Traditional lead generation is dead for B2B SaaS companies focused on high Annual Contract Value (ACV).

Casting a wide net for MQLs (Marketing Qualified Leads) is a guaranteed path to mediocrity when the buying committee involves six to ten stakeholders and your sales cycle spans six months.

You need precision. You need focus.

That’s where Account-Based Marketing (ABM) steps in. Forget the generic ABM frameworks from 2022. We are operating in 2025.

The modern ABM strategy must be fully integrated with AI, intent data, and Product-Led Growth (PLG) signals. It must function as the high-precision engine that feeds your revenue machine (and ensures your SDRs aren’t wasting time on generic prospects).

Our team built and refined the B2B SaaS ABM Pipeline Framework to solve this exact problem. It positions ABM not as an alternative to lead generation, but as the strategic process that converts high-value accounts into predictable, scalable revenue.

Here is the actionable, 7-phase blueprint used by top-tier SaaS companies today.

Key Takeaways: The 2025 ABM Mandate

- ABM is the Precision Engine: ABM is not a replacement for lead generation; it is the refinement engine. We use it to create a high-conversion bridge from MQLs straight to high-value MQAs (Marketing Qualified Accounts).

- Targeting 3.0: Your Target Account List (TAL) must leverage AI-driven technographics and Product Usage Data (PLG signals) for true competitive advantage.

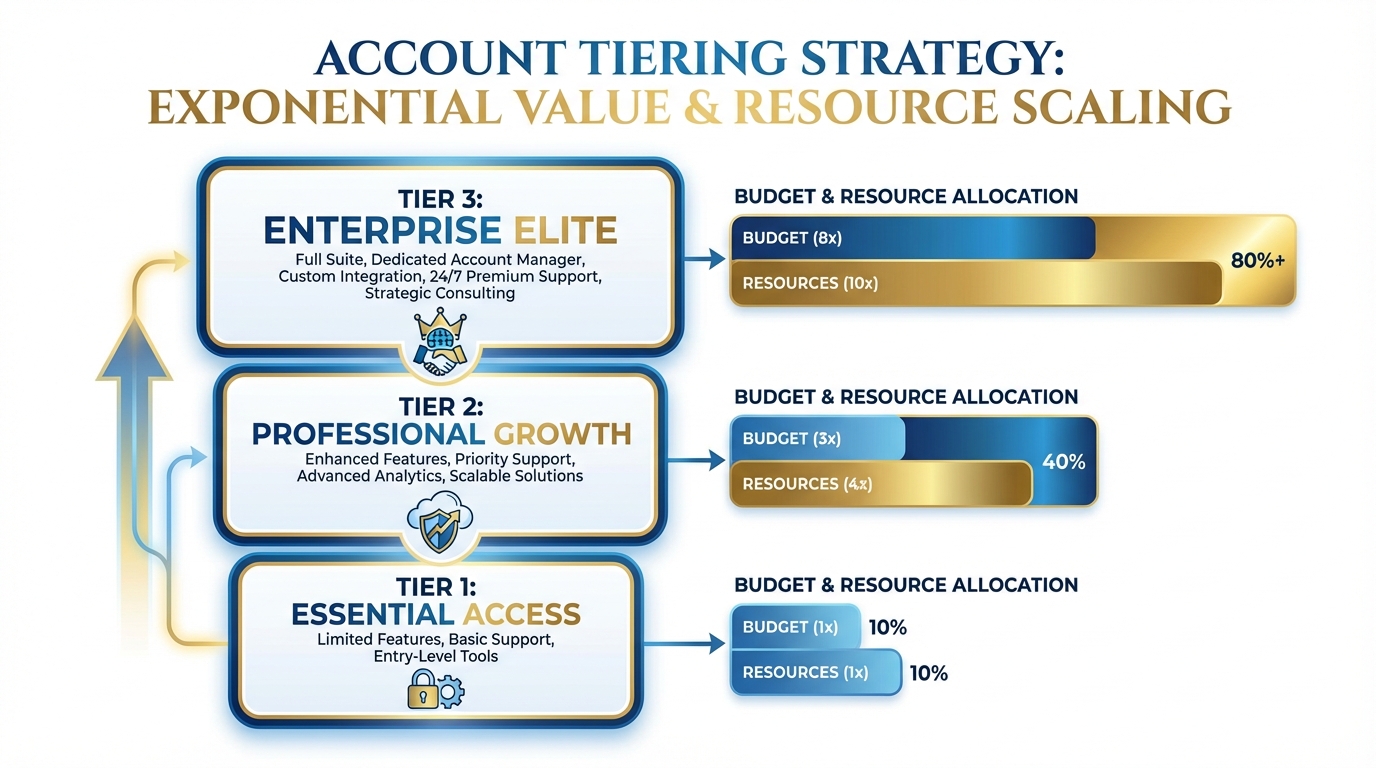

- Budgeting by Tier: Resource allocation must be dictated by the chosen ABM tier (1:1, 1:Few, 1:Many). Prioritize investment in human personalization for 1:1 accounts.

