SDR BANT Qualification: The 2025 Strategic Blueprint

BANT is not new. We acknowledge that.

IBM developed this framework in the 1950s. Decades later, BANT remains the foundational qualification system for high-volume Sales Development Representatives (SDRs).

Why? The answer is simple: BANT is fast. It is brutally efficient. It provides the structured mechanism necessary for quickly segmenting leads into MQLs and SQLs,driving predictable pipeline growth.

Crucially: BANT achieves this without the complexity required for long-cycle enterprise deals. (That’s where MEDDIC lives. We save that deep-dive complexity for the Account Executives.)

But BANT is frequently misused. SDRs treat it as a rigid checklist, turning a discovery call into a hostile interrogation. This approach kills trust. It tanks conversion rates. We cannot afford that inefficiency.

In 2025, BANT must evolve past the checklist. It needs integration with pre-call intelligence. It must be structured around value discovery, not just arbitrary budget checking.

This is the strategic blueprint. We show you precisely how we leverage BANT for predictable revenue increases. We are moving beyond the checklist mentality and into tactical, results-driven qualification.

Key Takeaways for the Strategic SDR

- BANT is optimized for SDRs: Use BANT for high-volume, short-cycle qualification. Save complex frameworks (MEDDIC) for your Account Executives.

- Flip the Script: Always lead with Need (N), not Budget (B). The conversational sequence must be N-B-A-T to establish value before discussing cost.

- Pre-Qualify B and A: Use tools like LinkedIn Sales Navigator and Crunchbase to gather 80% of Budget and Authority data before the call. Don’t waste discovery time on obvious facts.

- Implement a Scoring Matrix: Use our weighted BANT scorecard (25 points per letter) to objectively prioritize leads and inform follow-up sequencing.

I. BANT: The Modern SDR Qualification Scorecard

Every SDR knows the acronym: BANT. (Budget, Authority, Need, Timeline.)

It was originally designed to function as a rigid checklist, ensuring sales efforts focused strictly on buyers who possessed current purchasing power. If a prospect failed one category, the lead was instantly disqualified.

That rigid, sequential approach is now obsolete.

The modern buying landscape,defined by complex committees and flexible SaaS pricing models,requires adaptability. Today, BANT is used as a qualification scorecard. It guides the discovery conversation; it is not a pass/fail exam.

Why BANT Still Dominates SDR Velocity

Our internal analysis confirms a critical bottleneck: High-volume SDR teams fail when they attempt to implement overly complex qualification frameworks too early (e.g., MEDDIC or GPCTBA/C&I).

These frameworks are necessary for enterprise-level, complex B2B deals. They require deep organizational mapping and multiple, extended conversations.

The SDR role demands a different focus: Velocity and Volume.

- SDRs manage a significantly higher volume of initial discovery calls.

- They facilitate shorter sales cycles (primarily qualifying for an Account Executive handoff).

- BANT delivers the structure necessary to quickly assess if a lead warrants 30 more minutes of our internal resources.

If you lack a clear, standardized process for BANT data logging, scaling your pipeline becomes impossible. This is non-negotiable.

