Recession-Proof Income: 5 Online Streams Founders Need

The global economy operates in cycles. This is not a theoretical discussion.

In December 2025, the signal is clear: volatility is the new baseline for business. Relying on a single revenue source,whether your 9-to-5 or your primary business offering,is no longer strategic. It is a massive liability.

We build high-performance lead generation systems for high-growth companies. Our core understanding: Stability requires redundancy. Financial security is engineered; you don’t stumble upon resilience.

This guide is your strategic blueprint for digital diversification. We focus strictly on high-leverage online income streams that are scalable and anti-fragile.

These streams must meet two critical criteria:

- They must be highly scalable and require minimal manual input (automation is key).

- They must thrive during economic contractions,not just survive them.

We are prioritizing systems that solve immediate, painful business problems (e.g., cost-cutting, efficiency gains) or cater to essential human needs (e.g., targeted education, low-cost distraction).

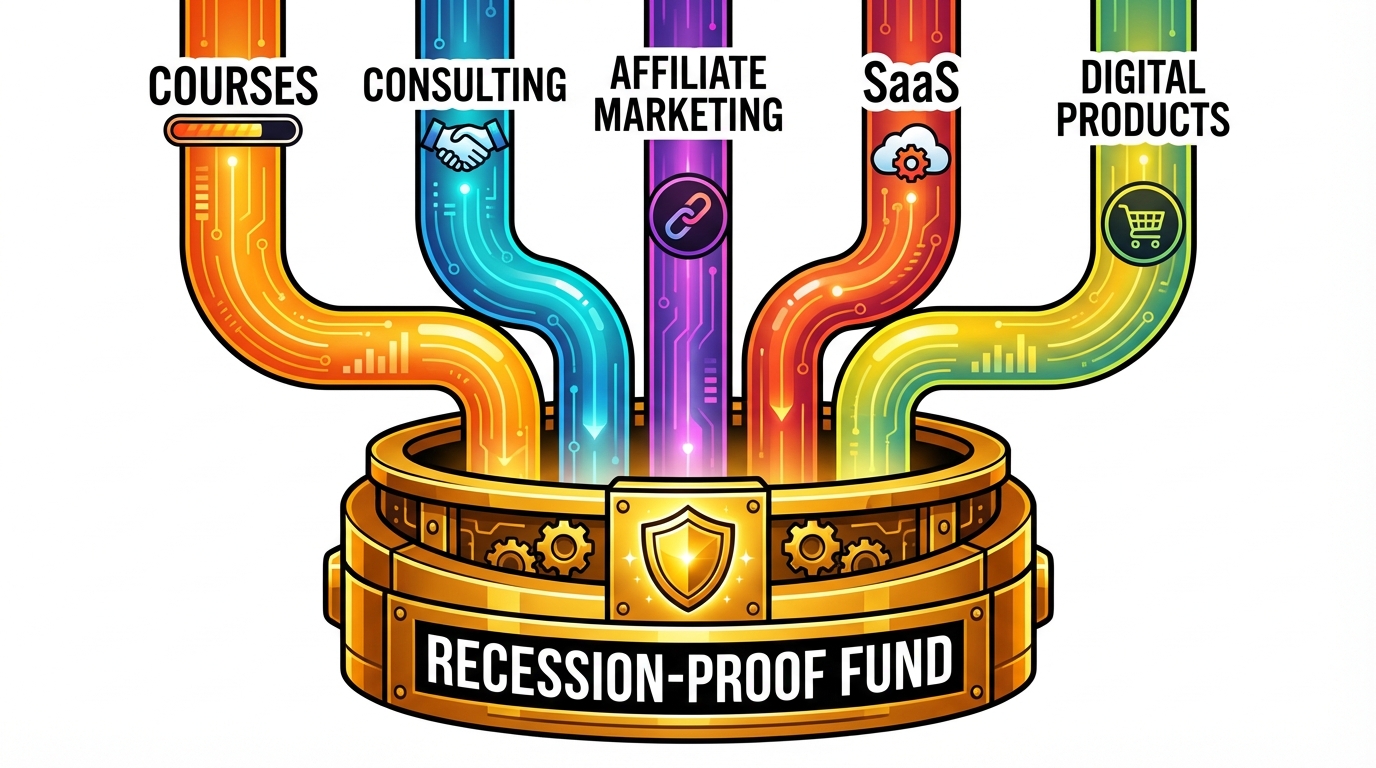

The Diversification Mandate: Four Strategic Imperatives

- The Recession-Proof Lever: During economic contractions, clients cut costs, but they never cut revenue generation. Your services must focus sharply on two outcomes: Cutting operational costs or driving lead volume efficiently. If your offering doesn’t achieve one of those, it is expendable.

- Scale Without Overhead: Passive income streams require leveraging digital assets (templates, high-value SOPs, specialized courses). These are zero-inventory products. You build the asset once; the margin is nearly 100% thereafter. This is how we achieve non-linear growth.

- Secure the Foundation (Before You Scale): Do not attempt diversification on shaky financial ground. Secure six months of liquid operating costs immediately in a high-yield account. Aggressively eliminate high-interest debt. This is mandatory financial hygiene that prevents panic selling during a downturn.

- Active Income Funds Passive Growth: Prioritize high-value, active income streams first (e.g., fractional consulting, implementation services). These deliver immediate, high-margin cash flow. Use this fast cash to strategically fund the creation and launch of your long-term, scalable passive assets. Cash flow dictates speed.

Step #1: Establish Your Financial Bedrock (The Non-Negotiable)

