Let’s be direct: The debate between Product-Led Growth (PLG) and Sales-Led Growth (SLG) is officially over.

Pure-play models are obsolete. Especially in competitive B2B SaaS markets.

You simply cannot afford to ignore the efficiency of self-serve adoption (PLG) while simultaneously neglecting the revenue ceiling unlocked by high-touch enterprise sales (SLG).

We are now operating in the era of Product-Led Sales (PLS).

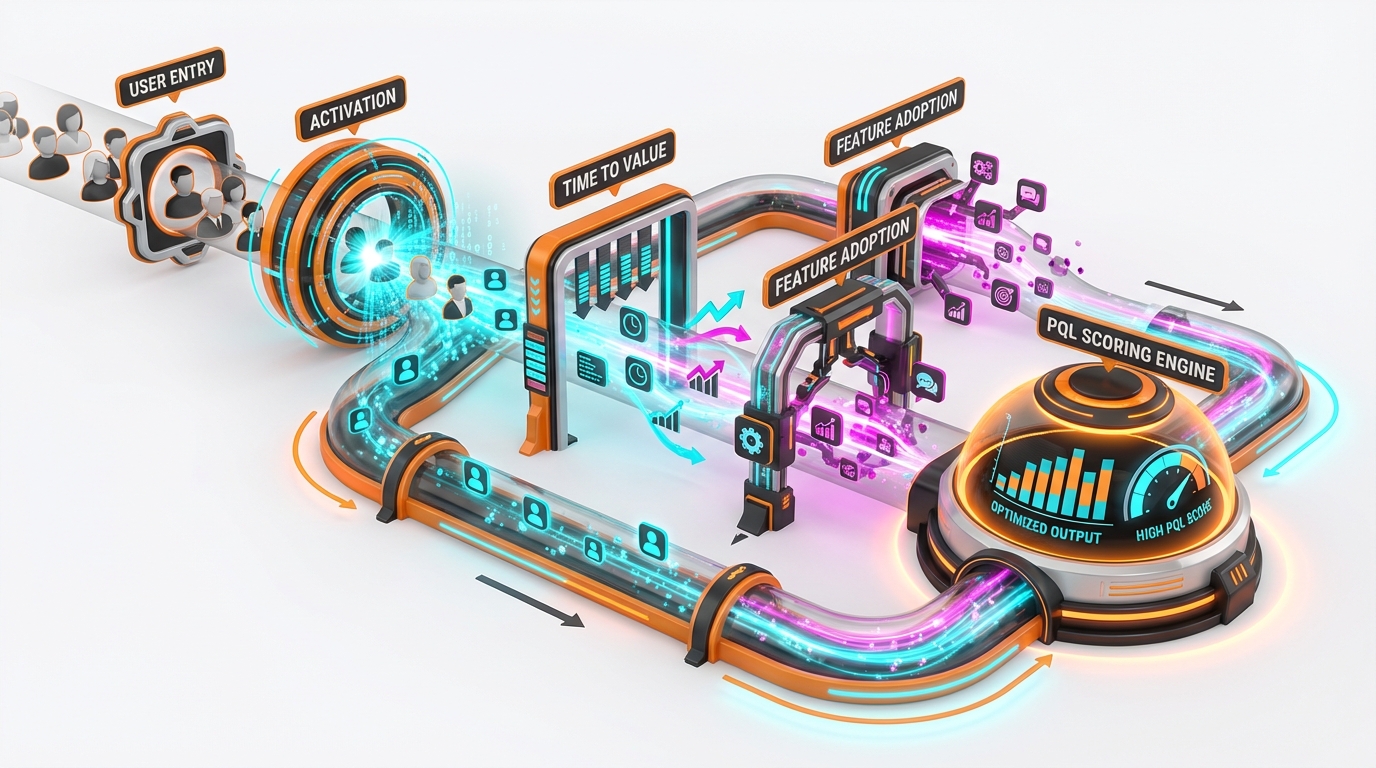

This hybrid approach demands total operational clarity. Specifically, you must standardize how you identify, score, and transition leads from a free product experience into a high-touch sales engagement.

This isn’t just theory. This is the pragmatic, step-by-step framework our team uses every day.

We engineer predictable revenue growth by combining AI-driven lead intelligence,finding the right client personal emails at the right time,with focused sales intervention. (It’s precisely how we achieved our 77% revenue boost.)

Key Takeaways:

- PLG is not replacing SLG. It is fueling it. The primary goal of modern PLG is to generate high-intent, pre-qualified leads (PQLs) for immediate sales intervention.

