Seamless.AI developed a powerful data engine. We acknowledge the technology’s strength in raw data retrieval.

But for founders and scaling SDR teams in 2025, that platform presents two critical bottlenecks. We identified these issues based on our internal testing and client feedback:

- The Cost Trap: Enterprise-level pricing is prohibitive, especially for startups. The credit system often results in unused, expired inventory,meaning you end up paying for data you don’t use (or can’t use fast enough).

- The Workflow Gap: Seamless is primarily a data finder. It critically lacks the integrated, multichannel Sales Engagement Platform (SEP) features that define modern, high-conversion prospecting. (You still need three other tools just to execute a proper sequence.)

We are not delivering a flat, generic list of 15 tools here. That approach provides zero value.

Our job is to segment the market based on value, workflow maturity, and verifiable data quality. You need to know precisely which tool fits your budget, addresses your compliance needs (crucial in 2025), and meets your specific automation requirements.

Key Takeaways: The 2025 Shift

- The All-In-One Mandate: For teams demanding pure scale and integrated outreach, all-in-one AI lead generation platforms (like Apollo.io or Pyrsonalize,our own solution) now offer superior feature sets at a fraction of the enterprise cost.

- The Credit Trap: Seamless.AI and Apollo credits typically expire monthly. If you are an SMB or a startup, look for alternatives where credits roll over. (Paying for unused data is a drain on capital.)

- Compliance Mandate: If you prospect in EMEA or highly regulated industries, Cognism and Lusha offer demonstrably superior GDPR alignment compared to most US-centric data platforms.