- New Metrics: Shift focus immediately from MQLs to MQAs (Marketing Qualified Accounts) and IQAs (Intent-Qualified Accounts). Stop tracking vanity metrics.

Phase 1: Strategic Tier Selection & The Budgeting Guide

Before we ever touch a CRM or build a target list, we define the effort required per account. This decision is non-negotiable; it dictates your entire ABM budget.

The core ABM principle is simple, yet often ignored: Higher Potential ACV = Smaller List + Deeper Personalization.

You cannot treat all accounts equally. Our team breaks ABM execution down into three distinct tiers based on required resource commitment:

- 1:1 (Strategic ABM): The Enterprise Play. Reserved exclusively for whale accounts (typically >$500k+ ACV). Your list size is microscopic (5–20 targets). Personalization is entirely manual, research-intensive, and requires executive-level access and hyper-customized content (think dedicated outreach and physical gifts).

- 1:Few (ABM Lite): The Mid-Market Engine. Targeting high-growth mid-market accounts ($50k – $250k ACV). List size is manageable (50–100 accounts). We personalize based on shared pain points within a cluster (e.g., industry-specific tech stack, shared regulatory hurdles).

- 1:Many (Programmatic ABM): The Volume Scaler. Used for lower ACV or high-volume prospecting (Under $50k ACV). List size is large (500+ accounts). Personalization relies almost entirely on automated AI tools, intent data signals, and dynamic content insertion based purely on firmographics.

Your resource allocation must directly reflect this effort disparity.

If you commit to 1:1, 70% of your budget must flow into human capital: dedicated researchers, specialized SDRs, and custom content creators. If you opt for 1:Many, 80% must be allocated to technology (Intent Data, AI personalization software, and scaling ad platforms).

This table summarizes the necessary strategic investment for each tier:

| ABM Tier | Target ACV Range | Personalization Level | Resource Focus |

|---|---|---|---|

| 1:1 (Strategic) | $500K+ (Whale/Enterprise) | Hyper-Custom (Market of One) | Human Research, Dedicated SDRs, Executive Access |

| 1:Few (Lite) | $50K – $250K (Mid-Market) | Cluster-Based (Shared Pain Points) | Sales Engagement Tools, Segmented Ad Spend |

| 1:Many (Programmatic) | Under $50K (SMB/Volume) | AI-Driven Dynamic Content | Intent Data Tools, AI Lead Generation Tools, Ad Platforms |

Phase 2: Defining ICP and Target Account List (TAL) 3.0

You’ve defined your ABM tiers and established the required effort per tier (Phase 1). Now, we need the list.

