The Necessary Mindset Shift: Investor vs. End-User

The End-User Valuation Gap

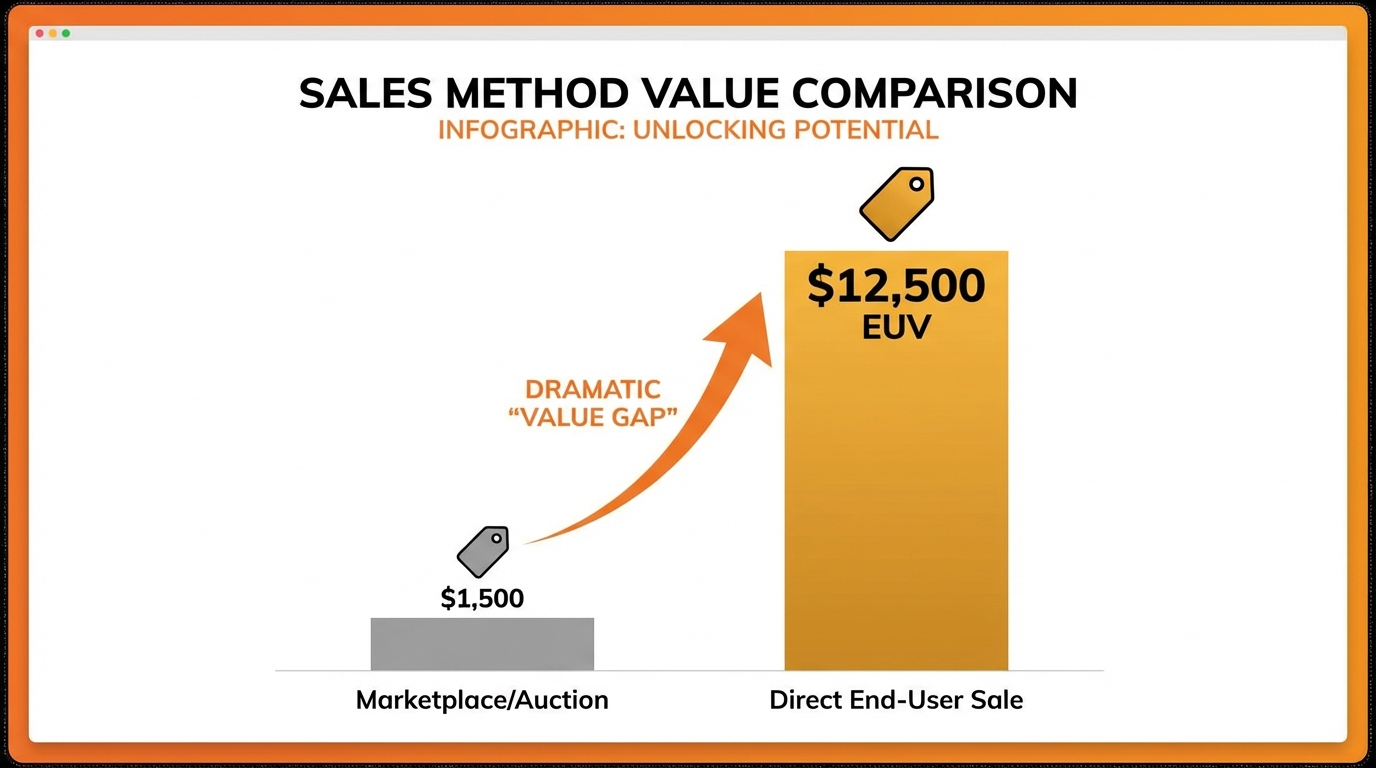

Why does strategic outreach yield seven-figure results where traditional methods stall? It comes down to perceived value and necessity:- The Investor Valuation (The Low Ceiling): This value is speculative. It is based on comparable sales data, keyword traffic estimates, and generic monetization potential. This is a generalized, low-leverage calculation.

- The End-User Valuation (The True Target): This value is strategic. It is based on brand defense, competitive moat creation, mandatory market category ownership, and future growth alignment. This is the non-negotiable, corporate acquisition cost.

