Most founders and sales leaders conflate Demand Generation (DG) and Lead Generation (LG).

They use the terms interchangeably. Worse: they treat them as opposing forces.

This is a strategic mistake in the SaaS world.

The traditional marketing funnel model is broken for complex B2B sales cycles. Why?

It fails to account for multi-stakeholder purchasing, dark social influence, and the critical shift away from MQLs to actual sales pipeline velocity.

Our team scaled organic lead flow by 77%. We achieved this by systematically understanding exactly where DG ends and where LG begins.

We treat them as sequential components of one unified growth engine,not separate departments fighting over budget.

You need a blueprint that moves beyond abstract definitions. Specifically: You need to know which tactics drive market awareness and which ones generate high-intent, personal email addresses ready for conversion.

Key Takeaways for SaaS Leaders

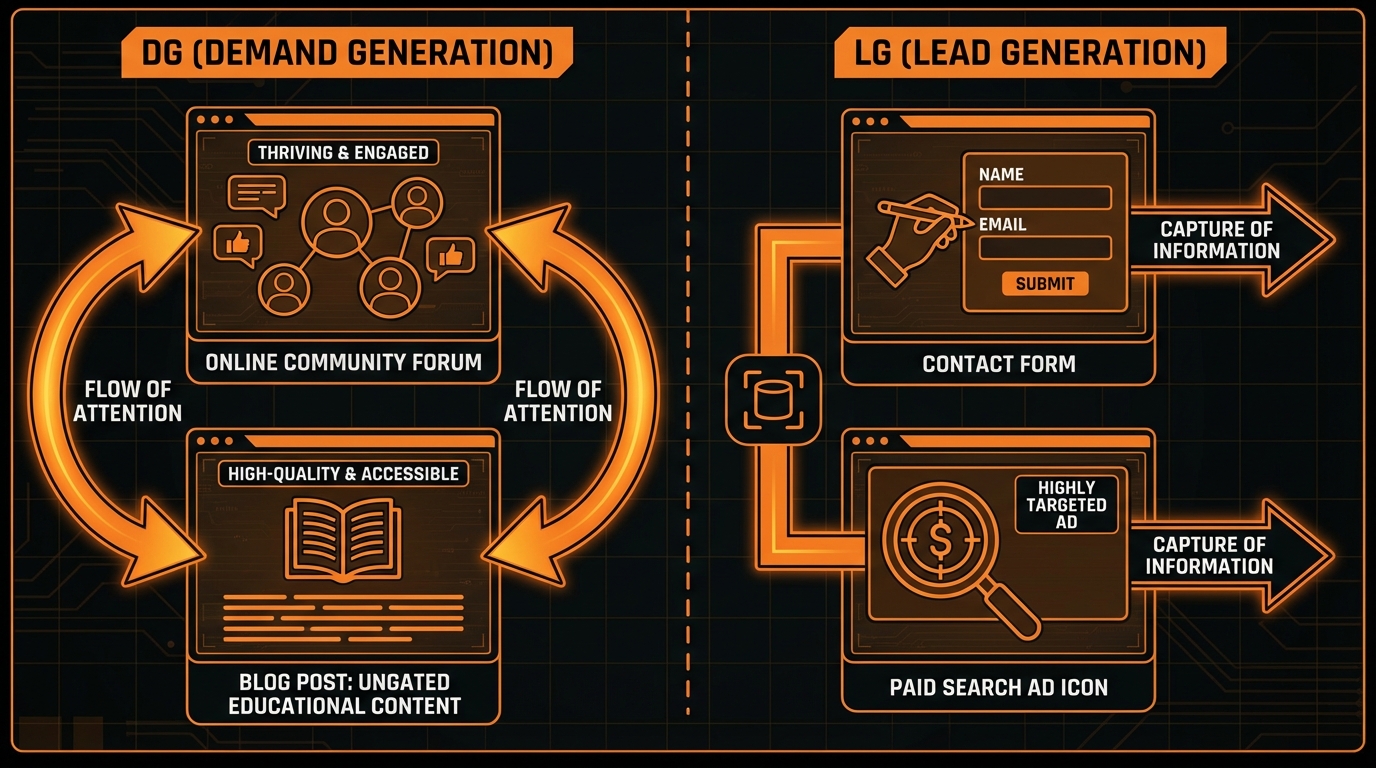

- DG is Top-of-Funnel Trust: It builds market awareness and trust, typically through ungated educational content, valuable community engagement, and Dark Social tactics.