We cannot discuss scaling revenue streams if your foundation is unstable. This is not optional; this is fundamental financial engineering.

It takes absolute priority over launching any new venture. Your operational runway must be secured first.

1. The Liquid Emergency Fund: Securing Your Runway

Recessions create volatility: job insecurity, delayed client payments, and frozen credit lines. We mandate a 6 to 12-month buffer.

This fund must cover essential personal and business expenses. Keep it liquid. Non-negotiable holding spots:

- High-Yield Savings Accounts (HYSAs).

- Short-term Treasury bills.

That is the only acceptable home for this defensive capital.

2. Aggressive Debt Elimination

High-interest consumer debt (credit cards, predatory loans) is a guaranteed negative ROI. Eliminate it now.

Every dollar paid toward 25% APR debt is exponentially more valuable than a dollar invested in a volatile market. The math is not complex; the action required is.

The goal is zero financial friction. When the market tightens, maximum cash flow flexibility is the only metric that matters,not mandatory, high-interest payments. Clear the runway.

Step #2: Active Income Streams: High-Leverage Cash Flow Generators

Active income leverages your existing high-value skills. It generates immediate, high-rate cash flow.

Recessions force staff cuts, but the need for measurable results remains zeroed out. Companies pivot: They ditch expensive full-time hires (FTEs). They hire specialized, project-based contractors instead.

Your only focus must be measurable ROI. Offer services that either directly cut operating costs or aggressively boost their sales pipeline. No exceptions.

2.1. The Automation Arbitrage: Selling Efficiency

Budgets shrink. Companies need one employee to execute the work of three. This is not optional for survival.

AI and automation consulting is inherently recession-proof because it targets this exact pain point: inefficiency.

- The Niche: Offer specialized services in automating high-friction processes,sales outreach, customer onboarding, or internal reporting. Use tools like Zapier, HubSpot workflows, or custom data stacks.

- The Pitch: You are not selling hours. You are selling an FTE reduction. Frame your retainer as 1/10th the cost of hiring one mid-level analyst. This is immediate cost avoidance.

- Key Skill: Understanding how to integrate AI Lead Generation Software To find Clients Personal Emails into existing CRM stacks. This is a direct, measurable ROI service that clients cannot afford to postpone.