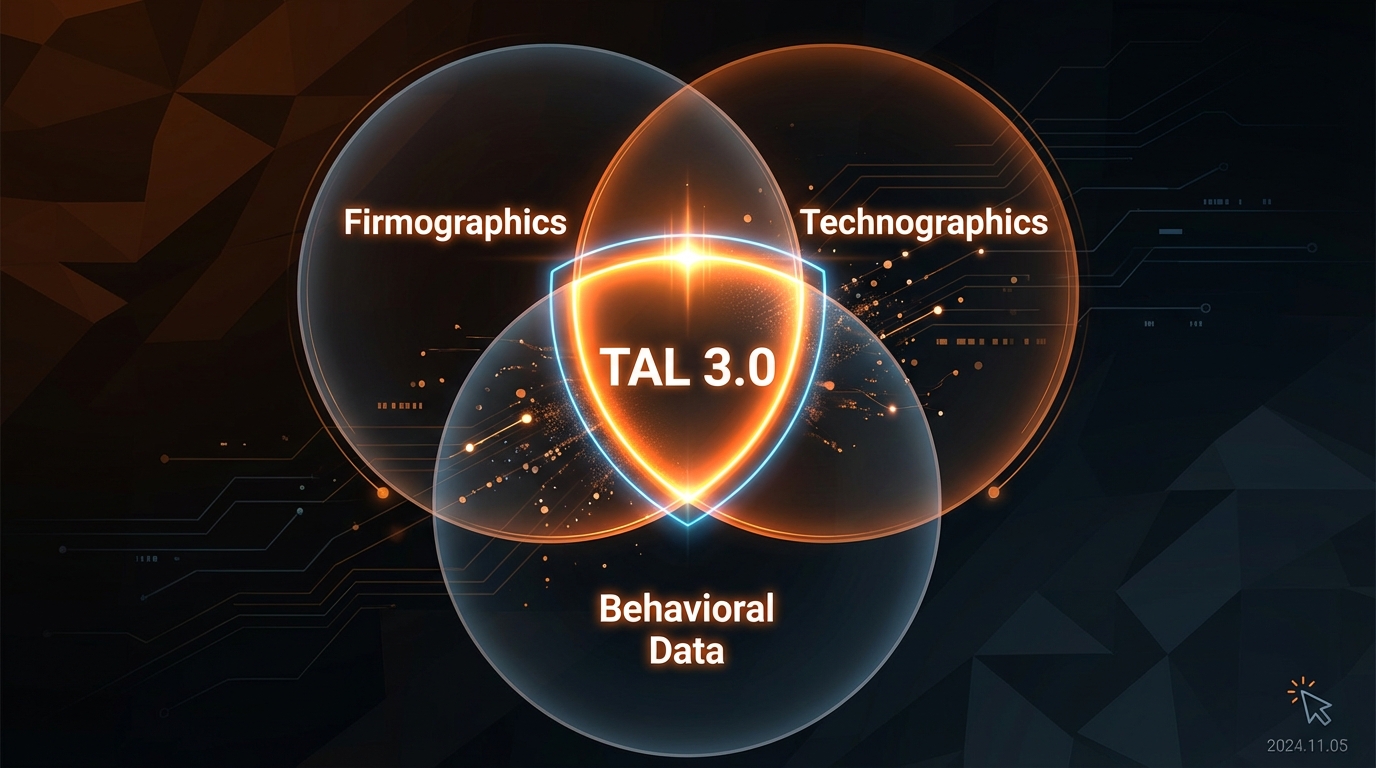

The days of building a Target Account List (TAL) based only on industry and employee count are dead. That is ABM 1.0, and it will fail you in 2025.

To win enterprise deals, your TAL must be strategic. It must be built on three integrated data pillars that prove immediate fit and perfect timing.

Pillar 1: Technographics (The Non-Negotiable Fit)

You must know the technology stack of your target accounts. This isn’t optional. It proves immediate product fit,before you even send the first cold email.

- If your SaaS product integrates seamlessly with HubSpot, why are you wasting time targeting companies that run on Salesforce? (It makes zero sense.)

- If you are a competitor replacement, target accounts currently paying for your rival. We call this the competitor replacement strategy, and it is the fastest path to ROI.

Use tools that scrape and verify the installed technologies. This is the fastest way to prove fit and craft highly relevant, competitive messaging.

Pillar 2: Intent Data (The Timing Signal)

Intent data tells you exactly who is actively researching topics related to your solution. This is the ultimate prioritization signal for your SDR team.

Do not treat all ICP-fit accounts equally:

- ICP fit + No Intent = Long-term nurture target.

- ICP fit + High Intent = Intent-Qualified Account (IQA). This requires immediate, dedicated outreach.

Our rule is simple, and we enforce it rigidly: Our SDRs are only allowed to spend more than 30 minutes researching an account if they are flagged as an IQA. Time is finite. Focus only on the accounts that are “in-market” now.

Pillar 3: Product Usage Data (The PLG Signal)

This is the critical differentiator for modern B2B SaaS ABM. If you offer a free trial or freemium product, you are sitting on a goldmine of proprietary usage data.

When an individual signs up, they are an MQL. But that account graduates instantly when usage accelerates:

- Multiple users from the same high-value account (e.g., “Acme Corp”) sign up.

- A user hits a specific usage limit (the “Aha!” moment) that triggers a paywall.

That account becomes a high-priority MQA (Marketing Qualified Account) demanding sales intervention.

This is the essence of modern hybrid sales. We must understand how PLG vs. SLG Lead Gen strategies merge to form the perfect, conversion-ready TAL 3.0.