- LG is Bottom-of-Funnel Transaction: It captures identifiable contact information (e.g., verified personal emails) from prospects who have already signaled high intent.

- The MQL Trap is Real: Gated content MQLs rarely convert in modern SaaS. Your focus must shift to Sales-Accepted Leads (SALs) or Product Qualified Leads (PQLs).

- Attribution Matters: DG success is measured by Self-Reported Attribution (SRA) and Brand Search Volume. LG success is measured by CPA and Win Rate.

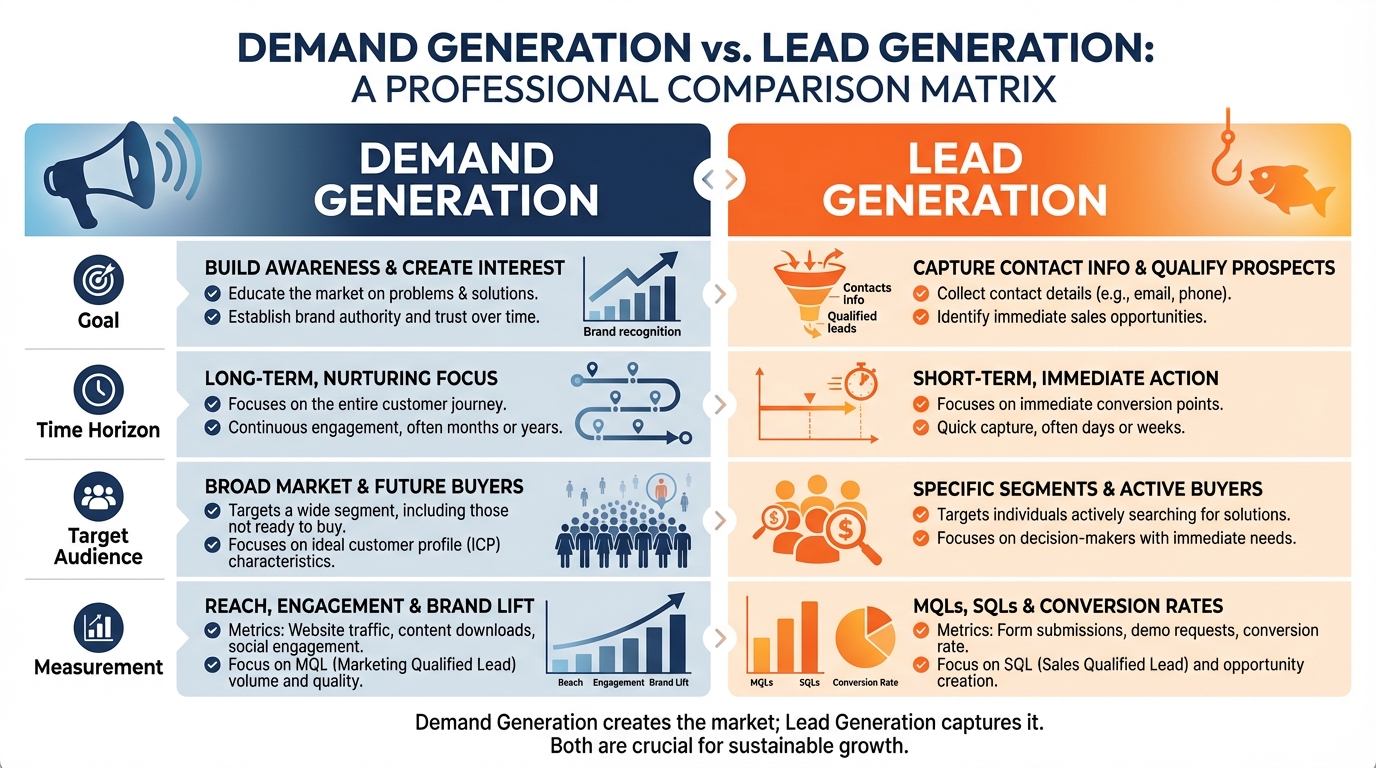

Foundational Definitions: The Core Comparison Matrix

We need to define the scope immediately. This is non-negotiable.

Demand Generation (DG) creates the market conditions for success. Lead Generation (LG) capitalizes on those conditions.

