Measuring Sales Development Representative (SDR) performance is not about tracking activity. It is about predicting revenue.

The market demands precision. We cannot afford vanity metrics or ambiguous reporting that fails to connect effort directly to pipeline value. Tracking inputs (calls, emails) without corresponding outputs is operational negligence.

Your SDR program must function as a scalable, predictable engine. If you cannot quantify the results of every touchpoint,from initial cold outreach to qualified handoff,you are losing money.

This guide breaks down the essential SDR KPIs and metrics. We focus exclusively on the measurements that truly drive high-ticket lead quality and predictable conversion rates.

We use this exact framework daily to ensure our outreach efforts translate directly into measurable revenue increases and accelerated sales cycles.

THE MODERN MANDATE: The 2025 SDR framework requires a shift from volume-based metrics to value-based outcomes. The only KPIs that matter are those directly linked to Pipeline Quality, Conversion Velocity, and overall Sales Cycle Acceleration. If a metric doesn’t help you forecast revenue with 90%+ accuracy, it is a distraction.

The Five Non-Negotiable Principles of SDR Performance

To ensure your SDR program fulfills its mandate as a predictable revenue engine, we must adhere strictly to these core measurement principles:

- Activity Metrics Are Diagnostic Tools: Dials, emails, and connection rates are purely inputs measuring effort. We use them only to diagnose operational bottlenecks,never to define success.

- Conversion Rate is the Apex KPI: The Lead-to-Opportunity Conversion Rate (L2O) is the definitive measure of SDR effectiveness. This metric dictates pipeline quality and velocity.

- Velocity Defines Opportunity: Lead Response Time (LRT) must be tracked religiously. We know that engaging a qualified lead within five minutes yields a 400% higher conversion rate. Speed is pipeline integrity.

- The Revenue Connection: Every SDR effort must be traceable back to Closed-Won Revenue Sourced. If a metric or activity does not contribute demonstrably to qualified pipeline generation, it is operational waste and must be immediately eliminated.

- Strategic AI Integration: Leverage modern AI and automation tools,not to replace the SDR, but to eliminate administrative drag (data hygiene, logging) and enhance personalization, directly boosting connect rates.

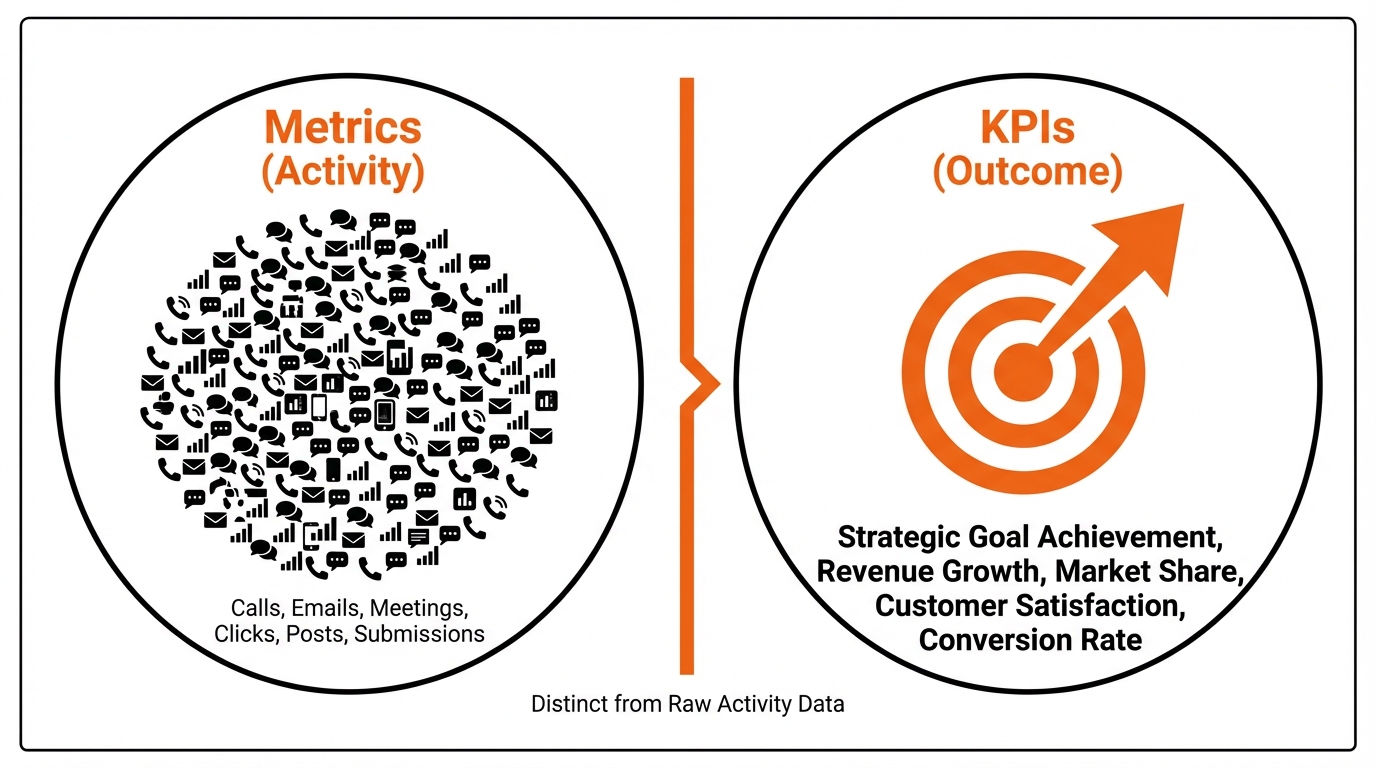

Step #1: Differentiating Metrics from KPIs

Before establishing any targets, we must first clarify the fundamental difference between a metric and a Key Performance Indicator (KPI). Confusing the two is the fastest route to misaligned incentives and wasted effort.

