leads that lack the budget, authority, or urgency to close, thereby maximizing the efficiency of the qualification process.

Frequently Asked Questions

- Should I use Manual or Predictive Lead Scoring in 2025?

- For high-volume, transactional sales, predictive scoring (using AI/ML on large datasets) is superior. For high-ticket B2B sales, a hybrid approach is mandatory. Use automated, rule-based (manual) scoring for explicit criteria (e.g., job title, company size) and leverage AI/Predictive scoring to fine-tune behavioral weights and identify subtle intent signals across your website and content engagement.

- How often should Sales and Marketing align on lead definitions?

- Alignment must occur quarterly, at minimum. This quarterly audit (often referenced as Step 7 in comprehensive frameworks) must be a joint effort. If Marketing is consistently sending leads that Sales rejects, the scoring model is fundamentally broken, indicating a severe misalignment in the definitions of MQL and SQL.

- What is the maximum score a lead should achieve before sales contact?

- A lead should never reach 100 points without sales intervention. Generally, if a lead hits the 70-75 point threshold, they are ready for immediate sales outreach. Scores above 80 often indicate the lead is actively looking for a demo or is already evaluating competitors. Delaying contact past the MQL threshold is a fatal error in high-ticket sales, resulting in lost opportunities.

References

- Lead Scoring: How to Find the Best Prospects in 4 Steps – Salesforce

- Lead Qualification Process: The 2026 Sales Checklist – Highspot

- [PDF] How to Qualify Leads for Sales – Consensus

- Lead Scoring Explained: How to Identify and Prioritize High-Quality …

- How to Qualify Leads in 7 Simple Steps (With Examples) – LanderLab