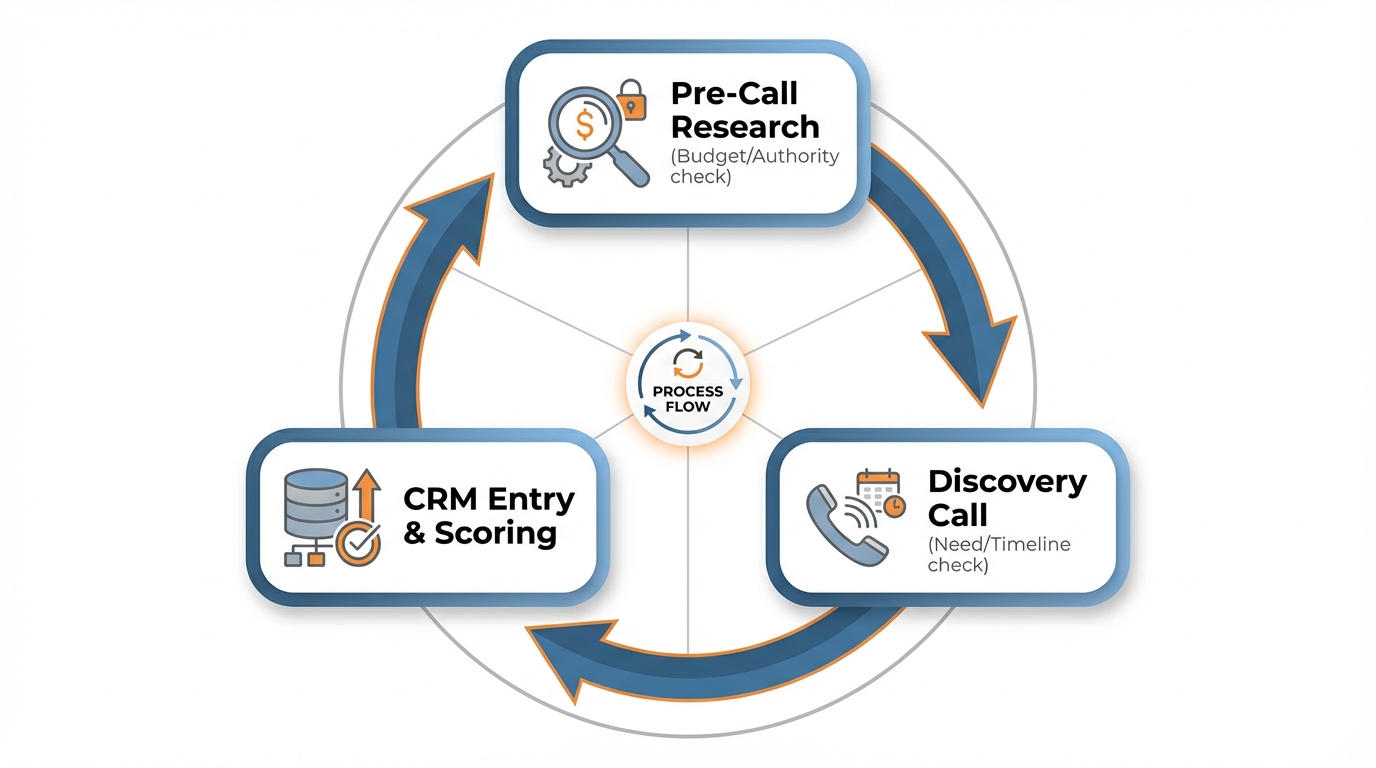

II. The Modern SDR BANT Workflow: Pre-Call to CRM

Step #1: Budget Pre-Qualification (The Financial Signals)

- Recent Funding Rounds: Did the company raise a Series A, B, or C in the last 6-12 months? This confirms allocated capital for growth, infrastructure, or scaling tools. The budget exists.

- Hiring Spikes: Are they actively hiring VPs, Directors, or specialized roles (e.g., Head of Revenue Operations)? Hiring signals investment directly into the functional area our product solves.

- Competitor Tech Stack: Use intelligence tools (like ZoomInfo or BuiltWith) to confirm they already pay for similar high-ticket solutions. If they have a budget line item for a competitor, they have a budget for us.

Step #2: Authority Mapping (The Buying Committee Blueprint)

- The Champion: Your primary contact. They experience the pain daily and drive the internal momentum.

- The Economic Buyer (EB): The person who controls the budget and signs the check. Typically VP or C-suite.

- The Technical Buyer/User: The team that uses the product daily. They hold veto power based on integration and workflow feasibility.

- The Gatekeeper: Procurement, Legal, or Finance. They slow the process; they rarely stop it if the EB is aligned.

