The standard Sales Development Representative (SDR) playbook is dead.

If your team is still prioritizing raw dial volume over targeted, personalized connections, you are losing money. Your pipeline is clogged with junk. Your Account Executives (AEs) are frustrated,and rightfully so.

In 2025, SDR success is not measured by activity. It is defined by precision.

You must shift your focus immediately: move from simple activity tracking to outcome-driven Key Performance Indicators (KPIs). These are the metrics that truly measure trust, conversion efficiency, and direct pipeline contribution.

We use this exact framework to scale our own high-ticket lead generation systems. It ensures every SDR action directly correlates with measurable revenue growth.

Here is the strategic blueprint for measuring SDR performance today.

Key Takeaways: SDR Performance Strategy

- Activity vs. Outcome: Stop relying solely on volume metrics (dials, emails sent). Prioritize Outcome KPIs like Lead-to-Opportunity Conversion Rate and SDR-Attributed Revenue.

- Response Time is Revenue: The average lead response time is too slow. Tracking and forcing sub-5-minute response times is critical for high-ticket conversion.

- Quality Data is King: Poor lead data destroys SDR efficiency. High Connection Rates prove the quality of your lead sourcing, a metric we use AI Lead Generation to optimize.

- Pipeline Value: Every SDR should be tracked by the potential dollar value they introduce, not just the number of meetings booked. Focus on ACV (Annual Contract Value) contribution.