Here is the critical distinction:

-

Metric: A raw, quantitative input. It tracks operational volume and effort.

Example: 100 calls made, 500 emails sent.

-

KPI (Key Performance Indicator): A strategic output measurement. It evaluates the effectiveness of that effort against a core business objective.

KPIs answer the question: Are we moving closer to our revenue goals?

If your team makes 1,000 dials (strong metric) but books zero qualified meetings (failing KPI), you have an operational failure. Our focus must always be on optimizing the conversion rate,the critical bridge between activity and outcome.

The Two Pillars of SDR Performance Evaluation

We categorize all SDR tracking into two essential groups. These groups define where we set strategic goals versus where we focus our coaching time:

- Pillar 1: Efficiency Metrics (Input): These are diagnostic measurements tracking volume, effort, and operational capacity (e.g., Dials, Emails Sent, Connection Rate).

- Pillar 2: Effectiveness KPIs (Outcome): These are strategic measurements tracking quality, conversion success, and pipeline generated (e.g., SQL Conversion Rate, Pipeline Value).

You need both data sets to run a successful SDR program. However, the Effectiveness KPIs dictate strategy; the Efficiency Metrics simply inform individual coaching plans.

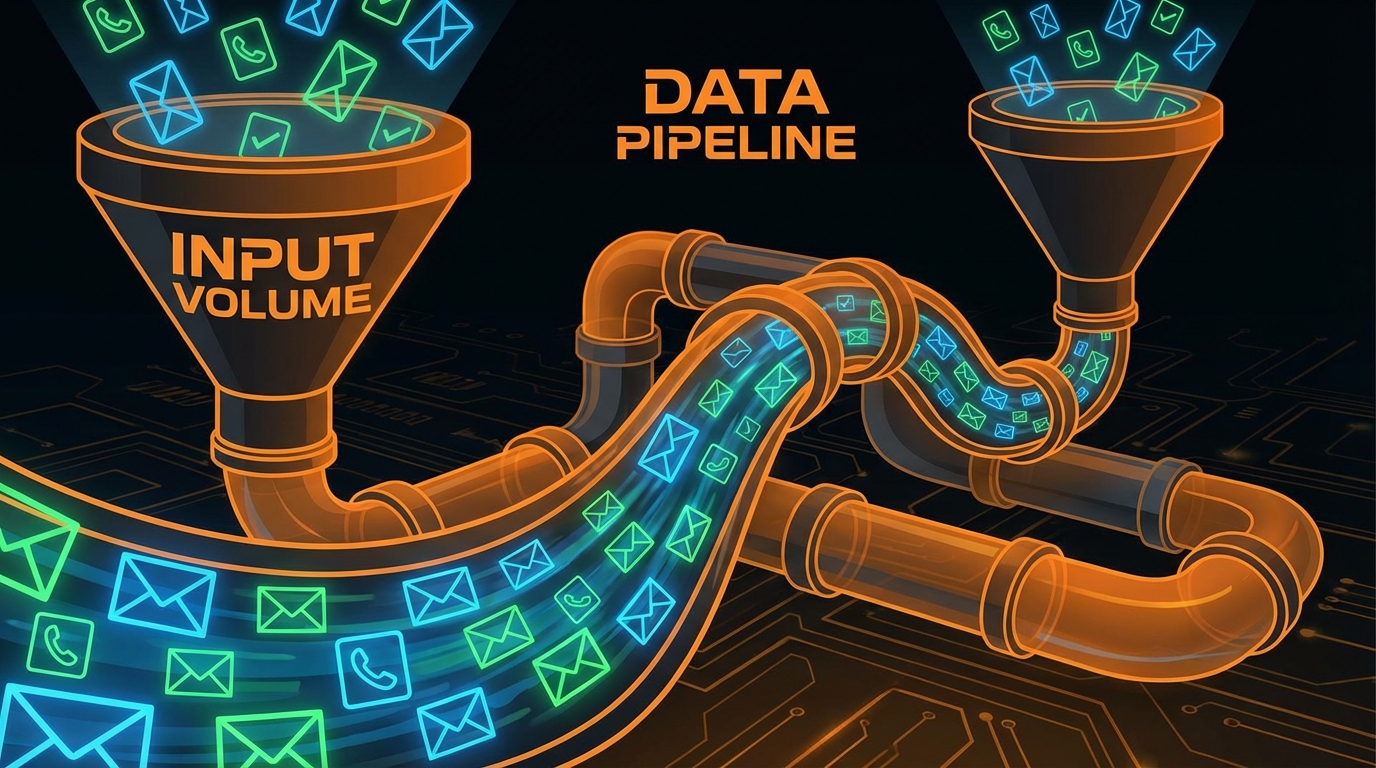

Step #2: Core Efficiency Metrics (The Input Volume)

Metrics track effort; they are the essential inputs that feed your sales funnel. Before analyzing outcomes, we must ensure SDRs are achieving maximum capacity utilization. These metrics confirm whether your team is putting in the necessary, consistent effort.