- Ditch MQLs. Focus on PQLs. Product usage data (activation signals) is a superior predictor of conversion than traditional marketing activity will ever be.

- The Handoff is the bottleneck. A successful hybrid model hinges entirely on a standardized, data-driven process for transitioning an activated user (PQL) into a sales-assisted conversation.

- Tech Stack Requirement: You need a robust Customer Data Platform (CDP) and predictive scoring capabilities to make the PLS model functional at scale. (And yes, that includes finding the decision-maker’s direct contact info immediately.)

The Foundational GTM Divide: SLG vs. PLG Mechanics

You cannot build a high-performing hybrid sales machine if you don’t fundamentally understand the foundational components you are mixing.

Most founders and sales leaders fundamentally misunderstand where their product truly sits on the traditional SLG/PLG spectrum.

We need to define these core mechanics first. The choice here is strategic, not philosophical,it is dictated entirely by your market, your product complexity, and buyer behavior.

Sales-Led Growth (SLG): Top-Down, High ACV, and Relationship-Driven

SLG is the legacy model. Revenue generation is driven almost entirely by the sales team, leveraging high-touch interaction and a necessary top-down approach (targeting C-level executives and key decision-makers).

When you sell complex, expensive, or highly regulated solutions, this approach is non-negotiable.

The Core DNA of SLG:

- High Friction is Necessary: The process requires extensive discovery, mandatory demos, complex contract negotiations, and lengthy security/compliance checks. (This friction protects your high Average Contract Value.)

- High Average Contract Value (ACV): Focus is exclusively on large enterprise contracts and mission-critical solutions (think $25k+ annual deals).

- Lead Type: Relies on Marketing Qualified Leads (MQLs). These are signals of *intent*,they downloaded your ebook or attended a webinar, but they have not yet used the product.

- Time-to-Value (TTV): Long. The user realizes value only after the contract is signed, the implementation is complete, and the integration is finalized.

Product-Led Growth (PLG): Bottom-Up, Self-Serve, and Velocity

PLG flips the script. The product itself is the primary engine for acquisition, conversion, and retention. The mantra is simple: Users try before they buy (or pay for advanced features).

This model prioritizes velocity and a low Customer Acquisition Cost (CAC).

The Core DNA of PLG:

- Zero Friction: Users sign up instantly via email or SSO. They must realize value immediately (low TTV).

- Low Initial ACV: Starts with freemium, free trials, or low-cost subscriptions. The goal is expansion and eventual monetization, not the initial sale.

- Lead Type: Relies on Product Qualified Leads (PQLs). This is gold. PQLs are based on actual, measurable product usage and demonstrated value realization.

- The Goal: Drive viral, organic growth and drastically reduce CAC by minimizing human interaction (at the lower tiers).

The choice between these two pure-play models is not based on preference. It is a pragmatic assessment dictated by market complexity and, crucially, how your buyer prefers to adopt new technology.

Use this decision matrix to determine your baseline position:

| Factor | Sales-Led Growth (SLG) | Product-Led Growth (PLG) |

|---|---|---|

| Product Complexity | High (Requires significant explanation, integration, and training) | Low (Intuitive, self-serve onboarding, quick setup) |

| Average Contract Value (ACV) | $25K+ (Enterprise and complex Mid-Market deals) | $0 – $5K (SMB, individual users, high volume) |

| Buyer Profile | C-Level Executives, Buying Committees, IT/Legal Sign-off Required | End-User, Developer, Team Manager, Individual Contributor |

| Primary Value Driver | Personalized relationship, customization, risk mitigation, and support | Immediate utility, speed of adoption, and time-to-value (TTV) |

Operational Deep Dive: PLG Lead Mechanics

Stop treating your free users like newsletter subscribers. If you want efficient lead generation in 2025, you must master the mechanics of the Product Qualified Lead (PQL).

This is the single biggest failure point we observe: companies scoring PQLs like Marketing Qualified Leads (MQLs). They are fundamentally different.

We need to redefine what a “lead” actually means in a PLG context. We focus exclusively on users who are actively solving a mission-critical problem using our tool,not those who merely downloaded a whitepaper.

Defining the PQL and PQA

For high-velocity PLG sales, precision is everything. Here are the definitions our team uses:

- Product Qualified Lead (PQL): A single user who has hit the “Aha!” moment. They have experienced the product’s core value and demonstrated specific activation behaviors that signal a high probability of conversion to paid status.