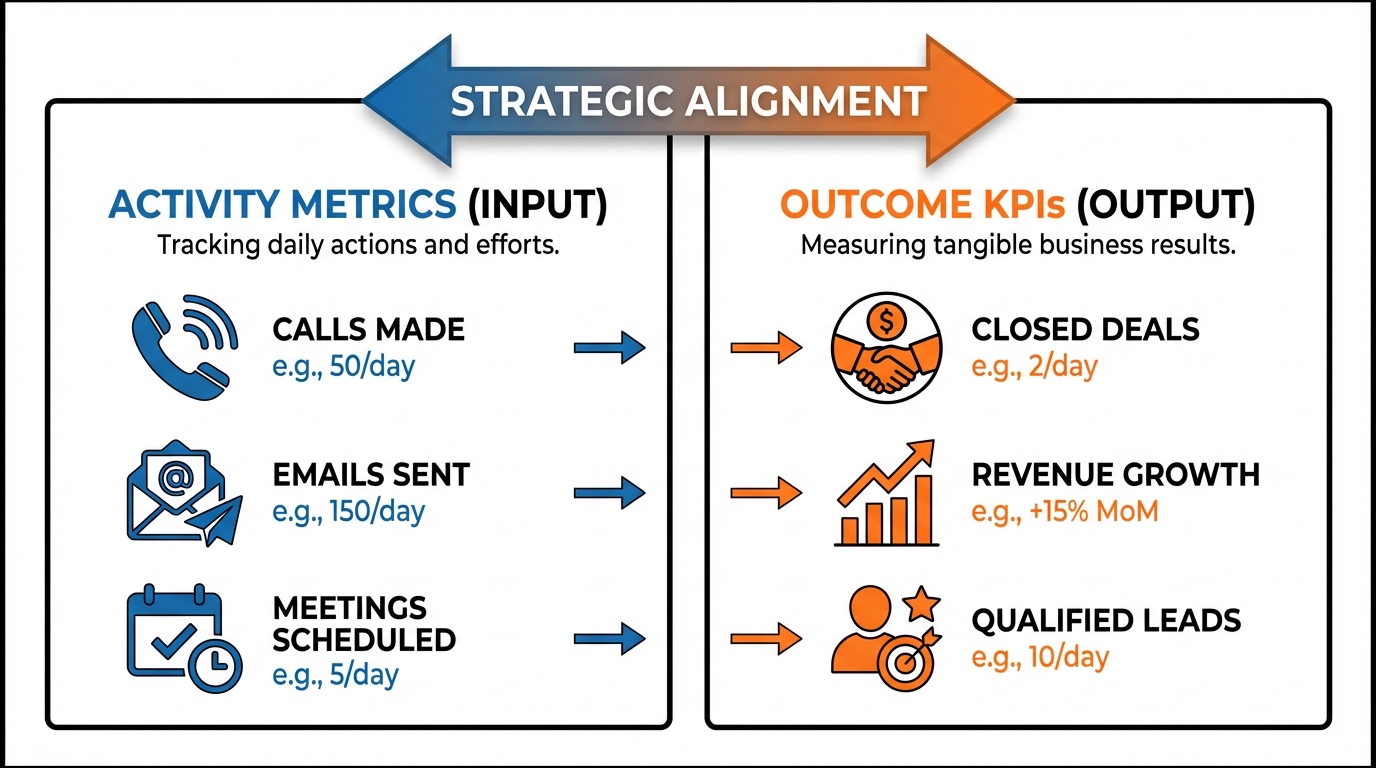

Activity Metrics vs. Outcome KPIs: The Strategic Difference

The fundamental mistake most organizations make is confusing raw activity metrics with strategic Key Performance Indicators (KPIs).

Metrics track effort,the volume of inputs (e.g., How many dials were made?). KPIs track results,the quality and impact of those inputs (e.g., What revenue did that effort generate?).

We require both to manage performance effectively. However, the strategic weight must always favor the outcome.

We leverage Activity Metrics as leading indicators: they diagnose inefficiencies and friction points within the sales process. Conversely, we use Outcome KPIs as lagging indicators: they confirm the effectiveness of the overall strategy and the SDR’s contribution to pipeline generation.

The Problem with Volume-Obsessed Tracking

A volume-obsessed tracking culture guarantees failure. When management prioritizes only input metrics, SDR behavior immediately shifts to manipulation:

- If you only track calls made, SDRs will rapid-dial low-value lists just to hit the daily number, wasting time and resources.

- If you only track emails sent, SDRs will blast generic, non-personalized templates. This destroys domain reputation, lowers deliverability, and tanks conversion rates.

The result is always the same: high activity, abysmal conversion rates, and massive agent burnout. We must shift the focus entirely.

The Mandate: Quality Over Quantity. SDRs succeed when they understand that 10 highly personalized, well-researched outreach sequences are exponentially more valuable than 100 generic, automated blasts. Your compensation structure and your core KPIs must strictly reflect this quality-over-quantity mandate.