1. Total Activities Logged

This is the foundational metric: the combined, raw count of all outreach efforts logged in the CRM.

- Calls made (Dials).

- Emails sent.

- Social touches (e.g., LinkedIn connection requests, messages).

Activity quotas establish the baseline work ethic. However, volume alone is insufficient,100 dials per day is meaningless if the target list quality is poor. We use this metric primarily as a diagnostic tool. When an SDR struggles with outcome KPIs (Step #3), the first check is always consistency in activity volume. Low volume equals low results, regardless of skill.

2. Emails Sent & Deliverability Rate

Volume is the input (Emails Sent), but technical health is measured by the Deliverability Rate. Inbox placement dictates success.

We track the total volume sent, but we obsess over the percentage that successfully lands in the primary inbox. A deliverability rate below 95% is a crisis requiring immediate technical intervention.

Low deliverability points directly to systemic technical failures:

- Data Hygiene: High bounce rates due to invalid or stale emails.

- Domain Health: Lack of proper domain warmup or poor sender reputation.

- Volume Abuse: Aggressive sending schedules triggering ISP spam filters.

Our protocols mandate strict data verification before campaign launch. As detailed in our SDR Cold Email Subject Lines: The 2025 Strategic Guide, the most compelling copy in the world fails if it lands in the spam folder.

3. Connect Rate (Dials)

The Connect Rate measures skill and list quality. It is the percentage of dials that result in a live conversation with the target prospect or an appropriate decision-maker (Connects / Dials).

This metric separates simple dialing volume from strategic outreach. A high volume of dials means nothing if you are not reaching humans.

A consistently low Connect Rate diagnoses operational deficiencies:

- List Quality: Outdated, incorrect, or highly protected phone numbers.

- Call Timing: SDRs are calling outside known optimal hours for the target market.

- Gatekeeper Proficiency: Failure to navigate or bypass receptionists and assistants effectively.

Improving this requires targeted coaching on gatekeeper navigation,a critical skill set. We continuously review and refine our approach using resources like our B2B Cold Calling Scripts: The 2025 Strategic Blueprint to ensure maximum live conversation yield.

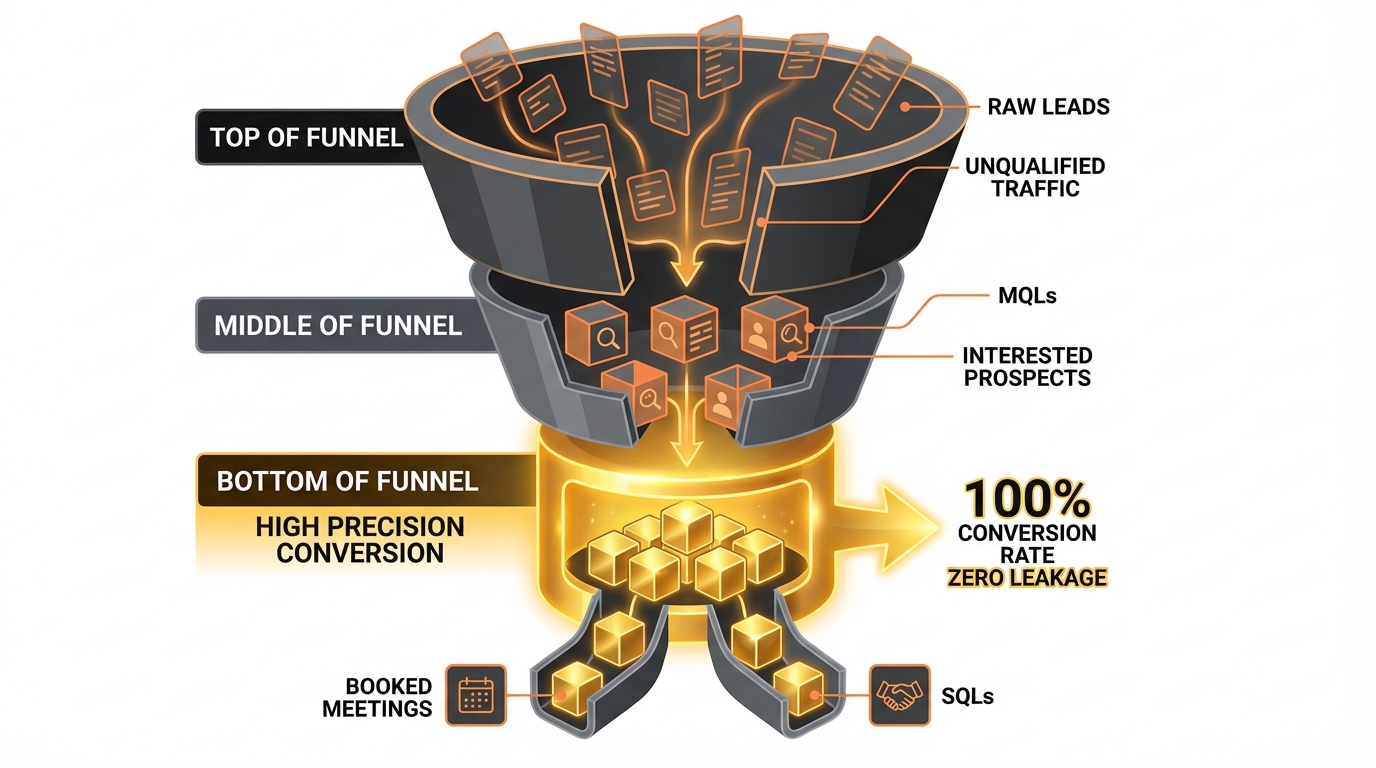

Step #3: Critical Effectiveness KPIs (The Outcome Quality)

While Step #2 measured effort (volume), this step measures results (quality). These are the metrics that determine the immediate health and long-term scalability of your sales pipeline.