- Product Qualified Account (PQA): The enterprise-level counterpart. This signifies an entire account (company) where multiple users have hit activation milestones, indicating organizational buy-in, widespread adoption, and a massive expansion opportunity.

Activation Signals: What We Actually Track

The entire PQL strategy hinges on identifying the precise “Aha!” moment,the point where the user realizes the core value proposition. This moment is unique to every product, but our team organizes the critical signals into three strategic categories for scoring:

- Depth of Usage (Individual Commitment): These signals prove the user is relying on your solution.

- Completed core setup steps (e.g., integrating a data source, connecting required APIs).

- Reached a feature limit on the free plan (This is the monetization trigger,they need to upgrade now).

- High frequency of use (daily/weekly active users sustained over a 30-day period).

- Breadth of Usage (Virality & PQA Momentum): These signals prove organizational adoption.

- Invited X number of team members (The primary PQA signal).

- Shared or exported work product Y times outside of the organization.

- Used the product across multiple distinct departments or use cases (indicating versatility).

- Intent and Pain Points (Monetization Readiness): These signals prove they are actively considering the paid tier.

- Attempted to access a paid-only feature (clear upgrade intent).

- Engaged with in-product support or chat regarding billing, pricing, or enterprise features.

- Usage patterns that suggest the free plan is now causing significant friction (e.g., hitting storage limits or dealing with major watermarks).

We don’t rely on static scoring models. Our approach uses dynamic AI weighting to prioritize these signals.

Example: A user who invites five team members and hits a paid feature limit is exponentially more valuable,and requires immediate sales intervention,than a user who logs in daily but only uses basic functionality.

To pinpoint these high-value users instantly, you need automated prioritization. For a detailed breakdown on how we automate this process, read our guide on AI Predictive Lead Scoring Models Explained.

Ready to identify your PQLs instantly? Start Your Free Trial Now.

The Future is Hybrid: Product-Led Sales (PLS) Flow

Pure PLG is not a silver bullet. It excels at acquiring SMBs and accelerating velocity,but it hits a hard revenue ceiling when targeting customized, high-ACV enterprise deals.

Enterprise deals require human negotiation, complex integration, and stakeholder alignment. The product cannot close these deals alone.

This is why 90% of successful PLG companies eventually layer in a dedicated sales team, creating the crucial Product-Led Sales (PLS) motion.

We call this the hybrid model. It is the future of scaling revenue.

The PQL-to-Sales Handoff: Precision Timing and Criteria

The handoff point is the single most delicate operation in the PLS model. If you hand off too early, you waste expensive sales time. If you hand off too late, you miss the window of high intent.

Sales must engage only when two conditions are met: the user is highly activated, and the potential Annual Contract Value (ACV) justifies the cost of human interaction.

Our team uses a strict, four-point filter for Sales Assist intervention:

- High PQL Score (The Activation Signal): The lead must exceed a non-negotiable, pre-defined usage threshold (e.g., 85/100). This score validates deep product adoption.

- Product Qualified Account (PQA): The account firmographics must align perfectly with your enterprise Ideal Customer Profile (ICP). We look for 500+ employees, Series C funding, or specific revenue markers. If the PQL score is high but the PQA is low (i.e., a solo founder), the lead is disqualified from sales intervention.

- Critical Intent Signal: The user triggered a specific, high-value action that indicates a need for scale. Examples: accessing the “Integrations” page for Salesforce or SAP, inviting 10+ teammates, or downloading the security whitepaper.

- Time-Bound Constraint: Urgency is key. The user is either approaching the end of their free trial or has recently hit a critical usage wall (e.g., 90% of their data limit used). This creates immediate leverage for the sales rep.

If the user hits the PQL score but fails the PQA filter (i.e., they are a perfect user but a low-value account), they remain strictly in the self-serve funnel. Sales time is the most expensive resource you have. Do not waste it manually closing $99/month contracts. Automated email sequences and in-product nudges handle those conversions.

Step-by-Step: Executing the Contextual Intervention

When the four criteria are met, the SDR does not launch a traditional cold outreach sequence. That approach fails 99% of the time.

Instead, they execute a Contextual Intervention. This means the outreach is not about selling; it’s about solving a specific, observed bottleneck.

- Deliver the Data Package: The PQL system must instantly deliver a complete data profile to the assigned SDR. This package must include: user firmographics, job title, exact sequence of actions taken, and the specific usage wall they hit.