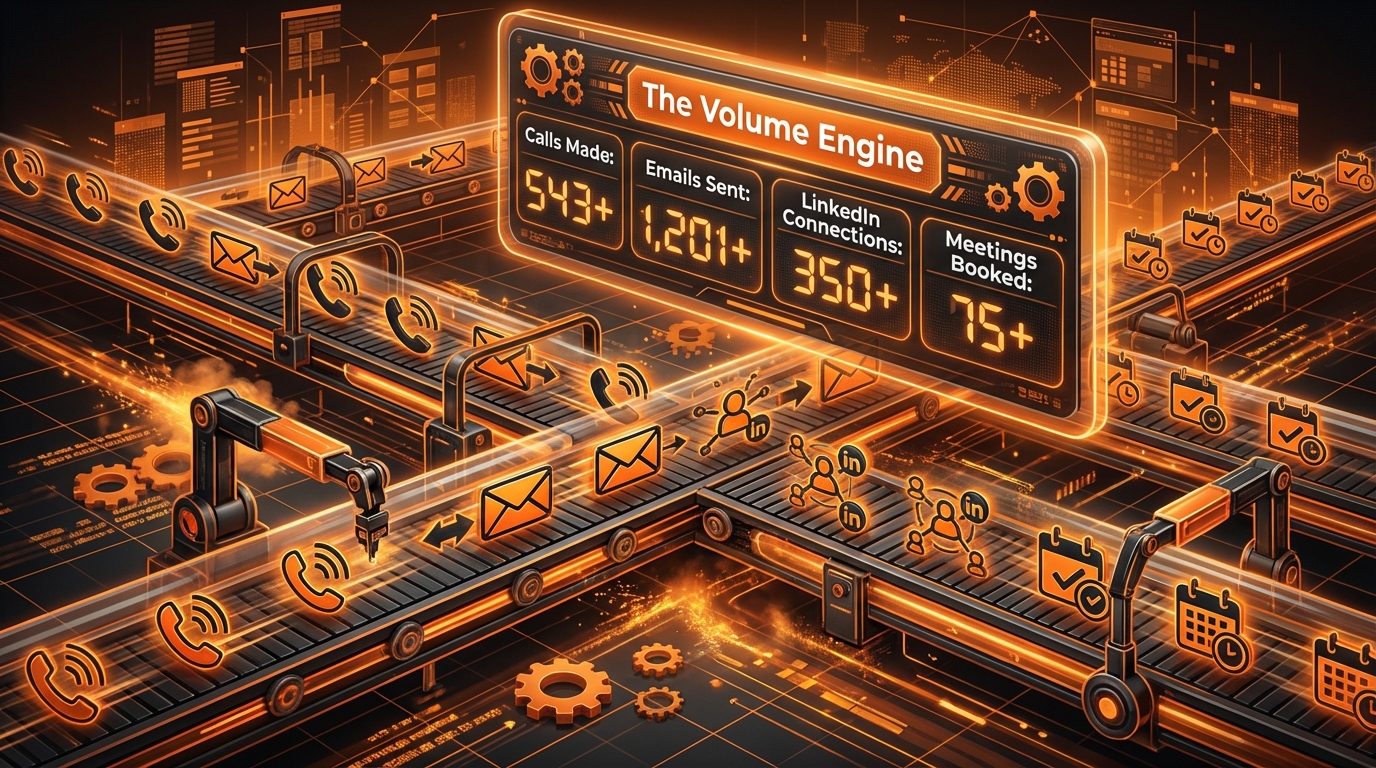

Essential SDR Activity Metrics: The Volume Indicators

Activity metrics are the foundation. They quantify the raw input and confirm that your SDRs are consistently executing their playbooks. While they track effort,not results,they are essential for diagnosing performance gaps and setting realistic, data-backed quotas.

1. Emails Sent and Deliverability Rate

This tracks the sheer volume of digital outreach. While simple volume proves effort, the true measure of input quality is deliverability.

- Why it matters: High volume confirms playbook execution. However, if deliverability is poor (emails bounce or hit spam traps), the volume is irrelevant.

- Actionable Insight: We mandate deliverability rates above 98%. This requires continuous list cleaning, domain health monitoring, and pristine, verified contact data.

2. Call Volume and Connect Rate

Call volume (the raw number of dials) is a pure effort metric. The Connect Rate,dials resulting in a conversation with the target decision-maker,is the first true indicator of quality.

- Diagnostic Check: If volume is high but the connect rate is low, the diagnosis is clear: poor list quality, outdated data, or SDR difficulty navigating gatekeepers.

- Strategic Demand: We demand high connect rates (typically 5%+) because it forces SDRs to prioritize better data segmentation and leverage highly personalized B2B Cold Calling Scripts to bypass the initial block.

3. Email Open and Positive Response Rates

These metrics measure the initial effectiveness of the message packaging (subject line) and content.

- Open Rate Threshold: If the open rate drops below 30% (for highly personalized, low-volume campaigns), the subject line is failing. Immediately review your personalization methodology and your SDR Cold Email Subject Lines.

- Response Rate Focus: This must be tracked strictly by Positive Response Rate. An SDR generating 10 “Take me off your list” replies is creating noise, not pipeline. We only count replies that request more information or agree to a next step.

Core SDR Outcome KPIs: The Quality Indicators

Activity metrics confirm effort; outcome KPIs measure results. These are the metrics that matter most to revenue leadership. They directly quantify the SDR’s contribution to the sales pipeline, dictate incentive compensation, and drive strategic planning.