If your goal is increasing the sheer volume of people who know your solution exists,and actively trust your expertise,you are executing DG.

If you are aiming to exchange high-value assets (a demo, a free trial, access to proprietary data) for a client’s verifiable contact information, you are doing LG.

Understand this: LG is a transaction. It is not a favor. It’s the direct injection of pipeline potential.

To build a scalable SaaS engine, you must understand the operational differences. Here is how DG and LG contrast across five critical strategic dimensions:

| Dimension | Demand Generation (DG) | Lead Generation (LG) |

|---|---|---|

| Primary Focus | Market Creation, Authority Staking, Trust Architecture | Contact Capture, Conversion Rate Optimization (CRO), Pipeline Filling |

| Funnel Stage | Top-of-Funnel (TOFU) and Early Middle-of-Funnel (MOFU) | Late MOFU and Bottom-of-Funnel (BOFU) |

| Key Tactic Example | Ungated Thought Leadership (Content that helps, not sells), Strategic Partnerships, Authority Reviews | Free trial sign-ups, Demo requests, Pricing page conversion (High-intent actions) |

| Desired Outcome | Category Creation, Increased Direct/Brand Search Volume, Faster Pipeline Velocity | Qualified Leads (SALs/PQLs), Closed Won Deals, Immediate Revenue |

| Target Audience | The Total Addressable Market (TAM), Future Buyers, Industry Gatekeepers | Specific, high-intent individuals ready to buy (The Hired Guns) |

The Unique SaaS Context: Why The Old Funnel Is Obsolete

SaaS marketing is not B2C. It operates under unique pressures that render traditional marketing funnels obsolete.

Here is the reality:

- The buyer journey is non-linear, complex, and unnecessarily long.

- Purchasing requires navigating multiple stakeholders (Procurement, IT, End-User).

- Competition is fierce. Trust is not a bonus,it’s the only true differentiator.

Because of this extended complexity, the traditional hand-off from Marketing (DG) to Sales (LG) doesn’t just fail; it fails catastrophically. We call this the MQL Trap.

The MQL Trap and the Shift to Intent

For decades, lead generation relied on the Marketing Qualified Lead (MQL). This meant someone downloads a generic whitepaper, and Marketing immediately dumps them on Sales.

In 2025 (and beyond), the MQL is dead.

Why? Modern buyers are interruption-averse. They know downloading that “free” eBook is a contract for 12 pushy follow-up emails from an SDR.

This cycle generates low-quality leads, wastes high-value SDR time, and guarantees severe misalignment between your teams.

We must stop prioritizing contact forms. We need to focus on Intent Signals.

Intent signals are behavioral data points proving someone is actively searching for a solution,not just passively consuming content.

Lead Generation must target these high-intent signals exclusively:

- Searching for “Alternatives to [Competitor X]”. (This is high commercial intent.)

- Visiting your pricing page multiple times in a short window.

- Using an AI tool to find clients personal emails based on specific job titles and tech stacks.

- Engaging deeply with a free tool or calculator on your site. (This shows active problem-solving commitment.)

The goal is simple: Move from MQLs (low intent, high volume) to Sales-Accepted Leads (SALs). These are leads Sales has already vetted and agreed are worth dedicating resources to.

Stop measuring success by the volume of names in your CRM. Start measuring it by the percentage of leads that Sales actually accepts, schedules a meeting with, and converts to pipeline. That is pragmatic growth.

Tactical Deep Dive: Deploying DG and LG Across Key SaaS Channels

The biggest mistake we see founders make? Assuming a channel is inherently Demand Gen or Lead Gen.

It isn’t. The channel is just the delivery mechanism. The tactic applied to that channel determines its function, its intent, and its resulting quality.

1. Content Marketing: Ungated vs. Gated Assets

This is the clearest, most critical distinction. Master this, and your MQL quality immediately jumps by 40%.

- Demand Generation Content (Ungated): This content must solve a problem immediately. It builds brand equity and establishes trust. It requires zero commitment from the user. Think benchmark reports, long-form guides, and expert opinion pieces. (We prioritize ungated content because it maximizes organic search visibility and shareability.)

- Lead Generation Content (High-Intent Gated): This is transactional content. It must be a specific, high-value asset that warrants asking for contact information,or, ideally, it’s the direct offer of your product itself.

The Rule: If you gate a generic, introductory eBook, you are diluting your brand and generating low-quality MQLs. If you gate access to a proprietary AI prospecting tool (like ours) or a personalized ROI calculator, you are generating high-intent LG.