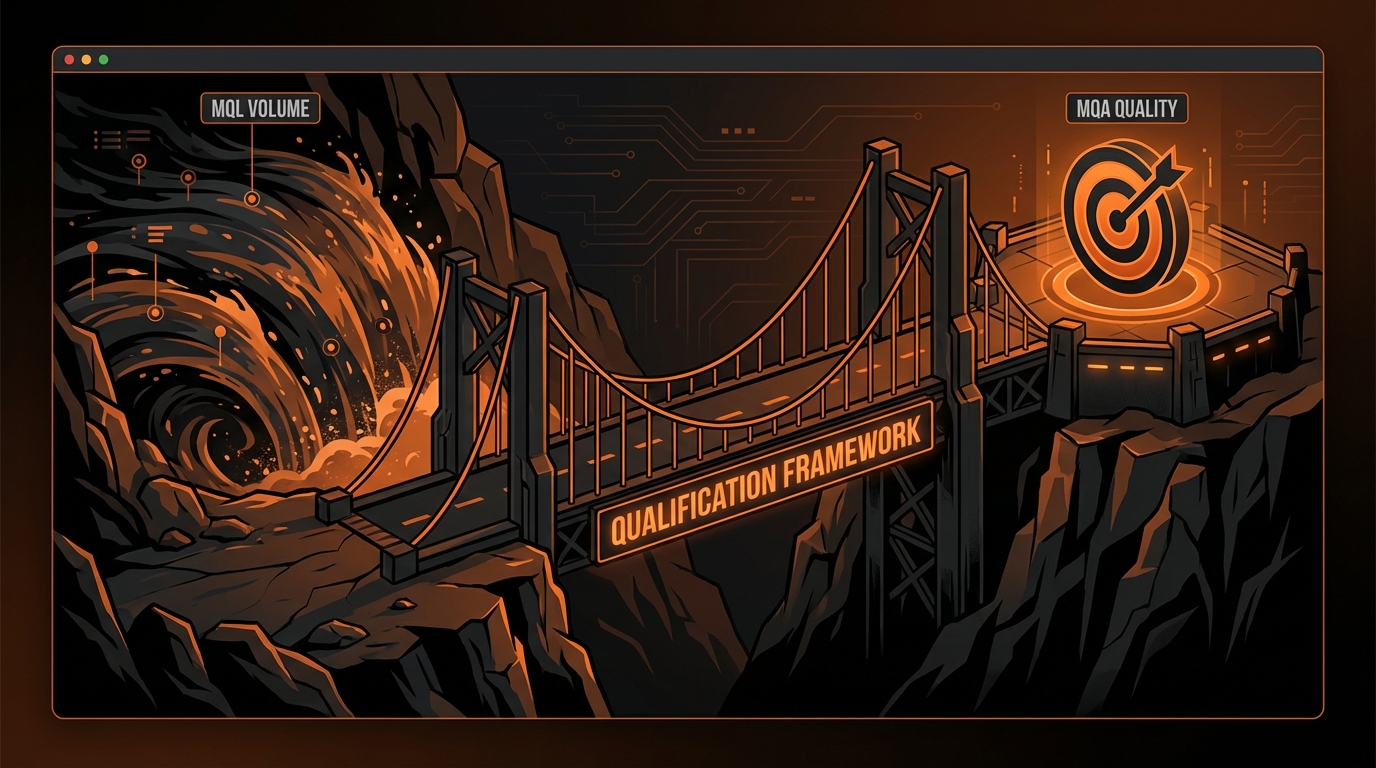

Phase 3: The Lead Generation Bridge (MQL to MQA Conversion)

ABM isn’t about ignoring inbound leads. It’s about weaponizing them.

This phase is your Lead Generation Bridge. It’s the mandatory process we use to convert generic inbound traffic (MQLs) into highly qualified Target Accounts (MQAs).

If you don’t build this bridge, your sales team will waste time chasing generic form fills.

This is the precise, four-step playbook for qualifying inbound leads and integrating them into your strategic ABM framework:

- Inbound Capture & Real-Time Enrichment.

A lead (MQL) fills out a form. Your system must immediately trigger AI-powered enrichment tools (like Pyrsonalize) to pull complete firmographic and technographic data.

You cannot afford to wait for manual qualification. Speed is mandatory here.

- Account Matching & Prioritization Scoring.

Match the MQL to an existing account in your CRM. If the account is already on your established Target Account List (TAL), they skip the line,the MQL is instantly prioritized.

If the account is new but scores highly against your ideal customer profile (ICP) criteria, it is immediately added to the 1:Few or 1:Many lists.

- Define the MQA Threshold (The Double Signal).

An account only becomes a Marketing Qualified Account (MQA) when it meets one of two crucial criteria. This prevents sales time waste.

- Path A: High Intent Signal Confirmation. The account shows documented high intent (e.g., specific pricing page visits, high-value asset downloads, or confirmed third-party intent data).