1. Lead-to-Opportunity Conversion Rate (L-to-O)

This is arguably the most critical SDR KPI,it is the ultimate quality check. The L-to-O rate measures the percentage of qualified leads that an SDR successfully transitions into a legitimate sales opportunity (moving the stage in the CRM).

Success here demands rigorous adherence to your qualification framework (BANT, MEDDIC, GPCT, or whatever criteria you employ).

The Strategic Insight: A high L-to-O rate confirms the SDR is qualifying effectively and building solid foundations for the Account Executive (AE). A low rate signals a severe qualification failure: they are booking “fluffy” meetings that waste AE time and clog the pipeline.

- Formula: (Number of Opportunities Created / Number of Qualified Leads Contacted) * 100

- Benchmark: This varies widely by industry (high-ticket SaaS often targets 15–25%). Define your internal baseline and optimize from proven data.

2. Meetings Booked and Held

Booking a meeting is the immediate goal, but the “Meetings Held” metric is far more valuable. The difference between these two numbers reveals the true quality of the initial setup.

A high no-show rate is a direct indicator of a qualification failure. It means the prospect was not truly invested, or the SDR failed to establish sufficient value and urgency during the initial contact.

Actionable Goal: Track the ratio of Meetings Booked to Meetings Held (the Show Rate). If this ratio consistently drops below 80% (or your internal target), review the SDR’s confirmation and follow-up sequence immediately. This is a fixable process gap.

3. Pipeline Contribution Value

We need to stop tracking meetings as abstract numbers. Start tracking them as dollar signs.

This KPI measures the total dollar amount of new potential business,the estimated value of the opportunities,that an SDR feeds into the pipeline each month. It is the purest measure of revenue alignment.

Why this is crucial for high-ticket sales:

- It aligns the SDR’s focus directly with revenue generation, not just simple activity targets.

- It incentivizes them to pursue high-value, strategic accounts over easy, low-value leads.

- It provides a clearer ROI calculation for the entire SDR function.