If efficiency is high but effectiveness is low, your SDRs are busy,but they are failing. Focus your coaching and resource allocation here to drive meaningful revenue.

1. Lead Response Rate (Email)

This KPI measures the effectiveness of your messaging and targeting. It confirms whether the high volume of emails logged in Step #2 is actually hitting the mark.

Formula: (Number of Positive Responses / Total Emails Sent) * 100

Note on Calculation: We strictly count positive or neutral responses that indicate genuine interest or request a follow-up. Auto-replies, bounces, and unsubscribe requests are filtered as noise.

If your response rate is consistently low, the problem is not volume,the problem is relevance. The input is wasted.

Common causes of a low response rate:

- Your personalization is generic or perceived as automated.

- Your Ideal Customer Profile (ICP) definition is too broad.

- The value proposition is unclear or non-existent in the first line.

Benchmark: A high-performing outbound SDR team should maintain a 5–10% positive response rate for highly targeted campaigns.

2. Lead Qualification Rate (LQR)

This is the true measure of SDR skill and pipeline quality. LQR tracks the percentage of leads contacted that successfully transition to a Sales Qualified Lead (SQL) or Sales Qualified Opportunity (SQO) in the CRM.

A high LQR indicates the SDR is:

- Targeting the correct accounts (fit).

- Using effective qualification frameworks (e.g., BANT, MEDDIC).

- Successfully articulating value and handling initial objections.

If LQR is low, your Account Executives (AEs) are wasting valuable time on unqualified leads. This creates immediate friction and distrust between Sales Development and Closing teams,a critical organizational failure.

Actionable Insight: Audit the call recordings of SDRs with low LQR. They are likely skipping critical discovery questions or failing to establish pain points and budget authority.

3. Meetings Held Rate (Show Rate)

Booking a meeting is only half the battle. Getting the prospect to actually show up is the KPI that matters, as it validates the quality of the initial qualification.

Formula: (Number of Meetings Held / Number of Meetings Booked) * 100

A low show rate signals a fundamental lack of commitment from the prospect. This indicates that the SDR failed to properly anchor the meeting’s value.

Common reasons for poor show rates:

- The SDR booked the meeting without ensuring the prospect took ownership of the calendar invite (e.g., clicking ‘Yes’).

- The qualification was weak; the prospect didn’t see enough immediate, personalized value to commit their time.

- Poor handoff process: The SDR failed to send a strong pre-meeting confirmation and a clear agenda outlining the next steps.

We demand a minimum 80% Meeting Held Rate. Anything lower means the SDR is booking “phantom meetings” that clog the AE’s schedule and destroy pipeline confidence.

4. Lead-to-Opportunity Conversion Rate

This is the ultimate financial health indicator for your top-of-funnel operations.

It measures the percentage of initial leads (e.g., MQLs or raw contacts) that the SDR converts into a formal sales opportunity stage in the CRM.

This KPI directly measures the efficiency of the entire SDR process, encompassing list building, successful outreach, and final qualification. If this metric drops today, the entire sales pipeline shrinks 90 days later,guaranteed.

Step #4: Velocity and Efficiency Metrics (The Speed of Money)

If Step #3 measured the quality of the outcome, Step #4 measures the speed at which that outcome is achieved. In high-ticket sales, velocity is a massive competitive advantage,speed literally kills the competition.

These metrics track how quickly your SDRs move qualified prospects through the initial funnel stages. Efficiency is measured in minutes, not days. This is where you identify and eliminate operational friction.

1. Lead Response Time (LRT)

This is the time elapsed between an inbound lead submitting a form (e.g., demo request) and the SDR’s first attempt at contact. We track LRT in seconds, not minutes.

The industry standard is a non-negotiable 5 minutes.

Why the urgency? If an inbound lead waits 30 minutes, their interest cools significantly. Our internal data proves that leads contacted within 60 seconds convert 2x higher than those contacted after 10 minutes. This metric requires robust automation, immediate notification systems tied directly to the CRM, and the right Essential SDR Tech Stack.

2. Sales Cycle Length (SDR Stage)

This metric defines the duration required for a lead to progress from “First Contact” to “Sales Qualified Opportunity” (SQO). It is a direct indicator of bottlenecks in your qualification process.

- If the cycle is too long: The SDR is likely over-nurturing, failing to establish urgency, or avoiding the ask for the meeting. This drains pipeline energy.

- If the cycle is too short: The SDR is rushing qualification, leading to poorly vetted leads and a high subsequent drop-off rate (low Meeting Held Rates).

Our goal is consistency, not just speed. A predictable, optimized sales cycle length is essential for accurate revenue forecasting and resource allocation.