2. Community and Dark Social: The DG Powerhouse

In 2025, the buying process is happening in the shadows. Buyers are making decisions in private, untrackable spaces,what we call Dark Social.

- Private Slack channels (The new water cooler).

- WhatsApp/Telegram groups.

- Review sites (G2, Capterra).

Demand Generation dominates here. Why? Because it’s about establishing presence, genuine helpfulness, and trust,not immediate capture. LG tactics look spammy and amateur in these environments.

Actionable DG Tactics in Dark Social:

- Review Sites (G2/Trustpilot): Ensure relentless social proof and transparent pricing. Buyers check these sites before they ever hit your homepage. Treat them as owned media.

- Community Engagement: Deploy your founding team or top experts to consistently answer questions in industry Slack/Discord channels. Do not pitch. Provide genuine, non-monetized value.

- Thought Leadership (Podcasting/Video): Long-form audio/video builds unparalleled trust and authority. This DG effort establishes thought leadership that leads to high-intent brand search (a definitive LG signal) later down the line.

You cannot directly “lead gen” in these spaces. Your goal is to generate the demand that compels the prospect to search for your brand specifically.

3. PLG Integration: DG Feeds the Funnel, LG Drives Revenue

For modern Product-Led Growth (PLG) SaaS companies, the DG/LG distinction is perfectly defined. It’s a clean handoff.

The DG Role in PLG: DG creates massive awareness around the problem and positions the freemium or free trial as the fastest, most obvious solution. It focuses entirely on driving qualified traffic volume to the sign-up page (acquisition).

The LG Role in PLG: LG takes over the moment the user is inside the product. This is where we focus on converting Product Qualified Leads (PQLs).

PQL conversion is pure, high-intent Lead Generation. We analyze specific usage patterns that signal a high likelihood to pay:

- Used core feature X five times.

- Invited two or more teammates to the workspace.

- Hit a critical usage limit (The expansion cue).

This hybrid approach is non-negotiable for scaling SaaS in 2025. Our team detailed this strategic move in our guide on the PLG vs. SLG Lead Gen: The 2025 Hybrid Sales Blueprint.