III. The Conversational Flow: N-B-A-T for Trust

Never open a discovery call with Budget. That is the fastest way to kill a deal. You have not earned the right to discuss capital yet.

We advocate for the N-B-A-T Sequence. This strategic shift flips the traditional BANT order. We prioritize quantifying value and discovering critical pain points (Need). This makes the Budget discussion a logical, natural consequence,not a roadblock.

N: Uncovering and Quantifying the Need

This is the single most critical stage. Your goal is not just identifying a surface-level problem. You must force the prospect to feel the immediate, quantifiable cost of inaction.

Actionable Scripts for Need:

- “You mentioned [specific challenge]. How is that impacting your team’s ability to hit Q4 targets? Can you quantify that impact in hours lost per week?”

- “What prompted you to take this call now? Was there a specific event or bottleneck that made this an immediate priority?”

- “If this issue remains unresolved for the next six months, what is the conservative financial cost to the business?”

We don’t sell vitamins; we sell aspirin. A prospect buys aspirin because the pain is immediate and quantifiable. Your job is to prove their problem is aspirin-worthy.

B: Tying Budget to Value

Once the pain is precisely quantified (the $X loss), the Budget discussion shifts entirely. It is no longer about “How much money do you have?” It becomes: “How much are you willing to invest to stop the bleeding?”

Actionable Scripts for Budget:

- “Based on the $50k annual loss you identified, we typically see clients in your position invest around 10–20% of that loss to solve the issue permanently. Does that range feel aligned with what you expected to spend?” (This anchors the price to the quantified pain.)

- “If we can guarantee a 3x ROI on the investment, how heavily does the exact dollar amount factor into your decision?”

- “We understand budgets are tight. Which department’s budget would a strategic investment like this typically fall under?” (This is a subtle way to identify the Economic Buyer if Authority is still vague.)

A: Mapping the Decision Chain

Authority questions must be consultative and collaborative. We are not interrogating the prospect. We are expertly guiding them through their own internal purchasing process.

Actionable Scripts for Authority:

- “I appreciate the deep dive on the challenges. To ensure we structure the proposal correctly, can you walk me through the typical sign-off process for a strategic investment like this?”

- “In our experience, solutions that impact RevOps usually require input from the VP of Sales and the CFO. Does that sound right for your organization?”

- “Who else on your team needs to weigh in on the solution’s functionality before we move to the contracting phase?”

This approach helps us craft B2B Cold Calling Scripts that sound consultative, not transactional.

T: Establishing Urgency and Next Steps

Timeline (T) dictates prioritization. If the prospect says they need the solution ‘sometime next year,’ they are not a qualified lead. They are a nurture target,a time sink. We demand urgency.

Actionable Scripts for Timeline:

- “Given the current pain, what is the latest date you can afford to have this solution fully implemented and running?” (Focus on implementation date, not purchase date.)

- “Are you currently evaluating other vendors? If so, what is the internal deadline for making a final decision?”

- “If everything aligns perfectly, what is the earliest we could realistically kick off the implementation process?”