- Hyper-Contextual Outreach: The outreach (email, LinkedIn, or in-app message) must reference the specific, observed action. This is the only way to break through the noise.

“Our system flagged that you connected three data sources in the last 48 hours, hitting the limit on your current plan. We see this when teams are trying to centralize their marketing stack. Our Enterprise tier includes unlimited data sources and dedicated support for integrating systems like HubSpot and SAP,which, based on your profile, you’ll need next week.”

- Amplify Value, Do Not Close: The initial goal is not to sell the product or book a demo. The goal is to help the user unlock more value faster. The sales rep acts as a consultant, offering to bypass self-serve friction points (e.g., custom configuration, security review, or complex billing).

- Focus on Organizational Expansion: For high-value PQAs, the rep’s mandate is immediate scale. They shift the conversation from individual use to stakeholder alignment, compliance, security, and scaling the solution across the entire organization. You are turning a $200/month individual subscription into a $75,000 annual contract.

This fundamentally transforms the sales rep’s role. They transition from a generic closer to a highly informed, specialized customer success consultant. This model dramatically boosts PQL-to-SQL conversion rates.

Organizational Structure: Integrating Product and Revenue Teams

Silos are the death knell of Product-Led Sales. In traditional Sales-Led Growth (SLG), misalignment usually occurs between Sales and Marketing. In a PLS framework, Sales and Product must be fully integrated.

This integration requires dedicated, cross-functional teams. We recommend structuring your revenue engine around specialized Growth Pods:

- The Core Growth Pod: This team owns the self-serve engine. Key roles: Product Manager, Growth Engineer, Data Scientist, and Product Marketer. Their mandate is optimizing Time-to-Value (TTV), activation rates, and free-to-paid conversions.

- The Product-Led Sales (PLS) Pod: This team owns the high-ACV handoff. Key roles: Dedicated SDRs, Account Executives, and a specialized Sales Operations analyst. Their mandate is maximizing PQL-to-SQL conversion rates and driving enterprise expansion revenue.

The crucial, non-negotiable link between these two pods is the Data Scientist. This role manages the PQL scoring model, continuously refines the PQA criteria, and ensures the Product team is optimizing features that generate high-ACV, high-scoring PQLs. Data integrity dictates your revenue ceiling.

The Metrics That Matter: PQL Conversion vs. MQL Volume

You adopted the hybrid Product-Led Sales (PLS) model for a reason: to capture high-ACV enterprise revenue efficiently.

That means you must immediately ditch outdated, volume-focused Sales-Led Growth (SLG) metrics. Tracking MQLs (Marketing Qualified Leads) is a vanity exercise when your product is the primary acquisition engine.

Comparing the Metrics: Efficiency vs. Scale

The classic SLG funnel (MQL → SQL → Closed Won) is obsessed with departmental handoffs and sheer volume. It’s slow, and it relies on hopeful outreach.

The PLS funnel, however, focuses entirely on efficiency, deep user engagement, and verifiable value realization. We track signals that prove intent, not just forms submitted.

If you are serious about scaling your hybrid model, these are the only metrics that deserve your team’s attention:

-

PQL Conversion Rate (The Ultimate Efficiency Signal).

This is the percentage of Product-Qualified Leads (users who hit your defined activation threshold) that convert to a paid plan, either self-serve or sales-assisted. This metric measures the effectiveness of your product experience and the precision of your sales intervention.

-

Time-to-Value (TTV).

How fast does a new user hit their critical “Aha!” moment? Our data shows a direct correlation: lower TTV means dramatically higher PQL conversion and reduced churn risk. Optimize this ruthlessly.

-

Expansion Revenue Rate.

This proves the long-term health of your PLG motion. It tracks the revenue generated from existing customers who started on a free or low-tier plan (upsells, cross-sells). If your product truly scales to the enterprise, this number must grow aggressively.

-

Lead Velocity Rate (LVR) for Product-Qualified Accounts (PQAs).

Forget tracking raw MQL growth. We track the month-over-month growth of high-scoring *accounts* (PQAs),these are entire organizations showing intense, multi-user product usage. This is the single best leading indicator for future enterprise sales pipeline health.

Stop chasing vanity metrics,website traffic, blog views, or raw MQL volume. Those metrics lie.

We only invest in signals that prove the user is actively deriving value from the product. Remember this mandate: Value precedes revenue. Always.