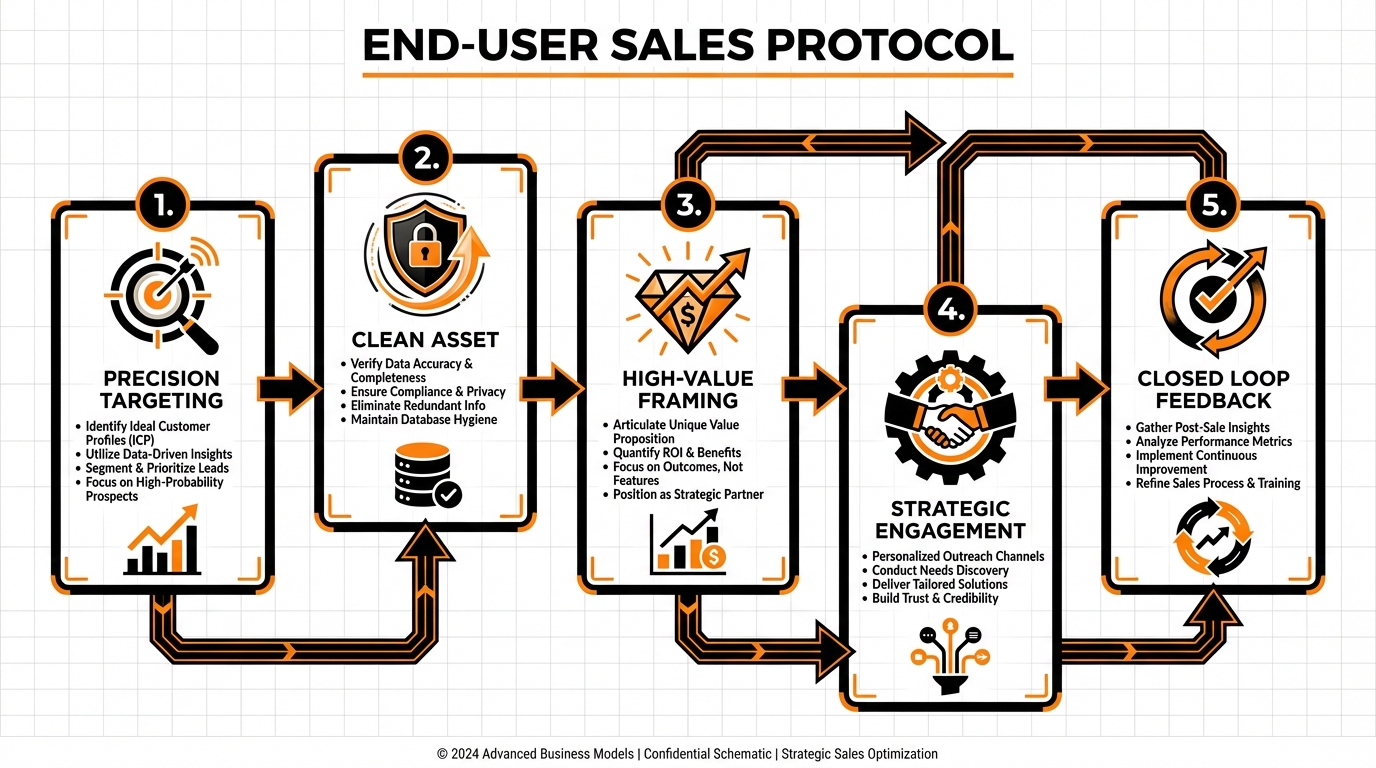

The Core Strategy: Five Non-Negotiable Rules for End-User Sales

- REJECT Commoditization. Marketplaces are built for commodity flips and low-margin investors. Your target is the corporate buyer,the only source for securing true, strategic asset value.

- Valuation is Predictive ROI. You must abandon comparative sales data (comps) immediately. Calculate the End-User Value (EUV) based purely on the buyer’s competitive advantage and projected long-term marketing savings.

- Master Account-Based Marketing (ABM). Identify 5–10 ideal target companies. Then, leverage strategic AI lead generation software (the kind we build) to pinpoint the exact decision-maker (CEO, CMO, or VP of Strategy) and secure their verified corporate email address. This step dictates your conversion rate.

- The Pitch is a Strategic Memo. Deliver an ROI-focused Asset Acquisition Memo. Frame the domain not as an optional purchase, but as a necessary, immediate business solution that solves a critical market problem.

- Security Demands Corporate Escrow. For any transaction exceeding six figures,especially seven-figure deals,use a specialized, reputable corporate escrow service. Never rely on basic consumer platforms for high-value asset transfers.