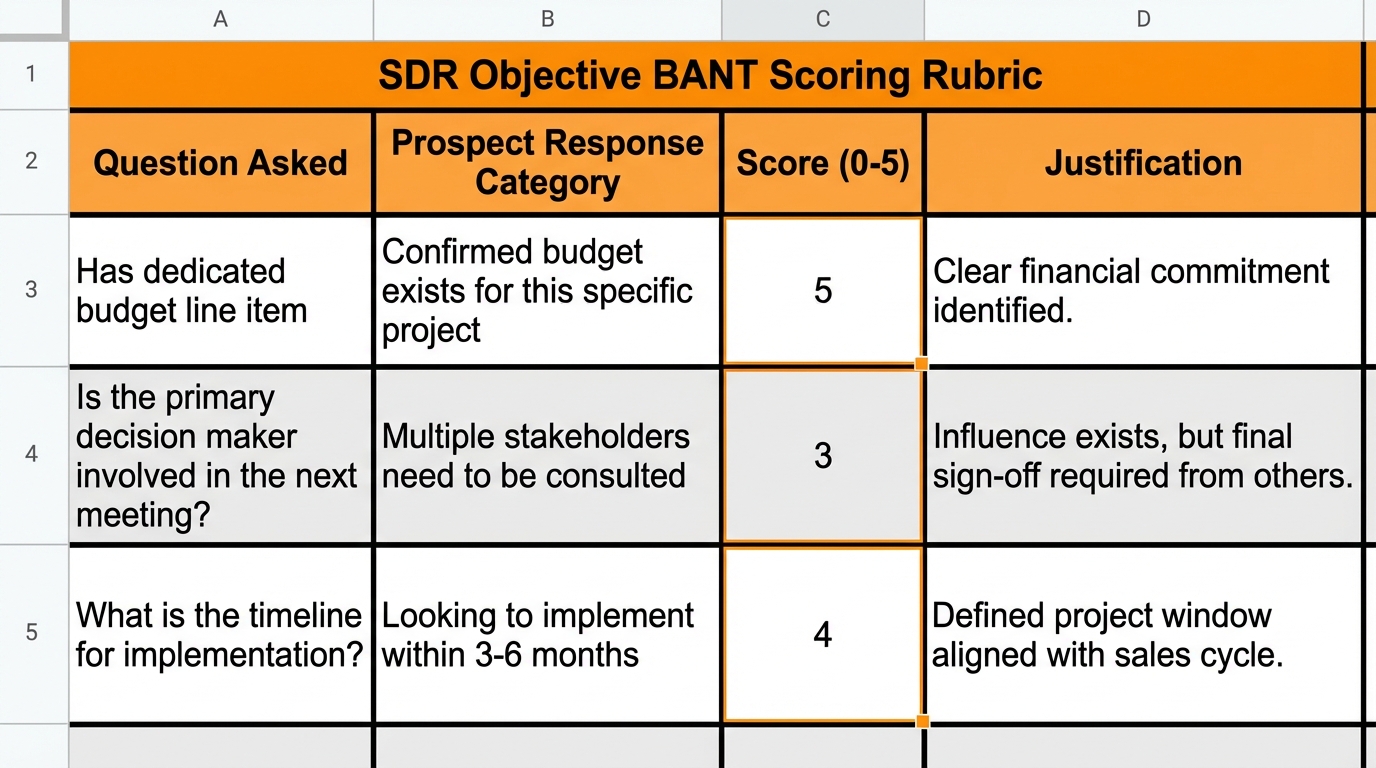

IV. Tactical SDR Toolkit: The Objective BANT Scorecard

Subjectivity kills qualification. An SDR feeling “good” about a discovery call is irrelevant. We demand predictable revenue, not subjective feelings.