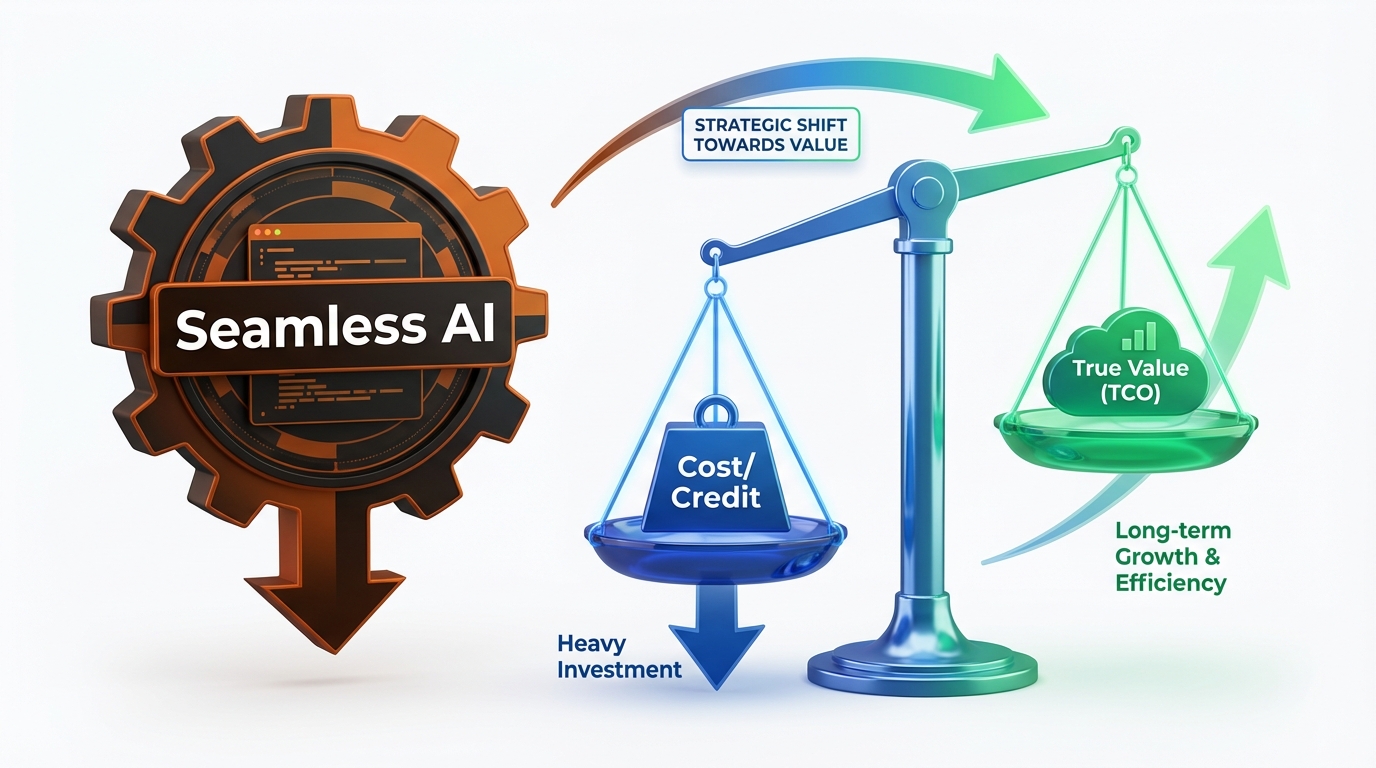

The Strategic Shift: Seamless AI Alternatives Ranked by True Value (TCO)

We analyzed the True Cost of Ownership (TCO) and actual data coverage of the leading platforms. This isn’t marketing fluff.

This executive comparison table focuses on the critical metrics that founders and high-performing SDR teams actually care about in 2025: predictable pricing and conversion capability.

| Tool Name | Starting Price (Paid) | Free Tier Limitations | Core Strength | Global Coverage Score (1-5) | True Cost Caveat |

|---|---|---|---|---|---|

| Pyrsonalize | Free Trial | Full feature access | AI Personal Emails & Conversion Funnels | 4.5 | Focus on quality, validated data over raw, unverified volume. |

| Apollo.io | $49/user/mo | Limited credits (60 emails/mo) | All-in-One Sales Engagement & Database Scale | 4.0 | Credits expire monthly. Data accuracy can vary significantly outside of US tech. |

| ZoomInfo | Custom (High) | N/A (Demo only) | Enterprise Data Verification & Intent Signals | 4.5 | High minimum commitment. Pricing is notoriously opaque and non-negotiable for startups. |

| Cognism | Custom (High) | N/A (Demo only) | GDPR Compliance & EMEA Phone Data Mastery | 5.0 | Built exclusively for mid-market/enterprise sales teams with large budgets. |

| Lusha | $36/user/mo | 5 phone credits/mo | Quick Chrome Extension Lookups & Compliance Focus | 3.5 | Focus is heavily on phone numbers, which are increasingly credit-intensive and less reliable for cold outreach. |

Tier 1: Best Budget & Freemium Alternatives (The Affordable Data Stack)

If you are a solo founder, a small agency, or an SDR testing new markets, the $147+/month minimum commitment from Seamless.AI is non-viable. We understand that constraint.

You need maximum flexibility and minimal financial friction,that is the strategic requirement for scaling growth.

This tier focuses exclusively on delivering reliable, segmented data enrichment without forcing you into an expensive, proprietary ecosystem. These are the tools that allow you to start generating leads today (not next quarter).

1. Derrick App: The Google Sheets Workflow Eliminator (TCO Winner)

Derrick App solves a painful, time-wasting workflow problem: the constant manual jumping between LinkedIn, your spreadsheet, and your CRM.

It transforms Google Sheets into your dedicated prospecting hub. This translates to zero adoption friction for any team already running G-Suite.

The strategic advantage here is the pricing structure,designed for sustainable growth.

Their $9/month entry point is over 16X cheaper than the Seamless.AI minimum commitment. And crucially (this is the game-changer for SMBs): credits roll over indefinitely. You never lose value if your prospecting volume fluctuates month-to-month.

- Focus: Modular data enrichment (Email Finder, Phone Finder, Tech Lookup).

- Pricing Edge: Extremely low entry cost; credits never expire (True Cost of Ownership is unbeatable).

- Unique Feature: Built-in AI (GPT-4/Claude) for automated lead scoring and qualification directly within your sheet.

2. Hunter.io: The Gold Standard for Deliverability

Hunter.io remains the undisputed gold standard for pure email finding and verification accuracy.

If your singular focus is achieving maximum deliverability for high-volume cold email campaigns, Hunter’s native verification tool is superior. Many competitors treat verification as an inaccurate, secondary feature; Hunter treats it as the core product.

It is simple, reliable, and provides the best cost-per-verified-email ratio on the market today. We recommend this for any team prioritizing domain health above all else.

“The 2025 sales stack demands reliability. If your list accuracy falls below 95%, you are actively wasting SDR time, severely risking your domain reputation, and sacrificing pipeline health. Verification is not optional.”