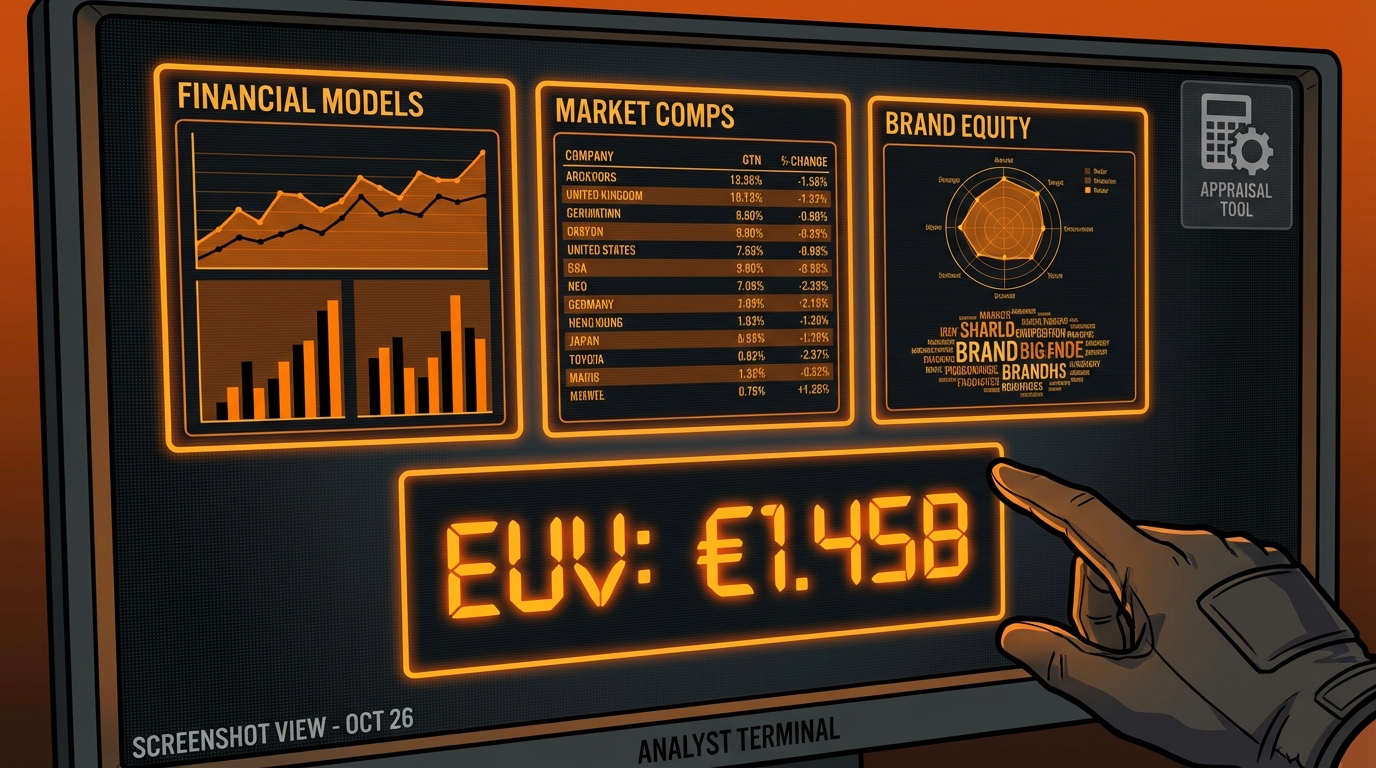

Step #1: Calculate End-User Value (EUV)

The single biggest strategic failure is relying on generic appraisal tools (e.g., Estibot). These platforms measure investor value.

We don’t care about investor value. We need End-User Value (EUV).

EUV is the measurable strategic advantage the domain provides to one specific, high-revenue business. This valuation is consistently 5x to 10x higher than any generic appraisal will ever calculate.

Our EUV Calculation Framework: Justifying Premium Prices

We justify premium prices by quantifying the asset’s strategic impact. If you cannot quantify it, you cannot sell it.

- Competitive Advantage Score: Does this domain neutralize a major competitor? Does it solidify 100% market dominance? Quantify the budget line required to achieve that result without the domain.

- Type-In Traffic & SEO Authority: Quantify the annual organic traffic gain. Calculate the exact Cost Per Click (CPC) savings over the next three years. This calculation provides a direct, indisputable ROI figure we can present to the CFO.

- Brandability Multiplier: Is the asset category-defining? Is it short, memorable, and globally recognized? (Single-word .coms carry the highest strategic multiplier.)

- Risk Mitigation: What is the quantifiable legal and reputational cost of not owning this asset? This is the most powerful leverage point in any negotiation.

If you cannot write a two-page, financially detailed memo justifying why the domain is worth $750,000 to Target Corporation X, you are not ready for direct end-user sales. Period.

Step #2: Clean the Asset (Corporate Legal Audit)

You calculated the End-User Value (EUV) in Step #1. That valuation is useless if the asset is dirty.

Corporate procurement is slow. Their legal teams are meticulous. They mandate zero risk exposure.

Any indication of legal trouble, historical SEO spam, or ownership ambiguity will instantly kill the deal. Price becomes irrelevant.

The Mandatory Corporate Cleanliness Checklist

You must ensure your asset is bulletproof *before* outreach. This audit protects your valuation:

- Trademark Clearance: Conduct deep, global trademark searches. If infringement exists, you must pivot immediately. This is a non-negotiable risk for any major corporation.

- Ownership History Audit: Use tools like the Wayback Machine to verify the domain’s content history. Corporate SEO teams reject assets previously linked to illicit content, spam, or low-quality PBNs. They run their own audits.

- Registrar Status & WHOIS: The domain must be unlocked and free of restrictions (e.g., transfer locks, payment holds). Ensure all WHOIS data is current and precisely matches the selling entity.