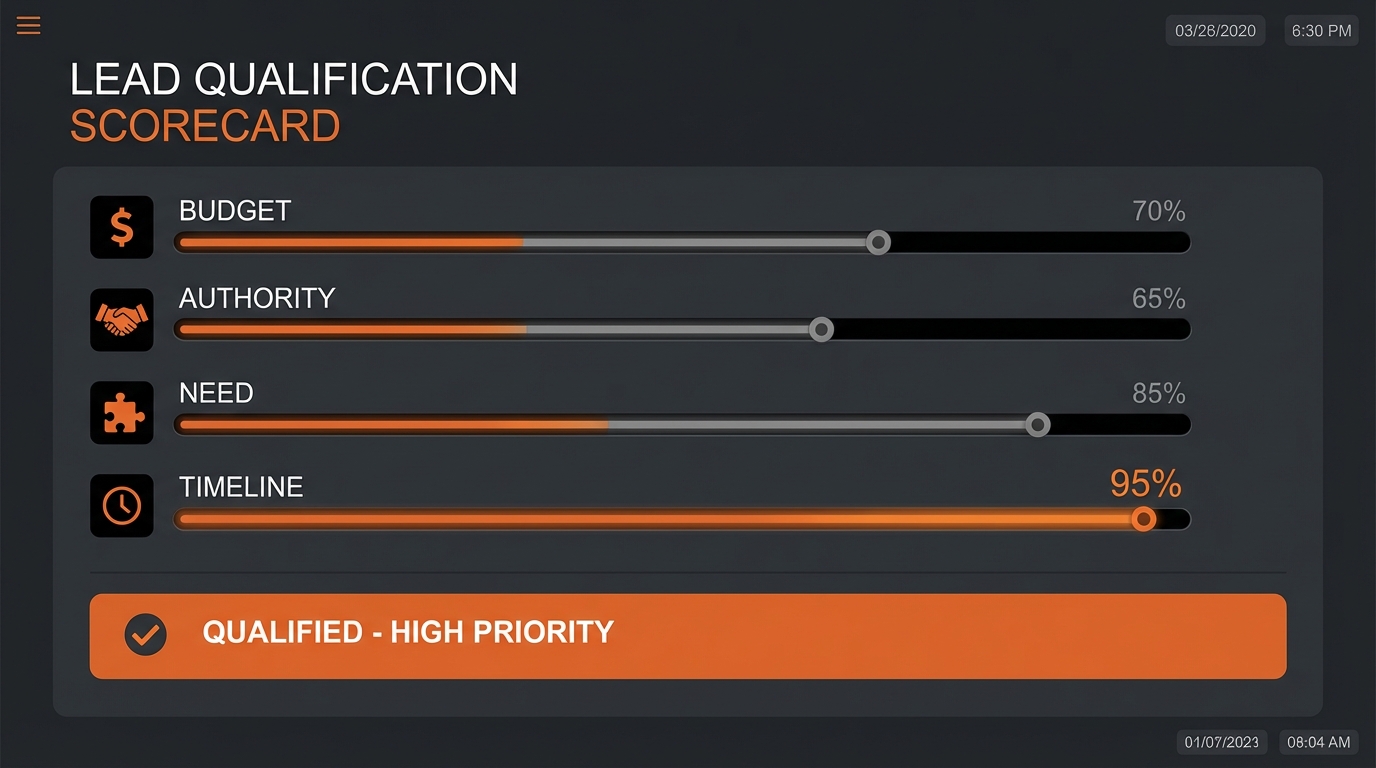

You need measurable data. We implemented a weighted BANT Scoring Matrix specifically to transition leads from MQL to SQL objectively. This system assigns 25 points maximum per category,100 points total.

The SQL Threshold: We only hand off leads scoring 75 points or higher. This is the minimum requirement for a true Sales Qualified Lead (SQL) and ensures the AE is speaking only to high-intent opportunities.

The SDR BANT Scoring Matrix

| BANT Criteria | Qualification Level | Score Value (Max 25) |

|---|---|---|

| Budget (B) | Strong (20-25 pts): Budget allocated, range disclosed, or recent relevant funding confirmed. | 25 |

| Medium (10-19 pts): Budget flexible, pain quantified, investment acknowledged, but no firm range set. | 15 | |

| Low (0-9 pts): No budget, price-shopping, or unwilling to discuss the cost of inaction. | 5 | |

| Authority (A) | Strong (20-25 pts): Direct decision-maker or confirmed Champion with direct access to the Executive Buyer (EB). | 25 |

| Medium (10-19 pts): Influencer/User; decision committee mapped and agreed to next steps with the EB. | 15 | |

| Low (0-9 pts): Just gathering information; cannot identify key stakeholders or decision process. | 5 | |

| Need (N) | Strong (20-25 pts): Pain is quantified (cost of inaction known), business-critical, and urgent. | 25 |

| Medium (10-19 pts): Problem acknowledged, but impact is not yet quantified or is categorized as a ‘nice-to-have.’ | 15 | |

| Low (0-9 pts): No clear problem or latent need; solution is vaguely interesting. | 5 | |

| Timeline (T) | Strong (20-25 pts): Clear deadline (under 3 months) driven by internal or external factors. | 25 |

| Medium (10-19 pts): Timeline 3-6 months; next steps agreed upon and scheduled. | 15 | |

| Low (0-9 pts): ‘Sometime next year’ or ‘just exploring options.’ Zero commitment to action. | 5 |