3. Follow-up Cadence Adherence

Did the SDR execute the established multi-touch sequence exactly as defined? This KPI tracks the fidelity of the execution against the proven strategy.

Modern sales engagement platforms (SEPs) allow management to track adherence to pre-defined cadences across all channels (email, phone, social).

- 100% adherence is the only acceptable goal.

- Any deviation means the SDR is intentionally or accidentally ignoring the proven, optimized path designed for conversion.

If an SDR claims that the company cadence isn’t working, but their personal adherence rate is 70%, the data proves otherwise: the process was not followed. Adherence is non-negotiable proof of process discipline.

Step #5: The Financial Scorecard (Revenue Impact KPIs)

We have covered quality, volume, and speed. Now we address the only metric the C-suite truly tracks: revenue contribution.

Step #5 moves beyond activity metrics to establish the SDR team as a true profit center. These KPIs directly tie SDR performance to the ultimate bottom line.

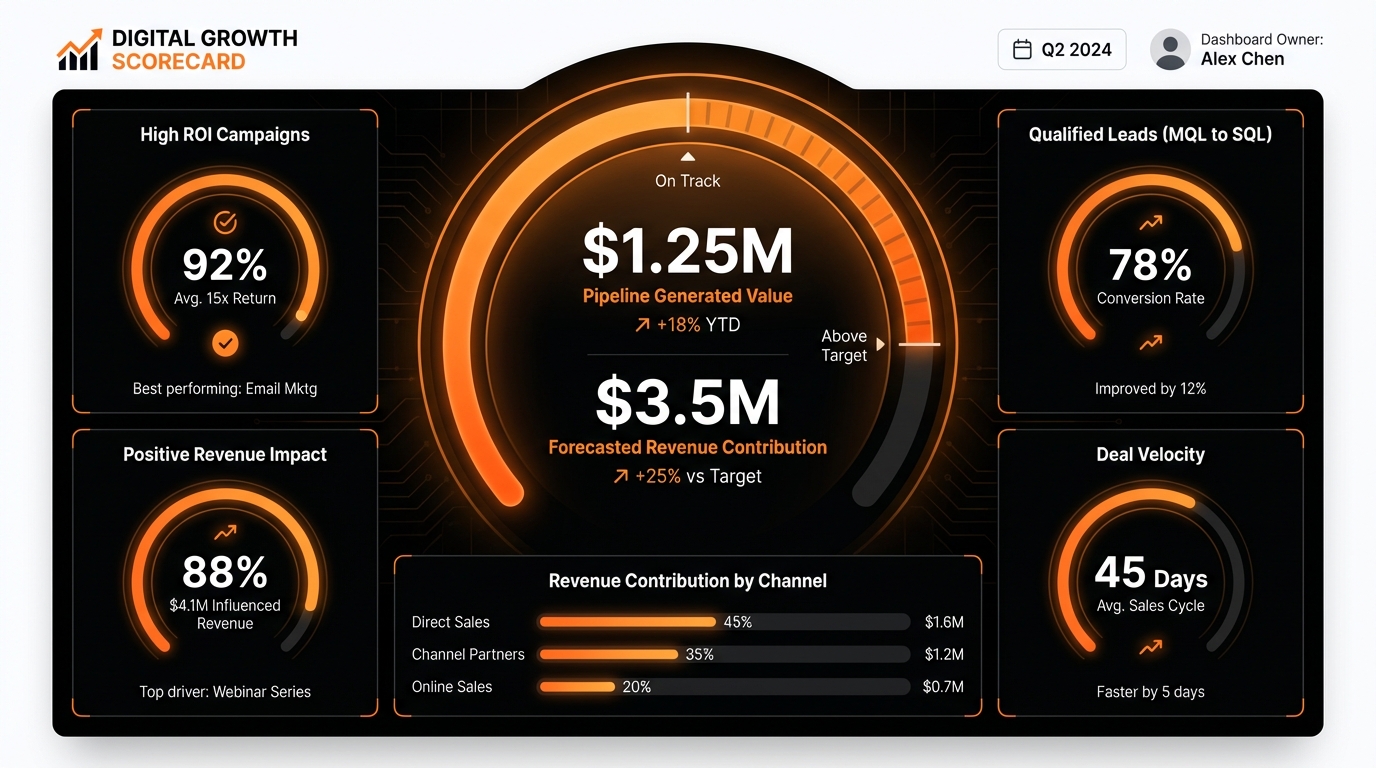

1. Pipeline Generated Value (PGV)

PGV is the total dollar value of all qualified opportunities successfully sourced by the SDR within a defined period. This is the first true measure of financial impact.

This metric is critical because it forces SDRs to prioritize value over sheer volume. We do not reward activity; we reward revenue potential.

- Example: An SDR generating 5 opportunities worth $100k each ($500k total) is 5x more valuable than an SDR generating 20 smaller deals worth $100k total.

We specifically coach our teams to target Ideal Customer Profiles (ICPs) that align with our highest Average Deal Size (ADS).

2. Pipeline Coverage Ratio

This is the leading indicator used by sales leadership to assess risk. It answers one question: Do we have enough pipeline to hit our closing targets?

Formula: Total Pipeline Value / Sales Quota

If your quarterly quota is $1 million, and your SDR team generates $3 million in qualified pipeline, your coverage ratio is 3:1.