- Legal Documentation: Prepare digital copies of the full paper trail now. This includes proof of purchase, transfer history, and relevant identification. Corporate legal teams demand immediate access to documentation,no exceptions.

Transparency is leverage. If you know about a minor historical issue, disclose it proactively.

If the buyer’s legal team discovers an undisclosed flaw during due diligence, trust is destroyed. The deal valuation collapses instantly,or the deal terminates entirely. We prioritize proactive disclosure as a strategic advantage.

Step #3: End-User Identification and High-Precision Lead Generation

We are done with passive listing. This phase mandates aggressive, strategic Account-Based Marketing (ABM).

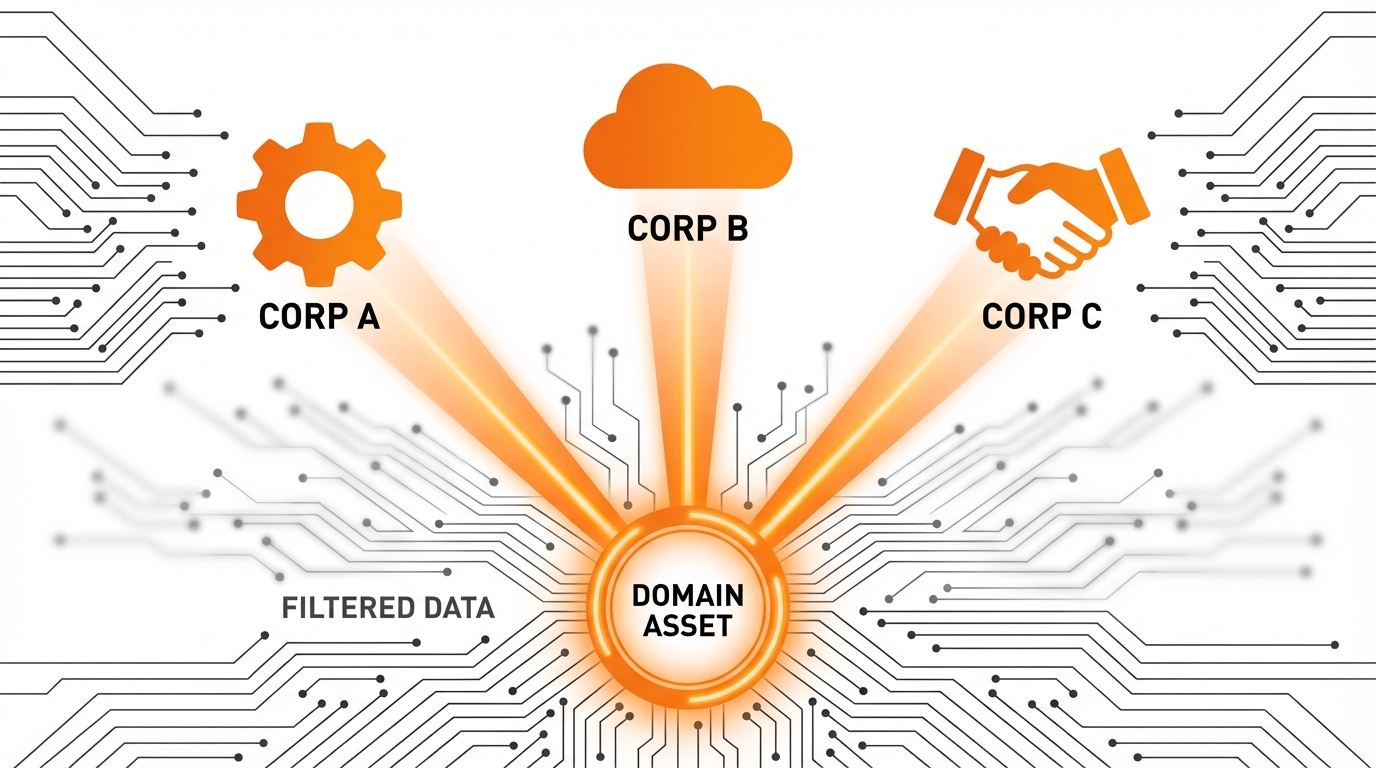

Your goal is specific: Identify the 5 to 10 global companies that will derive the highest possible End-User Value (EUV) from the domain.

These are not prospects. They are your only viable leads.

Mapping the Ideal Buyer Profile (IBP)

We apply the same targeting filters used in high-value B2B SaaS sales. You must qualify the potential buyer for budget, need, and strategic fit.

- Industry Mapping: Focus on sectors currently undergoing massive digital transformation. The industry must be actively investing heavily in the keyword relevant to your domain.

- PPC Spend Analysis: Identify organizations currently spending six figures monthly on Pay-Per-Click (PPC) for your domain’s keywords. They have already quantified the acquisition justification. They are paying the tax you can eliminate.