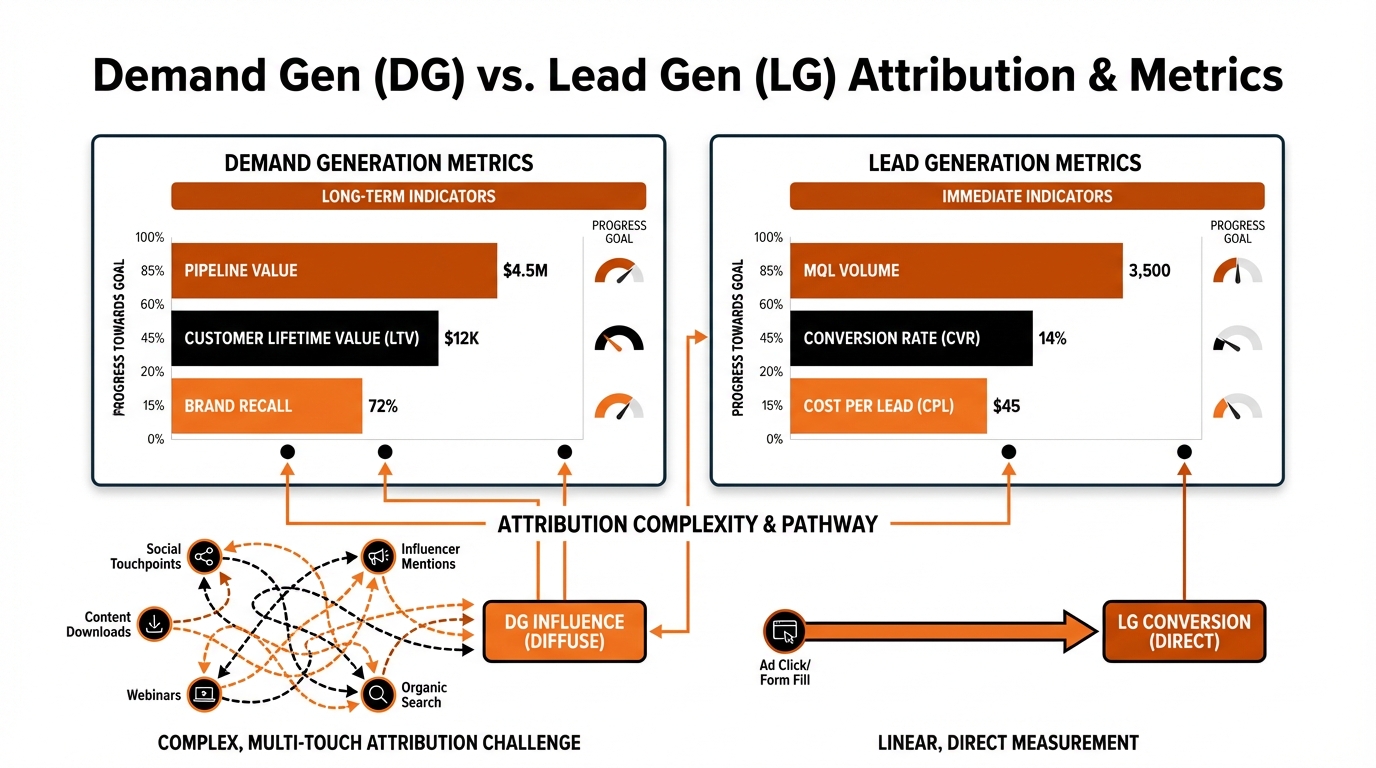

Metrics and Attribution for SaaS Growth

Here is the cold, hard truth: The failure to align DG and LG metrics is the primary source of conflict,and revenue leakage,between marketing and sales.

If your marketing team is compensated solely on MQL volume (a DG metric misapplied to LG), they will generate junk leads. Guaranteed.

Conversely, if sales is only measured by immediate closed revenue (the ultimate LG metric), they will actively ignore the crucial, long-term DG investments that build future pipeline.

You cannot afford this misalignment. You must measure Demand Generation and Lead Generation using separate, appropriate KPIs.

Demand Generation Metrics (Long-Term Health)

These metrics track the health and efficiency of your brand-building efforts. They are leading indicators of future LG success. Think of them as the vital signs of your market presence.

- Self-Reported Attribution (SRA): This is the single most crucial DG metric. We implement the simple “How did you hear about us?” question on every demo form. If the prospect answers “Podcast,” “LinkedIn,” or “Heard about you from a friend,” that is definitive DG success. (It’s proof the market trusts you, not just your ads.)

- Brand Search Volume: Track the monthly volume of searches for your company name or specific product features. A steady, consistent increase means your DG campaigns are breaking through the noise and generating pull.

- Pipeline Velocity: How quickly do prospects move through the sales stages? Strong DG shortens the sales cycle dramatically because prospects arrive pre-educated and pre-sold on your value proposition.

- Website Traffic (Ungated Content): High, sustained traffic to educational content (blogs, guides, resource hubs) indicates genuine market interest,not just traffic bought for a quick conversion.

Lead Generation Metrics (Immediate ROI)

These metrics are purely transactional. They track the immediate efficiency of your capture systems and the resulting sales outcomes.

- Cost Per Acquisition (CPA): We track this relentlessly. How much did it cost to convert a high-intent lead (like a free trial sign-up, or a client found using our AI software) into a paying customer? This metric determines profitability.

- Conversion Rate (Lead-to-Opportunity): This is the true measure of lead quality. It’s the percentage of captured leads (e.g., demo requests, PQLs) that successfully convert into qualified sales opportunities (SQLs).

- Win Rate of SALs/PQLs: What percentage of the leads deemed “sales-accepted” or “product-qualified” actually close? A high win rate confirms that your LG qualifying process is surgical, not leaky.

- Time to Conversion (TTC): How long does it take from the exact moment a lead is captured (form fill, trial start) until the first payment is processed? This metric heavily influences cash flow projections.