We mandate a healthy ratio,typically 3x to 5x,to ensure we account for inevitable deal loss and maintain predictable revenue growth.

3. Closed-Won Revenue Sourced

This is the ultimate accountability KPI. It tracks the actual, realized revenue generated from deals where the SDR was the undisputed originator.

If the deal closes, the SDR gets credit. Period.

This metric is essential for two reasons:

- Commission Calculation: We use this KPI,not just meetings booked,to calculate commission, forcing a focus on high-quality qualification.

- Attribution Integrity: It demands impeccable CRM hygiene. Attribution must be clear and non-negotiable from the moment the lead enters the system.

4. Customer Acquisition Cost (CAC) per SDR-Sourced Deal

CAC measures the efficiency of your investment. Are your SDRs sourcing deals profitably?

Formula: (Total SDR Team Costs: Salary + Tools + Commission) / Number of SDR-Sourced Closed-Won Deals

A high CAC indicates operational inefficiency. If the cost to acquire a customer through the SDR channel exceeds your target, we look for bottlenecks.

Often, the solution is technology: investing in better automation and AI tools to reduce manual research time, thereby drastically lowering the cost per acquisition and maximizing ROI on your team.

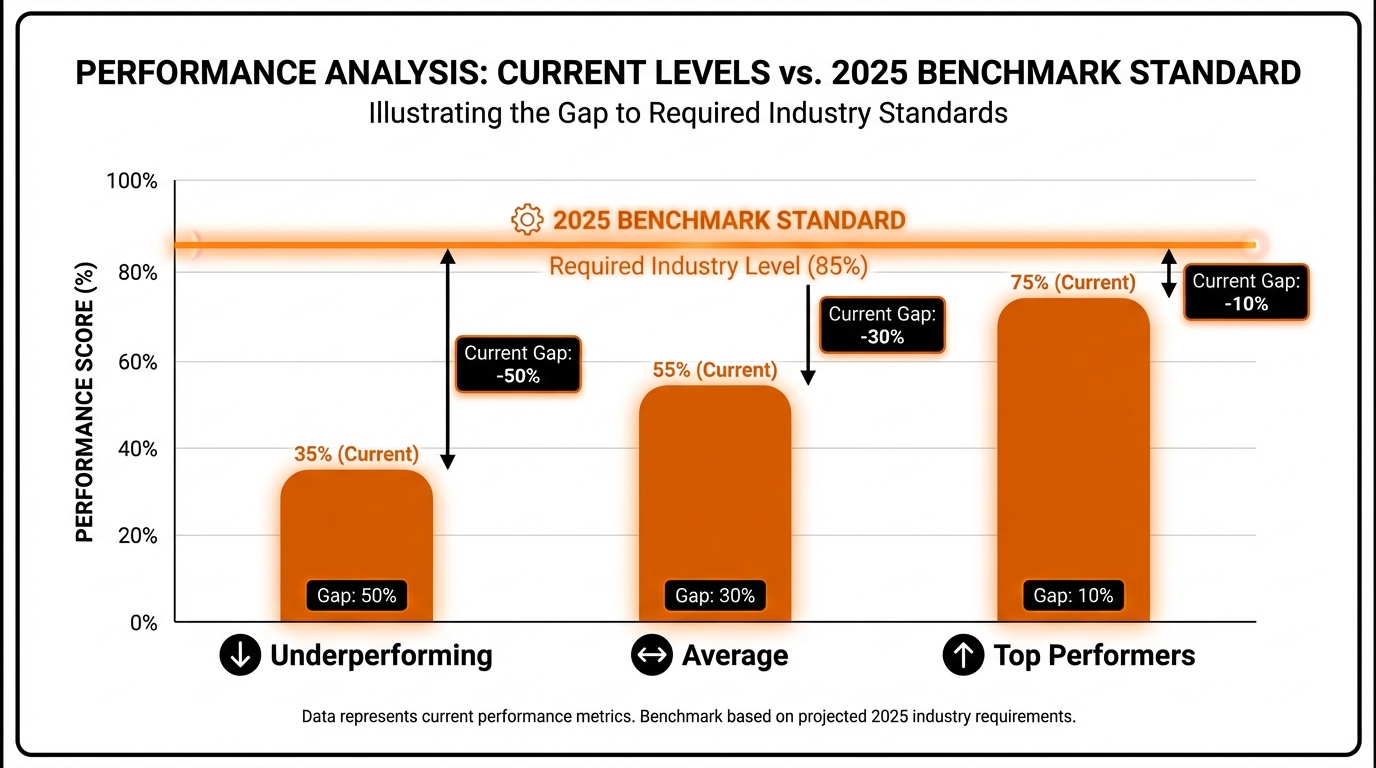

Step #6: Benchmarking SDR Performance (2025 Data)

We have defined the core metrics across quality, volume, velocity, and revenue impact. Now, we must answer the critical question: How do you know if your SDR team is performing effectively?

The answer lies in contextualizing your results against high-performance benchmarks. Defining KPIs is only half the battle; measurement requires context. Step #6 provides the necessary industry targets, but remember: these figures must always be adjusted based on your Ideal Customer Profile (ICP) and Average Contract Value (ACV).