- Path B: Multi-Stakeholder Engagement. At least three different decision-makers or key influencers from that account have engaged with your content or product within a defined period (e.g., 30 days).

- The Zero-Delay Handoff Protocol.

The MQA threshold is the firing gun. The account is instantly assigned to the dedicated SDR/Account Executive (AE) pair.

This handoff triggers the immediate launch of the personalized ABM sequence. Delay is revenue loss.

This systematic, data-driven bridge ensures that zero high-value inbound leads get lost in a generic, ineffective nurture stream. We turn curiosity into pipeline.

Phase 4: Sales & Marketing Alignment (Smarketing) 2025

Smarketing is the most critical failure point in most ABM setups.

It’s the step everyone talks about,and the one 90% of teams fail to execute correctly.

Forget the generic definition. For us, alignment means three things: shared metrics, co-owned budgets, and synchronized tool access. If you skip any of these, your ABM program is DOA (Dead On Arrival).

Our team doesn’t rely on weekly meetings to ensure alignment. We build alignment into the operational structure itself.

Non-Negotiable Smarketing Mandates:

- Shared Ownership of the TAL (Target Account List). Marketing does not unilaterally own the TAL,the entire GTM (Go-To-Market) team owns it. Sales must review, refine, and sign off on every account. If the Account Executive (AE) won’t commit to actively working the account, Marketing stops spending resources on it. Immediately.

- Mandatory Joint Campaign Kickoffs. For every 1:1 and 1:Few campaign, the Marketing Manager, SDR, and AE must conduct a mandatory kickoff meeting. Use this time to define the specific messaging, required assets, and the exact timeline. No kickoff, no campaign launch.

- Unified, Co-Owned Budgeting. The ABM budget is not segregated. If our Marketing team needs LinkedIn Ad credits to target the TAL, and the Sales team needs a custom direct mail drop, the money flows from the same co-owned pool. This ensures both teams prioritize the same accounts and eliminates budget silos.

- Real-Time Closed-Loop Feedback. When Sales rejects an MQA (Marketing Qualified Account), Marketing needs to know why immediately. This feedback loop is non-negotiable for refining the MQA scoring model and ensuring we stop wasting spend on accounts that will never close. (We use our lead generation software to track these real-time shifts, giving us granular detail on engagement vs. rejection reasons.)

Phase 5: Hyper-Personalization & Multi-Channel Engagement

Generic cold outreach dies on arrival when targeting high-value accounts. We are not aiming for “Hi [Name].” We are aiming for surgical precision.

The goal of ABM personalization is not merely mentioning their name; it is referencing their specific, unique, and verifiable business challenge right now. If you fail here, all that Smarketing alignment (Phase 4) was wasted.

Our Proven 3-Step Personalization Playbook:

- The Problem Statement Layer (Deep Research):

Forget surface-level trigger events. Your team must identify a specific, verifiable, and current pain point. This requires deep intent data analysis.

(And yes, leveraging our AI tools to find this data faster is mandatory if you intend to scale personalization.)

Example: “I see your recent CDP integration likely created data silo issues for your sales org. We solved that for [Competitor Name].”

- The Asset Layer (Custom Content):

You cannot use generic content. Create or modify an existing high-value asset—a case study, report, or video—that directly resolves the Problem Statement identified in Step 1.

For true 1:1 ABM, this means building a custom landing page. (Title it something like: “The [Target Company Name] Roadmap to a 77% Revenue Boost.” This is the credibility hook.)

- The Delivery Layer (Multi-Channel Blitz):

Coordinate outreach across four critical channels simultaneously. Synchronization is key to maximizing impact and ensuring the target account sees the same message everywhere.

- Direct Email: Highly personalized messaging, delivered directly to the decision-maker’s personal work email. (This is where Pyrsonalize is non-negotiable for 1:1 success. We skip the generic info@ addresses entirely.)

- LinkedIn: SDR/AE connection requests and personalized InMail referencing the exact pain point and asset. (Ensure you are using a Compliant AI LinkedIn Lead Gen Stack—do not risk your account for volume.)

- Targeted Ads: Use dedicated ABM ad platforms (like RollWorks or Terminus) to serve the custom Asset Layer content only to employees within the target account’s IP range. This amplifies the message frequency dramatically.

- Direct Mail/Gifts (1:1 Only): A physical touchpoint that breaks through the digital noise. Use this sparingly, but use it strategically—it must reference the Problem Statement.