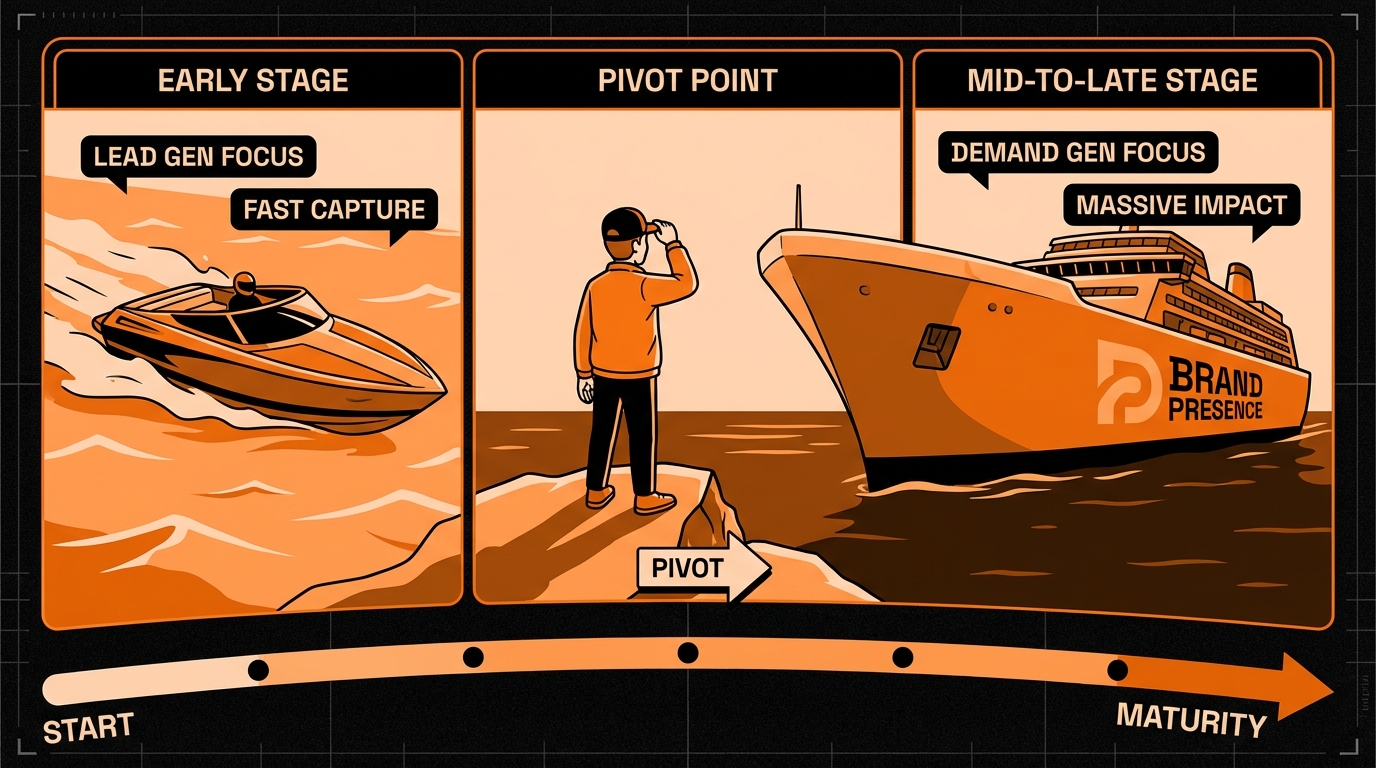

Strategic Alignment and Maturity: When To Prioritize What

The failures in metric alignment (which we just covered) are a symptom of a deeper operational problem: trying to execute two different strategies simultaneously.

You cannot do both perfectly from day one. Resource allocation is a strategic, pragmatic choice based on where your SaaS company sits in the market maturity curve.

Budget Allocation: Early Stage vs. Scale

Stage 1: Early-Stage SaaS (Pre-Series A)

Prioritize: Lead Generation (LG).

You need immediate revenue validation and proof of concept. This is about survival, not brand building. You must focus on the bottom of the funnel to secure quick wins and establish product-market fit. (Cash flow dictates strategy here.)

- Tactic: Highly targeted, feature-specific PPC ads, direct outreach using AI prospecting tools (the fastest route to pipeline), and maximizing conversions on existing landing pages.

- Goal: Generate $X in pipeline contribution this quarter and validate the ICP.

- Budget Split: 80% LG / 20% DG (Minimal, focused on foundational content).

Stage 2: Scaling SaaS (Growth Stage)

Prioritize: Demand Generation (DG) Investment.

Once you have validated the product and need to aggressively expand market share, pure LG becomes expensive and unsustainable. Relying only on LG drives up your Cost Per Acquisition (CPA) dramatically.

You need DG to lower your overall CPA and feed a larger, cheaper pool of aware, educated prospects.