For instance, enterprise B2B sales require extreme personalization and account-based strategies. This means lower daily activity volume (60 touches) but significantly higher conversion rates (8% L-to-O). We prioritize quality over raw quantity when the ACV demands it.

| KPI Category | Metric | High-Performance Benchmark (Target) | Strategic Impact |

|---|---|---|---|

| Activity/Efficiency | Total Daily Activities (Touches) | 60 – 100 (Outbound, highly personalized) | Ensures sufficient effort and market coverage without sacrificing quality. |

| Connect Rate (Dials) | 8% – 12% | Measures data hygiene and the effectiveness of contact timing/strategy. | |

| Conversion/Quality | Positive Email Response Rate | 5% – 10% | Indicates message relevance and the quality of personalization efforts. |

| Lead-to-Opportunity Conversion Rate | 5% – 8% | The primary measure of qualification effectiveness and lead quality handoff. | |

| Meeting Held Rate (Show Rate) | > 80% | Measures prospect commitment and the SDR’s ability to articulate meeting value. | |

| Velocity/Speed | Lead Response Time (Inbound) | < 5 minutes | Critical for maximizing inbound conversion rates; speed kills the competition. |

| Sales Cycle Length (SDR Stage) | 7 – 14 days (Ideal for high-ticket B2B) | Highlights process friction and qualification speed; faster pipeline velocity drives revenue. |

Step #7: Optimizing Performance with Data and AI

Tracking metrics and benchmarking are foundational. The true value lies in actionable analysis and optimization. Our goal shifts from merely reporting performance to establishing predictable, scalable growth.

The core principle is simple: The measurement system must drive the desired behavior.

1. Identify Bottlenecks (The Funnel Analysis)

Use your KPIs to pinpoint exactly where the sales development process breaks down. This diagnosis dictates the required intervention.

Scenario A: High Volume of Dials/Emails, Low Connect Rate.

Diagnosis: The problem is list quality, data accuracy, or poor timing. SDRs are reaching out to stale or incorrect contacts.

Solution: Immediately invest in better lead data enrichment tools. Implement AI-driven contact verification. Shift calling times based on geographic and behavioral data to optimize for connection windows.

Scenario B: High Connect Rate, Low Lead-to-Opportunity (L2O) Rate.

Diagnosis: The problem is qualification or messaging effectiveness. The SDR is successfully engaging prospects, but they are the wrong fit or the discovery process is weak.

Solution: Implement immediate, focused coaching on active listening and discovery questioning. Review and tighten the qualification criteria (BANT, MEDDIC). The SDR must be trained to disqualify quickly and effectively.

Scenario C: High L2O Rate, Low Closed-Won Revenue.

Diagnosis: The problem is the definition of “qualified” between Sales Development and Account Executives (AEs). SDRs are passing leads that are not truly sales-ready, lacking budget, authority, or need.

Solution: Tighten the Service Level Agreement (SLA) and the Sales Qualified Lead (SQL) criteria enforced by the AE team. Implement a feedback loop where AEs must justify why a lead was rejected. SDR compensation should be tied partially to pipeline progression, not just booked meetings.