- Revenue Threshold: Target companies exceeding $100 million in annual revenue. They possess the established budget structure necessary for non-essential, strategic capital acquisitions. If they can’t write a seven-figure check easily, they are a waste of time.

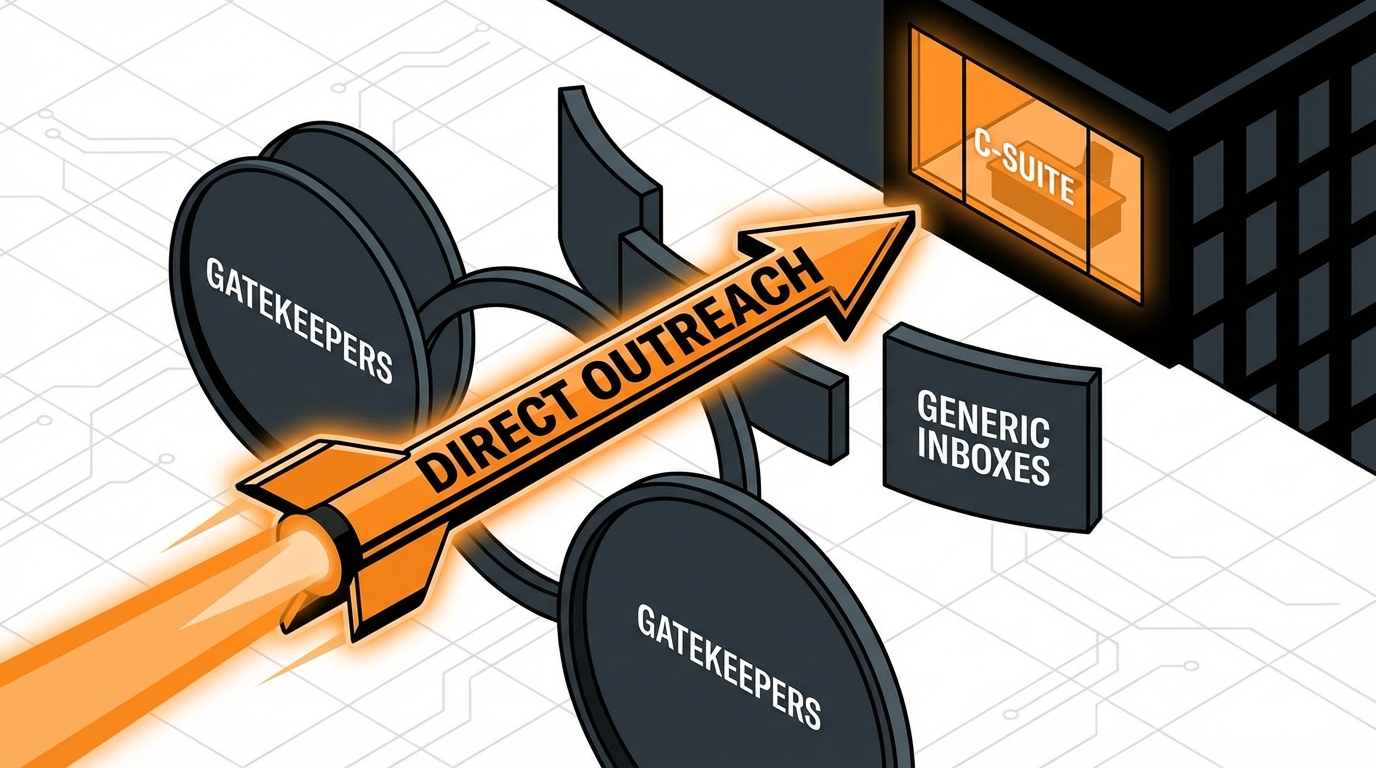

Finding the Verified Decision Maker (Bypass IT)

You must circumvent the technical gatekeepers. The IT department only sees cost; we need the executive who controls strategic budget allocation and brand direction.

- Target Roles: Chief Marketing Officer (CMO), VP of Corporate Development, or the CEO (for truly premium, short assets). These roles understand brand equity and future positioning.

- Data Precision is Non-Negotiable: We utilize specialized AI lead generation software to pull verified, direct corporate emails. Generic, unverified data destroys your sender reputation and instantly invalidates your outreach. This investment is crucial for high-value sales.

We apply these high-precision principles across all our lead generation efforts,whether it’s selling software or selling seven-figure domains. Our systems are built for this level of accuracy.

Need to build a robust targeting strategy that maps high-value accounts? Our 7-Phase ABM Framework details exactly how we structure outreach for maximum conversion.

Ready to start finding your end-users’ verified corporate emails? Start Your Free Trial.

Step #4: Strategic Direct Outreach Protocol

Mass emails fail. Period. We are deploying a hyper-personalized, high-value approach here.