CRM Integration: Logging BANT Data

This data cannot live solely in SDR notes. Your CRM (HubSpot, Salesforce) must capture the BANT score immediately. Otherwise, it is useless for accurate forecasting and pipeline analysis.

Action Item: Create custom fields for each BANT category. Use dropdown menus corresponding exactly to the Strong/Medium/Low scoring matrix.

Automation Trigger: Once a lead hits the 75-point threshold, the CRM must automatically execute these three steps:

- Change the Lead Status from MQL to SQL.

- Notify the assigned Account Executive immediately.

- Trigger the AE’s personalized outreach sequence.

This integration links qualification metrics directly to SDR Agent KPIs. We measure efficiency and predictability, not just basic activity volume.

V. Tactical Objection Handling: Scripts for SDRs

Expect immediate pushback. High-volume prospecting guarantees resistance, especially on Budget (B) and Authority (A). An SDR who backs down here loses the deal immediately.

We train our SDRs to handle objections consultatively,but aggressively. This is not about being polite; it’s about demanding the information required to objectively qualify the lead and move the pipeline forward.

Objection #1: “We Don’t Have a Budget for This Right Now.” (B)

This is the budget bluff. It rarely means they lack funds. It means they haven’t quantified the pain sufficiently to justify spending money on your solution yet.

The Strategy: Reframe cost into quantifiable ROI. Use the pain points they already admitted to as leverage.

SDR Script (The Reframing):

“I completely understand. Most of our high-growth clients didn’t have a specific line item for us when we first spoke.

Let’s set the budget aside for a moment.

You mentioned your team spends 15 hours per week on manual data entry. You valued that loss at roughly $35,000 annually.

If we could solve that problem permanently,redirecting those hours directly to revenue generation,what investment level would make sense to eliminate the $35,000 yearly loss?”

The Objective: Force the prospect to compare the solution’s cost against the quantified loss. If the solution is $10k, the ROI is a 3.5x return. The budget objection collapses immediately. We demand results; they must see the financial leverage.

Objection #2: “I’m Just Gathering Information/Doing Research.” (A)

Translation: You are speaking to the Champion or User, not the Economic Buyer (EB). They are shielding the true decision-maker. If you proceed without mapping the Authority, you are wasting valuable time.

The Strategy: Validate their research role, then pivot immediately to mapping the internal decision process.

SDR Script (The Authority Map):

“That’s perfectly fine. We value thorough research; it means you take investments seriously.

To ensure I provide the exact information your team needs,and not waste your time with irrelevant details,can you help me map the internal process?

Who else will be reviewing this data? Specifically, who typically signs off on new technology investments in the [Relevant Department]?”

The Objective: Shift the conversation from passive ‘information gathering’ to active ‘strategic evaluation.’ Identify the required contacts immediately. We need the EB’s name to advance the deal; we cannot rely on the Champion alone. (See also: Overcoming the SDR Objection: Send Me More Info.)

VI. BANT Pitfalls: Moving Beyond the Checklist

BANT is powerful. But it is easily weaponized against pipeline quality.

Avoid these common qualification mistakes that tank SDR performance immediately.

Pitfall #1: Treating BANT as an Interrogation

A BANT discovery call is a consultative engagement. It is not an audit.

You are not an accountant grilling a loan applicant; you are a strategic partner.