2.2. High-Ticket Fractional Executive Roles

High-growth startups cannot afford a $300k/year CMO when the market contracts. Mid-market companies need strategic oversight but lack the capital for full-time executive staff.

The solution is fractional expertise. This is high-ticket, remote consulting,pure strategy.

- Fractional CMO/Head of Sales: You manage strategy, not execution. You set the direction for the remaining internal team. Charge a premium retainer for 10-20 hours per week of high-level oversight.

- Fractional HR/Talent Acquisition: Help businesses manage necessary layoffs strategically, or rapidly optimize the hiring funnel for leaner, higher-quality teams.

We built the exact framework for securing these high-ticket clients without relying on traditional networking friction. Review our proprietary guide on LinkedIn Consulting Sales: The 2026 Conversion Blueprint to scale this quickly.

Step #3: Passive Online Income: Building Digital Assets

Passive income demands significant front-loaded work. But it minimizes ongoing time commitment (the ultimate efficiency hack).

The goal is clear: create digital assets that sell automatically,while you sleep. These assets are inherently recession-resistant. Why? They offer low-cost, immediate solutions to urgent problems.

3.1. Knowledge Products and Micro-Courses

When the market contracts, spending shifts. People invest heavily in upskilling (job protection) or career pivots. They are actively seeking affordable, actionable alternatives to expensive, slow university programs. This is your leverage point.

- The Format: Ebooks. High-value templates (SaaS documentation, financial modeling sheets). Short, hyper-focused video courses (under 120 minutes is optimal).

- The Niche: Focus strictly on practical, measurable niche skills. Examples: “Advanced Excel Automation for Accountants” or “Prompt Engineering for Non-Technical Founders.” Specificity drives conversion.

- The Platform: Deploy on low-friction platforms (Gumroad, Teachable). Price aggressively: Under $100 encourages impulse buying based on immediate, painful need.

3.2. Niche Content Monetization

A highly specific niche blog or YouTube channel functions as a long-term revenue asset. It generates reliable income via affiliate commissions and programmatic ads (AdSense).

Recession-proofing this stream depends entirely on two factors: Niche selection and deployment velocity.

To scale this content asset effectively, you need a clear, validated roadmap. We deployed our internal 9-Step Blueprint: Launching a Six-Figure Niche Blog Now to accelerate our validation process. Use our framework here.

3.3. Automated Affiliate Funnels

Affiliate marketing is a high-yield passive stream,but only if you promote essential, recurring-cost software. Think mission-critical SaaS, hosting, or productivity tools. Financial products (budgeting software, high-yield accounts) also work, as they address core financial anxiety.

- The Strategy: Engineer automated email sequences. Deliver high-value, problem-solving content first. Then, introduce the affiliated product as the only logical, necessary solution to that pain point.

- Recession Focus: Strictly promote tools that guarantee cost savings for small businesses or individuals. Focus on ROI. Examples: Cheaper alternatives to enterprise software (like Adobe), or streamlined, automated accounting tools.

This is not a scattergun approach. This process requires precision engineering and an obsessive focus on conversion rates. Learn the foundational model we use: The 2026 Blueprint for Automated Affiliate Funnels.