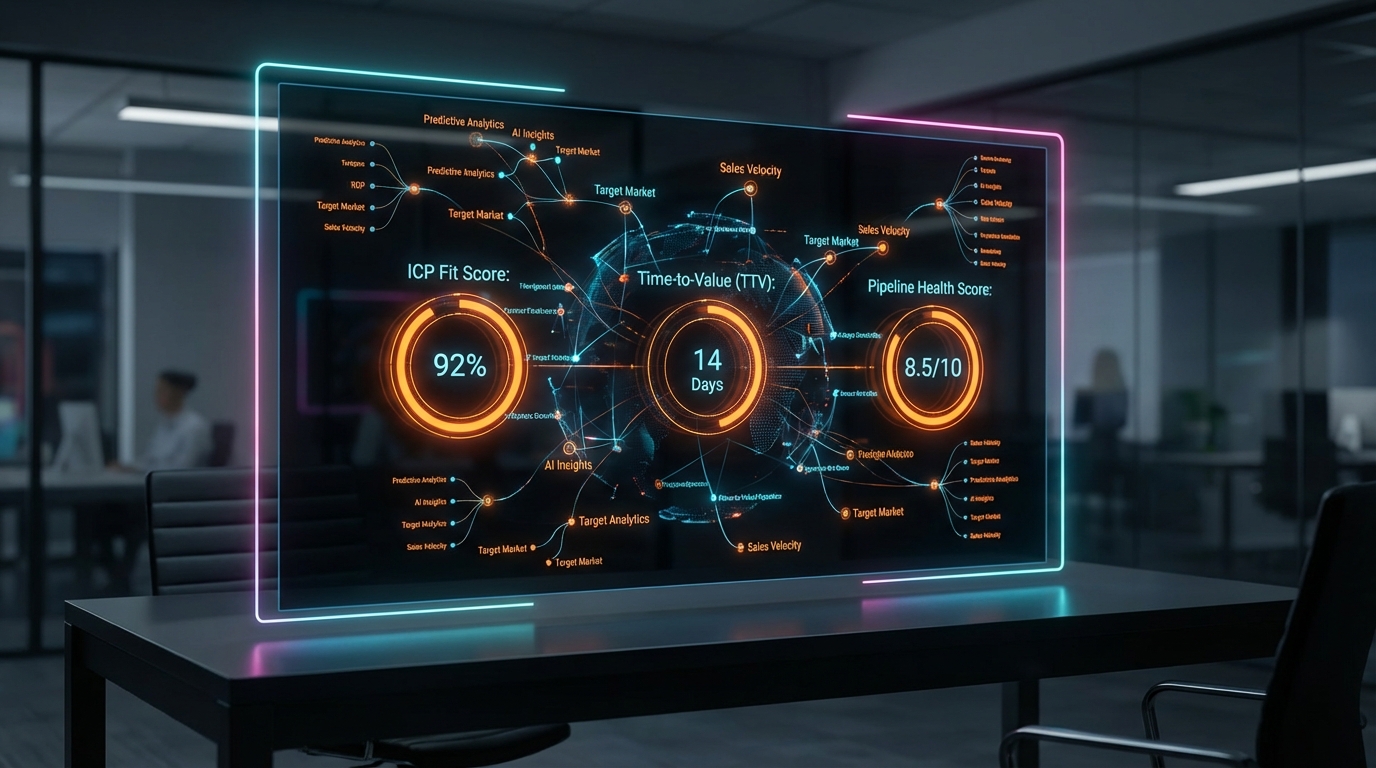

Advanced Strategic Metrics for High-Ticket Sales (2025 Focus)

Activity metrics confirm effort; standard outcome KPIs measure pipeline volume. To differentiate your high-performing SDR team,especially in high-ticket, complex sales environments,you must track metrics that reflect trust, efficiency, and profound revenue impact.

4. Lead Response Time (LRT): The Speed Advantage

Speed kills. In sales, speed converts pipeline into revenue.

The moment a prospect engages,whether by filling a form, replying to a cold email, or interacting with your content,the clock starts ticking. Our data consistently shows that responding within the first 5 minutes increases conversion rates by up to 400% compared to waiting 10 minutes or more. This is non-negotiable.

Organizational Mandate: LRT must be a primary, real-time KPI. It reflects organizational discipline and the SDR’s commitment to service quality.

- Inbound Target: Sub-5 minutes (immediate follow-up is critical).

- Outbound Target: Sub-30 minutes for replies during working hours.

- Tooling Necessity: Your Essential SDR Tech Stack Blueprint must include immediate notification systems linked directly to your CRM to eliminate delays.

5. Sales Cycle Length (SDR Phase)

This metric measures the total time elapsed from the SDR’s initial contact (or lead assignment) to the moment the lead is officially converted into a Sales Qualified Opportunity (SQO) and handed off to the Account Executive (AE).

Strategic Insight: A shortened SDR phase is the hallmark of a high-performing agent. It means the SDR is highly effective at establishing value and qualification swiftly. Conversely, a prolonged cycle suggests inefficiency, unnecessary nurturing steps, or poor initial lead fit (wasting time on prospects that will never convert).

Action: Track this average monthly and segment it by lead source. Use outliers to identify SDRs who are spending too much time on prospects who lack the necessary qualification criteria.

6. SDR-Attributed Revenue (Closed-Won)

This is the ultimate, crucial lagging indicator. It tracks the actual dollar value of deals that originated from an SDR’s efforts and eventually closed as “Won” by the AE team.

This KPI ties the SDR role directly to the company’s bottom line. If you need to justify the entire SDR function and calculate a reliable ROI on your lead generation investment, this metric is indispensable.