3. Skrapp: LinkedIn Native Prospecting Power

Skrapp is built for the LinkedIn power user. Its primary strength is its seamless Chrome Extension experience, making it ideal for individual contributors who build highly targeted lists manually while navigating Sales Navigator or standard profiles.

Their free plan provides enough volume to rigorously test their data coverage, and paid plans start at a highly competitive $39/user/month.

Crucial Caveat: Skrapp is heavily email-focused. If your strategy requires high-volume cold calling, you must anticipate pairing Skrapp with a dedicated phone number enrichment or dialer tool. This adds complexity and cost (TCO) that must be factored into your budget.

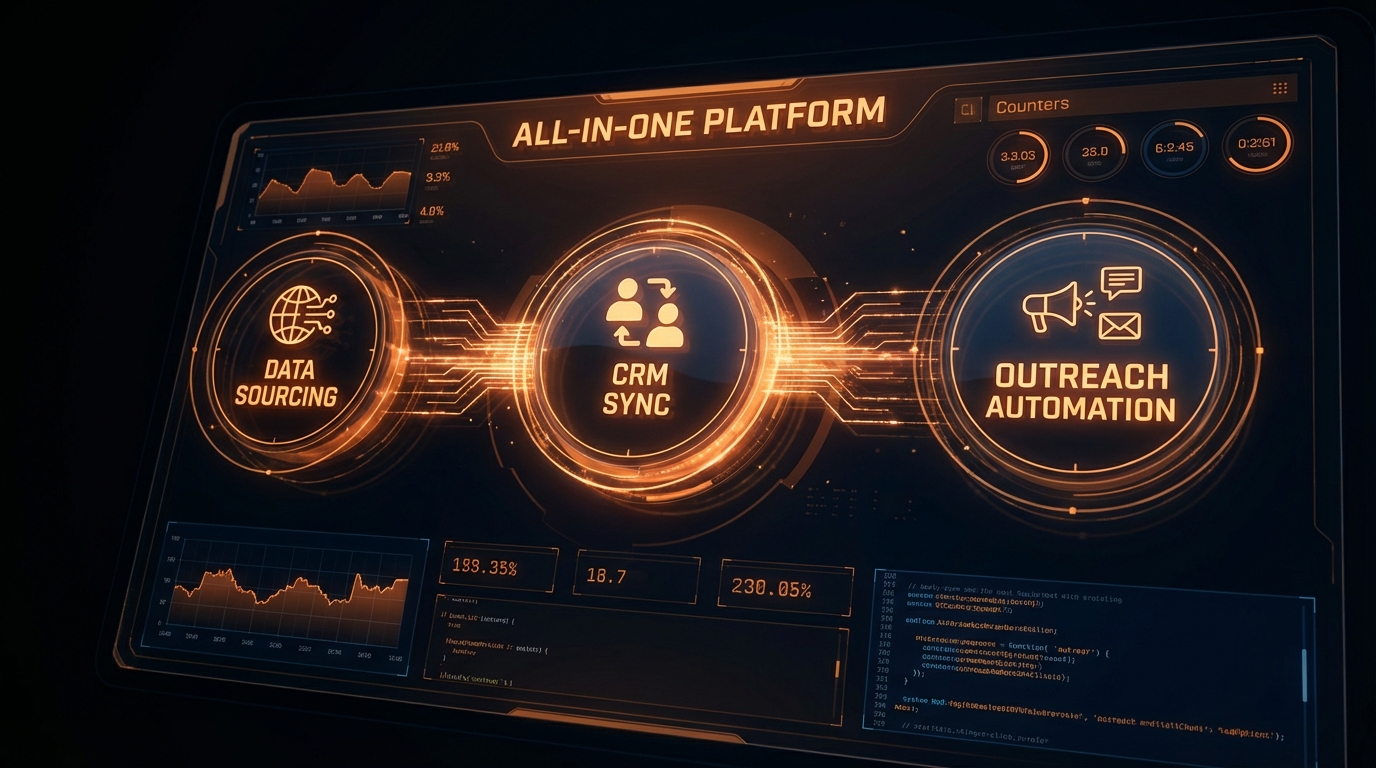

Tier 2: All-in-One Sales Engagement Platforms (SEPs)

Let’s be direct: Seamless.AI falls short in 2025 because it is a data finder, not a workflow engine.