- Tactic: Investing heavily in ungated, authoritative content, running brand campaigns (not based on direct conversion), launching a podcast, and building a community presence.

- Goal: Increase brand search volume by 50% year-on-year and decrease reliance on paid channels.

- Budget Split: 60% DG / 40% LG (LG maintains conversion efficiency).

Smarketing Alignment: The Shared Revenue Blueprint

The DG/LG silo must be eliminated. It is a cancer on revenue growth.

The only way to achieve true, scalable growth is through Smarketing (Sales and Marketing alignment) where both teams share a common revenue goal,not separate MQL and closed-won targets.

This alignment requires operational discipline. Here is our non-negotiable blueprint:

- Non-Negotiable Definition of Quality: Marketing must agree with Sales on what constitutes an SAL (Sales Accepted Lead) or an SQL (Sales Qualified Lead). If Sales rejects a lead, Marketing must analyze the rejection reason immediately and adjust their lead capture criteria. (No excuses.)

- Mandatory Closed-Loop Reporting: Sales must consistently feedback on the quality of leads and, crucially, the specific DG content that influenced them. This data immediately informs the DG team on what topics drive high-intent, not just high click volume.

- Eliminate the Attribution War: Use a CRM that tracks the entire, non-linear journey, from the first DG touchpoint (e.g., listening to a podcast episode or downloading a whitepaper) to the final LG conversion (demo booked). This eliminates the “Marketing vs. Sales” fight over who gets credit.

This integrated approach requires operational discipline and the right technology stack to track complex, multi-touch journeys. Our team outlined the exact technical and operational steps for this integration in our guide on the 2025 AI Lead Funnel: 7 Steps to Maximize Client Conversion. (You need to follow this blueprint if you plan to scale past $10M ARR.)

Frequently Asked Questions

Is Demand Generation just “Branding”?

-

Absolutely not. Traditional branding is often vague, focused solely on aesthetics or “vibes.”

Demand Generation (DG) is strategic branding with a P&L attached. We define it as the creation of market need using measurable, strategic tactics:

- Ungated educational content (high value, zero friction).

- Serious community building.

The goal is always to drive measurable intent signals,like increased Brand Search Volume,which directly impacts pipeline velocity later on. It builds trust, but its ultimate purpose is revenue generation.

Should a startup focus on DG or LG first?

-

If you are a new startup, you must prioritize Lead Generation first. Survival depends on immediate revenue and rapid market validation.

Lead Generation (LG) is built to capture high-intent leads who are ready to buy *right now*. DG is a long-term investment, requiring significant runway.

Scale DG only after you hit Product-Market Fit (PMF) and secure stable funding. The reality is that DG takes 6–12 months minimum before you see any significant ROI. You need LG wins to fund the DG experiment.

How long does it take to see results from Demand Generation?

-

DG is not a quick fix. It is a compounding investment, and we track results across distinct phases:

- Phase 1 (3–6 Months): Leading indicators manifest. You will see increased brand search volume and spikes in community engagement.

- Phase 2 (9–12 Months): Pipeline velocity improves dramatically. Customer Acquisition Cost (CAC) starts to drop significantly because your inbound leads are higher quality.

- Phase 3 (18+ Months): Compounding returns kick in. Unlike linear LG efforts, DG returns accelerate dramatically over time, making future growth exponentially cheaper and faster.

Can AI tools help with both DG and LG?

-

Absolutely. AI is fundamental to scaling both strategies, provided you use the right tools.

- For Lead Generation (LG): AI excels at precision. It identifies high-intent prospects, finds *verified personal contact data* (which is our specialty), and enables hyper-personalized, scalable outreach. This is the only way to bypass generic spam filters and reach decision-makers.

- For Demand Generation (DG): AI dramatically accelerates market intelligence. It analyzes trends, identifies competitor content gaps, and helps your content team prioritize the exact educational topics that will build the most authority and attract the highest quality audience pool.

Ready to take the next step?

Stop wasting time on generic MQLs. Find the high-intent personal emails of your ideal clients today.

Start Your Free TrialReferences

- Lead Generation vs. Demand Generation: Key Differences Explained

- Demand Generation vs. Lead Generation [The Definitive Guide]

- Demand Generation vs Lead Generation: Key Differences

- Demand Generation vs. Lead Generation: What’s the Difference?

- Demand Generation vs Lead Generation: The Key Differences – ON24