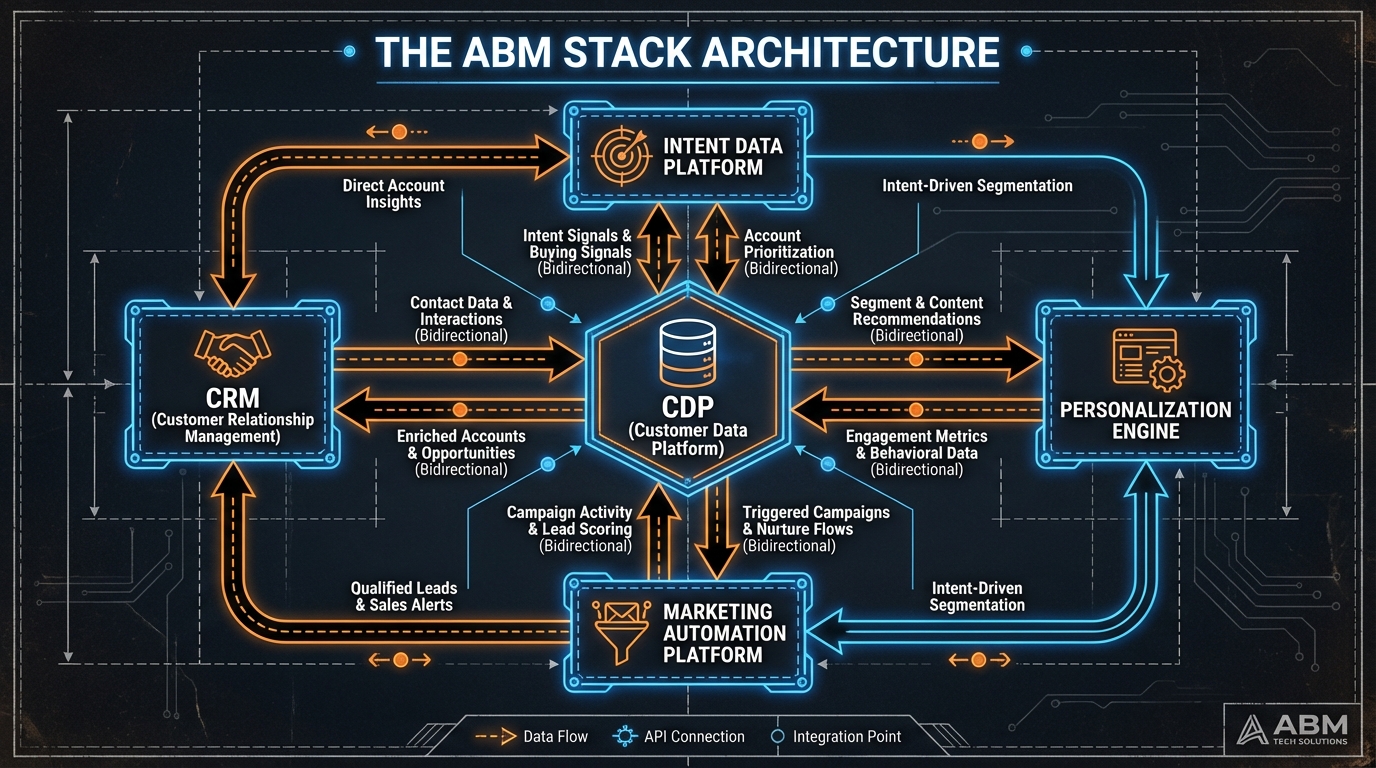

Phase 6: Integrated Technology Mapping (The ABM Stack)

You cannot execute surgical, multi-channel outreach (Phase 5) if your tools don’t talk to each other.

ABM is fundamentally impossible without a cohesive tech stack. Siloed tools don’t just reduce efficiency,they actively corrupt your data quality and kill deals. We know because our team has had to scrap and rebuild several client systems that failed due to poor integration.

Your stack must facilitate a flawless, circular flow of data: from identification (Phase 2) to engagement (Phase 5) and back to measurement (Phase 7).

We mandate four core components for any winning ABM stack:

- The CRM (The Single Source of Truth): This is the foundation. Whether you run on Salesforce or HubSpot, this is where your Target Account List (TAL) lives. All activities must be logged here. This system finalizes the MQA (Marketing Qualified Account) status.

- Data Enrichment & Intent Signals: This is where you acquire the intelligence needed for surgical personalization. We are talking technographics, firmographics, and real-time intent signals (e.g., ZoomInfo, Clearbit, specialized intent providers). This is the stage where Pyrsonalize delivers critical leverage. We provide the verified contact-level data (personal emails, mobile numbers) necessary for true multi-channel engagement. You simply cannot execute Phase 5 without this level of data verification.