The strategic shift for high-growth SDR teams is moving from siloed tools (data here, email there) to unified Sales Engagement Platforms (SEPs).

SEPs don’t just find data. They unify the entire outreach workflow,combining the B2B database, the sequence builder, the email sender, the LinkedIn automation, and the dialer into a single, cohesive system.

This unification is the key to scaling SDR productivity. It’s about workflow efficiency, not just finding emails faster.

1. Apollo.io: The Feature Powerhouse

Apollo.io is the undisputed, most popular Seamless.AI alternative for a simple reason: sheer feature depth combined with a massive contact database (over 275 million contacts).

It is the definition of an all-in-one platform,a complete replacement for your data stack and your engagement stack.

Here is why Apollo wins on strategic value:

- Data & Volume: Vast B2B contact database (The essential foundation).

- Engagement: Built-in sequencing for true multichannel outreach (email, LinkedIn, calls).

- Intelligence: Includes crucial intent data and lead scoring (Signals for precision targeting).

- Integration: Robust API and deep CRM synchronization (Essential for scaling).

The Pro plan ($99/user/month) is the sweet spot. It unlocks features like intent data that make Apollo a true competitor to enterprise tools (like ZoomInfo), but without the crippling annual commitment.

The Trade-Off: While Apollo offers unparalleled volume, our team consistently reports that data inconsistency is a factor compared to hyper-verified sources (e.g., Cognism). Your core decision here is Volume vs. Quality.

2. Genesy AI & Reply.io: Automation & AI Sequencing

If Apollo is the powerhouse database, Genesy AI and Reply.io are the masters of the multichannel automation layer.

These tools prioritize workflow optimization. They are less concerned with having the absolute largest database (they rely on strong data partners) and 100% focused on ensuring your outreach sequences are perfectly timed, personalized, and executed via AI.

We recommend these platforms when workflow efficiency is your bottleneck:

- Reply.io: Excels in AI-powered personalization and robust multichannel cadences (Email, SMS, Calls). It’s designed to keep sequences human-like, automatically.

- Genesy AI: Focuses on eliminating manual effort by unifying all prospecting channels into a single, automated flow. They promise significant productivity gains (up to 10x) by removing the necessity of manual data transfer.

If your SDR team is struggling with siloed outreach (LinkedIn prospecting done in Tool A, email sequences managed in Tool B), these integrated SEPs are the strategic solution. They automate the entire process of moving a cold lead from LinkedIn lead generation directly into a warming email sequence,seamlessly.

Tier 3: Enterprise Data & Intent Leaders (High Cost, High Accuracy)

Let’s be clear: These platforms are not “cheaper” alternatives. They are superior strategic investments.

This tier is designed exclusively for mid-market and enterprise revenue teams where data integrity, compliance, and predictive intent trump budget constraints (as they absolutely should).

1. ZoomInfo: The Verified Data King

ZoomInfo remains the strategic benchmark for enterprise sales intelligence. Their strength is their proprietary, human-verified data network. This provides the highest confidence in direct dials and complex company hierarchy mapping.

If you are targeting Fortune 500 accounts and require the highest possible accuracy for complex organizational maps, ZoomInfo is mandatory.

- Core Value: Unmatched depth of data, reliable direct dials, and advanced intent data (identifying companies actively searching for solutions right now).

- The Drawback: Pricing is notoriously opaque, requires a custom quote, and usually demands a significant 12-month minimum commitment. This is a platform for established, funded sales organizations,not the lean startup.

2. Cognism: EMEA & GDPR Compliance

For any team targeting the European market (EMEA), Cognism is the definitive, non-negotiable Seamless.AI competitor.

Compliance is their core product. They prioritize GDPR and CCPA alignment, ensuring your prospecting remains legally compliant in high-regulation regions (a crucial liability shield). Their proprietary “Diamond Data” provides phone-verified contacts.

The result? Significantly higher connection rates than generic databases. If your Ideal Customer Profile (ICP) is heavily weighted towards EMEA, Cognism’s superior global coverage score makes it the only pragmatic choice.

3. 6sense: ABM and Predictive Intent

6sense operates at the highest strategic level of sales intelligence: Account-Based Marketing (ABM) execution.

This platform moves far beyond simple contact finding. 6sense uses advanced AI to identify anonymous, in-market accounts and provides predictive modeling on when they are ready to buy.