Think of your initial contact not as a sales query, but as a strategic intelligence brief designed exclusively for the C-suite.

The Anti-Generic Cold Email Blueprint

The target executive receives hundreds of pitches daily. Your message must cut through the noise: Immediate, relevant value and undeniable authority are mandatory.

- The Subject Line: The Executive Summary. It must be short, urgent, and hyper-focused on their strategic business line. (Example: Strategic asset acquisition: [Domain Name] for Q4 expansion.)

- The Hook (The First Line): Prove Your Due Diligence. Reference a recent, relevant company event immediately. This is non-negotiable. Mention the new funding round, the recent acquisition, or a key competitor’s market failure.

- The Strategic Value Proposition: Quantify the Opportunity. State the strategic fit directly and quantify the cost of inaction. Example: “We recognize [Domain Name] immediately solves your Q1 2026 challenge of relying on high-cost paid search in the [Specific Market].”

- The Low-Commitment CTA: The Next Strategic Step. Do not ask for the sale. Ask for the next strategic step,a short, focused review. Example: “Would 15 minutes next Tuesday be viable to review the independent ROI analysis we prepared for this acquisition?”

Outreach fails if data quality is compromised. Manual scraping is obsolete,it wastes time and tanks deliverability.

We rely exclusively on cutting-edge AI lead generation software to secure the verified contact data of the exact decision-maker. If you are still relying on stale email lists, you are losing revenue. Start Your Free Trial and see the current stack we recommend for verified contact discovery.

Step #5: The High-Value Pitch: Framing the Asset Memo

The executive agreed to the call. This is not a product pitch. We are not presenting a listing.

We are delivering a detailed, confidential Asset Acquisition Memo. This document shifts the entire conversation: It moves the focus immediately from “cost” to “required investment,” “ROI,” and “competitive necessity.”

Key Components of the Acquisition Memo

- Executive Summary: The C-suite requires immediate answers. This must be a single-page snapshot detailing the domain’s strategic value, the data-justified acquisition range, and the immediate business case.

- Competitive Necessity: Use proprietary data to expose competitor moves. Prove this domain is an essential defensive asset or a critical offensive weapon required to gain or defend market share.

- ROI Modeling (The Core): This section justifies the seven-figure price tag. Detail projected savings over 36 months (e.g., massive PPC reduction, increased organic conversions, brand consolidation). If the investment is $2M but saves $6M in future marketing spend, the decision is already made.

- Technical Cleanliness and Transfer Protocol: Include the full technical audit (from Step #2). Provide airtight proof of legal clearance and define the clear, immediate transfer mechanism. Zero ambiguity is allowed here.

Our proprietary strategy demands hyper-personalization: We often build a simple, dedicated landing page engineered exclusively for the target company. It uses their exact branding, language, and market positioning to showcase the domain asset.

This intense level of personalization signals undeniable professionalism, scarcity, and strategic intent. It forces immediate action.

Step #6: Negotiation Dynamics with Non-Investors

The executive agreed to the call. The Asset Memo worked. Now, we negotiate the close.

Negotiating with a corporate buyer is fundamentally different from dealing with a traditional financial investor. Corporate teams are less emotional, but they operate within massive internal compliance structures.

The core difference? Corporate buyers focus on budget cycles, legal compliance, and strategic necessity. Investors focus purely on liquidity and immediate ROI. We must speak their language to close the deal.

Tactics for Corporate Negotiation

- Anchor High, Justify Immediately. Never use a round number. Your initial asking price must be precisely anchored by the calculated End-User Value (EUV) model established in the Asset Memo. Use a precise figure justified by ROI data. *Example: “$2,150,000 based on projected 3-year type-in traffic capture and brand defense.”*

- Bypass the Procurement Firewall. The first major resistance will come from their procurement or legal team. They are trained to reduce vendor costs. This is not a vendor purchase. You must immediately pivot the conversation back to the strategic executive who understands the asset value. Reiterate: This is a strategic acquisition, not a discounted expense.

- Maintain Strategic Scarcity. We never appear desperate. We are choosing the best strategic partner for this asset. Subtly leverage the fact that you have other high-value targets in the pipeline. This creates critical urgency where their internal bureaucracy creates friction.

- Prepare for the 90-Day Wait. Corporate budget approval is slow. Expect delays ranging from 90 to 180 days after a verbal agreement. Maintain professional, non-pushy follow-up during this period. The sale is not dead; it is trapped in bureaucracy.

Remember: High-stakes negotiations in 2025 are almost exclusively virtual.

The ability to adapt your strategy in real-time depends entirely on reading the room,even if that room is a Zoom window. You need to identify hesitation, alignment, and commitment based on subtle, non-verbal cues.