- Marketing Automation Platform (MAP) & Ad Targeting (Air Cover): These tools handle the mass communication and targeted air cover. Think email nurture sequences, IP-based web personalization, and account-specific ad distribution (e.g., Terminus, HubSpot ABM features, Marketo).

- Sales Engagement Platform (The Execution Layer): This is the engine for your SDRs and AEs. Tools like Outreach or Salesloft sequence outreach across email, phone, and social. The non-negotiable requirement: Direct integration with the CRM. Every touch must update the Account Record instantly.

The biggest failure point we see is latency in data flow. If your real-time Intent data doesn’t immediately update the Account Record in your CRM, your Sales team is working blind,using outdated context. Integration is not optional; it is the fundamental infrastructure of ABM success.

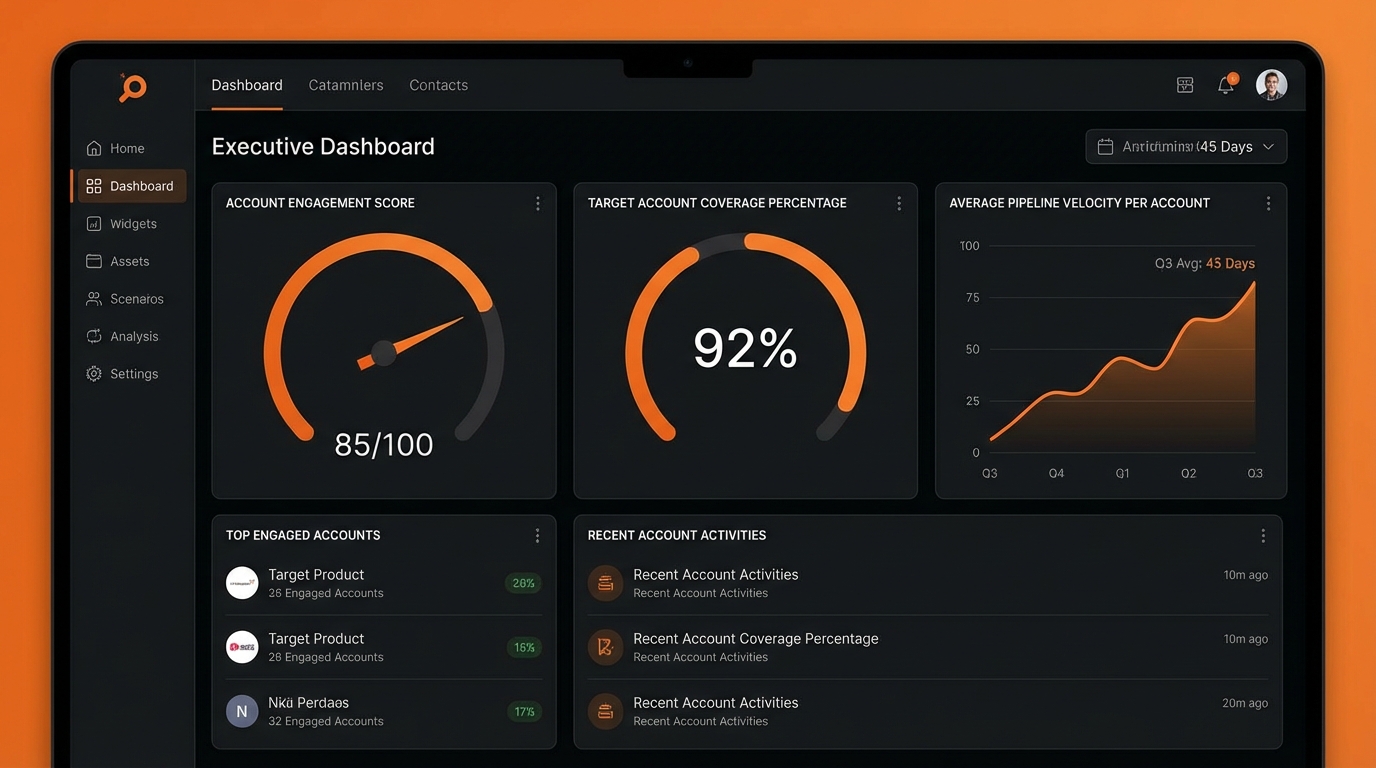

Phase 7: Account-Centric Metrics and Optimization

If you are still tracking Marketing Qualified Leads (MQLs), you are measuring the wrong thing entirely.