This is not just a tool; it is the strategic intelligence layer for marketing and sales alignment. It ensures your SDRs only target accounts showing clear, measurable buying intent. If your organization has adopted a true ABM strategy, 6sense provides the intelligence that basic data providers like Seamless.AI simply cannot match (or even understand).

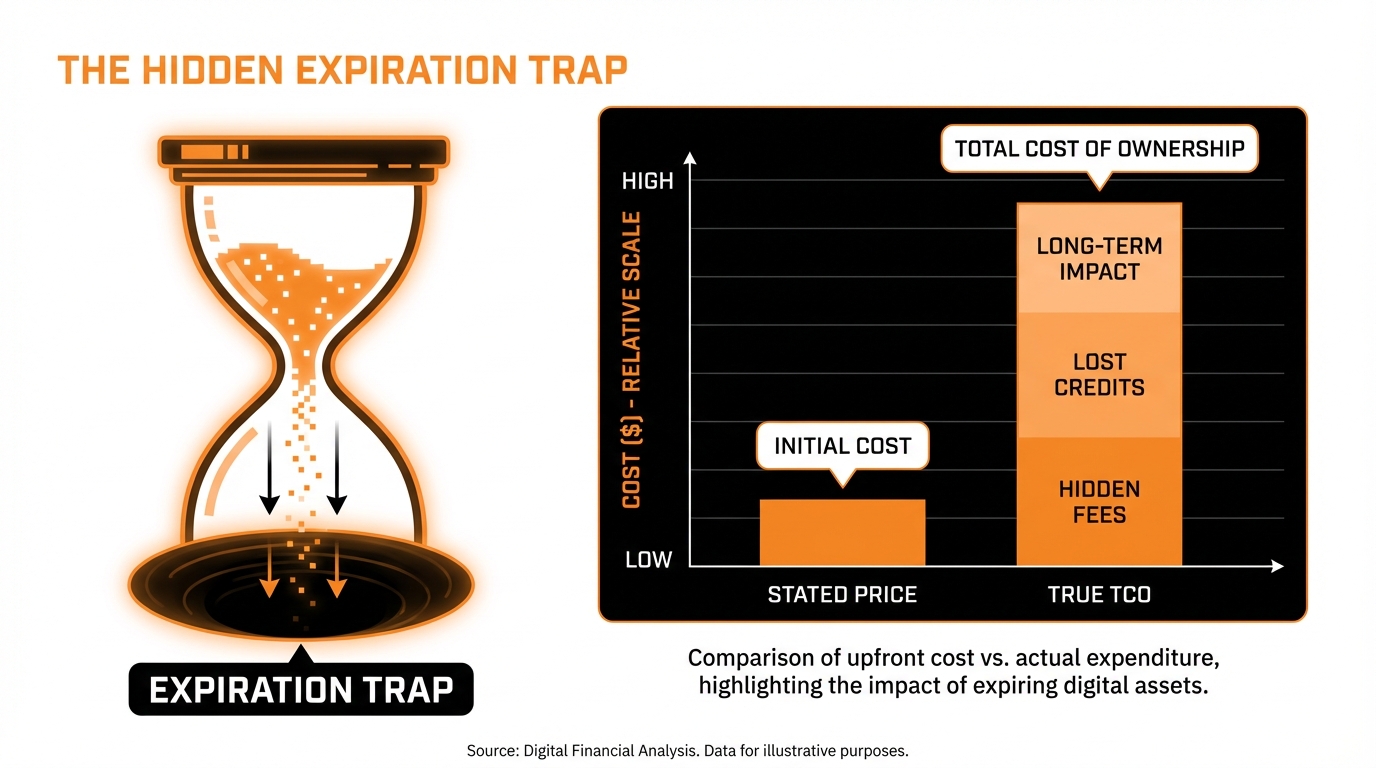

Deep Dive: Pricing, TCO, and the Credit Expiration Trap

The biggest financial mistake our clients make when moving off platforms like Seamless.AI is failing to calculate the True Cost of Ownership (TCO).

It’s not just the sticker price.

You must assess two strategic factors before signing any contract:

- Credit Expiration Policy: Do those credits roll over? (If they don’t, you are actively building financial wastage into your sales process.)

- Cost Per Verified Lead (CPVL): How many credits does it actually take to secure one, exportable, verified contact?