Mastering these signals is non-negotiable for closing million-dollar deals:

Mastering Non-Verbal Cues in Virtual Sales Negotiations

Marketplace vs. Direct Sales: The Value Gap

This strategic effort,the direct outreach, the Asset Memo creation, the executive negotiation,is mandatory for realizing premium domain value.

We do not rely on passive marketplace listings. Why? Because the outcome differences are not speculative; they are measurable revenue gaps. If you treat a six-figure asset like a low-tier listing, you are leaving 3x to 10x revenue on the table.

Stop selling to investors. Start selling to end-users.

| Metric | Passive Marketplace Listing (Sedo/GoDaddy) | Active Direct End-User Sale Strategy |

|---|---|---|

| Target Buyer Profile | Domain Investors, Brokers, Low-Tier SMBs (Liquidity Focus) | C-Suite Executives, Global Brands (Strategic Focus) |

| Valuation Basis | Comparable Sales (Comps), Investor Liquidity | Strategic ROI, Competitive Necessity (EUV – End User Value) |

| Average Commission/Fees | 15% – 20% (Broker/Platform Fees) | 0% – 3% (Escrow fees only) |

| Time to Sale | 12 – 36 months (Passive wait) | 3 – 9 months (Active ABM campaign) |

| Final Price Multiplier | 1x Investor Value | 3x – 10x Investor Value |

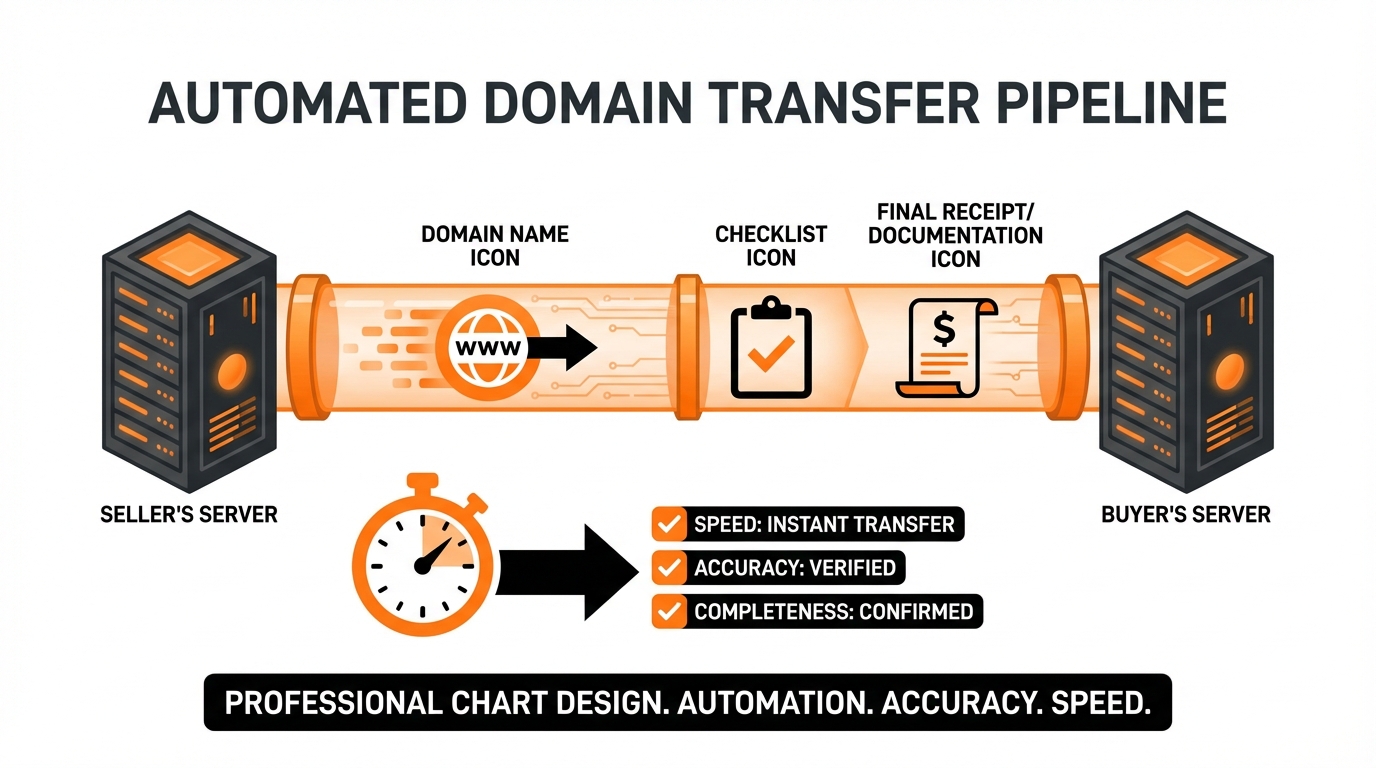

Step #7: Secure Finalization Using Corporate Escrow

You never handle the transfer of a six-figure asset without a professional, recognized escrow service. This is not negotiable; it is a fundamental pillar of corporate transaction security.