The Mandatory 2025 Tech Stack for Hybrid PLS

To run a truly efficient Product-Led Sales (PLS) motion,the one that captures high-ACV enterprise deals,you must abandon siloed spreadsheets and basic CRM setups.

The shift from MQL volume to PQL quality demands a foundation built on real-time data flow and deep automation. If your tech stack is broken, your funnel is leaking revenue.

CDPs: The Non-Negotiable Single Source of Truth

A Customer Data Platform (CDP) is not optional in 2025. It is the core operational layer for PLS.

The CDP’s sole mission is to aggregate every piece of user data,from product analytics, marketing automation, and your CRM (HubSpot, Salesforce),into one unified, comprehensive user profile.

This ensures that when our sales reps initiate outreach, they aren’t guessing. They have real-time, context-rich data on the user’s entire journey, right down to the feature they used 30 seconds ago. Without a CDP, your sales team is operating blind.

AI Scoring Automation: Prioritizing High-Intent PQLs

Let’s be direct: Manual lead scoring is obsolete. The volume of product usage data generated by a growing user base is too massive for human processing.

AI tools are essential here. They dynamically assign PQL scores by monitoring usage patterns and comparing them against historical conversion data. When a high-value user crosses the PQL threshold, the system automatically alerts the sales team.

Our team found that implementing dynamic AI scoring reduces manual qualification time by over 60%. This is pure efficiency gain.

If your lead identification process remains unoptimized, you are actively ignoring high-value enterprise clients already using your product.

You need the tools that identify them. We compiled the top platforms we use for this critical identification stage:

See Our Comparison: Best AI Lead Generation Tools For B2B Prospecting 2026Required Feeds: The Product Analytics Layer

To effectively feed the CDP and train the AI scoring model, you need granular, reliable product usage data. Garbage in, garbage out. These tools are mandatory:

- Product Analytics Platforms (Amplitude, Mixpanel, Pendo): For tracking precise user paths, feature adoption, and behavioral cohorts.

- Session Replay Software: For qualitative analysis,identifying friction points and drop-off reasons that raw metrics miss.

- Intent Data Platforms: To track account-level research and buying signals outside of your domain (crucial for identifying true enterprise readiness).

The quality of integration between these three layers defines the efficiency of your entire PLS funnel. If the data pipes are broken, your sales motion collapses.

We guarantee optimization from discovery to conversion. Review our definitive implementation guide:

2025 AI Lead Funnel: 7 Steps to Maximize Client ConversionRisk Mitigation: Eliminating Internal Friction (The PLS Alignment Crisis)

Implementing Product-Led Sales (PLS) doesn’t just change your tech stack; it fundamentally re-wires your organization. This always generates friction.

Why? Traditional sales teams demand control. PLS forces them to wait for the product to qualify the lead, shifting power away from the AE. You must proactively eliminate this tension.

Avoiding Sales Resentment (Compensation Alignment)

The single fastest way to derail your entire PLS motion is incentive misalignment. If an Account Executive (AE) earns the same commission on a $50k cold-sourced deal as they do on a $50k PQL deal, they will always prioritize the cold outreach. (They feel they have more control.)

You must change the math.

- Mandate Quota Allocation. A fixed percentage of the sales quota must be dedicated exclusively to PQL/PQA conversions. This ensures PQLs are treated as a mandatory, high-priority channel.

- Implement PQL Accelerators. Offer significantly higher commission rates or accelerators for deals closed from high-scoring PQLs. (Recognize the lower Customer Acquisition Cost inherent in this channel.)

- Redefine SDR Success Metrics. SDRs must be measured solely on PQL-to-Meeting conversion rates, not raw outbound volume. Their job is to add context and urgency, not to cold-qualify.

Ensuring PQL Quality Assurance

If your Sales team receives even one batch of low-quality PQLs, they will instantly lose faith in the entire system. They will revert to cold outreach immediately. This is mission-critical data integrity.

Your QA process must be ruthless.

Required QA Steps:

- Mandatory Sales Feedback Loops. Sales must consistently rate the quality and convertibility of every PQL they receive. This feedback is the direct input for the Data Science team to refine and recalibrate the scoring algorithm.

- A/B Test Activation Signals (Relentlessly). Continuously test which product actions actually correlate with high-ACV conversion. What worked 90 days ago is probably just noise today.

- Standardize Closed-Lost Categorization. Every unconverted PQL must be categorized clearly (e.g., “Budget Constraint,” “Missing Feature X,” “Wrong ICP Fit”). This structured data fuels funnel optimization for both Product and Marketing teams.