The Monthly Credit Burn Rate: Why You’re Losing Money

Platforms like Seamless.AI and Apollo.io rely heavily on the monthly credit cycle. If you buy 1,000 credits on January 1st, you must burn them by January 31st. If you don’t? They vanish into the ether.

For high-volume, enterprise SDR teams, this is often manageable. Their burn rate is consistent.

But if you run intermittent campaigns, target a niche market, or scale slowly, this policy is financially inefficient and strategic suicide.

We analyze this credit waste constantly in our lead generation case studies. Teams routinely overestimate volume and end up paying for 20% to 30% wastage every single month.

Our Pragmatic Solution:

- Seek platforms with rollover credits (essential for startups and niche operators).

- Prioritize tools offering “unlimited” exports (even if they have fair usage limits, they remove the critical, monthly use-it-or-lose-it pressure).

Calculating Your True Cost Per Verified Lead (CPVL)

Seamless.AI is notorious for requiring multiple, separate credit expenditures to achieve a single, usable contact.

Some legacy tools charge you once to find the email, charge you again to verify it, and charge a third time for the mobile number. This is designed to inflate your CPVL and mask the true expense.

A high-performing, strategic alternative minimizes CPVL. That is the definition of pragmatic efficiency.

Actionable Formula: Calculate Your Real CPVL

This is the metric that matters:

- Step 1: Take your total monthly plan cost (e.g., $199).

- Step 2: Divide this by the number of fully verified, exported contacts you actually used that month (e.g., 800).

- The Result: $199 / 800 = $0.24 CPVL.

If a platform’s convoluted credit system (like Seamless.AI) results in a hidden $0.50 CPVL due to complexity, waste, and expiration, then the “cheaper” alternative,even if it offers fewer raw features,is the superior strategic investment for your sales budget. We prioritize CPVL over feature lists every time.