The Quality vs. Quantity Test:

| SDR | Meetings Booked | Resulting Revenue | Strategic Conclusion |

|---|---|---|---|

| SDR A | 20 | $50,000 | High Activity, Low Quality Pipeline |

| SDR B | 10 | $200,000 | High Quality, Exponential Value |

Mandate: SDR B is exponentially more valuable. Your incentive compensation plan must heavily reward agents who consistently deliver high-value pipeline, not just high volume of meetings.

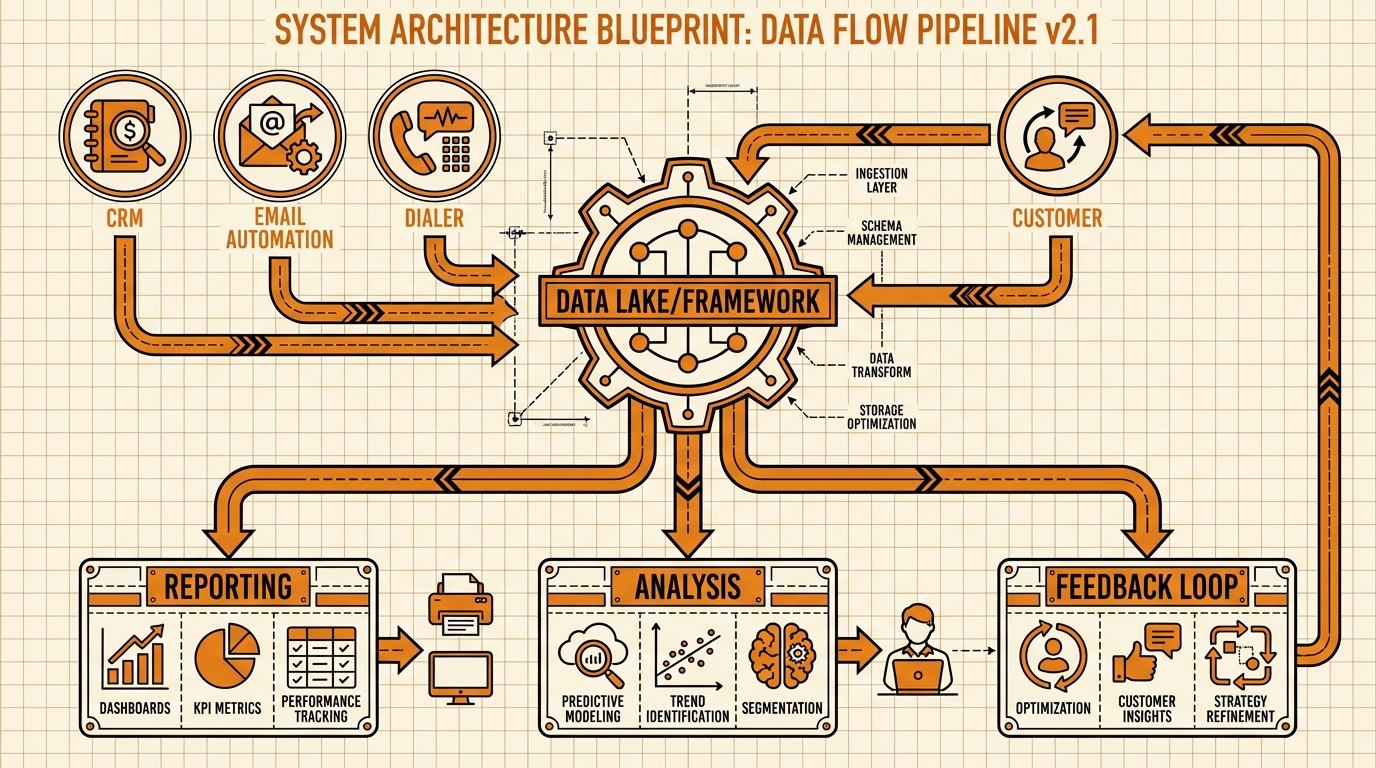

Tracking SDR Performance: The Data Framework

Measurement is impossible without a disciplined foundation. To track advanced KPIs,and ensure those metrics drive revenue,you need robust technology, standardized definitions, and disciplined data entry. You cannot manage what you do not measure.