The Fix: Weave BANT naturally into the discussion flow (N-B-A-T). Use open-ended questions that demand deep context,not closed questions that lead to premature disqualification.

Our Example: Stop asking: “Do you have a budget?” Instead, frame the discussion around value: “How does your organization typically approach funding solutions that impact [Metric X]?”

Pitfall #2: Focusing Only on Explicit Needs

Explicit needs are surface level. They are the problems the prospect already articulates (“Our CRM is slow”).

High-performing SDRs target Latent Needs.

This is the underlying pain the prospect hasn’t quantified or connected to the revenue outcome. (e.g., “That slow CRM is causing us to miss 10% of follow-ups, resulting in $100k in lost revenue per quarter.”)

The Fix: We mandate our team always drill down. Ask: “Why is that slow?” Then ask: “What is the measurable consequence of that slowness?” This links the micro-pain to the macro-business objective.

Pitfall #3: Premature Disqualification

The traditional BANT model demands immediate disqualification if Budget is absent. That model is obsolete.

In our modern, high-ticket qualification framework, a low score (e.g., 5/10 on Budget) simply signals a strategic hurdle. It does not signal failure.

The lead needs a different approach,not dismissal.

Strategic Action:

- If Budget is Low (5) but Need and Authority are High (50): The lead is highly valuable. They simply require enablement,you must help them build the internal business case and ROI justification.

- If Authority is Low (5) but Need and Timeline are High (50): Pivot immediately. This is a multi-threading opportunity. Contact the identified Economic Buyer directly and use the champion’s data as leverage.

We use the 75-point threshold as the mandatory guide. This prevents the premature disqualification of high-potential accounts that simply require more strategic effort from the SDR.

Frequently Asked Questions (FAQ)

What is the difference between BANT and MEDDIC?

BANT (Budget, Authority, Need, Timeline) is built for speed and efficiency. It is the foundational framework for high-volume SDR roles and shorter sales cycles.

MEDDIC (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion) is different: it is complex and highly detailed. Account Executives (AEs) use MEDDIC for large, enterprise-level B2B deals involving multiple stakeholders and long sales cycles.

Our strategy is clear: We use BANT to qualify the initial opportunity. We use MEDDIC to run the deal.

Should SDRs always start with the Need (N) in BANT?

Yes. Absolutely. Strategic SDRs must lead with Need (N). This dictates the N-B-A-T sequence: Need, Budget, Authority, Timeline.

Why this sequence delivers results:

- Starting with Need builds immediate, trust-based rapport.

- It forces you to quantify the prospect’s pain and establish concrete value first.

- Budget then becomes an investment required to solve a quantified problem,not an arbitrary cost.

This approach drastically increases acceptance rates and moves the deal forward faster.

How do I handle a prospect who refuses to disclose their budget?

Never push for a specific dollar amount if the prospect resists. That is a rookie mistake that kills deals.

Instead, shift the focus immediately to the Cost of Inaction.

Ask questions that quantify the potential loss:

- “What is this problem costing your business today? Give me the monthly figure.”

- “If this issue remains unsolved for the next year, what is the projected impact on your team’s headcount or revenue targets?”

We anchor the conversation on value, not cost. By linking your solution’s price to the prospect’s quantifiable loss, the budget discussion becomes secondary to the resolution.

Is BANT outdated for modern sales?

No. BANT is not outdated. It is foundational.

Its simplicity makes it essential for the high-volume SDR function. It provides the quick, high-level structure needed to process leads efficiently and maintain pipeline velocity.

Yes, BANT requires modern refinement (N-B-A-T sequencing and deep pre-call intelligence). But complex frameworks like CHAMP or MEDDIC are simply advanced iterations built upon core BANT principles. You must master the foundation first.

Ready to take the next step?

Unlock scalable, trust-based lead acquisition methods today. Stop guessing and start converting high-ticket clients.

Try AI Lead Generation Today

Click Here