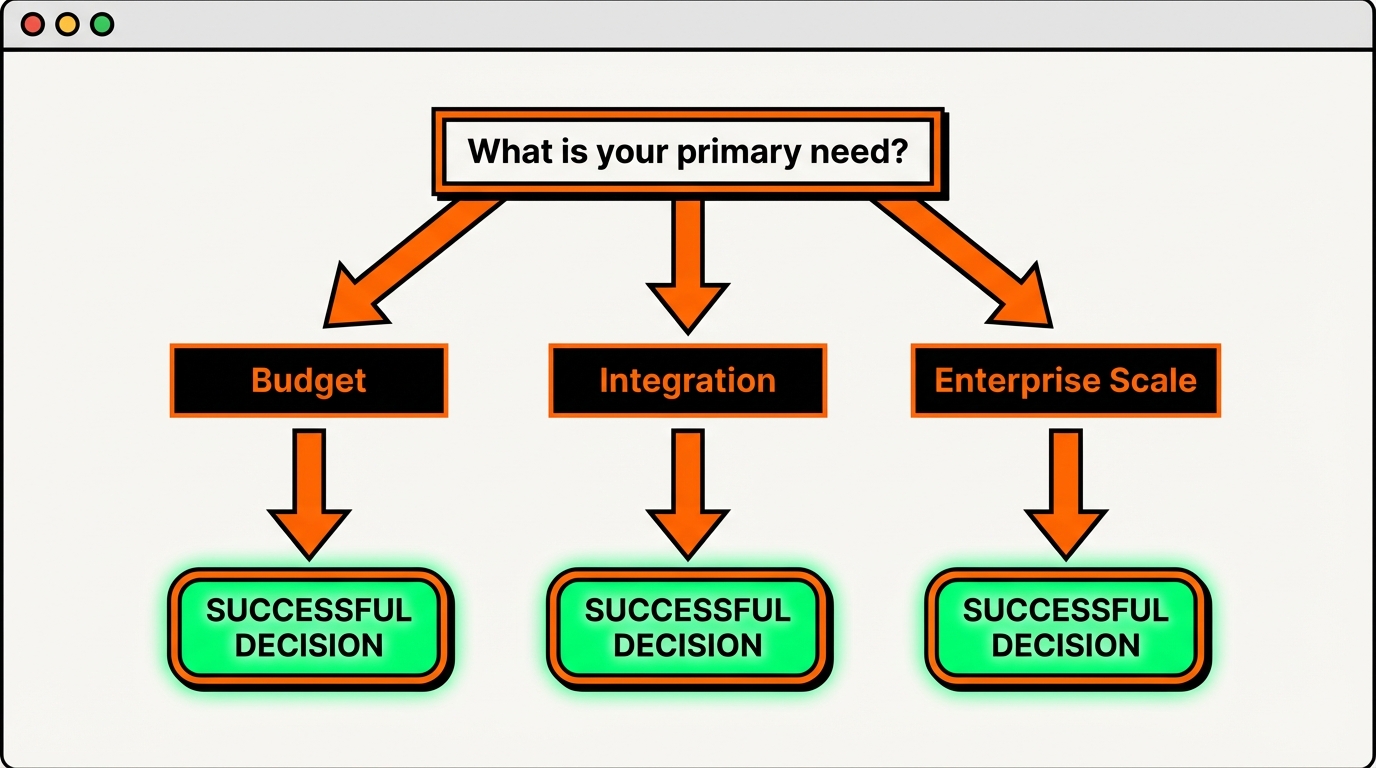

Actionable Conclusion: Choosing Your Seamless AI Replacement

Stop analyzing feature lists. That is a tactical error.

You must think strategically about workflow integration and critical bottlenecks.

Our team has analyzed dozens of tech stacks. Based on that data, here are our expert recommendations tailored to your specific organizational size and strategic needs.

Scenario 1: The Bootstrapped Founder or Solo SDR

You need reliable data with zero commitment risk and maximum budget efficiency (low TCO).

- Choice: Derrick App (for Google Sheets users) or Hunter.io (for pure email lists).

- Why: We recommend these because they minimize TCO risk. Credits often roll over,critical for low volume users,and require zero ramp-up time. You get high-quality data without falling into the commitment trap of an enterprise contract.

Scenario 2: The Scaling SDR Team (5-25 Reps)

You need to unify data discovery and multichannel outreach into a single, measurable process. Silos kill scale; consolidation drives revenue.

- Choice: Apollo.io or Genesy AI/Reply.io.

- Why: This is a consolidation play. These are true Sales Engagement Platforms (SEPs). They eliminate tool sprawl (data finder, email sender, sequencing) and deliver massive efficiency boosts across the entire 5-25 rep team. SEPs enforce a unified, scalable process.

Scenario 3: The Enterprise Targeting EMEA or High-Value Accounts

Accuracy, compliance, and intent signals are non-negotiable. You cannot afford a data error when pursuing a six-figure deal.

- Choice: Cognism (for EMEA/GDPR focus) or ZoomInfo (for US/Global verified data).

- Why: When the deal size is six figures, data quality dictates success. These platforms invest heavily in human verification and robust compliance (especially Cognism for GDPR). This reduces legal risk and dramatically increases connection rates on your most critical, high-ticket accounts.

The Final Word: Strategic FAQs

- What is the main difference between Seamless.AI and an SEP like Apollo.io?

- Seamless.AI is a pure data intelligence layer. It finds and verifies contact information,that’s it.

- A Sales Engagement Platform (SEP) like Apollo.io or our own Pyrsonalize tools is the complete execution engine. They handle the data and provide integrated workflow automation (sequencing, LinkedIn outreach, CRM sync). If you need to execute the entire prospecting process without switching tools, you need an SEP, not just a data scraper.

- Are Seamless.AI alternatives GDPR compliant?

- Compliance is the Wild West of lead generation. It varies wildly.

- Platforms like Cognism and Lusha are built with GDPR/CCPA alignment as a core, non-negotiable feature. US-centric tools often rely on complex ‘legitimate interest’ models that require careful configuration on your end.

- Our team’s rule: If you target EU prospects, you must check the provider’s specific compliance documentation. Do not skip this due diligence.

- Why is Seamless.AI pricing so difficult to find?

- This is a strategic choice by enterprise data providers (Seamless.AI, ZoomInfo). They use opaque pricing because they demand high annual minimum commitments.

- Their cost is determined by complex factors: team size, required credit volume, intent data access, and custom integration needs. They force a demo to qualify you for a high-ticket contract. This opacity is a clear signal that they are not designed for agile, self-service teams looking for plug-and-play solutions.

Stop Wasting Credits on Generic Data.

Ready to scale your organic lead generation? Our AI Lead Generation Software finds clients’ personal emails with unparalleled accuracy, eliminating the database guesswork.

Start Your Free Trial Today