Step #1: CRM Utilization is Non-Negotiable

The CRM (Salesforce, HubSpot, etc.) is the central hub for KPI calculation. Every interaction must be logged: every call disposition, every email reply, every follow-up. This discipline is not optional.

Failure to log data results in inaccurate conversion rates, distorted cycle times, and flawed forecasting. If SDRs skip data entry, your entire performance measurement system collapses. Period.

Step #2: Leverage AI for Data Quality and Scale

High-ticket sales demand extreme personalization, which requires pristine data. The biggest bottleneck for quality outreach is often finding accurate, verified contact information.

This is why AI Lead Generation and data enrichment software is indispensable. Utilizing tools that instantly verify contacts and find personal emails removes the “poor data” excuse for low Connect Rates and poor Deliverability.

The SDR must focus 100% on the personalized message, not on list cleaning. When the data works, the efficiency metrics skyrocket.

The Result: We see higher Activity Metrics (because the data is reliable) leading directly to higher Outcome KPIs (because the outreach is relevant and lands).

Step #3: Define and Audit Conversion Definitions

What constitutes a “Qualified Lead”? What defines an “Opportunity” (SQO or SQL)? These are not philosophical questions,they are operational standards.

These critical definitions must be standardized and rigorously enforced across Sales Development, Account Executives (AEs), and Marketing. Misalignment guarantees pipeline friction:

- Vague Definitions: SDRs pass unqualified leads, wasting AE time and trust.

- Overly Strict Definitions: The pipeline starves, slowing growth.

We audit these definitions monthly, basing adjustments purely on Closed-Won data. Example: If 70% of the Sales Qualified Opportunities (SQOs) passed by a specific SDR end up lost, that SDR’s definition of “Qualified” requires immediate, targeted coaching and adjustment.

Strategic KPI Comparison: Balancing Volume, Efficiency, and Value

Effective SDR management requires balancing input (Activity) against output (Outcome) through rigorous Efficiency metrics. Use this framework to strategically structure your SDR quota and coaching programs.

| KPI Category | Metric Examples | Strategic Purpose | Impact on High-Ticket Sales |

|---|---|---|---|

| Activity (Leading) | Emails Sent, Calls Made, Social Touches | Measures raw effort and input volume. Diagnoses workflow adherence. | Necessary baseline, but insufficient for measuring quality or success. |

| Efficiency (Mid-Funnel) | Connect Rate, Email Response Rate, Lead Response Time (LRT) | Measures data quality and outreach effectiveness. Diagnoses messaging issues. | High Impact. Dictates how well the SDR converts effort into conversation. |

| Outcome (Lagging) | Lead-to-Opportunity Rate, Meetings Held, Pipeline Contribution Value | Measures direct pipeline impact and qualification rigor. | Critical. Directly correlates SDR work to AE success and future revenue potential. |

How to Calibrate Quotas in 2025

Quotas must be realistic, data-driven, and balanced precisely between volume and value. Calibration requires working backward from the revenue goal, not forward from activity targets.

Step #1: Establish Conversion Ratios (The Revenue Back-End)

Quota setting must begin with the Account Executive (AE) goal and work backward. This ensures SDR activities are always mapped directly to projected revenue.

The Backward Calculation Example:

- If an AE requires $1,000,000 in closed deals this quarter, and the established AE close rate is 20%, the AE needs $5,000,000 in qualified pipeline (Opportunity Value).

- If the average opportunity value (AOV) is $50,000, the AE needs 100 net new opportunities.

- If your SDR team converts 15% of qualified meetings (SQLs) into opportunities, the SDR needs to generate 667 qualified contacts/meetings.

This final number (667) provides the non-negotiable activity baseline for the SDR, ensuring the quota is directly linked to the company’s revenue target.

Step #2: Implement a Weighted Scoring System

Not all activities are created equal. To reinforce the strategic mandate,generating high-quality pipeline,compensation must reflect the value of the outcome, not just the volume of effort.