The core dynamic is simple: The corporate buyer requires assurance the domain transfers upon payment. You require verified, secured funds before initiating the transfer sequence.

Escrow bridges this gap instantly. It removes risk for both parties, allowing the transfer process to move forward with verifiable legal backing.

Choosing the Right Escrow Service for High-Value Assets

For sales exceeding mid-five figures,and certainly for seven-figure deals,you must use specialized services, not generic payment platforms. We look for three critical features:

- Domain Expertise: They must have demonstrable experience handling registrar procedures, EPP codes, and transfer locks specific to high-value digital assets. This is non-negotiable complexity.

- Legal Licensing & Bonding: The service must be licensed and bonded to handle large sums. This satisfies the buyer’s internal Finance and Legal departments,a transaction killer otherwise.

- Rigid Milestone Definition: The workflow must be defined and immutable: Funds deposited → Seller initiates transfer → Buyer confirms receipt → Funds released. Zero exceptions.

The typical escrow fee (1% to 3% of the transaction) is simply the cost of doing secure, high-value business.

Attempting to bypass this fee is not just ‘rookie behavior.’ It immediately signals to the buyer’s legal team that you are not a legitimate, strategic seller. You kill the deal instantly by introducing unnecessary financial risk.

Step #8: Smooth Transfer and Post-Sale Documentation

The escrow is active. The funds are secure. Your final task is ensuring the technical transfer is flawless.

Friction during this phase kills momentum. It delays the final fund release,and severely damages your reputation for future high-value asset sales. We treat this transfer as a high-stakes technical execution.

The Transfer Execution Protocol

- Unlock the Asset Immediately: Remove the transfer lock (Registrar Lock) at your current registrar.

- Generate the EPP Code: This is the critical authorization key. Do not share it directly with the buyer yet.

- Secure the Key with Escrow: Send the EPP code and necessary account details only to the verified escrow agent for verification steps.

- Buyer Initiates Pull: The corporate buyer uses the EPP code to initiate the transfer request at their registrar.

- Execute Immediate Approval: Monitor your registrar account constantly. Approve the transfer instantly when prompted by your registrar. Speed validates the professionalism of the entire transaction.

Maintain transparent, open communication with the buyer’s technical team throughout the transfer period. Domain transfers often take 5–7 days; clarity minimizes anxiety and removes excuses for payment delays.

Post-Sale Documentation: Securing Future Credibility

Do not stop at the transfer. Provide a comprehensive final package. This streamlines the buyer’s internal processes and establishes you as a strategic asset manager:

- Official Bill of Sale: The legally binding document signed by both parties. File this immediately.

- Clean History Report: Provide verifiable documentation showing the domain’s history (i.e., clear ownership chain, no prior blacklisting).

- Associated Assets: Include any relevant supplementary files,parked landing page code, basic analytics, or previous branding mockups used to market the domain.

This level of seamless professional execution is what separates low-volume flippers from strategic asset managers. You are reinforcing your authority. You are building the trust necessary for your next six-figure sale.

Frequently Asked Questions

What is the difference between a premium domain and a standard domain?

A premium domain is not just a keyword. It is a strategic asset: short, category-defining, and immediately memorable. These domains (e.g., “AI.com,” “CryptoWallet.com”) capture high volumes of type-in traffic and possess immense inherent branding potential. This is why their valuations routinely exceed $100,000,sometimes reaching eight figures.

How long does it take to sell a premium domain directly to an end user?

For seven-figure assets, expect a minimum 90-day timeline. The outreach and initial negotiation might conclude in 30–60 days. However, the critical phase,corporate approval, legal vetting, and activating escrow,requires serious time. Plan for 90 to 180 days total. This is a strategic timeline. Never treat it as a passive waiting period.

Should I use a domain broker for high-value sales?

Brokers offer C-suite access and negotiation expertise, especially for assets over $500,000. But they charge 10% to 15%. If you possess strong B2B sales acumen and leverage high-precision lead generation software (referencing Steps 3–4), running a direct Account-Based Marketing (ABM) campaign is superior. We consistently see higher net returns by eliminating the broker middleman.

Is it legal to cold email executives about domain acquisition?

Yes, absolutely. Outreach regarding strategic asset acquisition falls under accepted B2B communication standards. The key is extreme personalization and professionalism. If your message is generic or unpersonalized,if it looks like spam,you will damage your reputation and violate best practices. Quality data drives compliant, high-conversion outreach.

Ready to take the next step?

Executing a seven-figure ABM strategy demands verified, direct contact data. Stop relying on outdated, generalized lists. Our AI lead generation software finds the personal emails of the true decision-makers: Founders, CEOs, and CMOs. This is how we bypass gatekeepers and close high-value deals.

Start Your Free Trial Now.

Click Here