The integrity of the PQL score is the single foundation of your entire PLS strategy. Treat it as the most valuable asset you own.

Conclusion: The Only Growth Vector That Works Now

Let’s be direct: The debate between PLG and SLG is dead. It is a false dichotomy that founders stuck in 2018 still cling to.

Sustainable, high-velocity growth,the kind that delivers a 77% revenue boost, for instance,comes only from successful integration. We call this Product-Led Sales (PLS).

The goal is not to choose a lane, but to define clear, non-overlapping lanes for both teams:

- PLG is your hyper-efficient acquisition engine. Its job is proving immediate value, driving initial adoption, and capturing low-cost users via the product experience.

- SLG is your high-ACV expansion engine. Its job is capturing enterprise revenue, negotiating complex deals, and driving expansion based on validated Product-Qualified Lead (PQL) data.

Operational rigor is non-negotiable. You must build the PQL scoring models, implement a tech stack capable of handling granular usage data, and ensure compensation alignment (as we discussed previously) before you launch.

If you skip the rigor, you get internal friction and stalled growth. If you nail the integration, you get scale. It’s that simple.

Ready to build your PLS engine?

Stop relying on outdated lead lists. We provide the AI lead generation software necessary to find your high-value clients’ personal emails and connect your sales team directly to PQLs.

Start Your Free TrialExecuting PLS: Addressing the Non-Negotiable Questions

What is the biggest difference between MQLs and PQLs?

The difference is stark. It separates potential interest from proven value.

- MQLs (Marketing Qualified Leads): Based on intent signals outside the product (e.g., website activity, content downloads). They indicate curiosity.

- PQLs (Product Qualified Leads): Based on actual usage behavior inside the product. They indicate activation and value realization.

PQLs have dramatically higher conversion rates because they are not just familiar with the solution,they have actively used it to solve a problem. An MQL is a tire-kicker; a PQL is already driving the car.

Is the hybrid Product-Led Sales (PLS) model suitable for every SaaS company?

No. PLS is not a silver bullet, and we won’t pretend it is.

It works best for products that can offer a low-friction entry point (freemium or free trial) and simultaneously have a high-value enterprise tier that requires human intervention to close.

If your product is inherently complex, demands extensive customization upfront, or targets only the C-suite for million-dollar deals, a pure Sales-Led Growth model might be necessary initially.

However, for the vast majority of modern B2B software, denying PLG elements is financial suicide. Integrating PLG components is the fastest way to drive down Customer Acquisition Cost (CAC) and scale efficiently.

How do we prevent the sales team from ignoring low-ACV PQLs?

This is a governance problem, not a sales problem. Sales reps follow incentives. If PQLs are ignored, it means your compensation structure is misaligned.

You must make PQL conversion the easiest, most efficient path to quota attainment. Here is the blueprint:

- Establish Dedicated Pods: Create separate sales segments (e.g., SMB/Mid-Market) that are specifically incentivized and structured to process high-velocity PQLs.

- Adjust Quotas: Reflect the expected lower Average Contract Value (ACV) of the self-serve channel. Compensate them efficiently for volume, velocity, and future expansion potential.

- Incentivize Expansion: Pay high commissions on upsells/cross-sells that occur within the first 12 months after a PQL conversion.

If closing a PQL is the shortest path to hitting their monthly target, your team will adopt the PLS motion instantly.

What are the critical tech stack components for PLS?

Product-Led Sales is fundamentally a data motion. If your data is slow, siloed, or unactionable, the entire PLS strategy stalls due to latency and manual effort.

The required stack is non-negotiable for high-velocity conversion:

- Customer Data Platform (CDP): To unify all behavioral, firmographic, and demographic data across the self-serve funnel.

- Product Analytics: To track the specific usage milestones that define a PQL (the “Aha!” moment).

- AI Predictive Scoring Models: To automate the prioritization process. We use AI scoring to ensure our team only engages the 1% of users who are 90%+ likely to convert.

Finally, your sales team needs tools (like our AI lead generation software) that turn that raw PQL identity into actionable contact information (personal emails) so they can initiate the human touchpoint immediately.

References

- Product-Led Growth vs. Sales-Led Growth: What’s the Right Strategy …

- Product-led growth vs. sales-led growth: Key differences explained

- From product-led growth to product-led sales: Beyond the PLG hype

- Sales-Led vs. Product-Led Growth – General Catalyst

- Sales-Led vs Product-Led Growth in SaaS: GTM Strategies Explained