Do not compensate equally for high-effort, low-impact metrics. Use a weighted system:

- Tier 1 (Low Weight: 5% of Quota): Activity Metrics (Emails Sent, Calls Made). These are purely diagnostic metrics and should not significantly impact compensation.

- Tier 2 (Medium Weight: 25% of Quota): Engagement Metrics (Connect Rate, Response Rate, Demo Attendance). These metrics indicate successful execution of messaging and initial interest.

- Tier 3 (High Weight: 70% of Quota): Outcome Metrics (Meetings Held, L-to-O Rate, Pipeline Value Generated). SDRs are paid primarily for generating qualified pipeline that converts to revenue.

This structure ensures SDRs are paid for results, reinforcing the mandate that quality pipeline is the ultimate goal.

Step #3: Continuous Optimization and Feedback

Metrics are useless without disciplined analysis. Implement mandatory, weekly 1:1 coaching sessions focused entirely on the data framework to identify bottlenecks.

Analyze performance gaps to drive targeted coaching and increase conversion efficiency:

- Scenario A: High Activity, Low L-to-O Conversion. The problem is qualification and messaging quality. The SDR is busy, but not effective. Coach on handling objections and improving discovery depth, rather than simply increasing dial volume.

- Scenario B: High L-to-O Conversion, Low Overall Volume. The problem is list generation, capacity, or time management. The SDR is highly effective when they connect, but they are not connecting enough. Coach them on effective prospecting tools, list segmentation, and daily scheduling discipline.

Frequently Asked Questions

Q: What is the single most important SDR KPI to track for high-ticket sales?

A: Pipeline Contribution Value (PCV). For high-ticket B2B sales, volume is irrelevant; quality is everything. Tracking PCV,the actual dollar value the SDR feeds into the sales pipeline,forces them to prioritize accounts with the highest potential revenue, directly aligning SDR output with company financial goals.

Q: How often should we review SDR performance metrics?

A: Performance reviews must be layered based on the KPI type:

- Daily/Weekly: Review activity metrics (e.g., calls, talk time, emails sent) to ensure consistency and immediate course correction.

- Weekly (1:1 Coaching): Focus on outcome KPIs (conversion rates, lead quality, meeting attendance). This is where coaching happens.

- Monthly (Formal Review): Analyze long-term trends, inform compensation payouts, and adjust quotas based on sustained performance data.

Q: Should I track Inbound and Outbound SDR metrics separately?

A: Yes, separation is mandatory. Trying to apply the same metrics guarantees failure. These are two fundamentally different sales motions:

- Inbound SDRs: Success is measured by speed (Lead Response Time) and qualification efficiency. The focus is on rapid conversion of warm leads.

- Outbound SDRs: Success relies on persistence and penetration. Key metrics are activity volume, Connect Rate, and the ability to convert cold leads into qualified opportunities (L-to-O conversion).

Quotas and benchmarks must strictly reflect these differing priorities.

Q: How do we ensure SDR data is accurate?

A: Data accuracy is the foundation of reliable KPI tracking. We achieve this through a multi-layered approach:

- Mandatory CRM Discipline: Enforce strict logging protocols. If it’s not in the CRM, it didn’t happen.

- Automation: Maximize technology (call recording integrations, email tracking) to eliminate manual data entry errors.

- Source Verification: Utilize AI lead generation and data enrichment tools to verify foundational data (emails, titles) *before* outreach begins.

Remember the core principle: Garbage in, garbage out. Data quality starts at the source, not the dashboard.

References

- The Essential KPIs and Metrics for Measuring the Success of SDR …

- Understand SDR Agent Effectiveness with the SDR Agent Analytics …

- 8 Key SDR Metrics to Track for a High-Performing Team – Artisan AI

- Measuring SDR Performance Using KPIs and SDR Metrics

- SDR Metrics and KPIs: ROI, Performance Targets and Goals