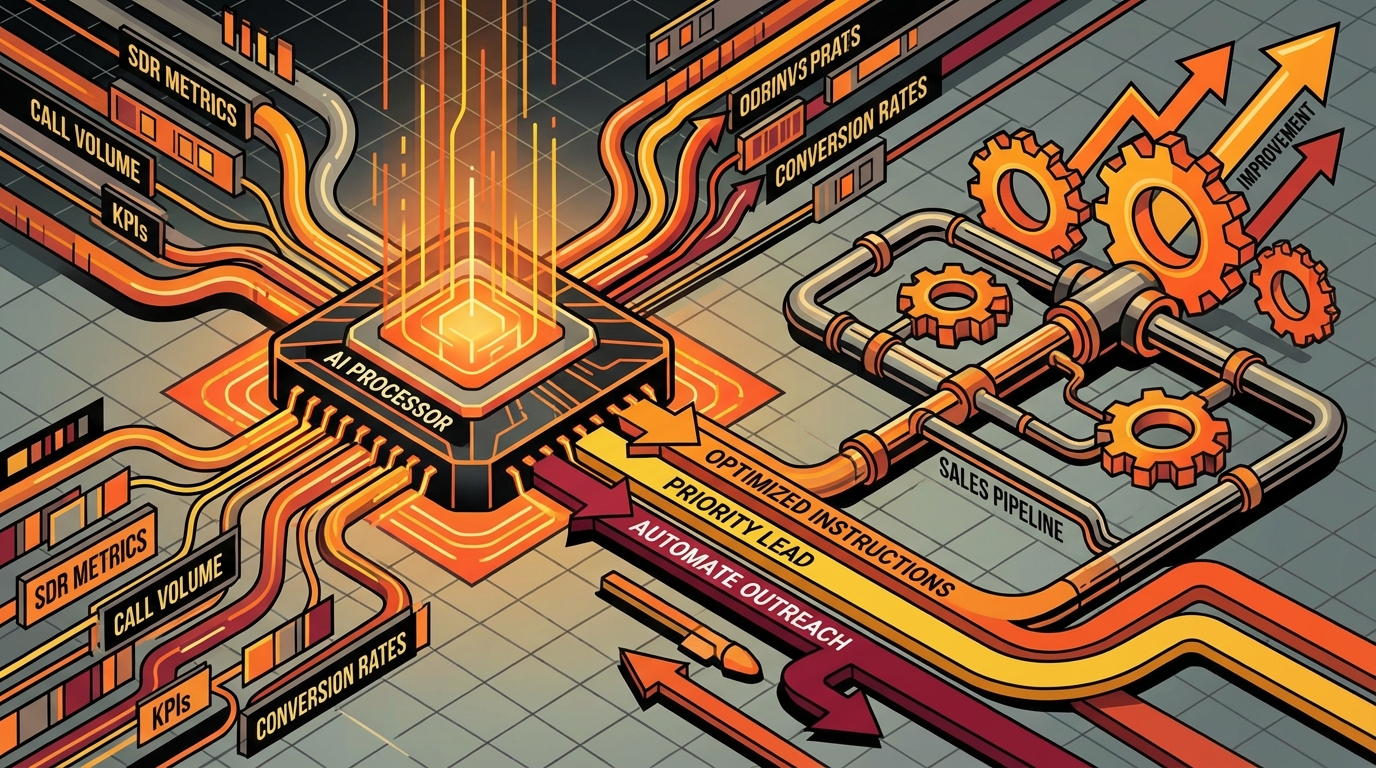

2. Leverage AI for High-Impact Activities

In 2025, SDRs should not be spending 40% of their time on manual research, data entry, or list scrubbing. AI must handle the repeatable, high-volume tasks.

We focus on using AI lead generation software to find accurate, personalized contact information and automate CRM hygiene. This shift directly boosts the Connect Rate and Data Quality KPIs.

When AI handles the heavy lifting, the SDR’s time is freed up for high-value human activities:

- Deep Personalization: Conducting research that goes beyond basic company data (e.g., recent news, pain points).

- Complex Objection Handling: Engaging in nuanced conversations requiring empathy and strategic thinking.

- Strategic Follow-Up: Crafting multi-channel sequences that adapt based on prospect engagement signals.

This organizational shift moves the SDR’s focus from efficiency metrics (volume) to effectiveness KPIs (quality and conversion).

3. Implement a Balanced Scorecard Approach

Never evaluate SDR performance based on a single metric. Doing so invites sandbagging (holding back leads) and metric manipulation.

A balanced scorecard ensures a holistic view of performance, rewarding sustainable, high-quality pipeline generation rather than short-term metric spiking. We recommend the following weighting structure:

- Quantitative Results (70% Weight): Pipeline Generated, Conversion Rate (L2O), Revenue Influence. These are the ultimate output metrics.

- Qualitative Skills (20% Weight): Discovery Call quality (assessed by manager/AI), CRM hygiene, Team collaboration, and adherence to company values.

- Process Adherence (10% Weight): Cadence compliance, Lead Response Time (LRT), and data accuracy. This measures commitment to the operating model.

This approach ensures SDRs are compensated not just for booking a meeting, but for building a compliant, high-quality pipeline that converts to revenue.

Frequently Asked Questions

What is the difference between an SDR KPI and an SDR Metric?

A metric is a raw, quantitative measurement of activity (e.g., 50 calls made). A KPI (Key Performance Indicator) is a strategic measure of effectiveness,it shows progress toward a core business goal (e.g., 5% Lead-to-Opportunity Conversion Rate). We use KPIs for strategic decision-making and forecasting; metrics are for daily operational diagnosis and funnel troubleshooting.

Should SDRs be compensated based on activity metrics or outcome KPIs?

Compensation must be primarily tied to outcome KPIs,specifically Qualified Meetings Held and Pipeline Generated Value. Activity metrics (dials, emails) are only acceptable as a minimum baseline requirement. We mandate linking compensation to outcome because it ensures the SDR focuses on quality qualification and direct revenue contribution, not just transactional busywork.

How often should SDR performance be reviewed?

Review cadence depends on the metric type:

- Daily/Weekly: Activity metrics (dials, emails, connections) must be reviewed constantly to ensure momentum and diagnose immediate workflow issues.

- Monthly: Strategic KPIs (conversion rates, pipeline value, time-to-conversion) require in-depth monthly analysis.

- Quarterly: Focus on quota attainment, overall pipeline health, and compensation adjustments based on Closed-Won Revenue Sourced.

What is a good Lead-to-Opportunity Conversion Rate for an outbound SDR team?

For highly targeted, high-ticket B2B outbound motions, we consider a Lead-to-SQO (Sales Qualified Opportunity) conversion rate of 5% to 8% to be high-performing. Achieving this requires exceptional personalization and stringent Ideal Customer Profile (ICP) targeting. If conversion rates drop below 3%, it is a clear indicator of poor list quality or a critical lack of message relevance.

How does AI impact SDR performance KPIs?

AI fundamentally shifts the performance baseline. AI tools increase SDR effectiveness by improving data quality and enabling hyper-personalization at scale. This directly boosts critical KPIs: Connect Rates, Email Response Rates, and, most importantly, Lead-to-Opportunity Conversion Rates. By automating administrative tasks, AI eliminates the need for high volume requirements and optimizes the SDR’s time for high-value, human-centric qualification and relationship building.

References

- The Essential KPIs and Metrics for Measuring the Success of SDR …

- Understand SDR Agent Effectiveness with the SDR Agent Analytics …

- 8 Key SDR Metrics to Track for a High-Performing Team – Artisan AI

- Measuring SDR Performance Using KPIs and SDR Metrics

- SDR Metrics KPIs: The Executive Guide to Building a Predictable …