ABM is a strategic investment, not a volume game. Success is measured by account movement, pipeline acceleration, and verifiable financial outcomes. Period.

We focus our optimization efforts on three crucial metric categories. These are the KPIs that drive scalable revenue, not vanity metrics:

1. Coverage and Awareness

- Target Account Reach: The percentage of key decision-makers within the Target Account List (TAL) for whom we have successfully identified and enriched contact data. (We benchmark 70%+ reach for 1:1 accounts,anything less means your personalization efforts will fail.)

- Account Web Traffic: Tracked visits from your TAL using reverse IP lookup tools (e.g., Clearbit Reveal, Leadfeeder). This validates whether your awareness campaigns are hitting the right targets.

- Awareness Score: A composite score tracking how many key contacts within an account have engaged with your content across all channels (website, ads, email sequences). This is the leading indicator of MQA status.

2. Engagement and Pipeline

- Marketing Qualified Accounts (MQAs): The total number of accounts that have crossed your defined engagement and intent threshold (defined back in Phase 3). This is the key handoff metric for the sales team.

- Pipeline Velocity: How quickly targeted accounts move from MQA status to Opportunity creation compared to non-targeted, inbound accounts. (If ABM isn’t faster, your targeting is inefficient.)

- Pipeline Contribution: The percentage of total sales pipeline generated directly from the ABM program.

3. Financial Outcomes

- Average Contract Value (ACV) Lift: Is the ACV of ABM-sourced deals demonstrably higher than traditional inbound deals? (If the answer is no, your targeting criteria or your TAL is fundamentally flawed.)

- Customer Lifetime Value (CLV): ABM accounts should exhibit lower churn and higher long-term value due to better fit, deeper relationships, and personalized onboarding.

- ROI per Account: Total net revenue generated divided by the total cost (technology, human resources, ad spend) invested in that specific account. (The ultimate measure of ABM effectiveness.)

This optimization loop requires precision. You need real-time data to make resource decisions. Our team leverages AI Predictive Lead Scoring to constantly refine which accounts in your 1:Many pool are trending toward MQA status. This allows you to shift SDR resources proactively,before the competition notices.

Frequently Asked Questions

What is the core difference between ABM and traditional B2B lead generation?

-

Traditional lead generation (LG) is a classic “cast a wide net” strategy focused purely on volume (MQLs) and converting individuals. We treat ABM as strategic “spearfishing.”

It’s about quality (MQAs), not quantity. You are treating the entire account,the full buying committee,as your single market. The approach is inverted:

- Traditional LG: Starts with the individual lead and works outward. Tactical.

- ABM: Starts with the Ideal Customer Profile (ICP) account and works inward. Highly strategic.

How does PLG data fit into the ABM framework for SaaS?

-

Product-Led Growth (PLG) data is, hands down, the most reliable intent signal we have access to. It eliminates the guesswork inherent in third-party data.

When multiple employees from a high-value company sign up for your free tier,or hit a critical usage milestone,that account automatically flags as a high-priority MQA. This verifiable usage data fuels two critical actions:

- It dictates your Target Account List (TAL) prioritization (who gets outreach first).

- It provides hyper-specific personalization fodder for sales outreach (what to talk about).

What is an Intent-Qualified Account (IQA)?

-

An IQA is an elite subset of your Marketing Qualified Accounts (MQAs). These are the targets you must prioritize immediately.

An account must meet your full Ideal Customer Profile (ICP) criteria AND demonstrate active, verifiable digital behavior, indicating they are currently “in-market” for a solution like yours. This behavior includes:

- High web engagement (multiple decision-makers viewing pricing pages).

- Downloading specific, high-value guides.

- Confirmed third-party intent data signals (e.g., researching competitors).

IQAs are the hottest targets on your list. They receive the highest priority and the most aggressive, hyper-personalized outreach sequences.

What is the recommended budget split for a 1:Few ABM campaign?

-

When running a high-impact 1:Few campaign (typically focused on the mid-market), our team utilizes this budget allocation model to scale personalization efficiently:

- 40% Tools & Data: Intent platforms, enrichment tools, and critical ad platforms (this is the non-negotiable foundational infrastructure).

- 40% Human Resources: SDR/AE time, specialized researchers, and outreach roles.

- 20% Content & Assets: Customized templates, segmented case studies, and hyper-relevant creative.

The mandate here is clear: You must scale personalization without sacrificing the quality of the engagement. This split achieves that goal.

Ready to take the next step?

Stop relying on generic databases. Start finding the personal emails of decision-makers in your Target Accounts today.

Start Your Free Trial

Click Here to Start Your Free Trial