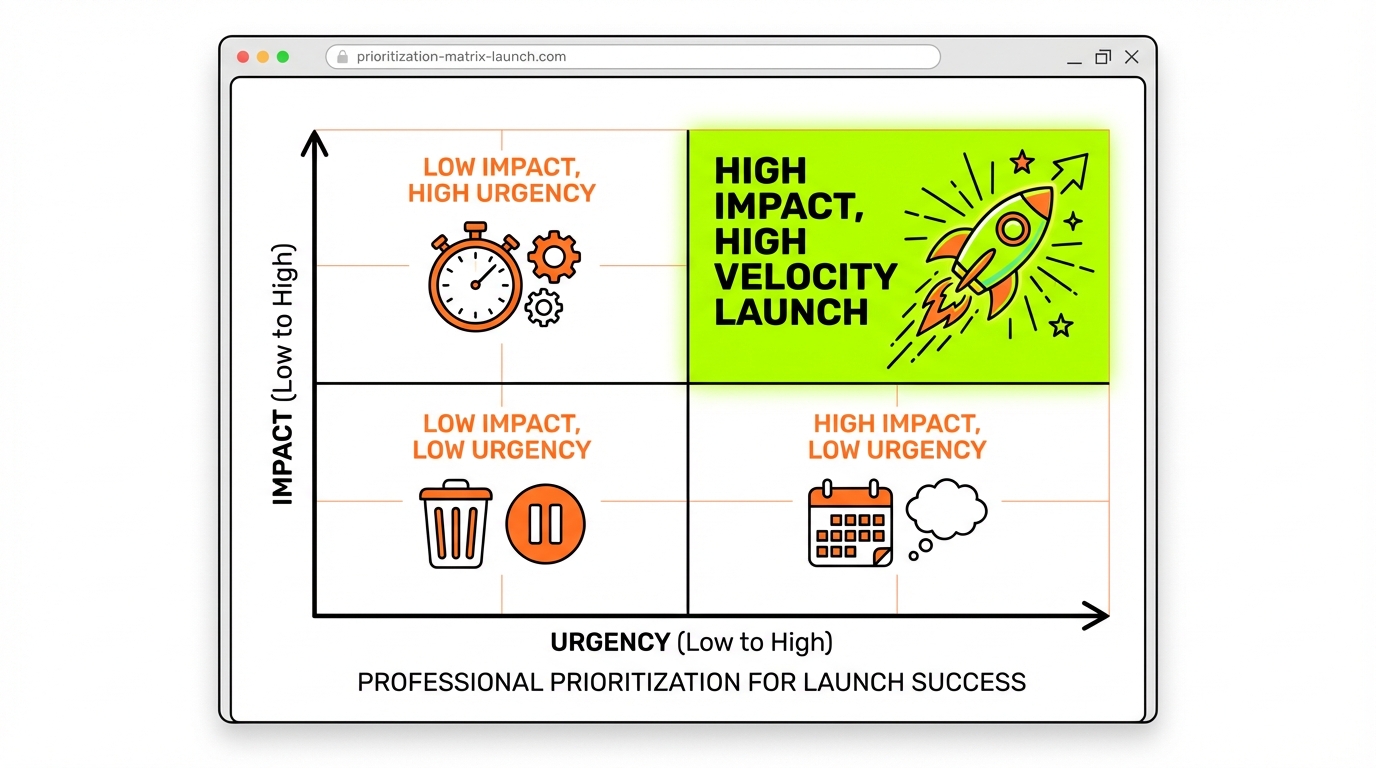

Step #4: The Prioritization Matrix: Launching & Scaling for Velocity

You cannot launch five income streams simultaneously. That is not strategy; it is a guaranteed failure state.

We focus on velocity and controlled expansion. You must prioritize based on your immediate need: rapid cash flow or foundational, long-term wealth building.

Use this matrix to determine precisely where to allocate your most valuable resources: time and initial capital.

| Income Stream | Effort/Skill Required | Time to First Payout | Scalability (Passive Potential) |

|---|---|---|---|

| Automation Consulting (Active) | High Skill / Medium Time | 1-4 Weeks | Medium (High rate, can productize services) |

| Digital Templates/Ebooks (Passive) | High Upfront / Low Ongoing | 4-8 Weeks | High (Zero cost of goods, immediate delivery) |

| Niche Blog / Affiliate Marketing (Passive) | Medium Upfront / High Ongoing | 6-12+ Months | Very High (Content is a long-term asset) |

| Fractional Executive Roles (Active) | Very High Skill / Low Time | 2-6 Weeks | Medium (Highest hourly rate potential) |

4.1. The Velocity Model: Active Income Funds Passive Assets

We advocate for the Velocity Model. This is the only pragmatic approach to scaling without burnout: Use high-rate active income to immediately fund the creation of high-ROI passive assets.

This is a three-phase execution plan:

- Phase 1 (Cash Flow Injection): Spend 80% of your operational time securing high-rate consulting or fractional work. Focus on immediate contract conversion. Use precise, targeted outreach (Upwork, TopTal, or direct LinkedIn campaigns,which is our specialty). This generates the capital required for the next step.

- Phase 2 (Asset Creation & Investment): Allocate the remaining 20% of your time,and 100% of the excess profit from Phase 1,to building one singular, high-value passive asset. Think technical template libraries, niche SaaS utilities, or a high-value micro-course focused on a single pain point.

- Phase 3 (Scaling & Decoupling): The asset is live. Shift your marketing focus entirely to driving automated lead generation and traffic to that passive product. Your reliance on high-touch, time-intensive active work dramatically decreases. This is where true scale begins.

Need immediate, small-scale capital injection to fuel Phase 1 quickly? We built a blueprint for exactly that. Review our guide on how to launch high-return hustles engineered for speed: Make $500 Fast Online: The 2026 AI-Powered Blueprint.

Conclusion: Engineering Your Financial Security

- When B2B spending slows (a common recession indicator), your low-cost educational products accelerate.

- When your high-ticket consulting pipeline tightens, your passive affiliate revenue stabilizes the floor.

- When manual lead generation fatigue hits, your automated systems maintain pipeline velocity,no exceptions.

Ready to take the next step?

Stop relying on manual outreach. Start generating high-quality leads for your new consulting or fractional service immediately. Start Your Free Trial of our AI Lead Generation Software.

Start Your Free TrialActionable FAQs for Recession-Proofing Income

- How much income diversification is enough to be recession-proof?

- Three distinct streams is the minimum required benchmark. We define this as non-correlated income.

- Our ideal structure for maximum security is:

- 1 Active Stream (e.g., high-rate B2B consulting or specialized service delivery).

- 2 Passive Streams (digital products, affiliate systems, or software subscriptions).

- This redundancy minimizes catastrophic exposure when a single sector fails.

- Should I prioritize passive income over active income initially?

- Absolutely not. Passive income is a long-term asset, not an immediate cash source (expect 6-12 months minimum for meaningful ROI).

- You must prioritize high-value active income first: consulting, specialized B2B services, or immediate lead generation systems. Use that immediate cash flow to fund the infrastructure,software, content systems, marketing,required to build your passive assets. Fund your future with today’s revenue.

- Which online businesses are most vulnerable during an economic downturn?

- Anything lacking measurable ROI. During a downturn, budgets are scrutinized; if a service doesn’t directly boost revenue or cut costs, it gets cut.

- This includes:

- Non-essential luxury goods.

- Broad, non-specialized marketing agencies (The generalists die first).

- Any “lifestyle” coaching that cannot guarantee a specific, profit-driven outcome (e.g., guaranteed client acquisition).

- Focus on critical pain points, not vanity metrics.

- Is it too late to start a niche blog or content site in 2025?

- No, but the barrier to entry is exponentially higher. Generic content is dead: AI handles the basics now.

- Your strategy must shift to hyper-specificity and authority. Focus on niches that solve expensive B2B problems:

- Complex automation workflows.

- Regulatory compliance for specific sectors.

- Deep-dive reviews of high-cost tools (like specialized AI lead generation software).

- Your content must not just inform,it must be the definitive solution.

References

- Recession-Proof Your Business: 7 Smart Strategies To Stay Profitable

- Recession-Proofing as a Creator: Why You Should Sell Digital …

- 8 Strategies to Make Your Wealth and Income Recession-Proof

- How to Prepare Financially for a Recession and Protect Your Finances

- What types of online business thrive during recession? – Reddit